US DOLLAR SENDING EARLY SIGNS OF A POTENTIAL REVERSAL

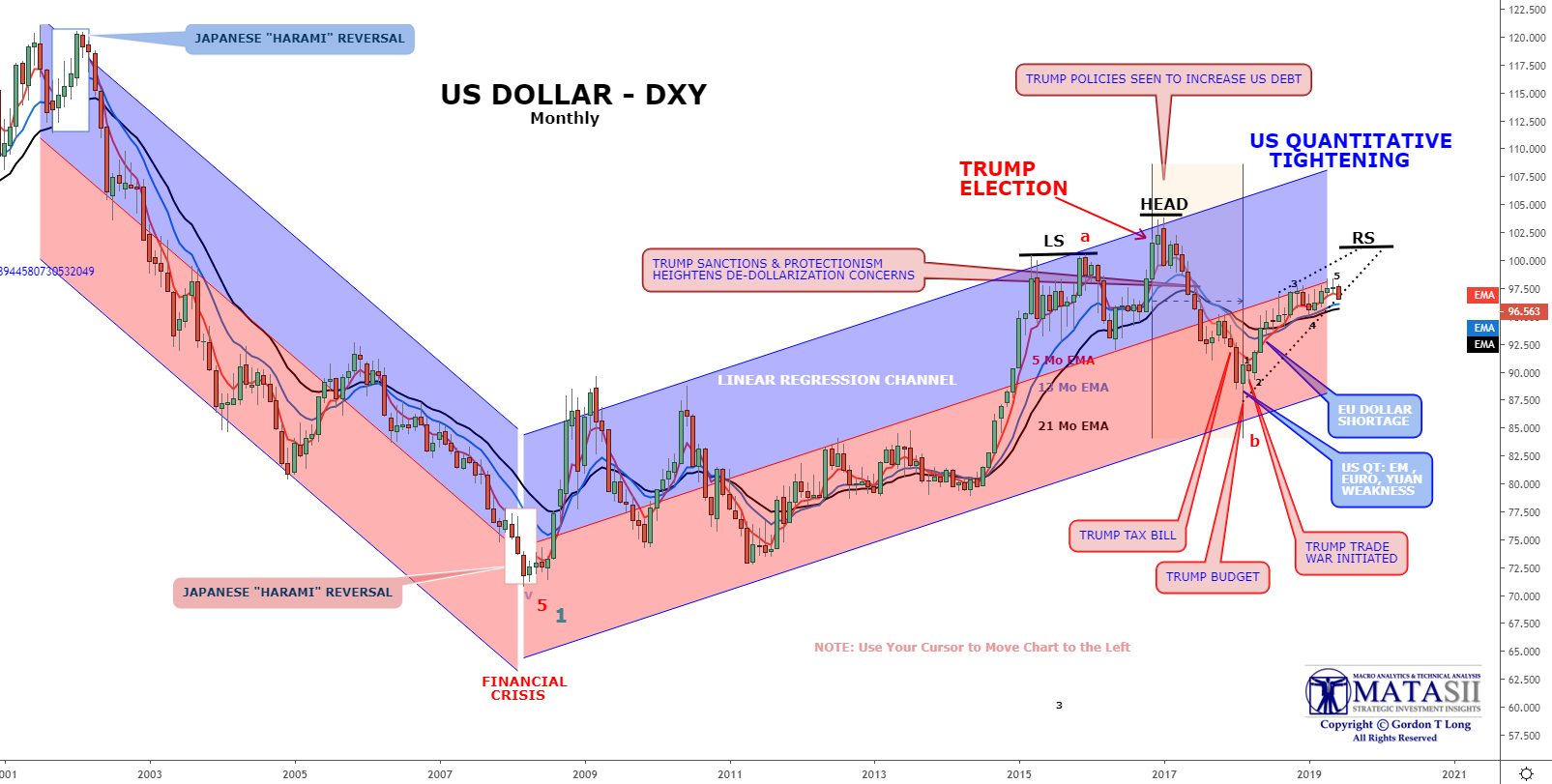

We have been posting this US Dollar DXY chart for a couple of years now. It has been very accurate in warning of US Dollar moves. Recently, the issue has been whether the DXY continues to follow the ellipse ring higher or separates from it. A separation is most often a warning of the beginning of a falling trend. The DXY has now separated from the ellipse.

The likelihood is for the DXY to fall towards the center-line or bottom of the red channel.

The DXY chart below indicates that there is a strong possibility that the US Dollar has completed the Ending Diagonal we have been flagging throughout the first half of 2019. June appears to be the potential turning point for the DXY.

The dollar has been experiencing a "flight-to-safety" in 2019. This may be coming to an end as investors realize that secular and structural forces are beginning to converge on the economy and market, such as the ugly geo- and domestic politics, too much public, and corporate debt, and shrinking global trade, just to name a few.

These problems need to be addressed through structural reform, compromise, and cooperation and cannot be fixed with simple cyclical monetary policies, such as interest rate cuts and more quantitative easing (QE). The dollar may be the early warning signal for the beginning of this realization.

There is obviously more than just that going on as the following S&P 500 versus 10 Y US Treasury Note Yields ratio drawn on a log scale shows.

Falling treasury yields associated with expectations for weak inflation and global central bank easing along with a rebounding S&P 500 have pushed our ratio through our "Doomed Top". This is highly unusual and suggests major distortions are occurring along with heavy market interventions and of course accelerating "De-Dollarization".

Our expectations are for a US Treasury yield counter rally which will put in a "right shoulder" before US Treasury yields head lower. This will be the results of:

1- POLITICAL CONFLICT

2- TRADE WAR INFLATION PRESSURES

3- HEAVY UST SUPPLY

4- WEAK FOREIGN BUYING

For more details see our recent post: 10Y US TREASURY NOTE (TNX) HITS MATASII TARGET

[SITE INDEX -- MATA: PATTERNS - US DOLLAR (DXY)]

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MATA: PATTERNS - US DOLLAR (DXY)

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.