TIPPING POINTS

RISING INFLATION

WHAT INFLATION MEANS TO THE MARKETS

We are presently caught in what has become a manic concern that inflation is approaching like a looming tidal wave. There is little doubt that Inflation continues to grow and broaden in scope. However, the perspectives on why this is occurring vary distinctly. The difference in views on why this is occurring can and will have important consequences to the market and your portfolio. This is what we will explore below.

We are presently caught in what has become a manic concern that inflation is approaching like a looming tidal wave. There is little doubt that Inflation continues to grow and broaden in scope. However, the perspectives on why this is occurring vary distinctly. The difference in views on why this is occurring can and will have important consequences to the market and your portfolio. This is what we will explore below.Many argue that inflation will be driven by an explosion in the money supply due to Covid stimulus along with acceleration in government fiscal spending associated with multi-trillion dollar new Democratic policies such as the $2T plus Infrastructure Bill. Others see it as a result of serious and growing chaos in the global supply chain brought about by the resumption of business in a post Covid world resulting in a demand spike and the associated shortages creating pricing pressures. It can also be reasoned that in the Covid-19 recession and recovery policy makers have not only added massive fiscal stimulus (as just mentioned), but also direct wealth transfer (aka helicopter money) to the equation with full Modern Monetary Theory (MMT). This will create a markedly different social and economic dynamic which will set the stage for a substantial new inflationary cycle.

All these views are correct and each will contribute to inflation, but are they only noise and not the signal that will actually direct the market’s flow like a river stream?

MATASII’S PERSPECTIVE ON INFLATION

There is little question that inflation will be the most-discussed topic in  Q2 2021. The chart to the right shows the Consumer Price Index for the last 5 years, indexed to 100 on the May 2020 observation point. It shows the February 2021 CPI was 2.8 percent above the May 2020 reading.

Q2 2021. The chart to the right shows the Consumer Price Index for the last 5 years, indexed to 100 on the May 2020 observation point. It shows the February 2021 CPI was 2.8 percent above the May 2020 reading.

The takeaway is that this is the “easy comp” effect and it will absolutely be a factor in Q2 2021’s CPI readings. As much as “everyone knows this”, actually seeing a 3 pct CPI print in Q2 will be confirming proof we have major inflation growth and the markets will react accordingly. Be ready.

In last fall’s October UnderTheLens video we argued with the aid of 40 slides that we have been experiencing for years Inflation PLUS Deflation which has been appearing as waves as our focus shifts in alignment with the news flows. That shift in focus comes as a result of one or the other appearing to be increasing more than it was or one of them is shifting to a newly impacted economic area.

In last fall’s October UnderTheLens video we argued with the aid of 40 slides that we have been experiencing for years Inflation PLUS Deflation which has been appearing as waves as our focus shifts in alignment with the news flows. That shift in focus comes as a result of one or the other appearing to be increasing more than it was or one of them is shifting to a newly impacted economic area.

We must not forget that both are relentlessly increasing, with each wave getting larger and therefore overall economic conditions becoming more fragile and precarious. The fact that Inflation is getting worse should not be any surprise. It should also not be any shock that the fallout from Covid will also accelerate disinflationary and deflationary pressures markedly. Both will get larger but for new reasons. I see 2021 to be about just such a shift in focus.

We will see a shift from an initial focus on an inflation surge to the hard realities of the strong headwinds of Deflation.

Inflation will be met with recessionary deflationary pressures. This is the prescription for Stagflation. (see our video: The Coming Deflationary Tsunami)

With that said we see the current focus on inflation to:

- Contain a significant transitory element in the nature of the increases in inflation which is associated with the shortages caused by the Covid recovery. What we are experiencing is similar to everyone turning the lights on at the same time and the Utility companies having never prepared for such a surge. Similarly, global “Just-In-Time” supply chain systems are not prepared for turning the global industrial machine back on when supply chains are built on a philosophy of there being no inventory in the system (other than in actual transit). It is ill prepared and re-starting such a system has never before been attempted.

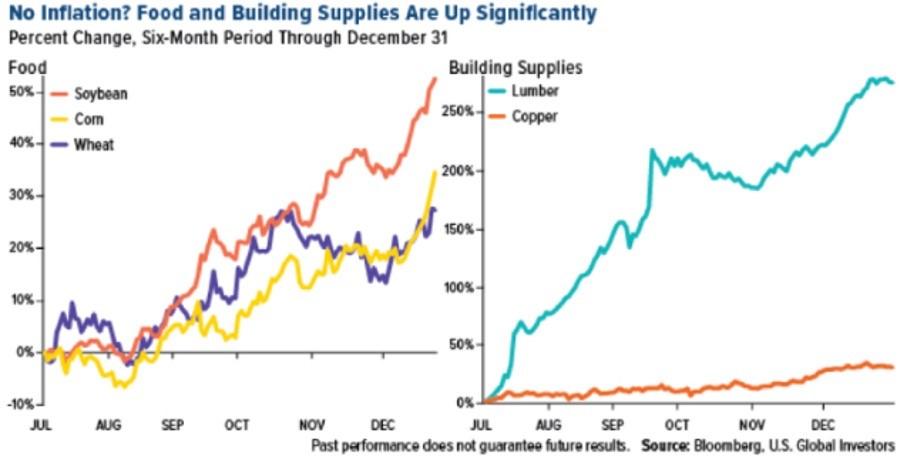

- We fully expect major spikes to continue in Soft (Food) and Hard (Metals) Commodities. These inflationary items are not transitory. We expect major inflation in food prices and agricultural land which is likely to do well in coming years. As I have pointed out in recent articles, we are already seeing high inflation in agricultural and overall commodities

A SIMPLE PERSPECTIVE

The markets current perspective on the reasons for the surge in inflation expectations (outlined above) have unfortunately ‘sowed the seeds’ for something very problematic in the longer term for America and many other developed economies.

- TAXATION: Massive spending and money supply expansion will result in just as dramatic increases in all forms of government taxation, fees license, tolls etc. The result will be the effective reduction in real disposable income. This will reduce consumption demand. Increasing taxes are disinflationary.

- US$ WEAKNESS: Massive government spending and US money supply growing will result in a falling US Dollar. This will force up the costs of imported goods. This is normally inflationary if the consumer can absorb the cost?

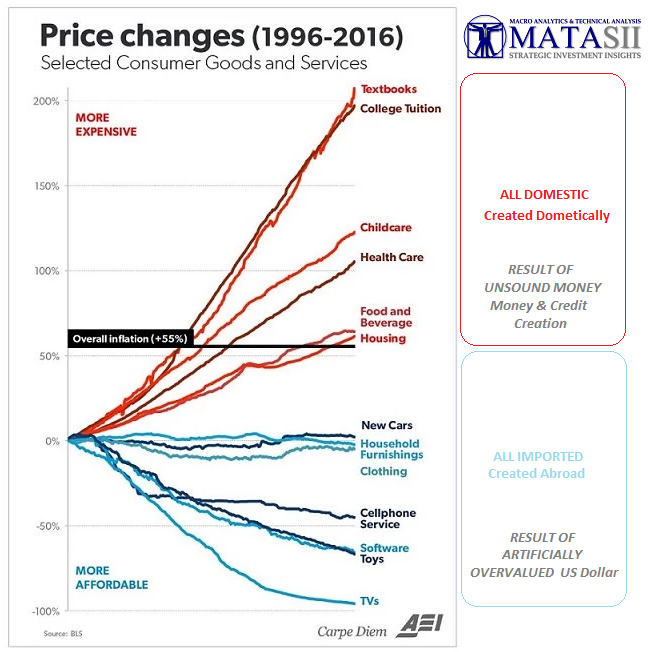

The graphic to the right is representative of the environment of Inflation and Deflation that the US consumer has been facing over the last 25 years. This is about to change because of the two points just mentioned. What we should soon expect is a reversal in this graph.

Imported goods are likely to become more expensive (because of a falling US dollar), while domestic items will be forced to fall in price because of falling consumer demand (due to shrinking real disposable Income).

A SHIFTING STANDARD OF LIVING

The result of this will be that the US will face a significant falling standard of living. Inflation will effectively reorder US consumption spending:

- A focus on what you Need versus What You Want,

- A focus on what you pay “Cash” for versus what you are have normally Financed (because Credit was readily available without posting unencumbered collateral).

INFLATION DRIVES REAL RATES WHICH IS UNDERPINNING MARKETS

Markets never go straight up or down. Even in strong advances there are retracements. That is what we see when we analyze Inflation through changing Real Rates to determine what lies ahead for the markets.

WHAT WE SEE

We are likely to soon see yields correct in a potential “D” wave (see chart directly below) before heading higher towards maybe -0.3 or -0.25 % as a result of the Chinese Credit Impulse (we have described in prior newsletters & videos). Something in the area of -0.3% is likely.

The sequence we see is highlighted in the chart below in black. Here is how it unfolds:

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.