TIME TO BATTEN DOWN THE HATCHES & REEF THE SAILS?

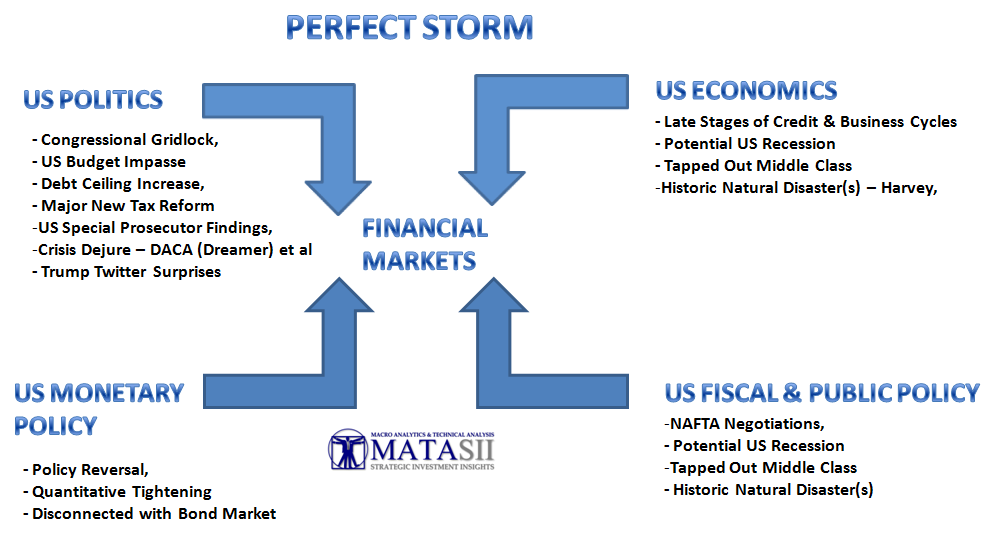

PERFECT STORM?

As fall approaches, we have entered a often scary time for the market and Investors. We have all the ingredients of serious problems which we have discussed in previous videos. Now however we have:

In Washington, a Three Headed Policy Monster in the form of Congress needing to 1- raise the debt ceiling, 2- pass a budget and 3- embark on Tax Reform. All major, contentious legislation individually - but having near term dead lines!

Globally, as John Mauldin among many others is articulating, the possibility of one of 3 Black Swans potentially triggering a Global Recession.

We have the serious & realistic chance of:

- Yellen Overshooting Monetary Tightening,

- The ECB under Mario Draghi running out of Bullets ( like simply sunning out of Bonds to buy!), or

- A Chinese Debt Meltdown!

....and there are many more!

- North Korea's Nuclear Threat which borders on a modern day "Cuban Missile Crisis" of the Kennedy Era,

-

Devastating US Hurricanes (Harvey & Irma) & Congressional Aid Required,

-

Special Trump "Collusion" Investigation & Investigating Prosecutor,

- The DACA ("Dreamer") Crisis dejure,

- NAFTA Negotiations Collapse,

- BREXIT Negotiations,

- A Slew of Critical Central Bank Meetings and QT announcement details,

... and of course the latest disruptive and startling Trump Twitter!

It is the combination of all these that gives you a sense of a perfect storm that is looming.

POTENTIAL BIG FREEZE

James Rickards is on the record outlining that he believes the powers to be are preparing for the eventuality of global market disruption associated from Quantitative Tightening forcing massive market shutdowns or what he refers to as the "Big Freeze".

I was actively trading on the pre-market global exchanges the morning of 911 and attempted through about 9:55 that morning, before the extent of what was going on became over the evident over the airwaves. What I saw and witnessed first hand from a market perspective was startling to me at the time. It wasn't just that the US Market never opened at 9:30, but I wasn't able to get fills on exchanges In Canada for example even though their market was supposed to be open and wasn't officially closed until much later.

I saw first hand how the global markets can be shut down with the "flip of a switch" even though they are supposedly all independent and national entities. The power and control I saw exercised was a startling revelation in a day that itself was beyond the pale!

HOW TO PREPARE

You have a Gun-to-Your-Head!

It presently feels like you have a gun to your head. Do you stay in the markets? On the other hand, if you leave how do you get any yield on your money! Is the game capital preservation in the short term?

Unfortunately, it gets even worse in trying to answer this question!

WHAT TO WATCH FOR

Let's ignore all the above (we'll come back to them later) and assume it is only noise for a second in the bigger picture.

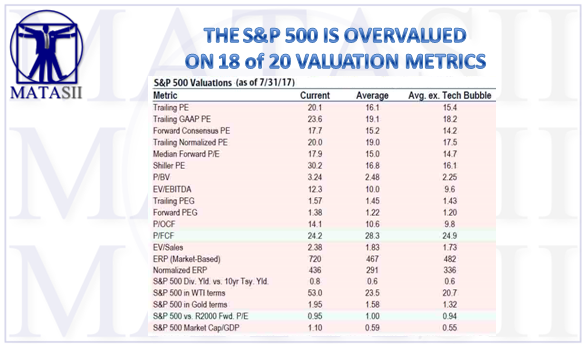

I am sure you have seen various versions of this illustration many times before.

What I can tell you about this chart is that it will always get you out too early and in too late! What is missing is an understanding of how markets actually transition. Let me explain.

Warren Buffett is well known for describing the market as a "slot machine" in the short term, but a "weighing machine" in the longer term. In the Longer Term, Market Fundamentals matter but in the Short Term according to Buffett, it is nothing short of a "crap shoot" - "Spin the wheel take your chance!" - All very 'catchie' but it does nothing to really help you time the market!

In our work we use a lightly different version of Buffett's idea:

- In the Short Term the market reacts to SENTIMENT

- In the Intermediate Term the market is influenced by RISK

- In the Longer Term the market is controlled by FUNDAMENTALS

We must remember, at tops market Euphoria & Greed ignores poor Fundamentals, and then at bottoms markets ignores improving Fundamentals because of Pessimism and Fear. This doesn't tell us about timing but it tells us what is definitely ahead. Sentiment gives us an understanding about timing.

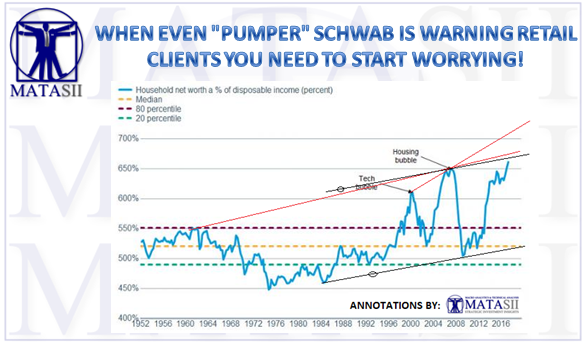

We must remember, at tops market Euphoria & Greed ignores poor Fundamentals, and then at bottoms markets ignores improving Fundamentals because of Pessimism and Fear. This doesn't tell us about timing but it tells us what is definitely ahead. Sentiment gives us an understanding about timing.- Some of the Worst Fundamentals in the history of the Financial Markets,

- Obscene Risk levels for which offer poor potential returns

This suggests that Longer Term FUNDAMENTALS and Intermediate term RISK have turned. When both have occurred this suggests we are in the later stages of a market top. This is important to recognize and to plan accordingly.

SO WHAT ABOUT SHORT TERM SENTIMENT?

Stock prices run in cycles. Periods of re-pricing are usually quick and powerful.

A 2.8% drop in stocks is all it takes...

...to convert sheer near full euphoria into outright panic...

Quite a collapse in confidence for a 'blip' in stocks... (NOTE - this collapse in sentiment is bigger and faster than the plunge in Aug 2015 following China's devaluation and the US flash crash)

At the same time, the 'plunge' in stocks has hammered BofAML's Global Panic-Euphoria index out of 'Euphoria'...

On a global basis, put-call ratios signal less euphoria than a month ago, and volatility has risen, taking Global Risk-love indicator from a protracted period in euphoria to barely inside the neutral zone.

With most of CNN's Fear & Greed factors suddenly flashing "Extreme Fear"...

But there's just one big caveat - almost 40% of the S&P 500 members are now trading below their 200-day moving-averages...

And that is what years of Central Bank conditioning does for investors' risk appetites.

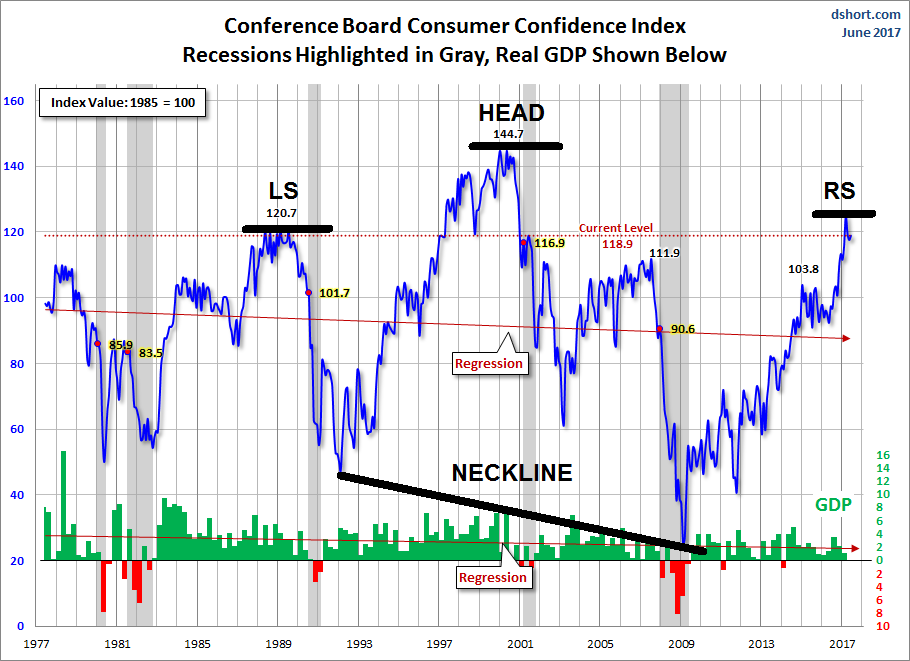

SENTIMENT: CONSUMER COMFORT CORRELATES WITH FORWARD S&P 500 PE

(1) The Fundamental Stock Market Indicator (FSMI) rose to a new record high during the week of August 19. It has been very highly correlated with the S&P 500 since 2000.

The FSMI isn’t a leading index of the S&P 500. Nothing leads the S&P 500, since it is a leading indicator itself, and is one of the 10 components of the Conference Board’s Index of Leading Economic Indicators. My indicator simply confirms or raises doubts about the underlying trend in the stock market. Its new high certainly confirms that the bullish trend in stocks remains intact.

The FSMI comprises just three components that reflect the underlying strength or weakness in the domestic and global economies. It is the average of the Consumer Comfort Index (which is a four-week average) and the four-week average of the Boom-Bust Barometer, which is the CRB raw industrial spot price index (weekly average) divided by weekly initial unemployment claims.

(2) The CRB raw industrials spot price index is up 30% since it bottomed late in 2015. It had stalled during late 2016 through the first half of 2017, but has been advancing again in recent weeks. One of its 13 components is the price of copper, which has gone vertical in recent days.

(3) The Boom-Bust Barometer (BBB) is simply the ratio of the CRB raw industrial spot price index divided by initial unemployment claims. To smooth it out, I track the four-week moving average, which is extremely pro-cyclical. The BBB has taken off like a rocket ship since late 2015 and has been in record-high territory this summer.

It is also highly correlated with the S&P 500 since 2000. That’s not surprising since it is highly correlated with another very pro-cyclical indicator, namely S&P 500 forward earnings.

(4) Consumer confidence is the third component of the FSMI, which averages the Weekly Consumer Comfort Index (WCCI) and the BBB. While the BBB is highly correlated with the S&P 500, the FSMI better tracks the stock index. That’s because the BBB is highly correlated with forward earnings and the WCCI is highly correlated with the S&P 500 forward P/E. The WCCI has recovered sharply since late 2011, and so has the P/E.

You can be assured, Sentiment will soon abruptly change. Whether a few months or a couple of quarters - it will happen!

WHAT WILL SHIFT SENTIMENT?

Remember how we began and I suggested we put aside as noise for the moment:

- The Perfect Storm - Rising Debt Ceiling, Passing a New Budget through Congress and Tax Reform.

- Three Back Swans - Chinese Debt Melt-Down, ECB & Mario Draghi run out of Bullets and Janet Yellen Over-shots on Quantitative Tightening.

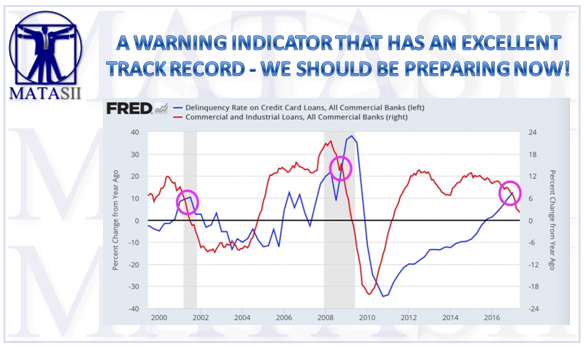

... or the turn in the Business and Credit Cycles which I have written about many times - all suggesting we can expect to see a recession sooner than much later!

CONCLUSION

Make sure you are fully prepared.

Remember, the top 5% and bottom 5% of market gains are always the most expensive!