WHAT IS DRIVING THIS RALLY'S RELENTLESS REGISTRATION OF RECORDS?

OBSERVATION

-

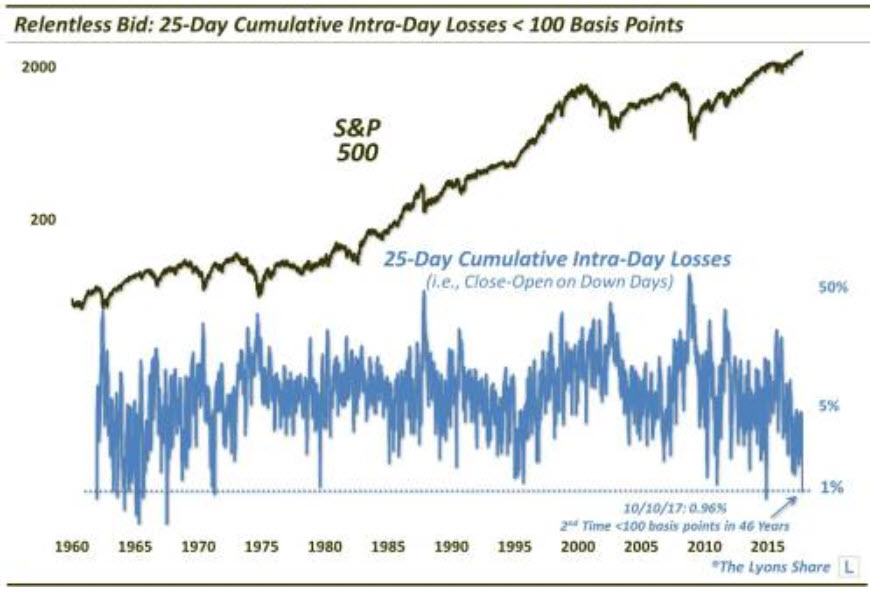

- By some quantitative measures, the recent bid is among the most relentless the market has seen in the past half century,

- No matter how the market opened, it has consistently closed the day strongly,

- Going back 55 years, the average cumulative intra-day losses over a 25-day period is about 660 basis points, or 6.6%. As of October 10, the last 25 days have seen a grand total intra-day loss of just 96 basis points, or 0.96%,(based on tallying all of the negative intra-day readings (e.g., days when the S&P 500 closed below its open) over rolling 25-day periods.)

- Outside of the period ending November 26, 2014, this is the smallest cumulative 25-day intra-day loss in the past 46 years – and the only one registering less than 100 basis points

SOURCE: Rally’s Relentless Bid Registering Records

KEY MESSAGE

Q: Is the market over-extended and overdue for a pullback OR is the bid a sign of persistent demand, standing ready to continue to buoy stock prices?

A: This is more than BOJ & ECB Central Bank Liquidity injections - This is reflective of computer controlled, not necessarily via a 'master plan' but by computers feeding off other computers. The current phenomena is likely to also work in reverse? Ouch!

PASSIVE INVESTING

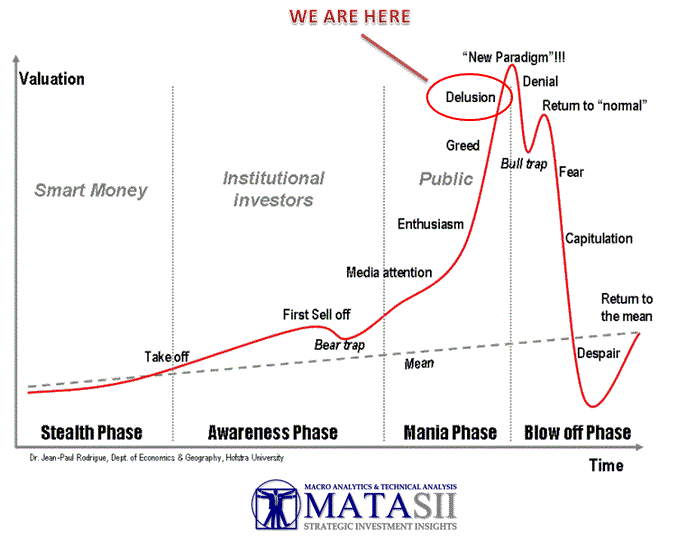

I suspect what is behind the computer bid orders is the growing degree of Passive Investing underway.

Smart and savvy investors, particularly buy and hold index investors, have reaped plentiful fruits for possibly mindlessly plowing their capital into low cost S&P 500 index ETFs. Indeed, this strategy has worked well for nearly a decade. The "fear of losing out" is becoming more pronounced. To new participants to the market they now "feel surely it will continue, right?". They sense the professionals must know something they don't and need to take advantage of the opportunity. This is a normal indicators of the final "blow off" stage when the public joins the rally.

A passively managed S&P 500 Index ETF, such as the SPDR S&P 500 ETF (NYSE: SPY), is up over 279 percent since March 9, 2009. Investors that merely bought and held have been rewarded for their lack of discrimination. Conversely, those who scratched their head, did some homework, and concluded that the market’s fundamentals are deficient, have been sorely punished.

Passively managed ETFs that simply mirror the movement of the S&P 500 are a fantastic investment vehicle when the stock market rises over an extended period. On the other hand, in a bear market, when there’s a protracted stock market decline, these passively managed index tracking ETFs are terrible investments. When the stock market crashes by 50 percent – which it likely will, these ETFs will also crash by 50 percent.