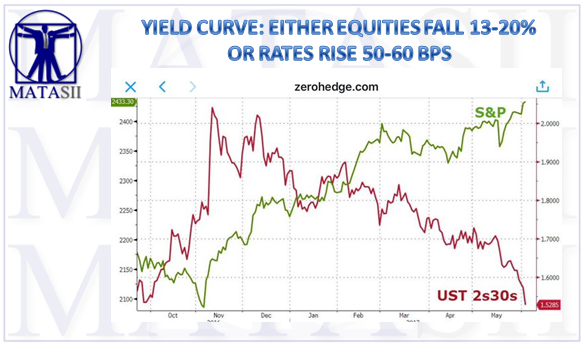

YIELD CURVE: EITHER EQUITIES FALL 13-20% OR RATES RISE 50-60 BPS

Quickly skimming the front pages of the financial press in recent days reveals one recurring, and puzzling, story: the diverging and contradictory signals being sent by the bond (deflationary) and stock (inflationary) markets.

Attempts at an easy reconciliation are doomed to fail as this paradoxical divergence has stumped everyone, including the person who is allegedly in charge of the US economy, Trump's top economic advisor, former Goldman COO Gary Cohn, who last week made the "embarrassing" admission that over the long run, the bond market - with its bearish signal - will be right. Recall the following exchange last Friday captured by Pedro da Costa:

CRAMER: What do you make of the fact that rates are going down so precipitously? Is it that trading partners keeping their currencies down and causing money to come here, or are the bond market right and we just saw a peak in employment and maybe even earnings?COHN: I don't think there's a simple answer or a simple factor here, but remember the bond market takes a longer-term view of what's going on. I think people are taking a longer-term view on our economy, our economy growth, and where they think policy's going.

Also last Friday, Mohamed El-Erian noted just this "quandary", and when referring to the divergence said "this (simple yet powerful) chart from @zerohedge warrants a PhD thesis in Finance"

... to which both Deutsche Bank had a simple retort: it's a "perfect storm melt up", as the Fed remains unable to truly tighten, whether due to fears over another "policy error" or concerns about China's debt load.

Unfortunately, while it is easy to stick one's head in the sand and ignore this historic divergence, correctly predicting what happens next could well be "the next big trade", as either the bond or stock market is massively wrong, and sooner or later the decoupling will have to converge. The question is in which direction.So, in the latest take on this critical topic, overnight Bank of America has released a report which repeats what is already known, namely that after Friday's payrolls, "the rates market is now pricing in just three more hikes to end 2019, including June.

Our fixed income strategists think the bond market is pricing a policy error from the Fed.

Given some of the implied rise in rates is simply risk premium, we think

the US bond market is implying a sharp slowdown in US growth to trend or even below."

Gary Cohn may want to ignore the last bolded sentence.

So what about stocks?

" The reason equities have been able to rally this year, despite falling bond yields, has been because earnings have been so strong. MSCI ACWI earnings are now expected to be 14% for this year, 11% for 2018 and 10% for 2019."Some other observations: the US earnings season was the best in 13 years and the European one the best in at least 15 years. That, according to BofA, can be attributed to the "synchronized upswing" in global growth.

"Although there have been some signs of that upswing losing a little momentum, hence the bid in the bond market, there is also evidence that it is ongoing in other areas. The German Ifo survey, for example, was described by its producers as "exuberant" which is not surprising since we cannot find a higher reading in its entire existence (including going back to pre-unification West German readings)."As we discussed yesterday, JPM disagrees with this optimistic assessment for several key reasons (see full note here). So perhaps earnings will not disappoint and the 14% growth in 2017 (and 11% in 2018) will take place as planned, although as JPM showed yesterday, Q1 may be as good as it gets, with growth slowing down sharply after the first quarter.

Of course, it's not just earnings, there is also the biggest factor of all: central banks. As BofA Chief Investment Strategist, Michael Hartnett, has repeatedly said, this in part to the ongoing central bank "Liquidity Supernova" with $1.1tn of assets purchased ytd. He argues in "Occupy Silicon Valley" that this is perhaps justified by lower than expected inflation, which is why investors have bid up growth stocks around the world."

And while the jury is still out on the earnings recovery - and whether central banks will risk tightening to the point where the "liquidity supernova" turns into a black hole for risk prices, one thing is certain: both bonds and stocks can not be right. So what does that mean for either stocks or bonds?

Since the answer is binary, and either bonds or stocks could end up being correct, here are the two options offered by Bank of America: either equities have 13-20% downside, or rates 50-60bp upside. The details:

If the bond markets are right and growth slows, then we think earnings growth would likely return to the path seen in recent years, i.e. barely above zero. If we fade earnings growth back to zero in 2018/19 and keep markets on current 2018 multiples, we find 13% downside potential for equity markets. Taking markets back to the multiples seen at the lows of August 2015 and Feb 2016 suggests 20% downside. If equities are right, then we think the US rates market has to move to price in the dot plot. Our US rates strategists find that means rates moving around 50bp higher in the belly of the curve. Given the extra supply they think is coming, they see 10Y rates at 2.85bp by year end.Some more details from BofA on these two possible outcomes.

Scenario 1: "stocks are wrong"

If markets adjust to current 2018 multiples there is c13% downside: If we simulate say 10% earnings growth for this year followed by flat earnings for the next two years, then the P/E on MSCI ACWI would rise to 17.3x from 15x on 2018 earnings. To go back to 15x, the market would have to fall by around 13%... The MSCI ACWI troughed around 14x in both the summer of 2015 and Q1 2016. To go back to these levels would imply a 20% pullback in equity markets. That however would be more consistent with concerns about renewed deflation and even lower bond yields than currently. We get similar numbers, if we were to apply the same type of analysis for the US market alone. The 13% pullback would unwind all of the post Trump rally and seems a more logical adjustment to bond yields at current levels.Scenario 2: "bonds are wrong."

Marking fixed income to the dot plot suggests 50bp+ of upside in yields: We have made the point frequently that the rates market continues to discount a much shallower pace of tightening than the Fed's dot plot. Indeed, post payrolls there are only three hikes priced by the end of 2019, including June. As a result, the Fed has rates peaking at 3% by the end of 2019 and the rates market at under 1.7%. The rates team looked at where 3Y and 5Y yields should be under a scenario where the Fed hikes twice more this year and three times in 2018 (in line with the dot plot). They put fair value at 1.91% and 2.25%, which compares to 1.44% and 1.74% right now. Put another way, the only way they could build in a decline in yields was if either the Fed was done after 2017 or abandons hikes for this year and hiked once per year until it reached 2.5%.Additionally, if the rate market is right, then BofA concedes that growth will also have to slow margedly.

However, you cut it that is a glacial tightening of rates and only likely to be achieved if the US recovery slows to trend or even below. It is only under such a scenario that it is conceivable that the Fed would slow their tightening to such an extent. In fact, our fixed income strategists have suggested to us that such a slow pace of implied tightening is little more than risk premia in the curve and as such can almost be viewed as the Fed going on hold. Indeed, they have calculated that the fixed income markets are actually factoring in the risk of a rate cut next year. Certainly there seems to be little room in any part of the curve for the prospect of any significant tax cuts or fiscal stimulus out of the Trump administration.The consistent message from the rates market would seem to be that any surge in growth that we have seen over the last 6-9 months fizzles out and that we head back to the post 2010 regime of sluggish global growth. Put another way, secular stagnation is alive and well.

For the record, and perhaps not surprisingly, this is where BofA stands on this debate:

As a house, we are in the equities can go higher camp, with our quant models remain resolutely bullish and Michael Hartnett is looking for his Icarus trade to continue. Meanwhile, although our fixed income strategists have recently moderated their call for higher yields but still see 10Y yields at 2.85% by the end of the year.Even so, the bank is unwilling to commit either way and hedges as follows: "We would argue that the equity markets are probably more in line with the Fed because they have been driven off of earnings, which is more in line with the soft economic data. So depending on which way this hard vs soft data debate ends, we could either have a 50-60bp back up in bond yields or a c13% drop in equity markets, or of course something in between."

So perhaps the best trade here is a compression trade, shorting equities while also shorting bonds, which however due to the high cost of carry in a world in which active managers are pressured to generate returns every month, if not week, is hardly actionable advice for the vast majority.

And then there was Gary Cohn's own take on the situation, which recall was the following: "remember the bond market takes a longer-term view of what's going on. I think people are taking a longer-term view on our economy, our economy growth, and where they think policy's going."

If so, the outlook for both the US economy and the stock market is quite poor.