MACRO

US ECONOMICS – PUBLIC POLICY

THE ADVANCING REGULATORY STATE

OBSERVATIONS: BIDEN’S POLL NUMBER ADJUSTED DOWN FOR INFLATION LIKE YOUR PAY CHECK!

When President Joe Biden was told by an interviewer that food prices are up 30 percent in four years, he completely dismissed it, countering with “American families have more money to spend!”

FACT CHECK

But that’s simply not true, and the Biden administration’s own data prove it. The average American worker’s weekly paycheck has risen about 14 percent under Biden, which is less than the 20 percent general inflation rate and even less than the 30 percent inflation rate for food, which is what Biden was specifically asked about.

Both the president and his lead economic advisor, Jared Bernstein, have fallaciously claimed in multiple interviews that inflation was 9 percent when Biden took office.

FACT CHECK

Again, the administration’s own data disprove this talking point. Inflation was only 1.4 percent at Biden’s inauguration.

When confronted with this fact, Bernstein redirected awkwardly with another falsehood that inflation, excluding food and energy prices, was at 9 percent in the second quarter of 2021.

FACT CHECK

Again, the Biden administration’s own data disproves this. The inflation Bernstein referenced, “core” inflation, was 3.7 percent at that time. Furthermore, Biden didn’t take office in the second quarter of 2021, but in the start of the first quarter. At that time, even the core inflation rate, which Bernstein referenced, was 1.4 percent – the same as the overall inflation rate.

Not to be dissuaded by the facts, Bernstein then pivoted to excusing the inflation rate entirely, claiming people are better off because their earnings are now rising faster than prices.

FACT CHECK

Apparently, Bernstein is completely unfamiliar with any statistics produced by his colleagues. In April — the most recent data available — prices rose faster than the average weekly paycheck. What that weekly paycheck can actually buy has fallen 4.4 percent since Biden took office, costing the typical American family thousands of dollars annually in lost purchasing power. Add in the additional borrowing costs from today’s higher interest rates, and that is thousands more in financial pain.

The combined effect has been the equivalent of reducing the typical American family’s annual income by $8,100.

But it seems no figures or statistics can change the mind of the political elites when it comes to inflation and how much Americans are hurting today. Never mind that the price of common foodstuffs like eggs, bread and peanut butter have risen 35 percent under Biden — the pain is all in your head.

The Biden administration’s and Big Media’s dismissive attitude to the financial plight of the American people adds insult to injury. Nothing is more elitist than telling working-class folks that their problems are imaginary! Ask Marie Antoinette how that turned out for her?

American families have soured on Bidenomics, not because of rhetoric, but because of reality. The spendthrift policies of this administration and its congressional allies have created a cost-of-living crisis, which is why millions of Americans are demanding a change in direction.

Much like the average weekly paycheck, you might conclude that the president’s poll numbers have been adjusted down for inflation.

WHAT YOU NEED TO KNOW!

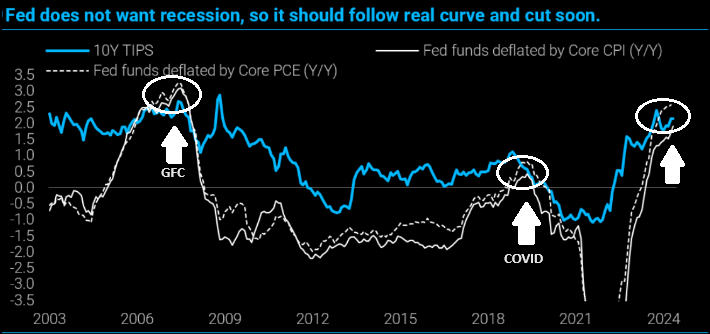

REAL RATES v POTENTIAL RECESSIONS

The disinflation in May CPI is overstated relative to real growth in activity, and lower goods prices only spur activity by raising real wages in a full employment economy. Nevertheless, the core pace has settled around 3.5%, low enough for the Fed to cut 50BP off the funds rate, at least. This should be done sooner rather than later, given the Fed’s stated bias to avoid recession.

The disinflation in May CPI is overstated relative to real growth in activity, and lower goods prices only spur activity by raising real wages in a full employment economy. Nevertheless, the core pace has settled around 3.5%, low enough for the Fed to cut 50BP off the funds rate, at least. This should be done sooner rather than later, given the Fed’s stated bias to avoid recession.

RESEARCH

MID YEAR UPDATES TO THIS YEAR’S ANNUAL THESIS PAPER

THE REGULATORY STATE

RELEASED – 01-17-24 — 212 Page Paper

CRUSHING COST OF REGULATIONS – The Hidden Financial Numbers Exposed

-

- During calendar year 2022, while agencies issued 3168 rules, Congress enacted 247 laws. Thus, agencies issued 13 rules for every law enacted by Congress.

- Since January 2021, the Biden Administration finalized 923 federal rules costing $1.6T.

- The Biden Administration finalized regulations imposing costs of over $1 trillion in just the last few months as agencies rush to protect their regulatory actions from possible rollback measures in the event that Biden loses the 2024 election.

THE EXPLODING COST OF WASHINGTON’S BUREAUCRATIC OVERREACH

-

- Since 2009, more than 5,300 regulations have been finalized that are expected to cost $2.6 trillion in present and future costs.

- The recent JCNF report confirms what was already clear from the regulatory tsunami unleashed by the Biden administration. The president is weaponizing agencies’ regulatory authority and bypassing the legislative process in favor of heavy-handed rulemaking, which has become the hallmark of this administration.

- The Loper Bright legal case presents the opportunity for the Supreme Court to restore the separation of powers, rein in the federal bureaucracy, and give Americans a voice by returning the power to Congress to approve major or costly regulatory changes.

CHEVRON DEFERENCE DOCTRINE – The Litigation To Stop Government Over-Reach

-

- The impact of the Chevron Doctrine on small businesses is clearly demonstrated in the Loper Bright v. Raimondo case currently before the Supreme Court. In that case, a group of family-run fishing businesses are challenging a costly federal rule that required them to pay for third-party monitors that cost up to $700 per day per ship, amounting to up to 20% of a ship’s take-home pay. Fortunately, the Loper Bright case presents an opportunity for the Supreme Court to rein in this kind of unconstitutional overreach by the regulatory state.

- “I don’t want to say that Chevron is responsible for all the ills of the modern administrative state, just most of them.”

DEVELOPMENTS TO WATCH

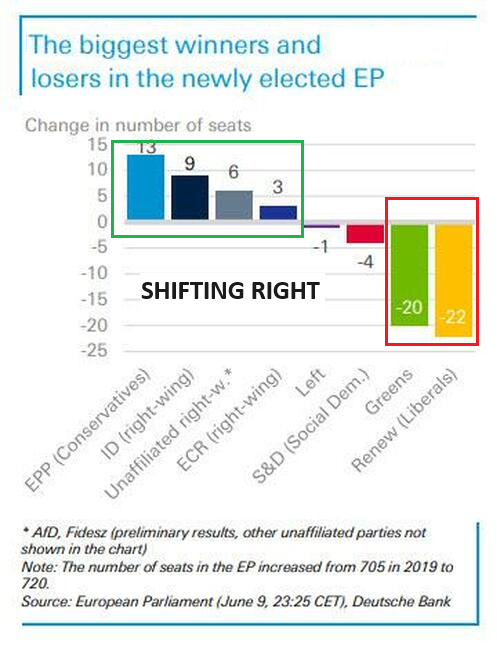

US WARNINGS FROM EU ELECTIONS

US WARNINGS FROM EU ELECTIONS

-

- A decided shift to the right which will likely be more exaggerated in the National Elections.

- Shift shows some national leaders may be in trouble.

- Immigration and Security mounting problem.

BIDEN’S EXECUTIVE BORDER ORDER MISLEADING ACCORDING TO GOLDMAN SACHS & US BORDER PATROL

“The ultimate effect would be a fraction of this as most affected immigrants would likely attempt other modes of entry. Legal challenges to the new rules might even block implementation altogether.” Goldman Sachs

Even if it was working as advertised, it would still admit 1.8 million illegals per year. Plus a massive carveout exempting all those whose home countries — like China and Venezuela — won’t accept them back.

NOTE: Over 150,000 people from those two nations alone have jumped the border so far this year.

GLOBAL ECONOMIC REPORTING

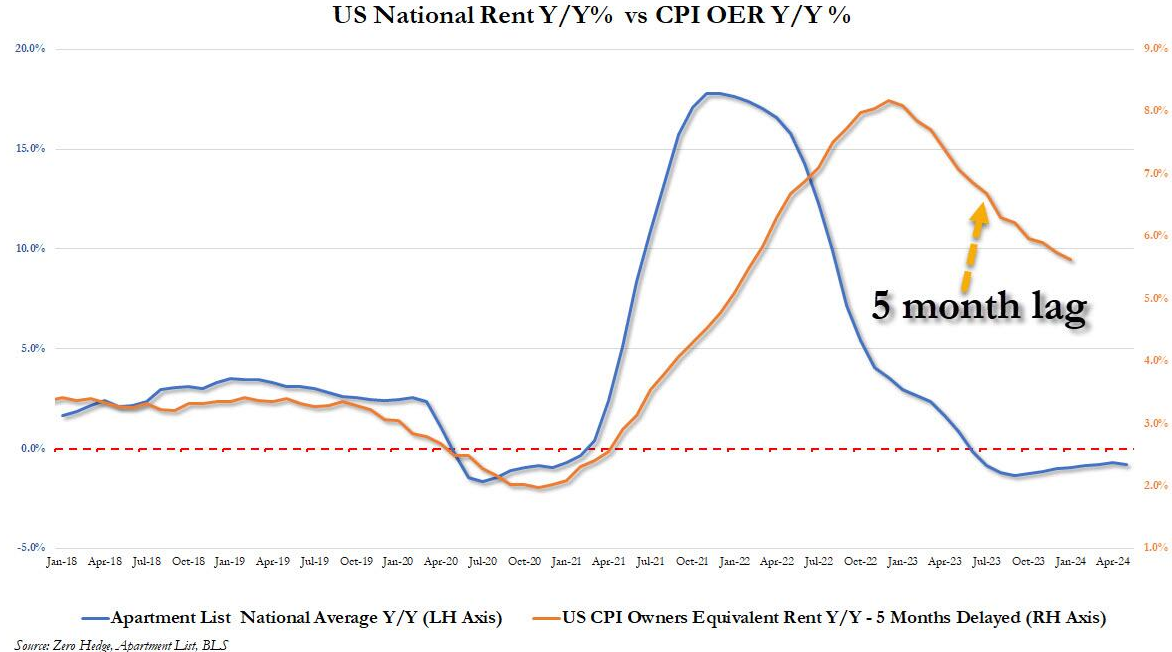

MAY CPI

MAY CPI

-

- With real-time rent flat to down for the past year, the BLS-tracked OER 5-months lagged, is up 5.6%, and will decline gradually for the next 18 months as it catches down to real-time rents, even as the latter are actively rising. A 0.2% monthly core CPI reading is likely to be the base case for the balance of the year, especially as it looks more and more like the long-awaited slowdown in shelter costs will hit as soon as the next report.

MAY PPI

-

- The headline producer price index unexpectedly tumbled 0.2% MoM in May (+0.1% MoM exp) from a +0.5% MoM rise in April. That’s the biggest MoM decline since Oct 2023.

- This left the YoY change in the headline index down from a revised 2.3% in April to +2.2%, (well below the +2.5% YoY expected). That is still the highest YoY since April 2023. Core PPI was unchanged MoM in May, (cooler than the +0.3% MoM exp).

- On a YoY basis, Core PPI dropped from +2.5%.

JOBLESS CLAIMS

-

- The number of Americans applying for jobless benefits for the first time surged last week to 242k (up from 229k and well above the 225k exp). That is the highest since August 2023.

- The last three weeks have seen the largest surge in claims since January.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.