WATCH US$ & CONSUMER COMFORT AS ECB'S OCTOBER 26TH MEETING APPROACHES!

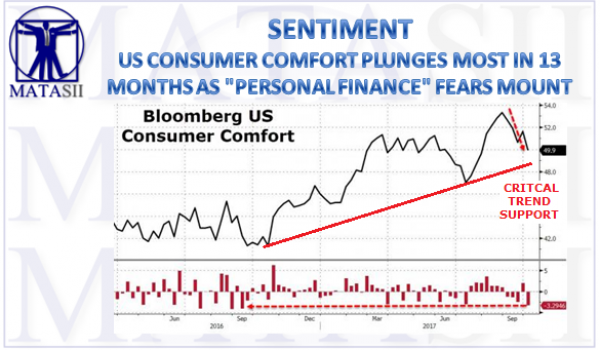

LATEST CONSUMER COMFORT UPDATE: US CONSUMER COMFORT PLUNGES MOST IN 13 MONTHS AS “PERSONAL FINANCE” FEARS MOUNT

--------------------------------------------------------------------------------------------------

EXISTING POST: WATCH US$ & CONSUMER COMFORT AS ECB'S OCTOBER 26TH MEETING APPROACHES!

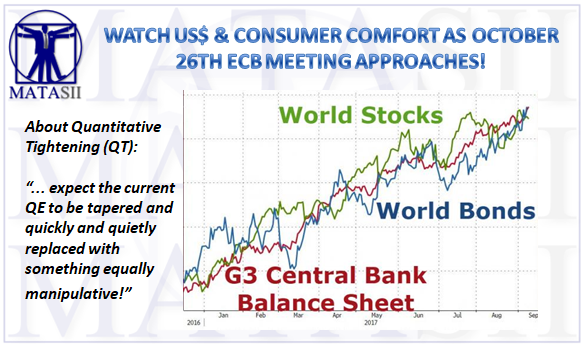

Unless you have been living under a rock you are well aware of what has been driving markets higher during the "Bull Market" and more recently, holding markets up. But all of this is in the process of changing as the Central Bank "PUT" is potentially about to be withdrawn via Quantitative Tightening (QT), if you believe the central bankers public rhetoric.

Equity Investors & Bond Traders are somewhat skeptically waiting for more defined details, specifically from the ECB. This did not come with Mario Draghi's latest announcement on September 7th (though there were many innuendos). Reuters leaked more details after Draghi spoke that many consider an obvious trial balloon (read: ECB LEAKS TRIAL STIMULUS REDUCTION BALLOON THROUGH REUTERS - NEXT MEETING 10-26-17). The current expectations are now for the details to be released during the upcoming ECB Meeting scheduled for October 26th, 2017.

What MATASII subscribers need to watch for as the meeting approaches are two fold:

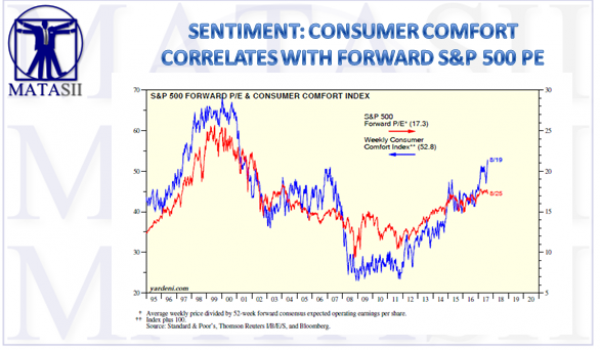

SENTIMENT SHIFT - CONSUMER COMFORT READING

Technicians are looking for a reversal in Bloomberg's Consumer Comfort Index which recently reached a 16 year high. It has been a reliable indicator of major market trend reversal and is central to many investors analysis like Dr Ed Yardeni and his Fundamental Stock Market Indicator (FSMI) :

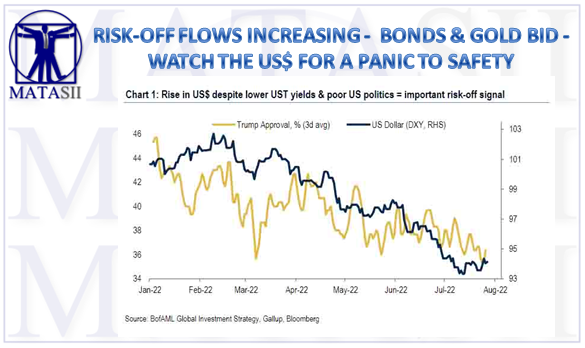

US DOLLAR - FLIGHT TO SAFETY

Additionally, Investors are looking for a potential violent reversal in the dollars 2017 fall as a "flight to safety" ensues. Confusion will prevail as this will occur with a temporary concurrent rise in the Euro as the ECB announces its tightening framework and corresponding schedule.