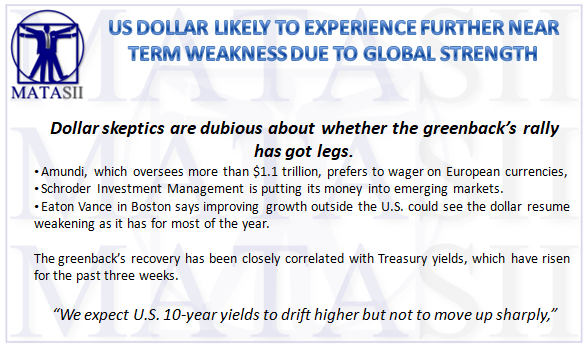

US DOLLAR LIKELY TO EXPERIENCE FURTHER NEAR TERM WEAKNESS DUE TO GLOBAL STRENGTH

-- SOURCE: 10-04-17 Bloomberg --

Dollar skeptics are dubious about whether the greenback’s rally has got legs.

- Amundi, which oversees more than $1.1 trillion, prefers to wager on European currencies,

- Schroder Investment Management is putting its money into emerging markets.

- Eaton Vance in Boston says improving growth outside the U.S. could see the dollar resume weakening as it has for most of the year.

The greenback’s recovery has been closely correlated with Treasury yields, which have risen for the past three weeks.

“We expect U.S. 10-year yields to drift higher but not to move up sharply,”

said Rajeev De Mello, head of Asian fixed income at Schroder Investment in Singapore.

“If other countries, especially the growth-sensitive emerging economies, continue to benefit from the stronger global economy, the U.S. dollar should be weaker against them.”

Eaton Vance's Eric Stein says the prospect of stronger economic growth around the world undermines the attraction of the greenback:

“The story of the growth prospects outside the U.S. improving more than that of the U.S. could keep the dollar weakening, as it has for most of the year, although a change in U.S. fiscal or monetary policy could lead to dollar strength,”