GLOBAL MACRO

MONETARY POLICY

MOODY’S SNIFFED OUT SOMETHING BIG!

OBSERVATIONS: TRUMP’S SAUDI TRIP & THE INVESTMENT DRIVEN PETRODOLLAR 2.0

The premise of the 1974 Petrodollar Agreement was that Saudi Arabia would only sell oil in dollars, which would stimulate demand for greenbacks as a reserve currency.

The US took a “carrot and stick” approach.

Bill Simon, who was Secretary of Treasury, went to the Saudis and said “everybody in the world needs oil, and if you price oil in dollars, then everybody needs dollars”. That basically underpins the role of the dollar today as the world’s reserve currency.

THE STICK

The stick was if you don’t do it, we’re going to invade Saudi Arabia and take over oil production.

THE CARROT

The carrot was if you price oil in dollars, we’ll give you a military security umbrella.

Needless to say, the petrodollar system was successful and led to a resurgence in the American dollar as the world’s key reserve currency, (despite Nixon ditching the gold standard just 3 years earlier).

Though the petrodollar system is still in place, the Saudis are now selling oil to China for yuan! ,This is a serious problem that Trump took swift action to address., That is why Trump’s first International Trip as President was to meet with Saudi Arabia, Qatar and the United Arab Emirates and keynote the address to the Saudi Investment Conference.

Yes, cracks are starting to show in the system, and that’s why Trump was in Saudi Arabia, to seal a new “Petrodollar 2.0″ alliance.

Currently, the amount of oil Saudi Arabia is selling for yuan and other currencies is miniscule compared to dollar-based sales.

The U.S., by strengthening its relationship with Saudi Arabia and creating Petrodollar 2.0, puts the pressure on China to reduce their tariffs and meet Trump’s requirements.

Otherwise China doesn’t have a source of dollars!

This time around, Trump is using a strictly carrot-based approach.

He’s on a charm offensive and looking to build strong lasting ties with Saudi Arabia and the broader Middle East.

This is a smart approach and can be expected to bear fruit in the near future. Saudi Arabia committed over $600B in US investment as an outcome of the meetings.

Had President Trump taken a threatening approach to Saudi Arabia, it almost certainly would have driven the country into China’s waiting arms.

America can’t afford to let that happen. It was big turning point and win for Trump.

The mainstream meeting ignored the trip.

WHAT YOU NEED TO KNOW!

WHAT YOU NEED TO KNOW!

1 AI

2==> DEEPSEEK

3====>AI AGENTS

4======>HUMANOIDS

RESEARCH – MARKET DRIVERS

1- MOODY’S SNIFFED OUT SOMETHING BIG!

-

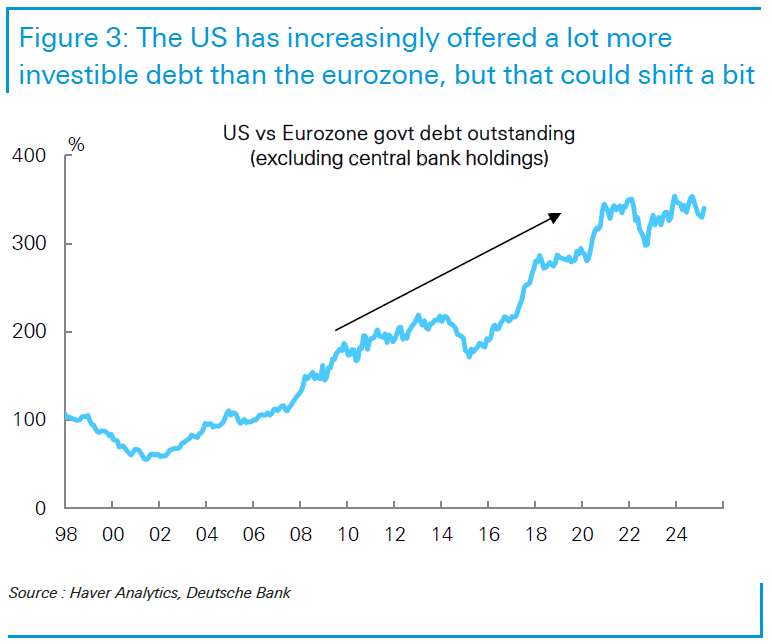

Moody’s nailed a broader truth — that US debt has surged because Germany’s post-Global Financial Crisis “debt brake” left it with space to borrow. American debt kept rising and taking a bigger share of the economy than China’s.

Moody’s nailed a broader truth — that US debt has surged because Germany’s post-Global Financial Crisis “debt brake” left it with space to borrow. American debt kept rising and taking a bigger share of the economy than China’s.- As Europe embarks on extra borrowing to bolster defense — at a stronger rating than Treasuries — there could be more triple-A bonds available to buy.

- The 2011 downgrade by Standard & Poor’s spurred what now looks like catharsis, which then started a decade-long rise. This time, particularly in real terms, (accounting for differences in inflation), the dollar looks expensive.

2- SURGING US FISCAL RISK

-

- It is important to realize that the current dynamic with the Dollar is now also about the abrupt “Plan B” shift in Trump Trade policy, where Tariffs are increasingly “out” and FX is “in,” with bilateral agreements on exchange rates being sought.

- This is creating an enormous demand for Dollar Downside Puts against Euro, Yen, Swiss Franc and Sterling.

- The U.S. Yield Curve remains too flat for the current state of the “Fiscal Profligacy” devouring us and forcing significant term-premium rebuild, hence this grinding and persistent state of Steepening which we are experiencing, and driving the ongoing demand for Curve Caps / Long-End Vol (30Y Payers), as the Global Long-End is feeling wildly precarious right now.

DEVELOPMENTS TO WATCH – POLICY DRIVERS

1- STABLECOIN & THE “GENIUS ACT”

1- STABLECOIN & THE “GENIUS ACT”

-

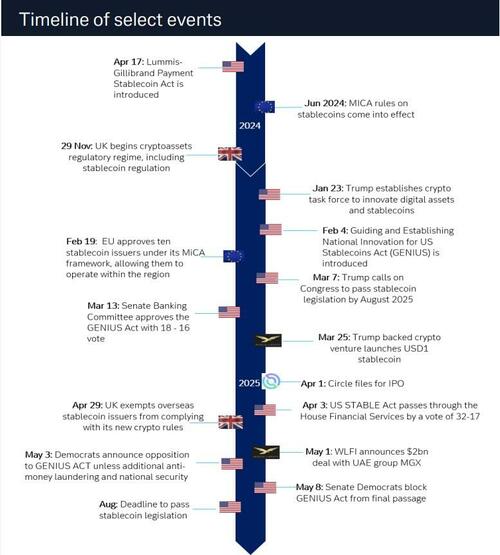

- More than just financial tools, stablecoins are fast becoming strategic assets.

- With 83% pegged to the US dollar and Tether ranking amongst the largest holders of US Treasuries, they’re reinforcing dollar dominance in a fragmenting world.

- Tether ranks amongst the top foreign holders of US treasuries ($98.5bn as of March 2025, a dramatic increase from nearly $0 in 2020).

- The US Congress is currently accelerating its efforts to create a regulated, dollar-backed stablecoin ecosystem by August.

2- CONVERGING FORCES

-

- My long time source of wisdom, Dr Lacy Hunt lays out five pivotal U.S. economic considerations, including tariffs, monetary policy, fiscal policy, debt overhang and demographics, which are aligning to depress economic growth for the balance of this year and into 2026.

- “Restoring the U.S. to its historical trend rate of economic growth depends heavily on reversing the debt overhang.

- The Fed has yet to cushion the economic restraint from current federal spending and adverse multipliers, the lagged effects of prior central bank actions, and the immediate demographic drag… the risk of recession is high and the transition to meaningful recovery will be fitful, uncertain and labored.

- Such an uncertain environment of tepid or negative economic growth will be conducive to a downward trajectory of long-term Treasury rates.”

GLOBAL ECONOMIC REPORTING – ECONOMIC DRIVERS

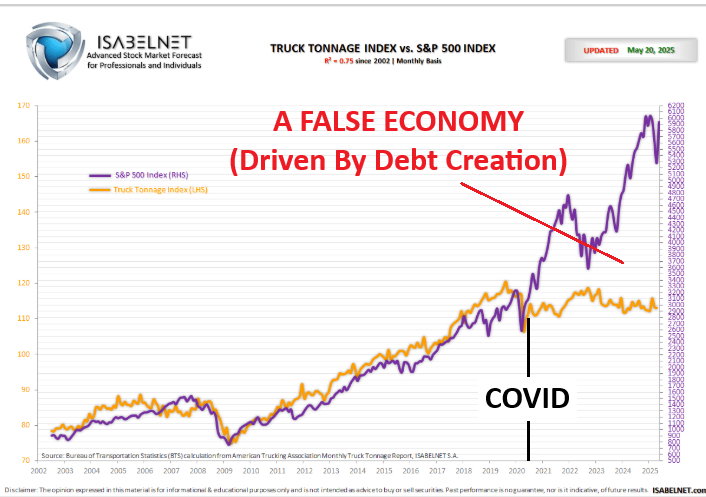

TRUCK TONNAGE versus S&P 500 INDEX

TRUCK TONNAGE versus S&P 500 INDEX

-

- The Truck Tonnage Index decreased by 0.3% in April. Trucks represent 72.7% of U.S. freight and serve as a barometer of the U.S. economy.

LEADING ECONOMIC INDICATOR (LEI)

-

- The U.S. Leading Economic Index (LEI) fell by 1.0%, signaling slower economic growth ahead but not indicating an imminent recession.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.