THEMES

US LABOR PRODUCTIVITY

FALLING US PRODUCTIVITY IS THE RESULT OF FAILED PUBLIC POLICY.

Using corporate free cash flows and borrowing to finance stock buybacks is not the road to creating or sustaining a productive society! However, this obsession is where the current corporate focus lies, which has left investment in labor productivity such as skills training off the priority funding list. In parallel the US Government’s current obsession with Climate Change has likewise removed the productivity of the nation from its top priorities and in fact is impeding it with expanding regulations, licensing, agency approval and compliance staffing.

It used to be said that the Business of America was Business. This is rapidly changing to the government’s focus cultural change resulting in a lack of focus and decay in the nation’s competitiveness & labor productivity.

- PROBLEM: Either No Government Policy Direction or Bad Public Policy,

- PROBLEM: Government Mis-focused on Climate Change versus Greatest Shock to Global Economy Since WWII,

- PROBLEM: There is No National Post Covid-19 Re-Emergence / Revitalization Plan

We Need To Urgently Focus on Fixing

The Competitive Productivity Problem

OR

It Will Quickly and Insidiously Fix Us!

WHAT YOU NEED TO KNOW

NATIONAL FOCUS IS REQUIRED:

NATIONAL FOCUS IS REQUIRED:

- A POST PANDEMIC RESET

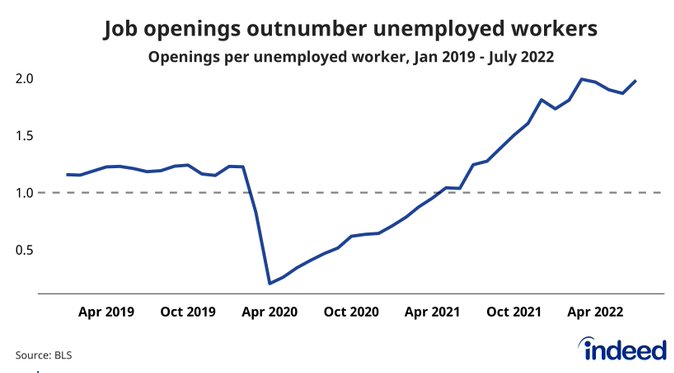

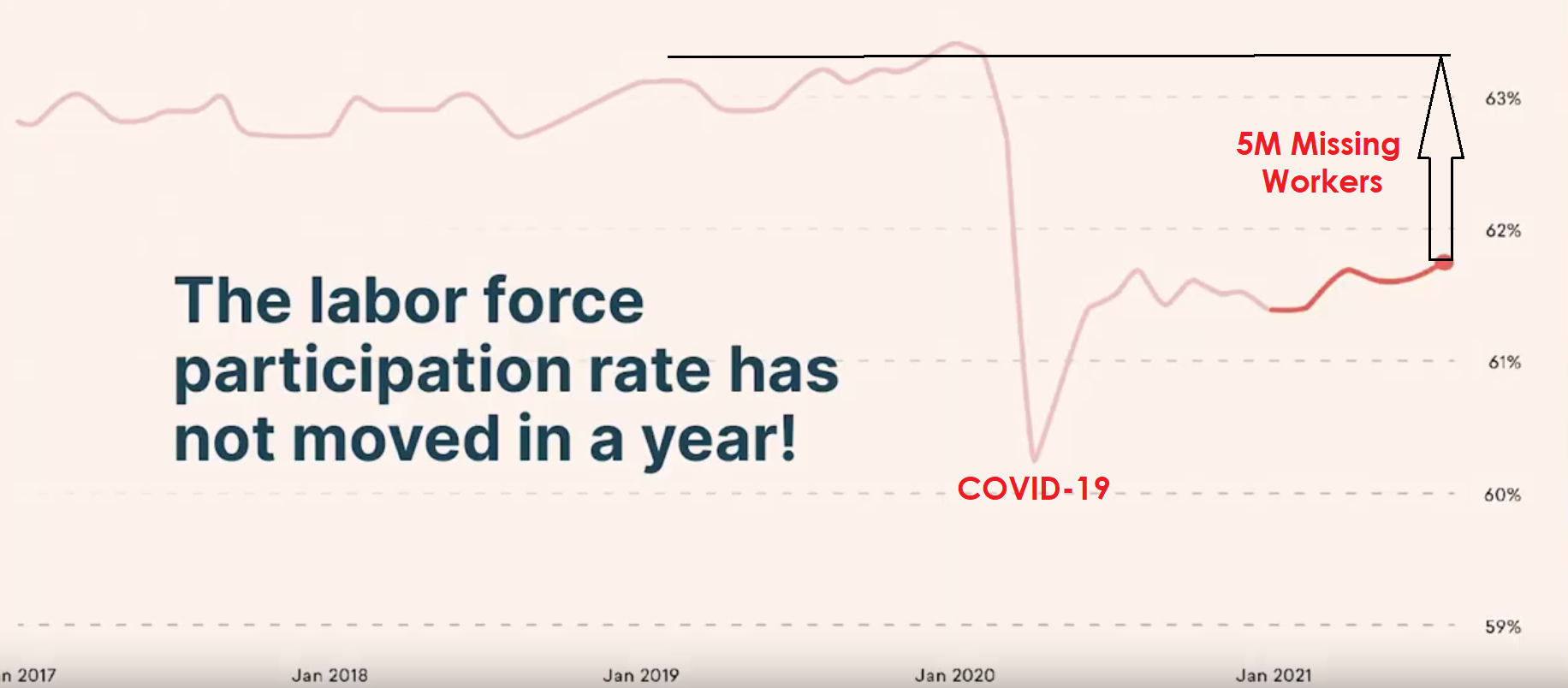

- Get Workers Back To Work & Fill The Employment Gap,

- Remove Government Program dis-incentives to go back to work.

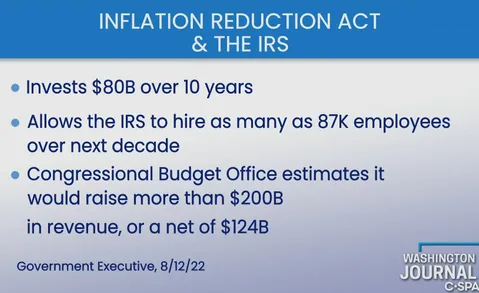

- BIG GOVERNMENT REGULATORY STATE:

- Reduction of “Out of Control” Federal, State, Local and Agency Regulations & Compliance Burden,

- IRS expansion of 87,000 new auditors & $80B budget increase is increasingly what is to be expected in the new emerging Regulatory State.

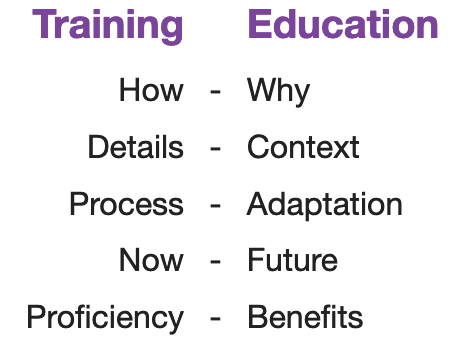

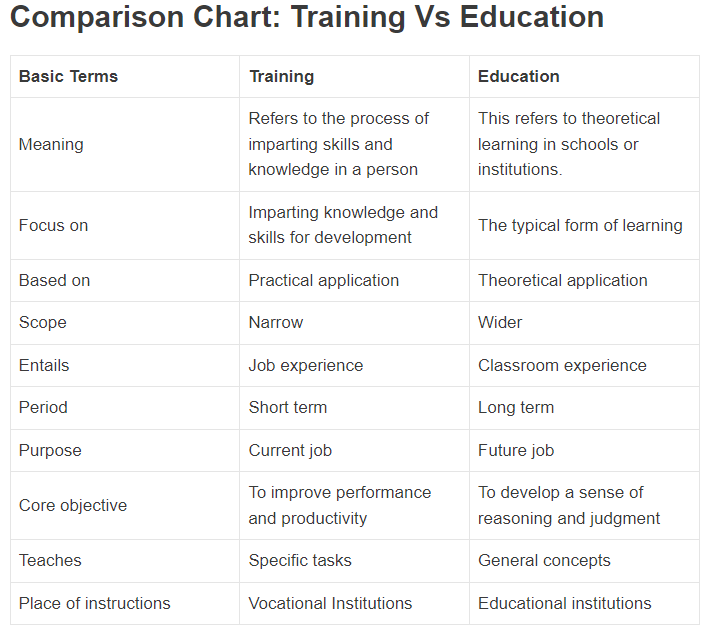

- NATIONAL RE-THINK OF EDUCATION versus TRAINING:

- Worker Skills & Management Training,

- Employee Retention.

- PRODUCTIVITY INVESTMENT

- Corporate understanding & alignment with of Gen Y and Gen Z workplace expectations of Work/Life balance,

- Rapid Adoption of AI Robotics,

- CAPEX Productivity Improvement Expenditure Tax Incentives.

LABOR PRODUCTIVITY IS ABOUT INVESTMENT, NOT COST CUTTING

=========

|

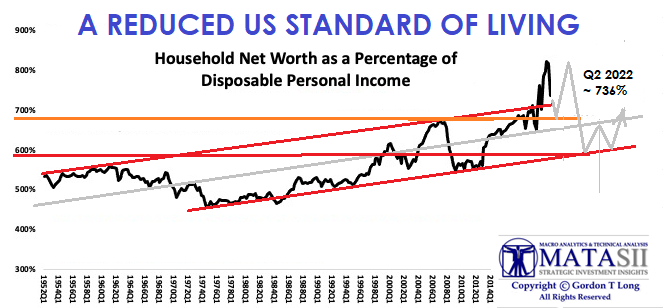

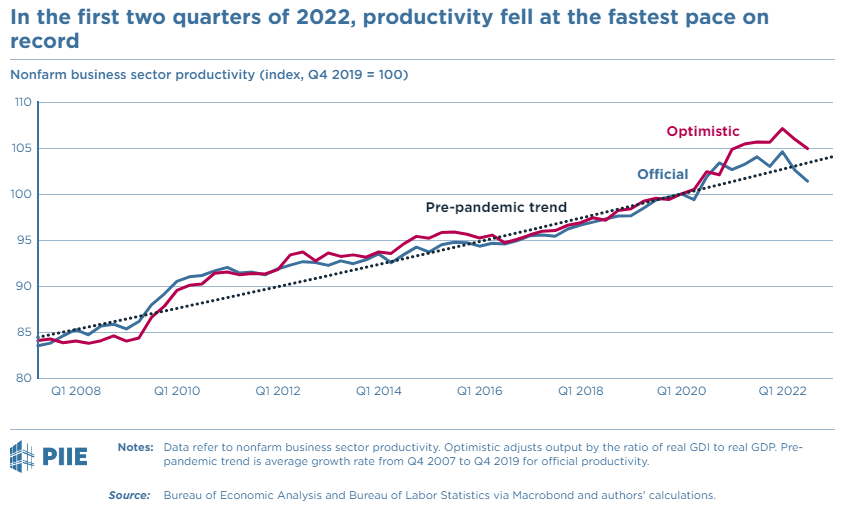

NATIONAL FOCUS PROGRAM REQUIRED The record US productivity slump in first half of 2022 risks higher inflation and unemployment. Over the last two quarters, US employment in the nonfarm business sector grew at a very strong 4.3 percent annual rate while output fell at a 2.3 percent annual rate. With average hours per worker decreasing, this means that output per hour, also called labor productivity or simply productivity, fell at a 6.0 percent annual rate. We also calculate an “optimistic” estimate of productivity growth, assuming output rose in the first half of the year, but even this optimistic estimate fell at a 4.0 percent annual rate. Although productivity growth is very volatile and poorly measured at high frequencies, these declines surpass the largest two-quarter declines since the data began to be collected in 1947— with the official estimate nearly twice as large as the most significant previous decline. The exact magnitude of this decline may reflect measurement error, but the broad story—that output growth is slow or even negative while job growth remains very strong—is clear and robust across a wide range of data. These data suggest the economy will not sustain higher compensation growth without passing it into price growth, perhaps even higher price growth than would usually be associated with this pace of compensation growth. Based on a range of measures, our best guess is that the underlying growth of wages is consistent with personal consumption expenditure inflation, excluding food and energy (core PCE inflation), of 4.5 percent or perhaps higher. Labor costs appear to have risen more than price growth, suggesting that, if anything, additional price increases are more likely than additional wage increases. Moreover, continued strong increases in employment while output is weak or falling are unsustainable. This raises the fear that businesses will downshift their hiring in the coming year, unless there is a large increase in output growth. POST COVID-19 PANDEMIC RESET URGENTLY REQUIRED

No matter which side you come out on this conflict, it suggests lower productivity is highly likely going forward compared to past trends. |

|

|

|

|

|

|

|

|

|

|

|

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.