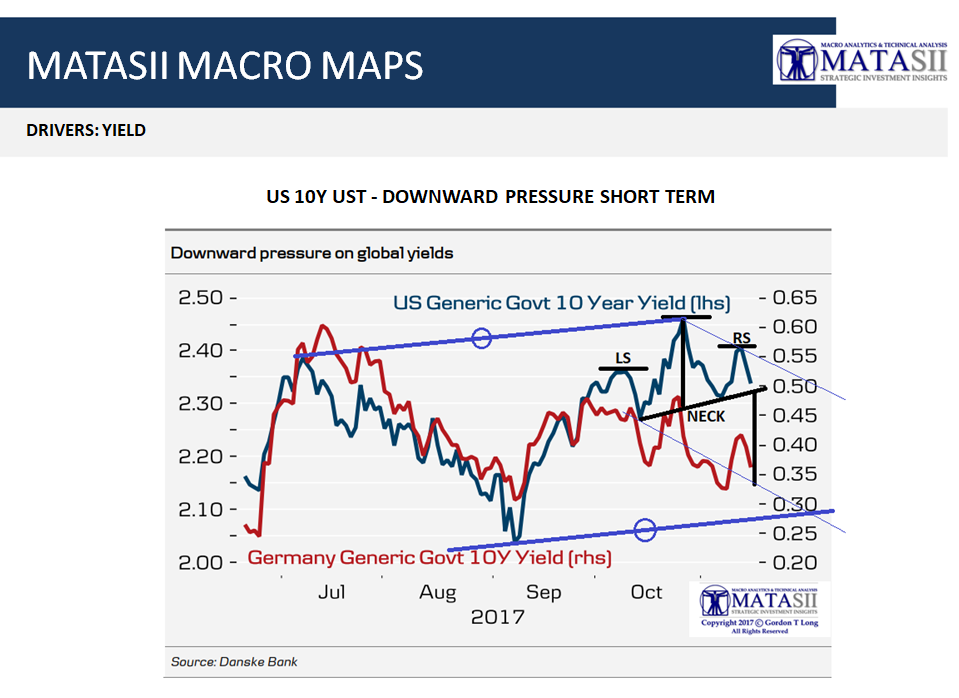

US 10Y UST - DOWNWARD PRESSURE SHORT TERM, UPWARD PRESSURE TO 2.9% IN 2018

SHORT TERM - DOWNWARD PRESSURE ON YIELDS

The recent move lower in yields underlines that despite:

- The ECB scaling back on bond purchases,

- A strong global business,

- Fed rate hikes

.. we should not expect to see a rapid further rise in either US or European long yields (10Y).

THE TECHNICALS ALSO SUPPORT THE MACRO VIEW

- The overall inflationary pressure is still low,

- Zero-rate policy in Japan and

- Continued QE bond purchases (though lower) in Europe

.... are keeping a lid on long yields in both Europe and the US.

Furthermore, if the negative sentiment continues in the global equity market, we could see a sector rotation into bonds. Bloomberg reports that the largest US Pension fund Calpers is looking to double its bond allocation to reduce the risk and volatility in its portfolio.

LONGER TERM - MOVEMENT TOWARDS 2.9% IN 2018

The red boxes above illustrate that the Fed's rate increases was a precursor to the 2000 and 2008 market crashes. The crashes stopped further increases. There is a strong probability that due to the amount of over leverage since 2008 the markets can not withstand rates higher than 2.90%.

If rates are pushed upward today, such that the 10Y UST approaches the 2.90% level, we suspect this level will trigger yet another violent market reaction.