VIDEO TRANSCRIPTION: IN-DEPTH - Where Financialization Will Lead Us

SLIDE 5

We have recently posted videos about Financialization of the US Economy.

We have recently posted videos about Financialization of the US Economy.

The first was last month's UnderTheLens Report entitled " Are Central Banks Caught in the First Globalization Trap?". Though it didn't specifically outline Financialization some of the points I would like to make in this report are outlined and expanded there.

This month's Macro Analytics video with Charles Hugh Smith talks about this subject directly. It was entitled "The Road to Financialization". I encourage you to review the 50 minute video which I touch on here for only a couple of minutes.

SLIDE 6

We attempted to answer the question that this slide raises. How exactly could this have happened?

The parabolic shape doesn't seem even remotely sustainable, yet for some reason it has evolved. We then tracked and discussed the major Pivots or Inflections in its evolution.

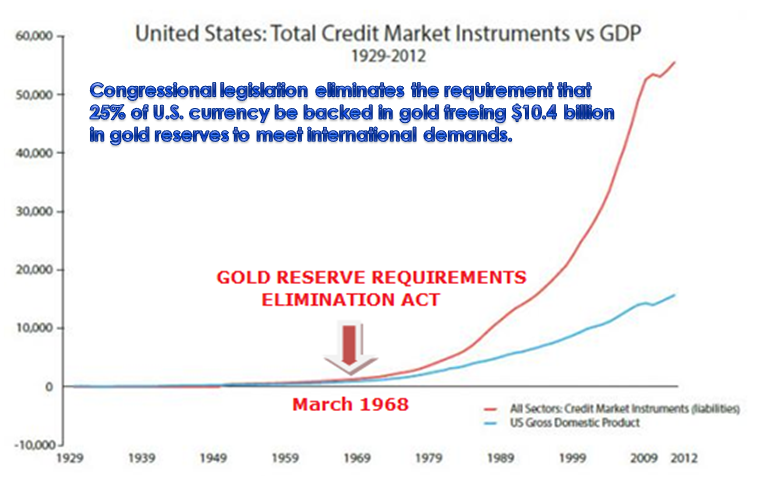

SLIDE 7

It is clearly evident that the first signs appeared in March 1968 when the US Congress based the "Gold Reserve Requirements Elimination Act". This stealth peace of legislation eliminated the requirement that 25% of US Currency be backed in gold. It was enacted to free up approximately $10.4B in gold reserves to meet international Balance of Payment settlement demands.

This was the initiation of removing the US from Sound Money and towards of "Fiat Currency" regime.

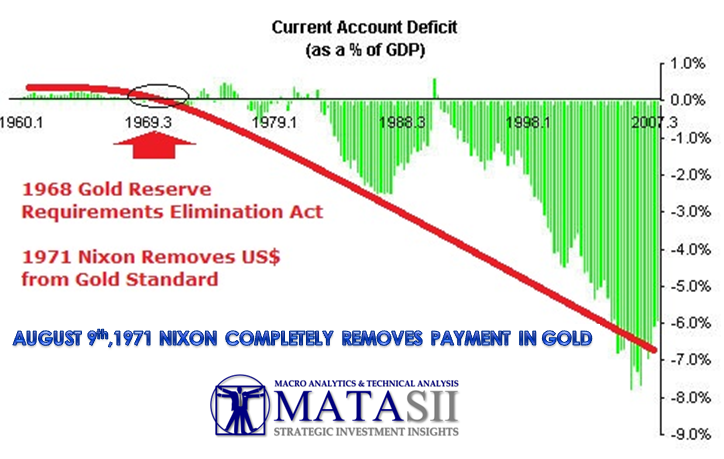

SLIDE 8

As pressures mounted on the US Balance of Payments to fund the costs associated with the Vietnam War and President Lyndon Johnson's "Great Society". President Richard Nixon shocked the world when unexpectedly, on August 9th 1971 he completely removed the US dollar from the Gold standard, thereby making the US dollar a "Fiat Currency". In other words, the US dollar was no longer backed by anything other than the 'promise and goodwill' of the American tax payer. The Financialization of America ha begun.

It was based on the US living beyond its means. That is, the US was Consuming more than it Produced and debt was required to maintain the existing US standard of living.

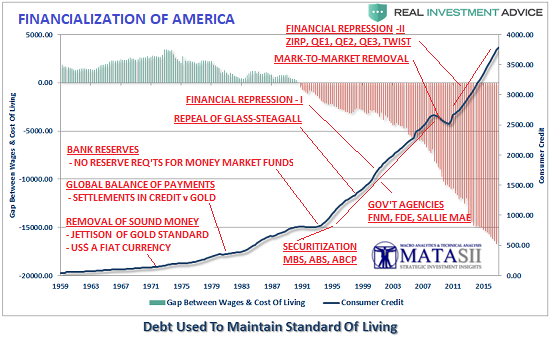

SLIDE 9

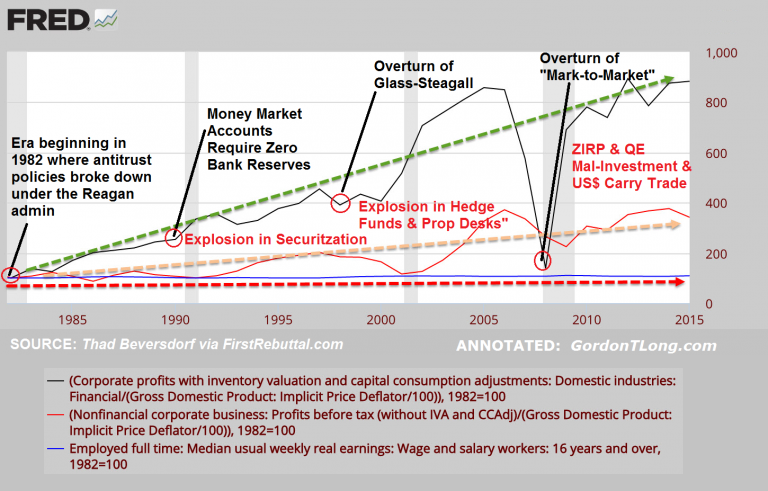

As I mentioned earlier, Charles Hugh Smith and I spent nearly 50 minutes on this and the following slide in the "The Road to Financialization" video, explaining each of the ongoing developments. There is no need to repeat that here but it is important to understand the political "spin" given for each of these steps.

SLIDE 10

What the slides point out is that financial rules and policy enactments were the result of the requirement and necessity to increase credit and debt in the US. Once the US was on the "treadmill", the requirements was for geometric growth.

The changes required became more suspect and egregious at every pivot. The absurdity of it was blatantly obvious with the overturn of "Mark-to-Market" (which has never been reversed) and monetary policies of ZIRP and various versions of QE.

SLIDE 11

What was the takeaway from all this? Charles Hugh Smith summarized it well when he wrote, "Each new policy destroys another level of prudent fiscal/financial discipline."

- The discipline of sound money? Gone.

- The discipline of limited leverage? Gone.

- The discipline of prudent lending? Gone.

- The discipline of mark-to-market discovery of the price of collateral? Gone.

- The discipline of separating investment and commercial banking, i.e. Glass-Steagall? Gone.

- The discipline of open-market interest rates? Gone.

- The discipline of losses being absorbed by those who generated the loans? Gone.

And so on: every structural source of discipline has been eradicated, weakened or hollowed out.

Financialization has consumed the nation's seed corn, and the harvest of instability is ripening in the fields of finance and the real economy alike.

SLIDE 12

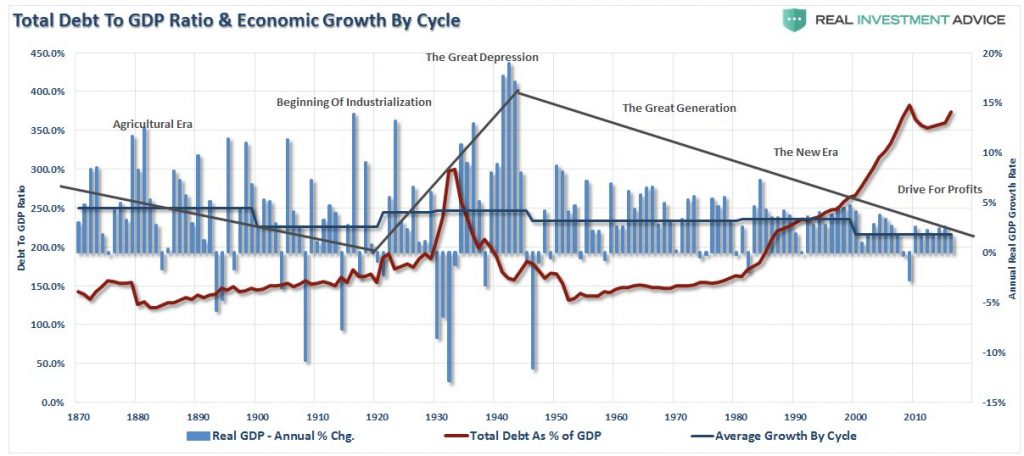

So where has the road to Financialization taken us, besides to unprecedented historic levels of Credit and Debt?

What other structural changes have also occurred as a consequence which may give us better insight into what may be in store for us in the future now that we no longer have any financial discipline?

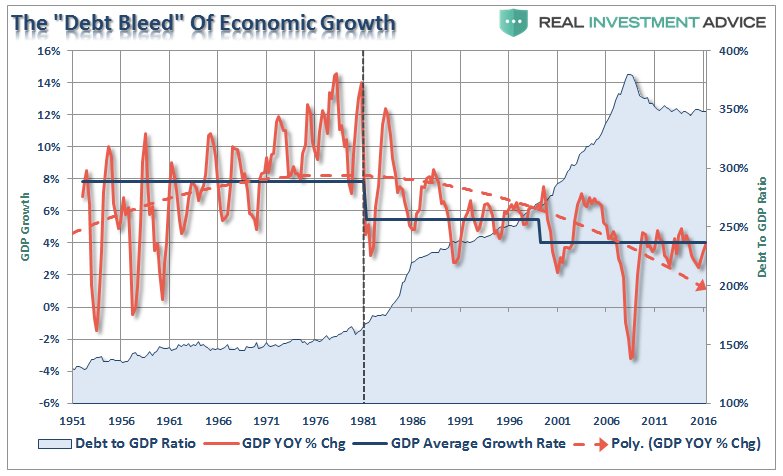

SLIDE 13

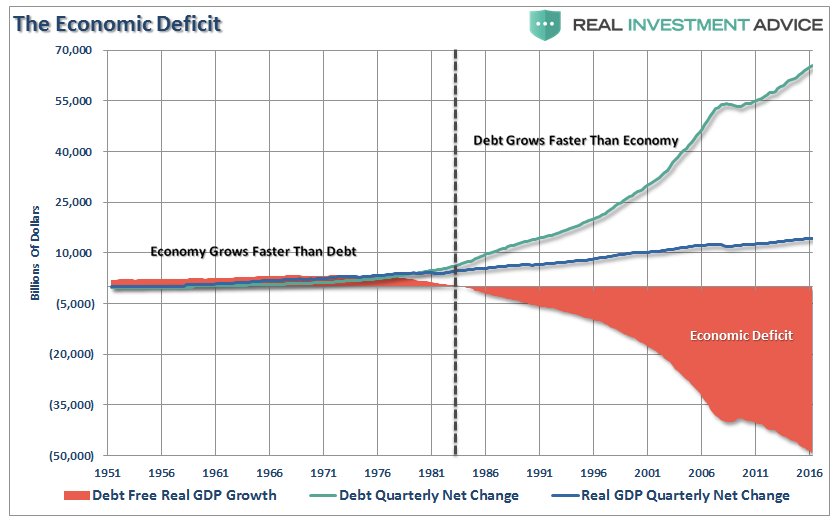

Fist we can see that Debt has grown much faster than the economy. We can also so that real US GDP excluding debt has plummeted.

SLIDE 14

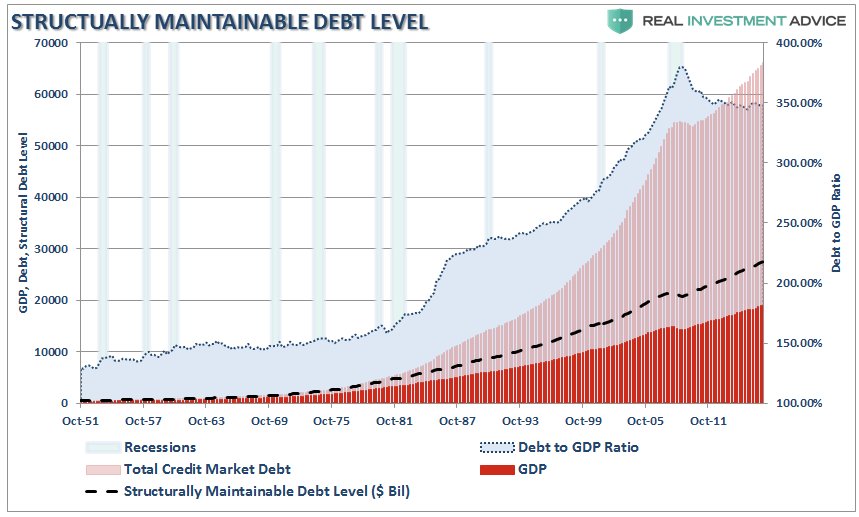

Some analysis suggests that current US debt levels, from a structurally manageable level, presently need to be reduced by approximately $35T. This is no longer possible in a ~ 25T Economy.

We have long ago "Crossed the Rubicon"!

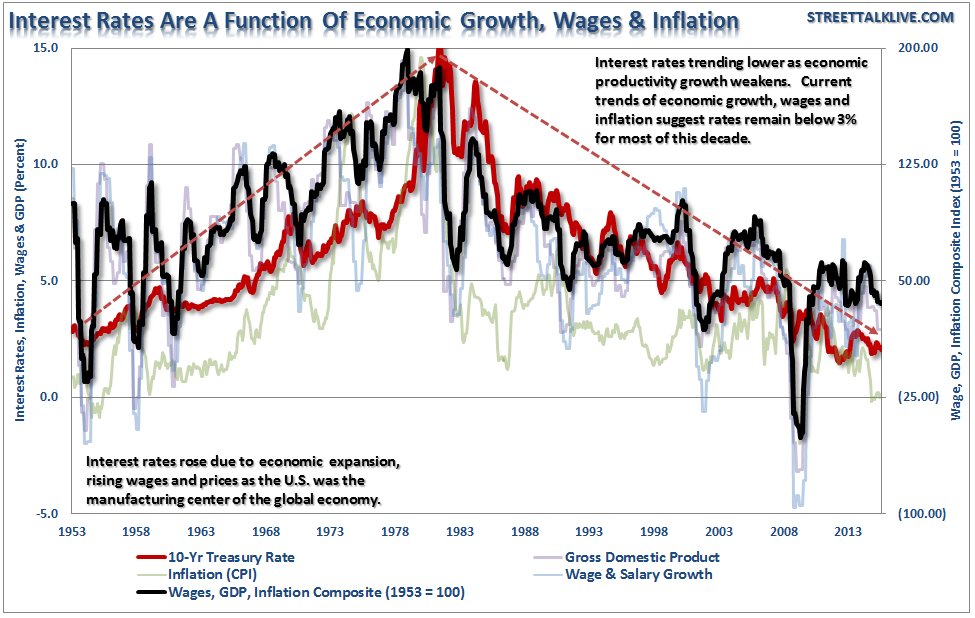

SLIDE 15

There is a very lose relationship between Economic Growth, Wages and Inflation. They all work together in a self supporting fashion.

What we see is that from the early 80' when Federal Reserve Chairman's Volcker's raised interest rates to over 15%, we have been experiencing a steady decline in interest rates (which has made credit fueled consumption less expensive), while economic growth, as well as wage and salary growth, declined.

Credit fueled consumption has effectively papered over a very troubling structural wage and growth story.

SLIDE 16

We see here more clearly the fall in US Economic activity as measured by Y-o-Y GDP Growth.

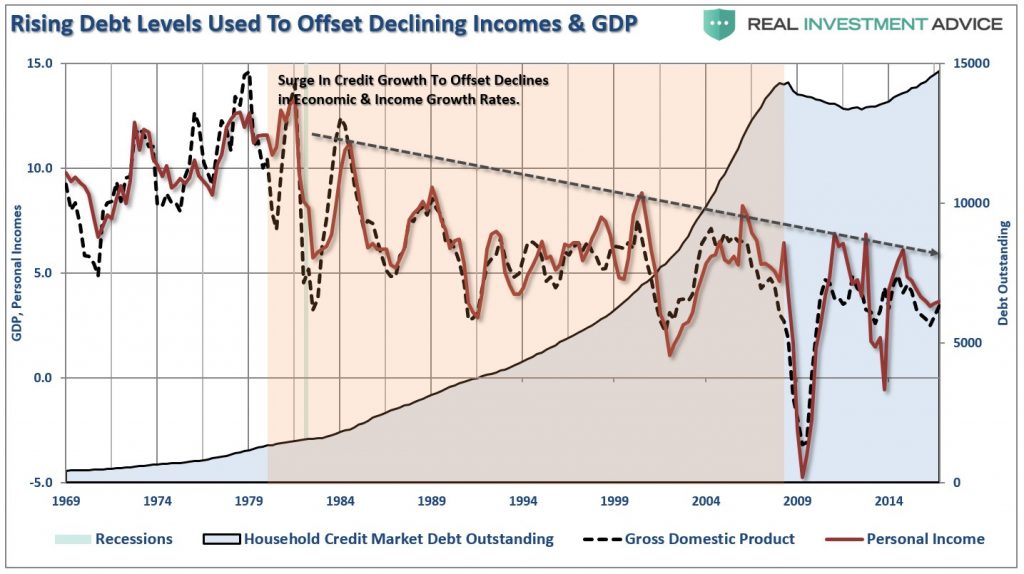

SLIDE 17

Here we see how a surge in Credit Growth has been used to offset the declines in Economic and Income Growth Rates.

What we need to appreciate is that Debt actually drives rates lower.

Debt is a Deflationary Driver.

This is incredibly problematic for Central Bankers who need Inflation to 'corral' excess government debt levels. We will talk more about that regarding Financial Repression in a moment.

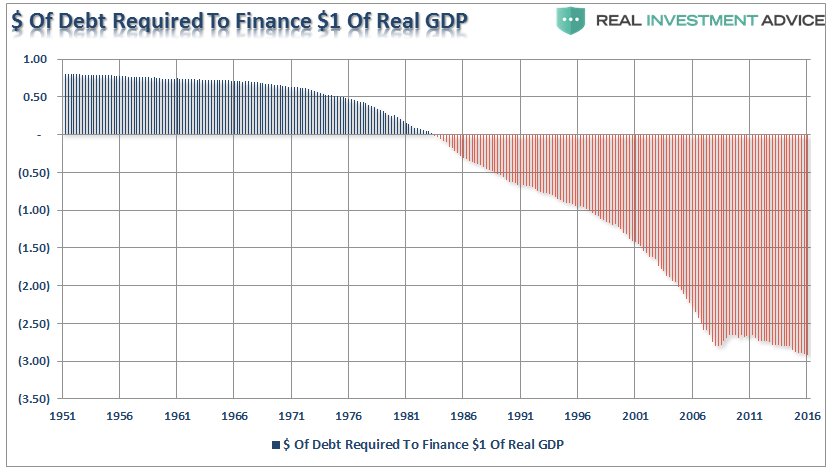

SLIDE 18

Before we do we need to also appreciate that increasing debt becomes less effective in increasing economic growth.

The amount of debt required to finance a $1 of real growth explodes higher. Many, including well recognized Dr Lacy Hunt of Hoisington Investment Management in Austin Texas suggests that increased fiscal stimulus debt is now, in a lot of instances, actually counter productive to achieving economic growth.

SLIDE 19

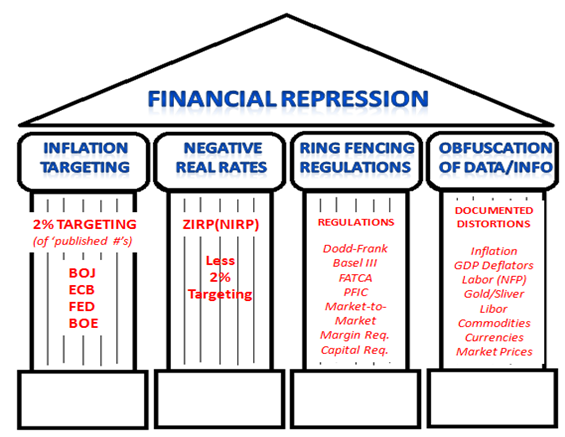

To keep this all working the central bankers ho resorted to the MacroPrudential Policy of Financial Repression. This is well documented and we have a site dedicated to it called the "Financial Repression Authority" or FRA. The four pillars of Financial Repression are shown here.

What is most important to our discussion is that Negative Real Rates are required to keep the wheel spinning and increasing credit and debt to be sustainable. This requires Inflation and why though inflation is good for no one other than primarily the government we have 2% inflation targeting policies.

SLIDE 20

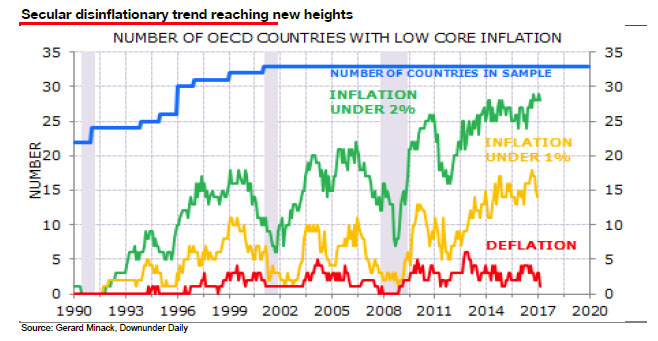

As I mentioned previously however Debt is Deflationary. We can see that central bankers are not winning their goal to get to 2% "published' inflation even though we are in year 8 of the recovery to the Financial Crisis.

SLIDE 21

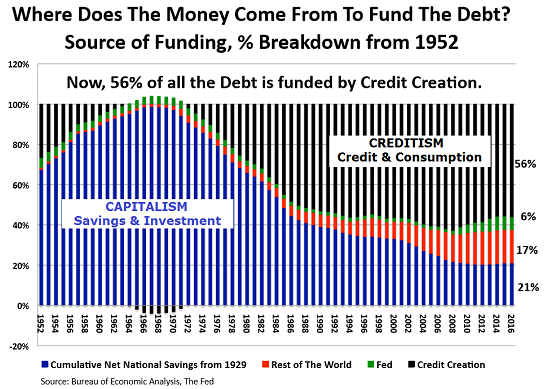

We have now reached the point where we no longer truly operating in a Capitalist System. My friend Richard Duncan has argued for some time that we are now in a system that is more correctly labeled a Creditism System.

As I mentioned at the beginning we now Consume more that we produce. Capitalism doesn't work in such as system because capitalism is about "Savings" being invested into productive assets to sustain economic growth.

Creditism is about credit and debt being used for consumption to sustain economic growth. The US as a consequence has grown to nearly an unprecedented 70% consumption economy.

SLIDE 22

All measures has a result have become grotesquely distorted

SLIDE 23

So where we are likely headed as a result?

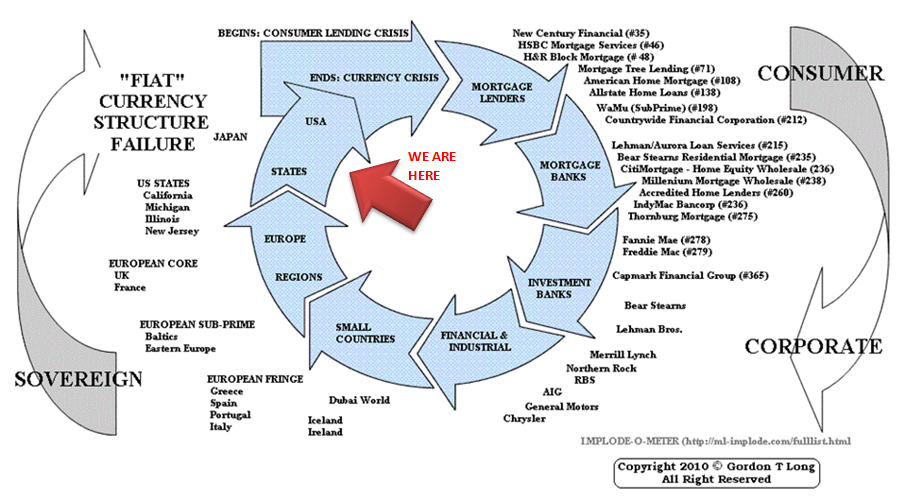

I put together this run-up to the Financial Crisis has the housing bubble began to explode (see detail on right side). It has followed the road map pretty closely ever since.

SLIDE 24

It ends with a failure in "Fiat Currencies" as the Debt Super Cycle ends and deleverages. We are not there yet but it is within 10 years and likely much sooner.

SLIDE 25

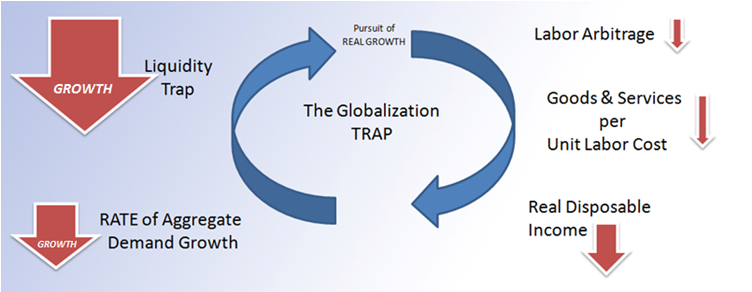

You have also sen this road-map previously regarding what I see to be the Globalization Trap that central bankers and many developed economies' governments are now caught in.

SLIDE 26

What it suggests is we will eventually see a Global "Liquidity Trap". It isn't because the central bankers won't inject endless amounts of money into the system. It will because there is insufficient unencumbered collateral creation to turn it into debt. We are not creating sufficient real wealth. Real wealth can only be created by growing it, mining it or building it. You can't "print" it!

This day will occur prior to the Fiat Currency collapse. It will assist in triggering that event.

SLIDE 27

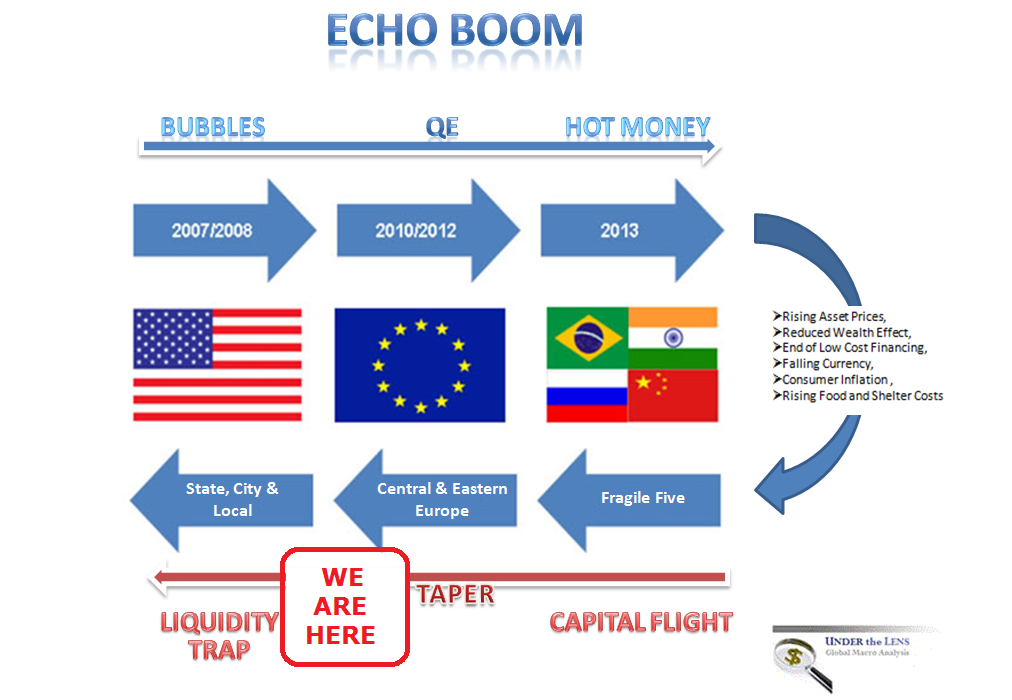

The Financial Repression policies of Quantitative Easing & ZIRP were intended to bring DEMAND forward to maintain growth. It is questionable they really achieved this, but if they have then it suggests there is a void in demand behind what was pulled forward. A major slowdown.

The bigger issue is however it created unintended massive SUPPLY and oversupply build up (because of cheap money for expansion) in the Emerging & Frontier economies. Whether offshore manufacturing or supply chain commodity requirements there has been nearly $55T in debt created. This debt needs to be paid for by sustained usage of the supply it was used to create.

Who sees a problem here?

SLIDE 28

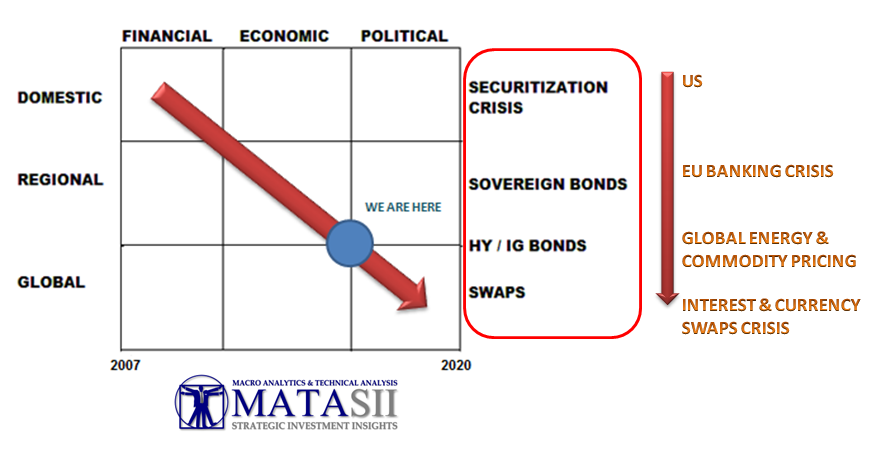

Another road map I put together has I failed to see the causes of the Financial Crisis addressed is this one here.

The Financial Crisis would lead to Economic issues which would culminate in Political discord.

Maybe most importantly it would lead to the collapse of the little discussed $700T OTC, unregulated Interest and Currency SWAPS market. A market totally within the purview of the international banks.

An edifice of derivative and contracts waiting for a counter party failure to cause it to implode.

SLIDE 29

The economics and road-maps are together pretty worrisome. But hat do they tell us about the future?

The economics and road-maps are together pretty worrisome. But hat do they tell us about the future?

The roadway after leaving Sound Money and adopting a Fiat currency regime is well marked by failed governments. No one has ever survived it.

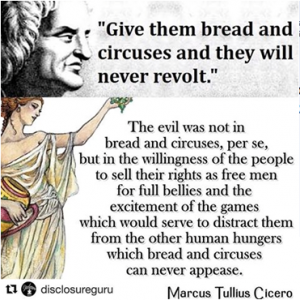

The Roman Empire left Sound Money when it started to "clip its coins" when it could no longer live beyond its means. It tried to keep the citizenry occupied with a strategy of Bread and Circuses. Call them Food Stamps and Media Spectacles like NFL Football.

SLIDE 30

Closer to modern times when the world moved from Monarchies to Republics and Democracy (around 1849) we witnessed the French Revolution.

We had issues of Inequality, Corruption and a Monarchy out of touch with the realities of the day. Sound familiar?

America’s “aristocracy,” once based strictly on bank accounts, acts increasingly hereditary as the vapid offspring and relations of “stars” (in politics, showbiz, business, and the arts) assert their prerogatives to fame, power, and riches - Similarity to the court of the Bourbons is the utter cluelessness of America’s entitled power elite to the agony of the moiling masses below them.

SLIDE 31

We don't have to look much further than Venezuela to see what to expect when a modern society begins to experience the ravages of removing itself from sound money.

Corruption, Socialism then Totalitarianism and utter social collapse in the standard of living as they knew it.

I encourage you to read "Letters From Venezuela: This Is What Life Is Really Like In A Post-Collapse Society" by Daisy Luther and other articles by Venezuelan's describing the unwinding process of a developed economy.

Don't believe for one minute this cannot happen in the US nor that the US is not already well on its way down the road.

SLIDE 32

What should we watch for to see if we are realistically following previous regimes?

- INCREASING LEVEL OF POLITICAL DISCORD,

- BROADER BASED SOCIAL UNREST,

- INCREASING LEVEL OF OUTBURSTS OF VIOLENCE,

- INABILITY TO REACH AGREEMENT – POLARIZATION,

- INCREASING EXAMPLES OF CHAOS, ANARCHY & RIOTS,

- INCREASINGLY MORE FORCEFUL MEASURES BY GOVERNMENT,

- MORE RADICAL FINANCIAL, ECONOMIC & POLITICAL POLICIES,

- BROKEN SOCIAL CONTRACT.

The world is not coming to an end

…… but like 1849 major changes are at hand!