US CORPORATE BUYBACKS HAVE DISTORTED LEVERAGE BETWEEN THE US & EUROZONE

--SOURCE: 04-29-17 The Heisenberg Report - "Oops: The Buyback Party Is Over" --

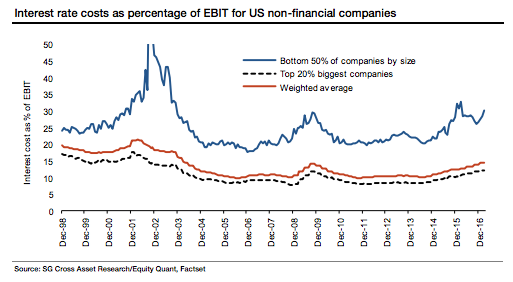

The debt that funds buybacks is being issued at artificially suppressed rates. This is just balance sheet leveraging or financial engineering assisted by central banks.

It's creating a leverage problem that looks like this:

(SocGen)

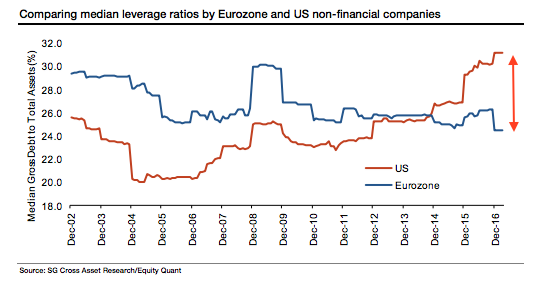

Or, if you want some international context, like this:

(SocGen)

But irrespective of whether you think all this leverage is likely to create a problem when the cycle turns (more on that here), equity investors (NYSEARCA:SPY) need to ask themselves what it means for stock prices if the heretofore insatiable corporate bid for Buybacks dries up.