YOU WILL BE LEARNING ABOUT"CLO'S" DURING THE NEXT FINANCIAL CRISIS - MATASII ADVISES YOU GET A HANDLE ON IT NOW

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS & PUBLIC ACCESS) READERS REFERENCE

SOURCE: 03-03-19 - "Satyajit Das: The CDO Bomb That Blew Up In 2008? There Is A New One"

In recent months, with the investor spotlight increasingly falling on the "leveraged loan problem", or the fact that there are now more leveraged loans outstanding - most of them offering virtually no covenant protection to investors and effectively stripping them of their "secured" position in the capitalization waterfall thus making them pari passu with high yield debt - than junk bonds, there has been a resurgence of discussions whether CLOs are the next "ticking timebomb", and whether Collateralized Loan Obligations which have emerged as the primary source of demand for new loan issuance, will be the new CDOs and catalyze a systemic crash.

In an attempt to short-circuit such concerns, two weeks ago Barclays published a "CLO mythbuster" piece, in which it first noted that since 2008, Bloomberg, the Financial Times and even Hollywood have provided the general public with myriad causes of the Great Financial Crisis (GFC), "rarely failing to include a layman’s introduction to CDOs and how they played a major role", and noting that "more recently, this conversation has grown to include comparisons to today’s CLO and leveraged loan markets, with premonitions of another GFC brewing just a decade after the last with CLOs acting as an accelerant."

But first, this is Barclays defines a CDO in general, and a CLO in particular:

The term CDO actually covers an array of structured vehicles backed by debt, whether that debt is leveraged loans (CLOs), high-yield bonds (CBOs) or even other structured products (CDO-squared). So, while CDO subsets may have somewhat comparable structures (an SPV issues debt tranches, AAA through equity, and buys assets), the performance of the underlying assets and the ability for the vehicles’ liabilities to match the cash flows generated by those assets have proved vital for the future performance prospects of structured products.

...

US CLOs currently own about 60% of the performing US loan market, while European CLOs own just under half of the European loan market since they also buy HY bonds. This represents a big change from the late 1990s when banks owned about half of the loan market. Other holders of US loans include mutual funds (15-18%), hedge funds/SMAs (14-18%), and a smaller percentage by BDCs (Business Development Companies), insurers and banks.

Incidentally, for those curious about the terms of a generic leveraged loans, these are debt instruments issued by companies like CenturyLink, American Airlines, Ziggo, and Altice. The loans are typically broadly-syndicated (BSL), rated BB/B, floating-rate (based on LIBOR/EURIBOR), have a soft-call period of 6-12 months, maturity of around 7 years (~4 year WAL) and facility size of about half a billion.

So in order to mitigate concerns about CLOs - which are synthetic structures that gobble up leveraged loan issuance - being the next crisis "accelerant", Barclays presented the "facts" for investors to use as a guide when planning for the next downturn, "instead of relying on media rhetoric." Here is what Barclays said:

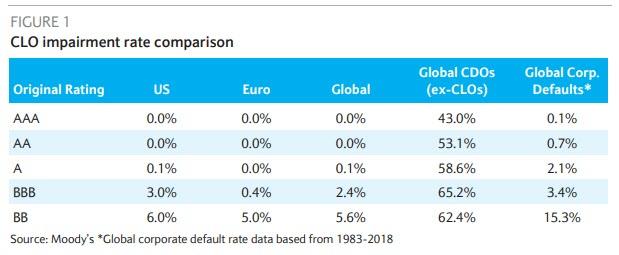

- CLOs are not like other CDOs. The results speak for themselves – per Moody’s, the 10 year cumulative impairment rate of Global CLO tranches originally-rated AAA is 0.0%, while for global CDOs (ex-CLOs) it is 43.0%.

- CDO lessons learned. From the CDO-era, we learned to avoid mark-to-market vehicles, to know the underlying assets, minimize correlations and understand the buyer base.

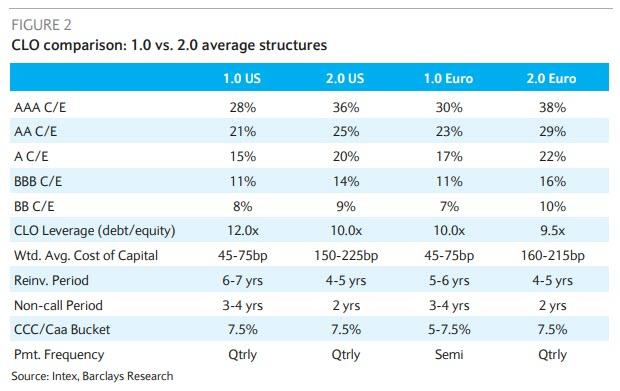

- CLO structures have evolved. Post-crisis CLO deals tend to have less structural leverage, shorter reinvestment periods, more restrictions on asset holdings and greater focus on matching asset cash flows to liabilities.

- CLOs are not forced sellers. CLOs are non mark-to-market vehicles that are incentivized to hold assets over the long term, rather than be forced to sell at the lows. Barclays also identified two theoretical sources of forced selling: defaulted CLO liquidations are extremely rare and the CLO warehouse market is small in comparison to the outstanding CLO market.

- CLOs are semi-forced buyers. Asset quality in CLOs is falling as a result of overall loan fundamentals decreasing, creating problems for CLO managers that continue to issue deals to satisfy investor demand and trade their portfolio, while keeping quality test limits in-line.

Additionally, the bank also argues that there are no market-value triggers in CLOs (although it later concedes that CLOs could technically become a forced seller should the CLO trip an Event of Default ) and tranches, specifically senior rated notes are typically held by longer-term, unlevered capital investors like banks, insurers and money managers (mostly Japanese). Additionally, the collateral (most of which is priced on a daily basis) comprises primarily first-lien leveraged loans and some high yield bonds in European deals, with prohibitions against owning other CLO tranches and synthetic securities.

Furthermore, according to the British bank, the structures of CLOs themselves were re-configured after the crisis to fit enhanced rating agency methodologies and comply with new regulations (eg. the Volcker Rule). As a result, post-crisis CLOs tend to have less structural leverage (more credit enhancement (C/E)), shorter reinvestment periods (time to trade the portfolio), more restrictions on asset holdings (no structured finance assets) and greater focus on matching asset cash flows to liabilities (limits on currency differences, floating versus fixed holdings, assets maturing after CLO liabilities mature).

Despite Barclays' spirited defense of CLOs and attempts to counter the "alarmist media rhetoric", and talk down their systemic risk, one person disagrees - the same one who correctly predicted the 2008 financial crisis. According to a Bloomberg op-ed by Satyajit Das, "financial markets have short memories", claiming - as the Barclays example above vividly demonstrates - that they’ve convinced themselves that CLOs are much safer instruments than the collateralized debt obligations, or CDOs, on which they’re based and which helped precipitate the 2008 crisis.

This is a big mistake because according to Das, "they’re wrong -- and dangerously so."

And while we already heard from Barclays why CLOs are not the threat the "media rhetoric" has made them out to be, here is Das' take why CLOs may well be the next CDO "financial bomb" set to hit financial markets:

* * *

The Bomb That Blew Up in 2008? We’re Planting Another One

Financial markets have short memories. Of late, they’ve convinced themselves that collateralized loan obligations (CLOs) are much safer instruments than the collateralized debt obligations, or CDOs, on which they’re based and which helped precipitate the 2008 crisis. They’re wrong -- and dangerously so.

Current CLOs outstanding globally total around $700 billion, with annual new issues of over $100 billion. That’s broadly comparable to subprime CDO volumes in 2008. Both Bank of England Governor Mark Carney and former Fed Chair Janet Yellen have warned about potential risks;regulators in Japan, where banks have been big CLO buyers, are particularly concerned.

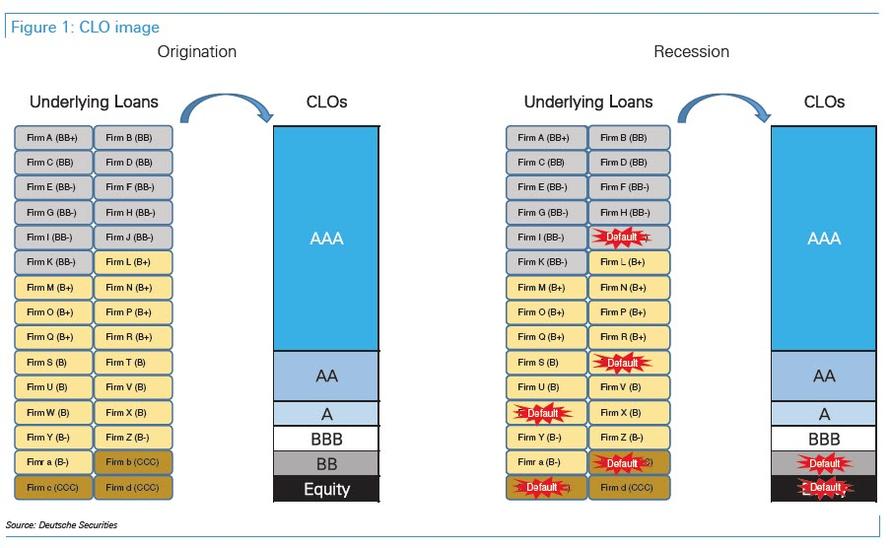

The structure of CLOs is economically similar to CDOs. Each pools multiple loans to create synthetic, bond-like investments. Investors buy a slice (or tranche) of the underlying interest and principal cash flows of the portfolio. A defined order of which investors get repaid first and which bear the most losses allocates risk differentially.

High-risk CLO equity pieces, which are unrated, are first in line for losses and last for repayment. Less-risky subordinated or mezzanine pieces, typically rated anywhere between BBB and B, rank ahead of equity. Low-risk senior pieces, typically rated A or better, rank first for payments and only bear losses if the equity and subordinated pieces are completely wiped out.

CLOs, like CDOs, are designed to increase the leverage on a portfolio of debt. In other ways, CLOs are indeed set up to be safer. Rather than mortgages, subprime or otherwise, they repackage corporate loans, primarily leveraged loans, as well as consumer credit such as automobile loans. Investors in better-rated tranches have greater protection than they would have in CDOs, as higher levels of losses are required before they lose money.

Until recently, they could also rely on the fact that the banks structuring these packages had to retain a minimum amount of the riskiest securities to ensure that they had skin in the game, better aligning their interests with those of investors. The kind of dodgy innovations we saw in 2008 (remember CDO Squared?) haven’t recurred.

Nevertheless, many risks remain. How safe or not CLOs are is contingent on several factors: the credit quality of the underlying loans -- as judged by the risk of default and the extent of loss if there is a default -- as well as the correlation between default and losses within the portfolio.

Several aspects of this risk aren’t well-understood. The credit quality of the leveraged loans which underlie the bulk of CLOs is poor, typically not investment-grade. Borrowers are highly leveraged. The loans increasingly have minimal investor protection, with over 70 percent lacking any covenants that would allow monitoring of financial condition and early intervention to manage problem borrowers. This exacerbates the risk of higher losses.

Investors assume that the portfolios are safer because they’re diversified. Yet, relative to mortgages, corporate-loan portfolios typically are made up of fewer and larger loans, which increases concentration risk. Leveraged loans are highly sensitive to economic conditions and defaults may be correlated, with many loans experiencing problems simultaneously.

Even buyers of high-quality tranches, who may be insulated from actual losses, face the possibility of mark-to-market writedowns, where the current value of securities declines. Relatively minor losses could impact such investors by reducing the protection for higher tranches and triggering rating downgrades. Similarly, general problems in credit markets, where margins increase, will decrease values.

Where investors are leveraged, falling values will result in margin calls. Hedge funds invested in riskier tranches will face withdrawal of funding and redemptions. Some investors, such as mutual funds, may be forced to sell because of loss or rating triggers.

Japanese banks, which have bought up to 75 percent of AAA CLO tranches and perhaps one-third of all CLOs, finance their holdings by borrowing dollars and euros in the inter-bank markets. Losses may create difficulties in rolling over funding, leading to a liquidity squeeze. As in 2008, that would accelerate declines in prices.

As we saw last December, problems with CLOs may result in a contraction of credit. CLOs purchase 50-60 percent of all leveraged loans, just as CDOs funneled funds into mortgages. The demand from CLOs has underpinned decreases in the price of credit and looser lending terms.

In the case of a downturn, the risk is that CLOs will create adverse feedback loops. Banks will be stuck with unsold inventories of underwritten loans. Falling prices, rising spreads and tightening credit availability will cause credit markets to seize up. Tighter credit will feed into the real economy, setting off losses, selling and price declines. Fears about the financial position of banks and investors will create contagion as depositors refuse to fund banks and investors demand their money back.

There are too many parallels to 2008 for comfort. Investors, many with uncertain expertise and weak holding power, have increased their exposure in the search for higher returns, which can be as high as 20 percent for the riskiest equity pieces. Bankers have aggressively underwritten leveraged loans and structured CLOs, earning around $2.8 billion last year. Built into this speculative episode, like its predecessors, is a euphoric flight from reality and a blindness to risks that continue to rise.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.