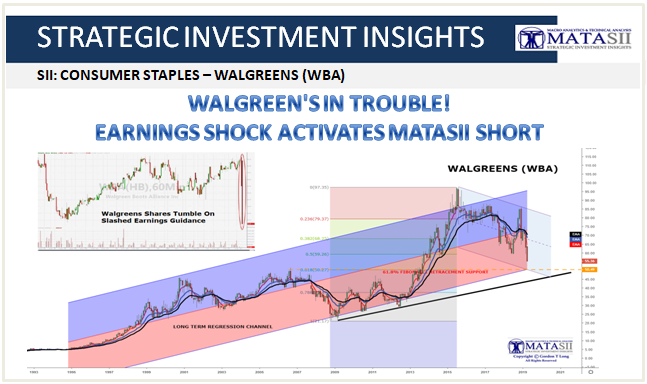

WALGREEN'S IN TROUBLE - EARNINGS SHOCK ACTIVATES MATASII SHORT

- MATASII IDEAS SHORT Trigger was activated at $58.00. Price closed 04-02-19 at $55.36

- Walgreen's had a confirmed downward trend prior to the earnings shocker!

- Expectations of earnings disappointment were already in the stock - however, there is likely more to go before finding support.

- Support should be found at the lower long term trend line (shown in black) and a 61.8% Fibonacci Retracement.

A PUBLIC SOURCED ARTICLE FOR MATASII

READERS REFERENCE: (SUBSCRIBERS-SII & PUBLIC ACCESS)

SII - CONSUMER STAPLES - WALGREENS (WBA)

SOURCE: 04-02-19 - - "Walgreens Shares Tumble On Slashed Earnings Guidance"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Walgreens Shares Tumble On Slashed Earnings Guidance

In what was undoubtedly the most closely watched earnings report of the session, Dow component Walgreens saw its shares drop more than 6% in pre-market trading after the company slashed its earnings guidance, becoming the latest corporate to undercut the economic growth narrative by slashing its earnings guidance.

After reporting results for its fiscal second quarter, the company said it's now expecting EPS growth for the upcoming fiscal year to be roughly flat, down from a prior forecast of 7%-12%.

Here are the highlights from the report:

- Net Sales: $34.5B (est $34.52B)

- Adj EPS: $1.64 (est $1.72)

- 2Q adjusted gross margin 22.6%, estimate 23.5%

- 2Q adjusted operating margin 5.3%

- Cuts Forecast

As CNBC reminds us, Walgreens and its rival CVS have been trying to draw more customers into their stores with new offerings like CBD-infused products, while balancing pressure form the Trump administration on pharmacy benefits managers to lower drug prices for consumers.

Here's the Walgreens press release:

Walgreens Boots Alliance, Inc. (Nasdaq: WBA) today announced financial results for the second quarter of fiscal 2019, which ended February 28, 2019.

Executive Vice Chairman and CEO Stefano Pessina said, “The market challenges and macro trends we have been discussing for some time accelerated, resulting in the most difficult quarter we have had since the formation of Walgreens Boots Alliance. During the quarter, we saw significant reimbursement pressure, compounded by lower generic deflation, as well as continued consumer market challenges in the U.S. and UK. While we had begun initiatives to address these trends, our response was not rapid enough given market conditions, resulting in a disappointing quarter that did not meet our expectations. As a result, we are now expecting roughly flat adjusted EPS growth for fiscal 2019.

"We are going to be more aggressive in our response to these rapidly shifting trends. We are focusing on our operational strengths and addressing weaknesses, making a number of senior appointments to bring change and accelerating the digitalization and transformation of our business. This will include expediting the execution of our partnership initiatives, fully developing our in-store neighborhood health destinations, re-imagining our front end retail offering, optimizing our store footprint and increasing the annual savings goal of our transformational cost management program from in excess of $1 billion to more than $1.5 billion. As a result of these actions, our business model will deliver improved performance in fiscal 2020, positioning us for mid-to-high single-digit growth in adjusted EPS in the following years."

Overview of Second Quarter Results Fiscal 2019 second quarter net earnings attributable to Walgreens Boots Alliance decreased 14.3 percent to $1.2 billion compared with the same quarter a year ago, while net earnings per share1 decreased 8.3 percent to $1.24 compared with the same quarter a year ago.

Adjusted net earnings attributable to Walgreens Boots Alliance2 decreased 11.5 percent to $1.5 billion, down 10.6 percent on a constant currency basis, compared with the same quarter a year ago. Adjusted earnings per share were $1.64, a decrease of 5.4 percent on a reported basis and a decrease of 4.3 percent on a constant currency basis, compared with the same quarter a year ago.

Sales in the second quarter were $34.5 billion, an increase of 4.6 percent from the year-ago quarter, and an increase of 6.7 percent on a constant currency basis, including the benefit from acquired Rite Aid stores.

Operating income was $1.5 billion, a decrease of 23.3 percent from the same quarter a year ago, primarily due to operating performance, costs related to the Transformational Cost Management Program and prior year impact of U.S. tax law changes related to AmerisourceBergen. Adjusted operating income was $1.9 billion, a decrease of 10.4 percent from the same quarter a year ago, and a decrease of 9.3 percent on a constant currency basis, primarily due to rising reimbursement pressure in the U.S. pharmacy business with fewer opportunities for mitigation as a result of slowing deflation of generic medications. In addition, performance was impacted by weak comparable store sales in U.S. retail and a challenging market in the UK.

Net cash provided by operating activities was $735 million in the second quarter, and free cash flow was $411 million.

Overview of Fiscal 2019 Year-to-Date Results For the first six months of fiscal 2019, net earnings attributable to Walgreens Boots Alliance increased 5.1 percent to $2.3 billion compared with the same period a year ago, while net earnings per share1 increased 12.0 percent to $2.42 compared with the same period a year ago.

Adjusted net earnings attributable to Walgreens Boots Alliance2 for the first six months of fiscal 2019 decreased 3.6 percent to $2.9 billion, down 2.8 percent on a constant currency basis, compared with the same period a year ago. Adjusted earnings per share for the first six months of fiscal 2019 were $3.09, an increase of 2.8 percent on a reported basis and an increase of 3.6 percent on a constant currency basis, compared with the same period a year ago.

Sales in the first six months of fiscal 2019 were $68.3 billion, an increase of 7.2 percent from the same period a year ago, and an increase of 9.0 percent on a constant currency basis.

Operating income in the first six months of fiscal 2019 was $2.9 billion, a decrease of 11.5 percent from the same period a year ago.

Adjusted operating income in the first six months of the fiscal year was $3.7 billion, a decrease of 7.5 percent from the same period a year ago, and a decrease of 6.6 percent on a constant currency basis.

Net cash provided by operating activities was $1.2 billion in the first six months of fiscal 2019, and free cash flow was $401 million, impacted by notable headwinds including cash tax payments, mainly from U.S. tax reform, legal settlements and prior year working capital benefits from the acquisition of Rite Aid stores.

Second Quarter Business Division Highlights

Retail Pharmacy USA: Retail Pharmacy USA had second quarter sales of $26.3 billion, an increase of 7.3 percent over the year-ago quarter.

Excluding the benefit from acquired Rite Aid stores, organic sales growth was 1.6 percent in the quarter.

Pharmacy sales, which accounted for 71.9 percent of the division’s sales in the quarter, increased 9.8 percent compared with the year-ago quarter, reflecting higher prescription volumes from the acquisition of Rite Aid stores, strong growth in central specialty and a 1.9 percent increase in comparable pharmacy sales. The division filled 286.3 million prescriptions, including immunizations, adjusted to 30-day equivalents in the quarter, an increase of 6.4 percent over the year-ago quarter. Prescriptions filled in comparable stores increased 1.8 percent from the same quarter a year ago.

Retail prescription market share on a 30-day adjusted basis in the second quarter increased approximately 90 basis points over the year-ago quarter to 22.3 percent, as reported by IQVIA.

Retail sales increased 1.3 percent in the second quarter compared with the year-ago period. Comparable retail sales were down 3.8 percent in the quarter, primarily due to a weak cough, cold and flu season compared with the year-ago quarter, continued de-emphasis of select products such as tobacco and a decline in sales of seasonal merchandise.

Gross profit decreased 3.2 percent compared with the same quarter a year ago and adjusted gross profit decreased 3.5 percent, primarily due to reimbursement impacts in pharmacy.

Second quarter selling, general and administrative expenses (SG&A) as a percentage of sales improved 1.4 percentage points compared with the year-ago quarter, due to continued cost saving initiatives, sales mix and bonus accrual reductions. On an adjusted basis, SG&A as a percentage of sales improved 1.4 percentage points in the same period. The second quarter of fiscal 2019 included $40 million of costs related to previously announced store and labor investments.

Operating income in the second quarter decreased 12.6 percent from the year-ago quarter to $1.2 billion. Adjusted operating income in the second quarter decreased 11.9 percent from the year-ago quarter to $1.5 billion, including an adverse impact of 2.4 percentage points due to the store and labor investments mentioned above.

Retail Pharmacy International: Retail Pharmacy International had second quarter sales of $3.1 billion, a decrease of 7.1 percent from the year-ago quarter, reflecting an adverse currency impact of 5.9 percent. Sales decreased 1.2 percent on a constant currency basis, mainly due to a 1.3 percent decline in Boots UK.

In the UK, comparable pharmacy sales decreased 1.5 percent and comparable retail sales decreased 2.3 percent, with Boots UK broadly maintaining market share amid weakness in its categories.

Gross profit decreased 8.9 percent compared with the same quarter a year ago. On a constant currency basis, adjusted gross profit decreased 1.2 percent, due to lower sales.

SG&A as a percentage of sales increased 0.5 percentage point. Adjusted SG&A as a percentage of sales, on a constant currency basis, was unchanged, with SG&A expenses reduced by 1 percent compared with the year-ago quarter.

Operating income in the second quarter decreased 22.6 percent from the year-ago quarter to $192 million, while adjusted operating income decreased 6.8 percent to $256 million, down 2.1 percent on a constant currency basis. The quarter benefited from phasing from the first quarter and bonus accrual reductions.

Pharmaceutical Wholesale: Pharmaceutical Wholesale had second quarter sales of $5.7 billion, a decrease of 0.3 percent from the year-ago quarter, due to an adverse currency impact of 9.4 percent. On a constant currency basis, sales increased 9.1 percent, primarily reflecting growth in emerging markets and the UK.

Operating income in the second quarter was $100 million, which included $83 million from the company’s equity earnings in AmerisourceBergen. This compared with operating income of $323 million in the year-ago quarter, which included $202 million from the company's equity earnings in AmerisourceBergen.

Adjusted operating income decreased 3.3 percent to $225 million due to the impact of currency translation. On a constant currency basis, adjusted operating income increased 3.0 percent, with sales growth and improved SG&A as a percentage of sales more than offsetting lower gross margin.

Company Outlook The company reduced its adjusted EPS guidance for fiscal 2019, from a range of 7 percent to 12 percent growth, to roughly flat, at constant currency rates. On a reported currency basis, the company anticipates approximately $0.04 cents per share of adverse currency impact.

Long-Term Business Model The company confirmed its existing transformation priorities and announced it will be taking immediate action to reinforce and accelerate them. With these actions, the company's business model aims to deliver improved performance in 2020, and mid-to-high single-digit growth in adjusted EPS, at constant currency rates, in the following years.

Transformational Cost Management Program The company's global cost review, scheduled for completion by the end of April 2019, has provided sufficient visibility to increase the annual cost savings target from the transformational cost management program from in excess of $1 billion to in excess of $1.5 billion by fiscal 2022. The program includes divisional optimization initiatives, global smart spending, global smart organization and digitalization of the enterprise to transform long-term capabilities.

During the second quarter and since the quarter ended, the company has taken decisive steps to reduce costs in the UK and to optimize the field management structure in the U.S.

The company continues to anticipate that aspects of such initiatives will result in significant restructuring and other special charges as they are implemented. The company has recognized cumulative pre-tax charges of $179 million for the six months ended February 28, 2019. These charges primarily relate to the Pharmaceutical Wholesale and Retail Pharmacy International divisions.

Dividends Declared During the second quarter, the company declared a regular quarterly dividend of 44 cents per share. The dividend was payable March 12, 2019 to stockholders of record as of February 15, 2019.

Conference Call Walgreens Boots Alliance will hold a one-hour conference call to discuss the second quarter results beginning at 8:30 a.m. Eastern time today, April 2, 2019.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.