MACRO

US ECONOMICS – MONETARY POLICY

IS AN INFLATIONARY DEPRESSION EVEN POSSIBLE?

OBSERVATIONS: IS AN INFLATIONARY DEPRESSION POSSIBLE?

Two weeks ago I described in this column what I recently witnessed at our major Town Meeting to address a $6.5 Million dollar town budget deficit. As I think back on the meeting, what I found myself thinking the most about was the two elderly ladies sitting next to me at the meeting.

They were both in their 80’s and had found themselves sitting together and after a brief exchange, they both recalled having met many years before at a town event. Both were now widowed and living independently in homes they had raised their families in.

As the meeting progressed I found myself doing the math on what the unprecedented tax hike was likely going to mean to me. The lady sitting next to me then leaned over and asked what it might mean to her. A couple quick questions later and the number displayed on my notebook. The expression on her face was that of someone who had just witnessed a serious accident. Confusion, shock, anxiety and a noticeable ash-grey change in complexion. She turned to the other lady and whispered into her ear. I observed a similar reaction.

After about 10 minutes the lady next to me turned to me and quietly stated: “I have no idea how I can afford this. I have always been frugal, worked hard and saved but this is just not possible!”

She never said another word before quietly leaving the adjourned meeting. The highly organized cadre of teachers firemen, police, town employees and government state employees commanded the evening – all people with pensions, state negotiated union wage contracts and all paid by the town or state.

The two ladies had only their spousal social security checks and a life time of savings that had long lost its purchasing power and failed to deliver interest earnings for too long to remember.

I went home and ran some numbers:

-

- Today, the average Social Security payment is less than half of what the average retired American spends each month.

- The average monthly Social Security payment in 2024 is $1,907, according to the Social Security Administration.

- But that is just a fraction of the $4,818 that Americans age 65 and older reported spending in 2022.

- General prices (not including services and taxes) are up well over 21% in the last three years, yet Cola adjustments have totaled 17.8%.

-

-

- 2022: The COLA for 2022 was 5.9%. This increase helped beneficiaries keep up with rising prices amid surging inflation.

- 2023: In 2023, the COLA was even higher at 8.7%. This substantial hike was a response to the continued surge in prices, particularly for essentials like food and fuel.

-

-

- Latest PCE shows Government Wages up 8.5%, (up from 8.4% but below the record high of 8.9%), while Private sector wages are up 4.5% from 4.2%.

- A recent survey that was just conducted by the Motley Fool discovered that 44 percent of retired Americans are thinking of going back to work because they need more money to survive. Their Social Security benefits have not adequately kept pace with high inflation.

- Americans are paying on average $784 more each month compared with the same time two years ago and $1,069 more compared with three years ago.

When the elderly are packing bags at the grocery store, the retired 55 year old retired town, state & Federal employees should fully appreciate that the elderly person packing their grocery bag is paying for their retirement.

Welcome to the New Regulatory State!

WHAT YOU NEED TO KNOW!

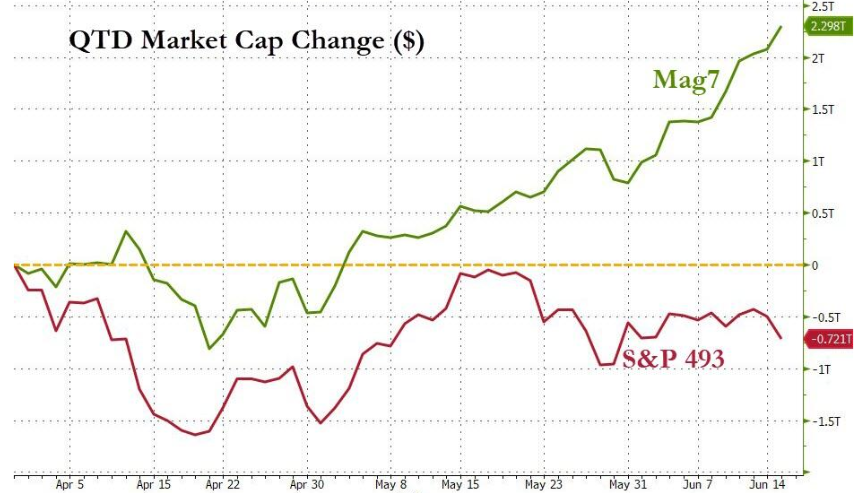

UNLESS YOU ONLY BOUGHT MAG-7 IN Q2 YOU LOST MONEY!

The Magnificent 7 stocks have added $2.3 trillion in market cap in Q2 while the 493 other stocks in the S&P 500 have lost $720 billion.

Since The Powell Pivot, the Magnificent 7 stocks alone have added over $5 trillion in market cap. Cumulative Buybacks over the last 5 years have totaled $4.3T. Where did the $4.3T come from? (view LONGWave – 06 12 24 – JUNE – The Great Debt for Equity Swap)

RESEARCH

AN INFLATIONARY DEPRESSION – Has It Already Begun?

-

- In a Sound Money Regime we can experience Depressions: Unemployment, Bankruptcies, Falling Prices, Devaluing Asset Prices and Deleveraging as Collateral Values Fall.

- In a Fiat Currency Regime we can experience Inflationary Depressions: Lost Purchasing Power Devalues Asset Prices – ie Real Estate falls in Price due to falling Real Disposable Income, Falling Savings and Rising Costs (Taxes, Maintenance), Rising Import costs, Falling Wealth – falling Housing Prices (Affordability) PLUS The standard impacts of Depression as well as Deleveraging as Collateral Values Fall.

- Additionally we have “Inflationary Pressures Regulated into Law”

- Cost of Climate Change Programs and Initiatives

- Cost of Sustainability & Green Programs and Initiatives.

- All this leads to an unfolding Inflationary Depressionary Process:

- Stagnation

- Stagflation

- Debt Crisis

THE INDIRECT EXCHANGE – How to Invest In An Inflationary Depression

- Exchanging NOTHING for SOMETHING

- “Something” is not Consumption nor the purchasing of non-Durable Goods

- “Something” is an Appreciating Asset (Collateral Wealth)

- “Something” has the attributes of:

-

-

- Scarcity

- Sustainable Demand -Shelter, Food, Water, Energy, Security (Retirement, Healthcare)

- Cash Flows positive

-

- “Nothing” is Present Value of a Currency Expected to Lose Purchasing Power.

- You must exchange that (worthless) paper claim for “Something”.

DEVELOPMENTS TO WATCH

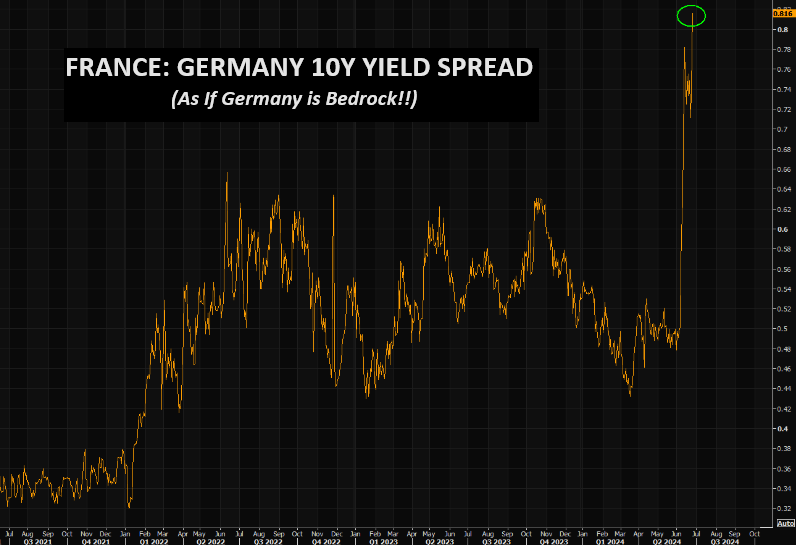

THE EU REGULATORY STATE – Regulatory Repression

THE EU REGULATORY STATE – Regulatory Repression

-

- Flawed Model Has lead to Regulatory / Single Market Destruction

- The 3 Fronts of Coming Change:

-

-

- A Flawed Structural Model

- Single Market Rule Stifling Innovation

- A Weak Germany & Broke Core France (3% Excess Deficit)

-

DARK POOLS – Growing Control and Influence

-

- As Nvidia achieved a $3 Trillion Market Cap we have noticed that Dark Pools are making over 300,000 trades in the stock weekly???

- Our first instinct was to take a look to see how much trading in Nvidia’s shares is occurring in Dark Pools – non-transparent trading platforms operated by some of the biggest trading houses on Wall Street, (which are also, insanely, allowed to own some of the largest federally-insured U.S. commercial banks holding trillions of dollars in deposits).

- Wall Street’s self-regulator, FINRA, began providing some Dark Pool data back in 2014. Unfortunately, the trading data for each Dark Pool and the respective stock it is trading is lumped together for the entire week, not by the minute or hour or day, and the data arrives to the public two weeks late for big cap stocks and four weeks late for smaller companies.

GLOBAL ECONOMIC REPORTING

US GDP Q1 FINAL

US GDP Q1 FINAL

-

- The US economy expanded an annualized 1.4% in Q1 2024, slightly higher than 1.3% in the second estimate, but continuing to point to the lowest growth since the contractions in the first half of 2022.

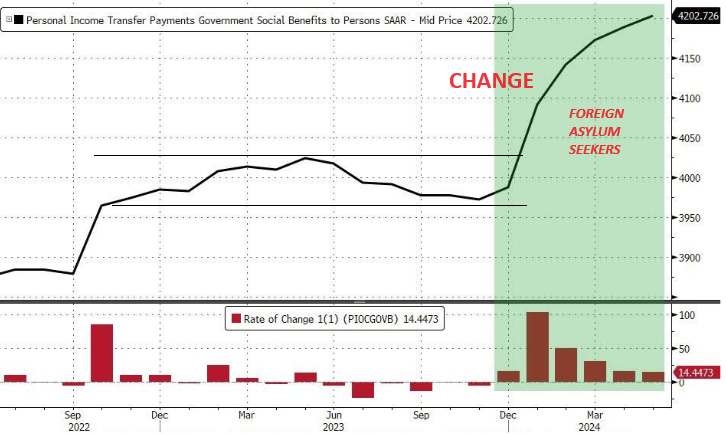

GOVERNMENT TRANSFER PAYMENTS – 2024 SURGE IN SOCIAL BENEFITS (Chart Right)

-

- 2024 Surge in Transfer Payments for Social Benefits directly contributed to the 1.4% Q1 GDP – the sixth straight month of rising government handouts.

GOVERNMENT SPENDING INCREASED DUE TO WAGE INCREASES – Nearly Double the Private Sector

-

- Government Wages increased 8.5%, up from 8.4% but below the record high of 8.9% (Note: This does not include Pension Increases.)

- Private Sector Wages increased 4.5% up from 4.2%.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.