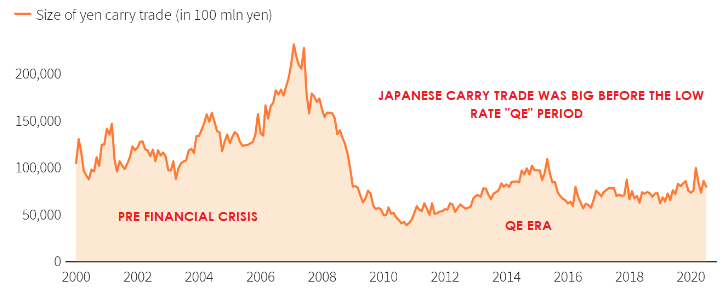

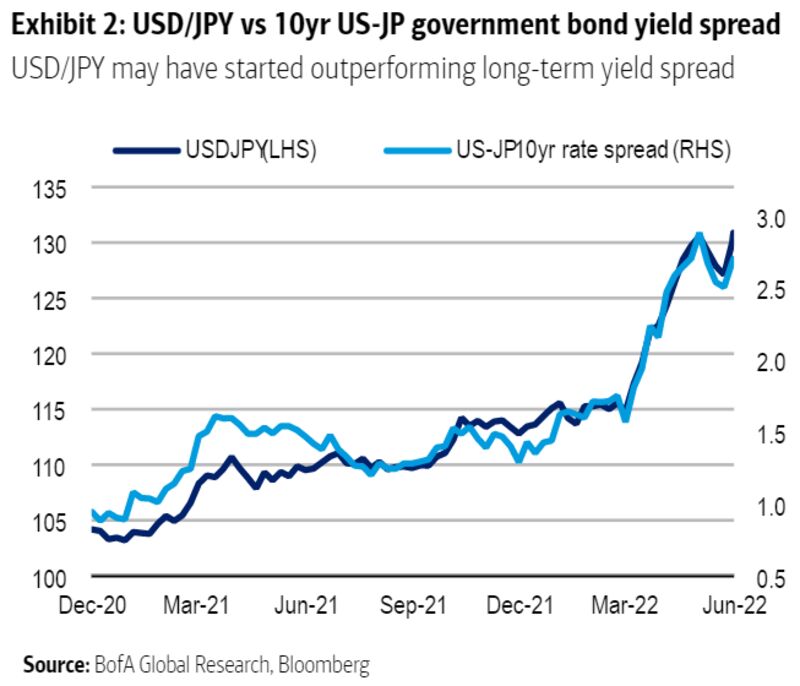

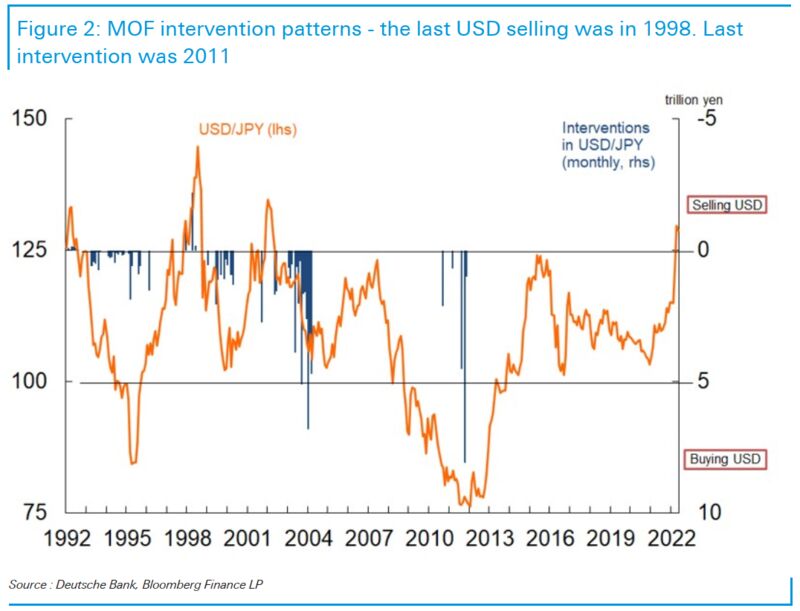

The BOJ is likely to soon move its YCC targets higher, which will reduce the “Carry” profits.

The BOJ will have reason to move eventually. When might this happen? The Monex Group sees it as inevitable:

“Yes, eventually Japan will follow the US lead. The BoJ always does. The one time it did not and insisted on a de-coupling from US policy, Japan got its Bubble Economy. Nobody, least of all Prime Minister Kishida, wants to go through that again”.

The question then becomes how long will it take to persuade the Bank of Japan’s veteran governor Haruhiko Kuroda to do this, or whether it will be necessary to wait until next year, when whoever is prime minister by then can pick a new governor? The problem, for those who would like to see the yen strengthen again, is that Kuroda is like the captain who is about to catch the great white whale, or perhaps the dog who is about to catch the car. Deflation has stricken Japan for a generation. He wants to be the one to beat it, and it’s hard to blame him.

Mrs. Watanabe, with some friends in the big Japanese investment institutions, may actually decide the issue:

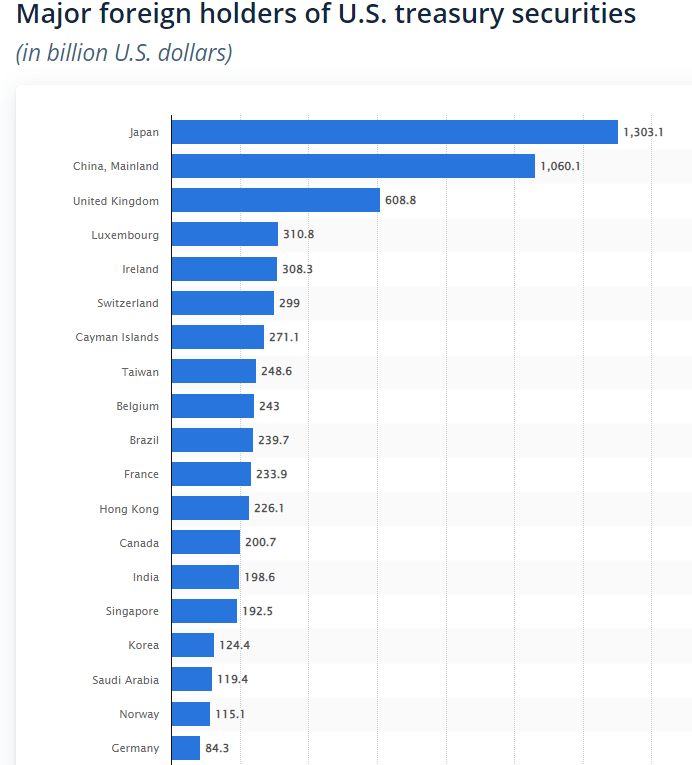

“Japanese investors hold the key to the fate of the Yen. Japan`s status as one of the major global creditors dictates as much. As long as Japanese institutional and retail investors refuse to invest in their own markets and instead continue to prefer global/US assets, the case for Yen appreciation will be hard to substantiate.

Here it is interesting to recall the history of the world’s single biggest asset manager, the Japan public pension fund. The GPIF manages US$1.7 trillion, of which approximately 26% are in global bonds and 24% in global stocks. In all the grandstanding about the merits or de-merits of Yen depreciation, it should not be forgotten that Japanese pensioners are thus a major beneficiary of Yen depreciation: a 10% depreciation should create a 2-3% upside performance windfall profit (obviously depending on hedge ratios and equity/bond markets performance). I am not a public pension actuary, but some friends who are suggest it is quite possible that at Y140-150/$ (and on current asset allocation), Japan`s public pension may actually become over-funded.

Importantly, the GPIF contributed greatly to forcing the last major inflection point in the Yen’s fortunes when it announced a major re-allocation out of domestic JGBs into global bonds and equities during the early years of the Abe administration.”

This is a very tenuous situation and any unexpected developments could easily spin matters into a crisis.

The world can not easily absorb a reduction if the Japanese Carry Trade as a major source of cheap money and readily available global liquidity.

Stay tuned and keep a close eye on Japan!