TIPPING POINTS

SMALL BUSINESS

SMALL BUSINESS PAIN IS SO SEVERE THAT IT CAN’T CONTINUE TO BE IGNORED!

OBSERVATIONS: RELENTLESS REGULATIONS, ELEVATED INFLATION & SOON SPIRALLING TAXATION

Canada just announced an increase in the capital gains tax from 50% to 67%. President Biden has likewise proposed increasing the US capital gains tax to 44.6% and additionally starting taxation on Unrealized Capital Gains. To cover the administrations planned 10 Year Biden Budget revenue increase requirements, it is estimated to be an additional $5.6 Trillion – yet to be found? Scheduled changes to the individual income tax made by the 2017 Tax Act are set to expire by the end of calendar year 2025 and Biden has said he will not renew them to assist in finding new tax revenue.

To stop the rich from obviously fleeing the US and taking jobs with them, the Biden administration is additionally supporting a G7 push for a minimum 2% Global Taxation on the “wealthy”.

Like taxing Unrealized Capital Gains, this is a new way of taxation. We currently have Local, State and Federal Tax regimes. We will be introducing a fourth level – A Global Tax Regime. When Personal Income was first introduced in 1913 it was to tax the rich only. Today even the destitute in the US must pay personal tax. Once the government introduces anything it can be counted on to quickly “morph” into something unrecognizable in very short order!

The Global 2% Wealth Tax proposal claims to address economic inequality by mandating a minimum tax on the wealth of the world’s wealthy. Here are the key points:

-

- Objective: The goal is to apparently raise funds for needed global initiatives related to poverty reduction, climate change, and other critical challenges (no further specifics given).

- Tax Rate: The proposal suggests that “billionaires” should pay a minimum of 2% of their wealth annually. This tax would apply to their “fast-growing” wealth. (Fast growing often reverses but losses appear not to be tax deductible.)

- Estimated Revenue: If implemented, this measure could generate approximately £250 billion (about $313 billion) per year.

- Supporting Countries: Brazil, Germany, South Africa and Spain have expressed support for this initiative. They believe that such a tax would help reduce inequality and provide much-needed public funds after the economic shocks caused by the pandemic, climate crises and military conflicts.

- Global Impact: The annual revenue from this tax could cover the estimated cost of damage caused by extreme weather events in a given year.

- Technical Details: French economist Gabriel Zucman is working on the technical aspects of the plan, which will be further discussed by the G20 group of leading developed and developing countries.

In summary, the Global 2% Wealth Tax claims to create a fairer tax system by ensuring that billionaires contribute a portion of their wealth to address global challenges.

“It represents a significant step toward combating inequality and financing essential public goods.”

If you actually believe any of this tripe, I have a bridge to sell you in New York! What is true is the debt binge we have been on must now be paid for – or at least the interest on the debt which at $2T today will soon also be unrecognizable.

WHAT YOU NEED TO KNOW!

PURCHASING POWER PARITY IS THE HIDDEN STORYOF DEBT

PURCHASING POWER PARITY IS THE HIDDEN STORYOF DEBT

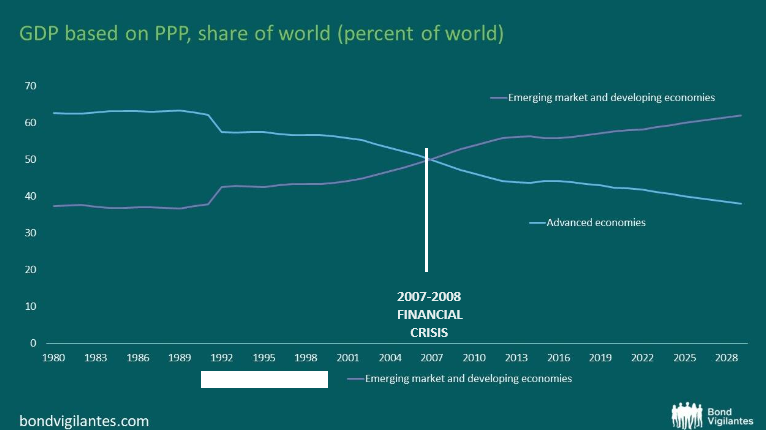

Purchasing power parity (PPP) measures the price of specific goods in different countries and compares the purchasing power of their currencies. It’s the rate at which a country’s currency would need to be converted to another country’s currency to buy the same amount of goods and services in each country.

Heavily indebted Developed Economies’ Fiat Currencies in aggregate are steadily devaluing when compared to less indebted and more commodity (real asset) Economies. There is a price to be paid for high sovereign debt.

RESEARCH

SMALL BUSINESS HEADWINDS: There is Nothing Small About the Headwinds!

-

- The reality of the US economy is that 6.4 million small US companies account for 85 percent of US jobs. Included in the remaining15% are 28 million Sole Proprietorships of less than 3 employees. The S&P 500 corporations contribute to the tune of 0.01%.

- American small businesses are the largest victims of a stagflationary economy, which is being weighed down by big government policies.

- Job Creators Network’s national poll of small businesses finds two-thirds of respondents say the current economic climate may force them to close their doors. Most businesses say the price hikes they are facing are more than the official inflation numbers suggest. One-third say elevated neighborhood crime is reducing their earnings. Small businesses are whimpering, not booming.

- The clear sentiment of National Small Business Week was a sense that Biden and Democrats are waging a war on small businesses.

REGULATING DIESEL HAULING OUT OF BUSINESS: Another Crippling Impact On Small To Medium Sized US Businesses

-

- The Biden administration announced last month that it plans to spend nearly $1.5 billion to make the U.S. freight industry “zero-emissions.” This is after the EPA finalized the “strongest ever” greenhouse gas standards for heavy-duty vehicles, a move that attracted strong criticism from trucking organizations.

- Ryder estimates cost increases to eventually add about 0.5–1 percent to overall price inflation in the US economy since transportation costs have a direct bearing on the price of goods sold in markets across the country,

- The problem is that the “school buses, trash and delivery trucks” operated by the cities and states are not accountable to making a profit from these vehicles, whereas commercial fleets must be profitable.

- This is yet another example of the crippling of small and medium sized business in America.

DEVELOPMENTS TO WATCH

WHO WILL BUY THE COMING SOCIAL SECURITY TREASURY ROLL-OVER??

WHO WILL BUY THE COMING SOCIAL SECURITY TREASURY ROLL-OVER??

-

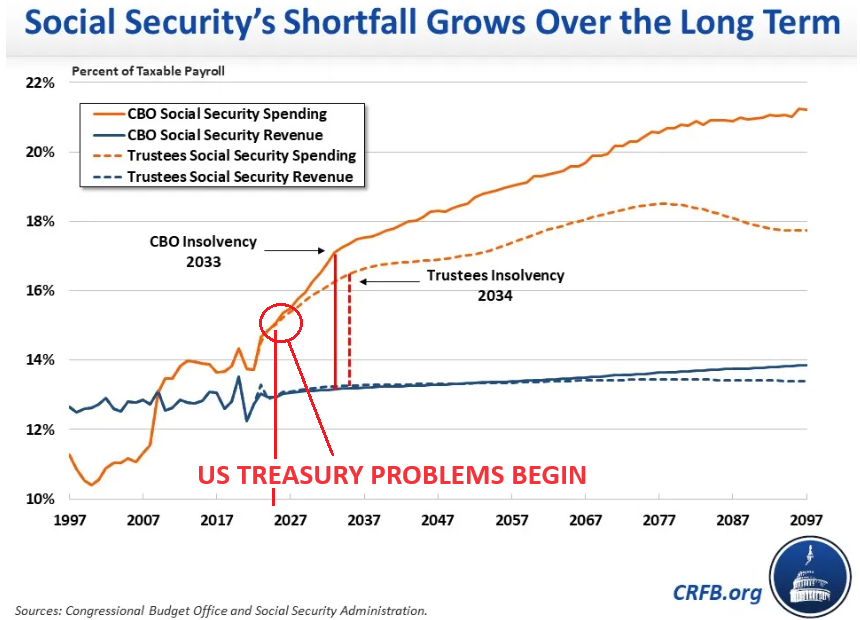

- Approximately one third of all U.S. government debt is “owed” to another government department! That Department is our Social Security System.

- Social Security will be insolvent by 2034.

- However long before that, the Social Security Treasury holdings will be liquidated to pay retiree benefits with no new buying occurring.

- The US Treasury must pay out the face value of the maturing bonds.

WHERE WILL THAT MONEY COME FROM???

SHOULD THE BUREAU OF ECONOMIC ANALYSIS (BEA) BE AUDITED?

-

- Long used Private Data, which has traditionally supported the BEA statistics, no longer matches nor supports BEA reporting. The divergences have become larger and more consistent.

- It has become such a major issue that it is amazing more public outcry is not being raised for an independent audit process being implemented.

- Issues with scoring budget proposals became such a similar political game years ago that an independent, non-partisan process was forced to be implemented. Are we at such a point with the BEA?

THESE ARE MAJOR INFLATIONARY ICEBERGS

GLOBAL ECONOMIC REPORTING

1- APRIL CPI

1- APRIL CPI

-

- It was a miss but not for the reason expected!

- OER catch down STILL to kick in.

- Next few CPI print likely will be a dovish meltdown, which means the next few months CPI will likely see even bigger misses.

2- APRIL PPI

-

- April Producer Prices rose 0.5% MoM (vs +0.3% exp), with March’s +0.2% MoM revised down to -0.1% MoM.

- The downward revision did not stop the YoY read rising to 2.2% (from +2.1% in March).

- This is the highest YoY read since April 2023 and is the fourth hotter than expected headline PPI print.

3- NFIB SMALL BUSINESS OPTIMISK INDEX

-

- Index at levels LOWER than the COVID Lows!

- Plans to Hire in Freefall

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.