WANT TO WIN DURING A PROTRACTED TRADE WAR? GO LONG THE DOLLAR!

-

Greenback seen a better haven than yellow metal in trade melee

-

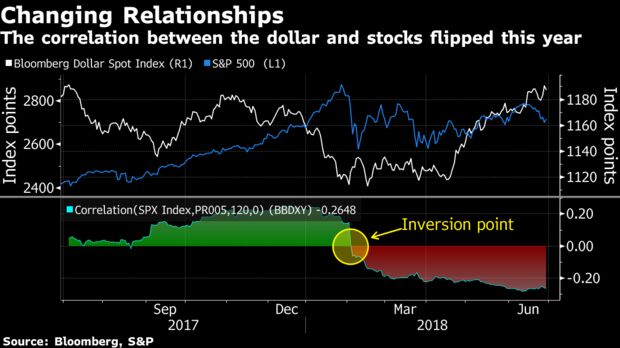

Currency’s correlation to stocks became inverted this year

Trade wars are good, and easy to win -- that’s a Donald Trump assertion which is giving succor to dollar bulls.

They see the greenback as a better haven than gold should the tariff tit-for-tat intensify. Four months after the U.S. president shocked equity markets with his vision of higher duties on imports to America, investors are discovering catalysts that should help the nation’s currency withstand trade turbulence better than gold.

“The dollar has become the main destination for safe-haven investors,” Ole Hansen, head of commodity strategy at Saxo Bank A/S, said by email from Copenhagen. “Geopolitical risk is on the rise, bonds and stocks have sold off and yet gold continues to drift lower.

The prospect that import tariffs will reduce the biggest economy’s current-account deficit at a time when the Federal Reserve raises interest rates has created a rare opportunity. The dollar can be used both as a haven and in carry trades, according to Andreas Steno Larsen, a global currency strategist at Nordea Bank AB in Copenhagen.

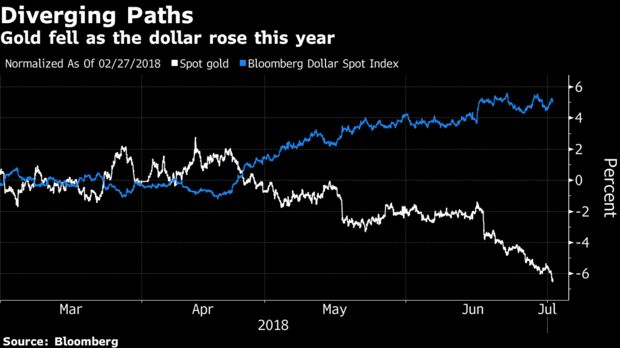

The currency’s hold over gold is strengthened by the fact the metal is usually priced in dollars -- they’re inversely correlated.

Bad Half

With bullion last week posting its worst first-half performance in five years, investors are recalculating how they weight traditional assets. The push is coming from a confluence of events, from Trump’s antagonistic stance toward America’s trading partners, to the fact that the Fed is winding down quantitative easing earlier than its counterparts in Japan or Europe.

The global stocks benchmark MSCI All Country World Index just notched its first back-to-back quarterly decline since 2015, and emerging-market equities posted the first drop in six quarters. Meanwhile the dollar is outperforming most major currencies. As the world’s most liquid bond market offers higher yields, the appeal dwindles for holding an asset bereft of an income stream such as gold.

Meanwhile, the currency strengthened its grip over gold prices, overshadowing other drivers including falling physical demand in India, industrial-demand expectations and dwindling investment flows in exchange-traded funds. About half of gold’s fluctuation since January could be explained by movements in the greenback, regression analysis shows. That’s a stronger bond than in any year in the past decade.

“We’ve seen a very tight relationship between gold and the dollar recently,” Carsten Menke, a commodities strategist at Bank Julius Baer & Co. Ltd., said by phone from Zurich. “It’s very difficult to make money trading gold when the dollar is rising.”

At the same time, the 120-day correlation between the Bloomberg Dollar Spot Index, which was up 1.7 percent this year through July 3, and the S&P 500 turned negative in February. A stronger-than-noise reading of negative 0.3 meant the benchmark indexes moved in opposite directions more than not. A rallying dollar may itself be a headwind to stocks.

A “significant” driver of the dollar’s gains this year has been reduced risk appetite, spurring a tide of capital to dollar assets as emerging markets seize up, according to Jane Foley, head of currency strategy at Rabobank. That said, “the sheer liquidity associated with the dollar means that for some investors it will always be a safe haven,” she wrote in a recent note.

The U.S. is expected to start enforcing fresh tariffs on a range of Chinese goods on Friday, with the Asian nation poised to retaliate immediately. China exported more than $500 billion to America last year.

Friends in a Crisis

Of course, the metal and currency don’t always move inversely. During times of acute panic, such as the Greek debt crisis, they may rise together.

Yet what protects in one scenario may be useless in another. Gold is a decent hedge against a currency collapse -- as savers in Turkey and Venezuela might attest to -- and it can protect against long-term inflationary trends, according to research from the World Gold Council. But its track record against equity volatility is more patchy, having sold off heavily during stock crashes in 2000 and 2008.

A long-dollar bet isn’t risk-free. Should the Federal Reserve be ready to call halt on the tightening cycle or company results start to disappoint, investors may want to reconsider, according to Wayne Gordon at UBS Wealth Management, who favors an allocation to gold.

“As we expect the pace of growth in the U.S. to soon peak and a recovery in Europe, I’m not certain the dollar would be the best place to be,” said the Singapore-based executive director for commodities and foreign exchange, who’s predicting the dollar will weaken by about 10 percent against the euro by mid-2019. “We remain convinced of broad dollar weakness in the longer term.”

For the moment though, those trusting in gold are keeping the faith -- even if only in the long term.

“We don’t want to get ahead of ourselves in calling for the death of gold as a safe haven, given that it has worked quite well for thousands of years,” Matt Maley, an equity strategist at Miller Tabak & Co., wrote in a note. “But it is weird that it acts so poorly recently when other safe havens and defensive plays have been acting so well.”