MACRO

US ECONOMICS – FISCAL POLICY

THE US TREASURY’S NEW “BUYBACK” PROGRAM IS QUANTITATIVE EASING (QE)

OBSERVATIONS: WASHINGTON BLUGEONS OLD YANKEE FRUGALITY

Last night I attended an urgent special Town Meeting to address the seriousness of a proposed budget for the coming fiscal year. It was fully anticipated to be an extremely contentious evening because of the crisis in the offering of a proposed financial budget overrun. The town was notoriously frugal, being of the “Old Yankee” vintage.

I suspect that what I witnessed is occurring at the local level across America – or will soon!

What caused the shocking & unexpected Budget Crisis?

-

- State Transfer Payment Funding cuts to the town due to massive state Illegal Immigration costs. (A town in our area was recently featured in the WSJ on the Immigration burdens with the problems they are facing).

- Broad based Inflation costs to town operations not seen in decades.

- Mandated Government/Police/Fire/Teacher union worker contract increases negotiated at the state bureaucratic level.

Massachusetts has a Proposition 2 1/2 Law that requires towns to have a vote if any budget proposal exceeds 2 1/2%. We are a town that has NEVER authorized such an increase!!

The need was not for a 2 1/2% but a 10% Budget increase. An increase to just hold the line at existing levels and freeze everything else.

I was dazed and somewhat bewildered by what actually occurred.

Instead of what historically has been near combustible objection to any request for increased funding, I witnessed a mass of helpless acceptance? It was as though for some reason everyone had been beaten into submission and had resigned themselves to a new reality they could no longer control nor fully understand? Like aliens on foreign soil, nothing any longer seemed familiar, reliable or could be counted on when matters got tough.

Former hardened combatant fiscal hawks sat quietly and didn’t bother to even rise to rally the anger of those being asked to shoulder increased taxes – costs many were incapable of absorbing without anguish. The large grey haired retiree contingent looked shaken, while trying to put on a brave face to hide the obvious worry.

The proudly independent town founded in 1711 had simply lost control of the decisions that had steered their town through wars, depressions, storms and even a pandemic. There were no answers. Only acceptance.

-

- Inflation came from Washington.

- Illegal Immigration came from Washington.

- Unions were national or state controlled. It seemed the town had no control over what was happening to itself.

The only thing the town was in control of was the responsibility of finding the money to now pay for it all.

The budget was approved and once proud Americans shuffled and stooped shouldered out of the high school gymnasium. A gym many had played in decades ago.

The banners from triumphant, hard fought State championships hanging in the rafters, reminding everyone of better times and the America they once knew.

WHAT YOU NEED TO KNOW!

INFLATION IS GOVERNMENT POLICY OFTEN INCURRED THROUGH ITS CREDIT FUNDING POLICY

INFLATION IS GOVERNMENT POLICY OFTEN INCURRED THROUGH ITS CREDIT FUNDING POLICY

“Inflation is always and everywhere a monetary phenomenon”.

According to Economic Nobel Laureate Milton Friedman, price levels increase when too much money is pumped into the economy due to excessive credit demand. Dramatic increases in the money supply can cause a notable shift in prices. If the money supply doubles, price levels are expected also to double.

Simply said:

-

- Inflation is “Too much money chasing Too Few Goods”.

- Financing Multi-Trillion Annual Budget Deficits is quite literally creating too much money and credit.

- Inflation is actually a “Hidden Tax” initiated by creating too much money which reduces the purchasing power of the money. In essence, it rewards the first users of the new money (government) while penalizing the later users through lost purchasing power. The lost purchasing power is due to the excess money now in circulation relative to increased supply of goods and services. The government pockets the difference in the form of goods and services it purchased now valued at higher amounts using the same currency. Think of it as how banks make money on the “float” outstanding and the time value of money. Only one in a hundred Americans understand or can explain it. Perfect for a politician to hide behind the mis-direction of blaming greedy corporations versus their fiscal policy.

RESEARCH

THE US TREASURY’S NEW BUYBACK PROGRAM

-

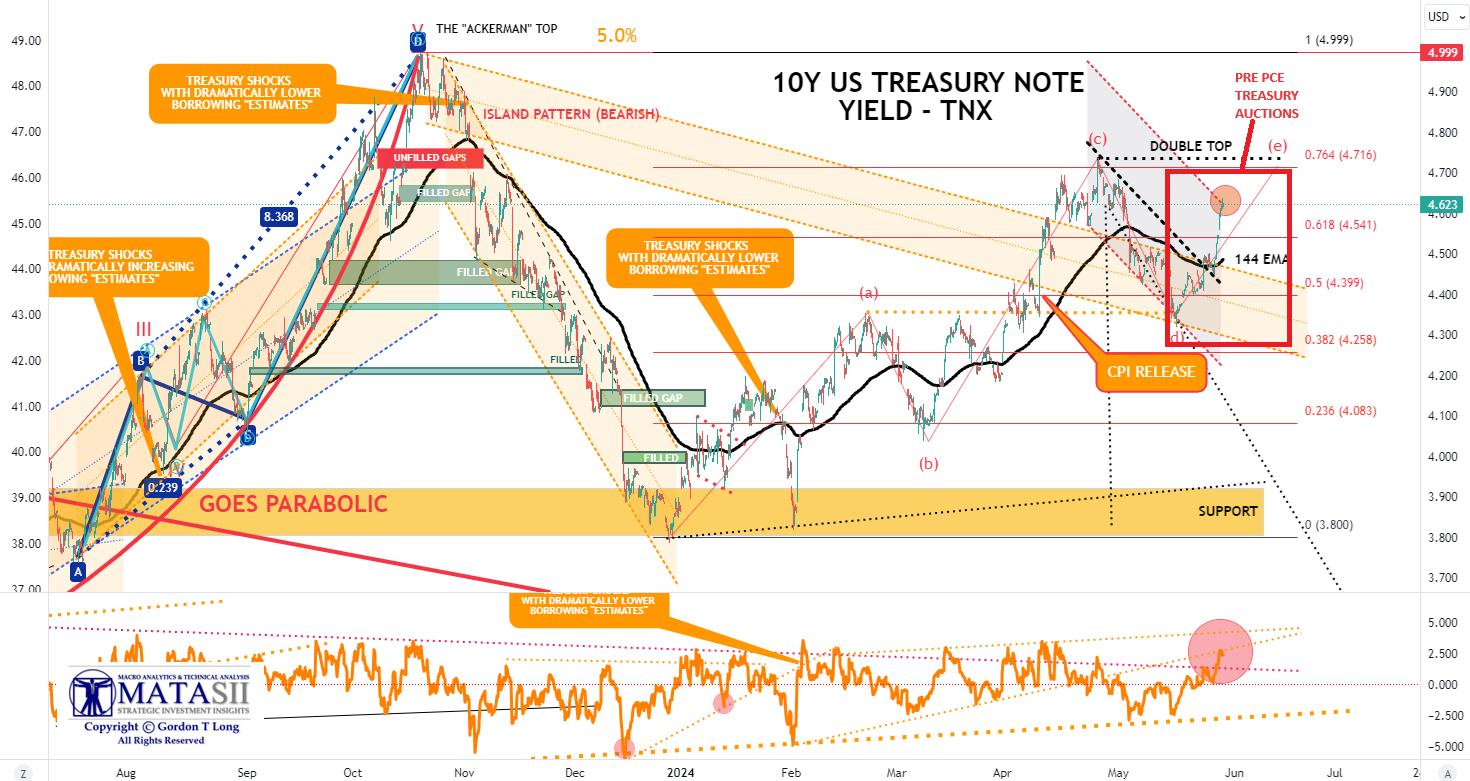

- With the Fed holding off on interest rate cuts in the short term, the Treasury’s buybacks are nothing more than QE by a different name.

- The “Higher for longer” policy at the Fed is now even more essential for holding back inflation as the Treasury injects liquidity into markets. If the Fed lowers rates now, the results of simultaneously expansionary monetary and fiscal policy will send consumer prices soaring.

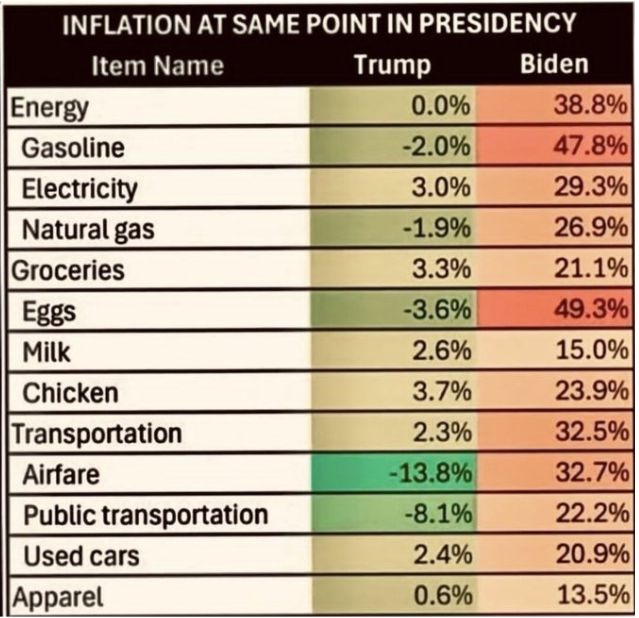

INFLATING ITEMS THE MIDDLE CLASS SOON WON’T BE ABLE TO AFFORD

-

- We highlight ten things that the middle class is starting to struggle to afford now.

- If nothing is done to slow the current inflation rate, this situation may only worsen in the next five years, making these things beyond the financial reach of the middle class.

DEVELOPMENTS TO WATCH

THE YELLEN TAILWIND IS FADING

THE YELLEN TAILWIND IS FADING

-

- We are witnessing an increasing absence of a tailwind for risk assets which has the potential to eventually become a headwind.

- Bank Reserves have fallen almost $250 billion since April. Almost $100 billion of that is due to a rise in RRP and the Treasury’s TGA holdings at the Fed.

THE “WHO” PANDEMIC AGREEMENT

-

- Two new instruments are being pushed through which would empower the WHO, (particularly its uncontrollable Director-General), with the authority to restrict the rights of U.S. citizens, including freedoms such as speech, privacy, travel, choice of medical care and informed consent, thus violating our Constitution’s core principles.

- If adopted, these agreements would seek to elevate the WHO from an advisory body to a global authority in public health.

- The new treaty called the WHO Pandemic Agreement and Amendments (to the existing International Health Regulations – IHRs), would centralize a significant amount of authority within this United Nations subsidiary if the WHO declares a state of “health emergency”.

GLOBAL ECONOMIC REPORTING

1- PERSONAL CONSUMPTION EXPENDITURE (PCE)

1- PERSONAL CONSUMPTION EXPENDITURE (PCE)

-

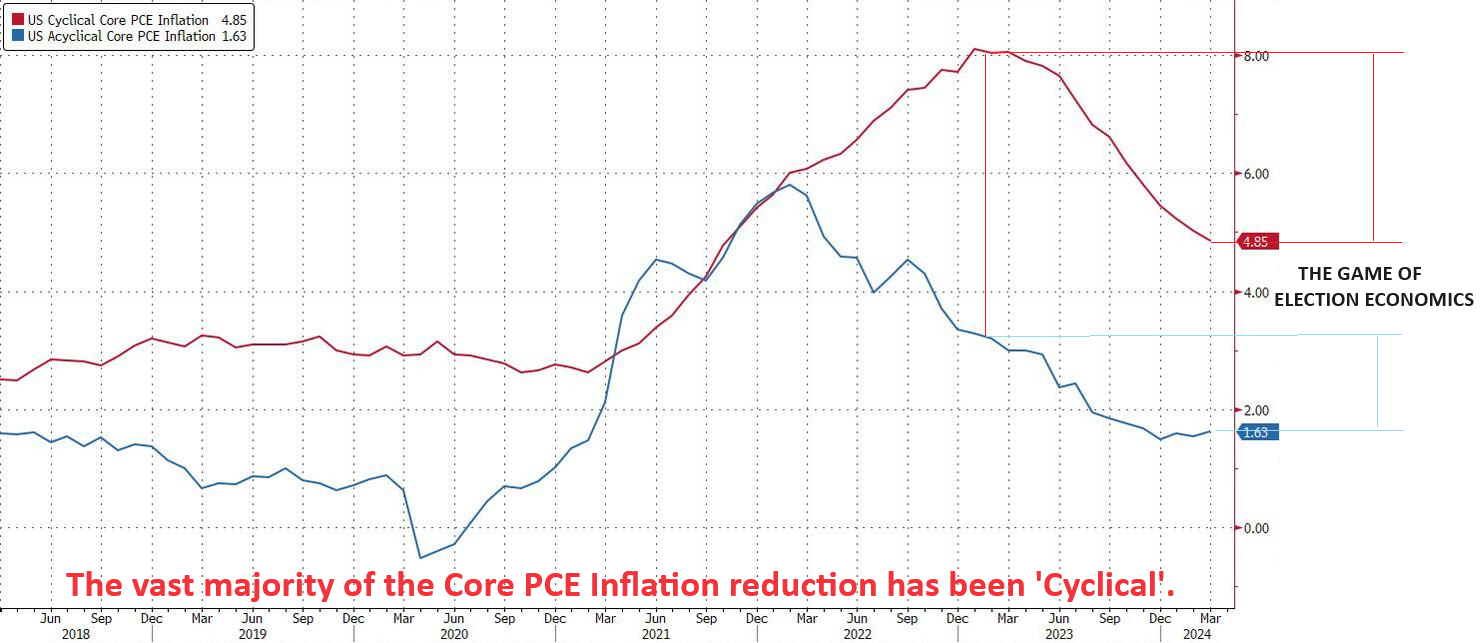

- The Biden Bureau of Economic Analysis posted a core PCE dropping from 0.3% to 0.2%, the lowest monthly increase of 2024. This is expected from the master Triumvirate plan. (View this month’s UnderTheLens video – “Election Economics”.)

- While the 12-month change was 2.75%, a three-year low, the 6-month annualized rate was 3.18%, the highest since July.

- The 3-month annualized rate was 3.46%, down from the previous two months but still higher than any point in 2H 2023, which suggests that this report was largely anticipated two weeks ago and won’t change much of anything for the near-term Fed outlook of “wait and see”.

2- 2024 Q1 GDP REVISED

-

- The latest GDP data released from Biden’s BEA, showed Q1 GDP was revised downward from 1.6% to just 1.3% (1.250% to be specific), which was the lowest GDP since the mini-recession of Q2 when GDP declined for 2 quarters in a row.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.