MACRO

US ECONOMICS

2024 HANGOVER: ELECTION GAMESMANSHIP & THE WEALTH EFFECT

OBSERVATIONS: IT’S THE DEBT CEILING ONCE AGAIN!

The recent spat in Congress over what was to be contained in the Continuing Resolution (CR) to keep the government open was quite telling about what may be the critical market moving issue in 2025. It centered around the Government Debt Ceiling.

DEBT CEILING WRANGLING IS BACK

• In June 2023, Congress passed legislation that suspended the Government’s Debt Ceiling until January 1st, 2025.

• That suspension allowed the Government to continue borrowing without being constrained by any borrowing limit.

• On January 1st, however, the Debt Ceiling came back into effect.

• The new Debt Ceiling was set at the level that Government Debt outstanding reached on January 1st.

• That means, starting January 1st, the Government will be unable to increase its debt until Congress passes a new law that raises the Debt Ceiling.

AN IMMEDIATE FUNDING PROBLEM?

• This situation could turn into a serious problem and fast.

• On December 19th, 38 House Republicans defied the demands of President-elect Trump by voting against a bill that would have raised the Debt Ceiling.

• These deficit hawks want Congress to enact spending cuts that would sharply reduce the budget deficit before they agree to raise the Debt Ceiling.

• Republicans have only a razor thin majority in the House.

• If only a handful refuse to vote to lift the Debt Ceiling, the

government will face an immediate funding crisis.

A SHOCK TO THE STOCK MARKET?

• If not resolved quickly, this impasse has the potential to

undermine market confidence and cause a significant stock

market selloff even before the new administration takes office.

• There are a number of reasons for this.

-

- First, the failure to get the Debt Ceiling lifted quickly could undermine confidence in President Trump and

his plans to cut taxes, resulting in a stock market selloff.

-

- Second, the inability of the government to borrow would mean that the Treasury Department would have to put in place emergency measures to prevent the government from defaulting on its debt.

These could include delaying government payments that don’t legally require immediate settlement, such as certain federal vendor payments or grants to states.

• Such spending delays could have a negative impact on the economy and undermine investor confidence.

-

- Third, a protracted battle over lifting the Debt Ceiling could also result in the credit rating of the United States being further downgraded.

• While a credit rating downgrade might not produce a stock market crash in and of itself, it would contribute to an erosion of confidence in the outlook for government policy, the economy and asset prices.

My colleague Richard Duncan discusses all this in his most recent Macro Watch video, but most importantly he discusses how a Debt Ceiling Standoff could actually boost asset prices during the months immediately ahead.

It is worth checking out, (a subscriber discount available for MATASII subscribers using the Promo Code “FLOWS”).

WHAT YOU NEED TO KNOW!

THE ZOMBIE RUSSELL 2000

THE ZOMBIE RUSSELL 2000

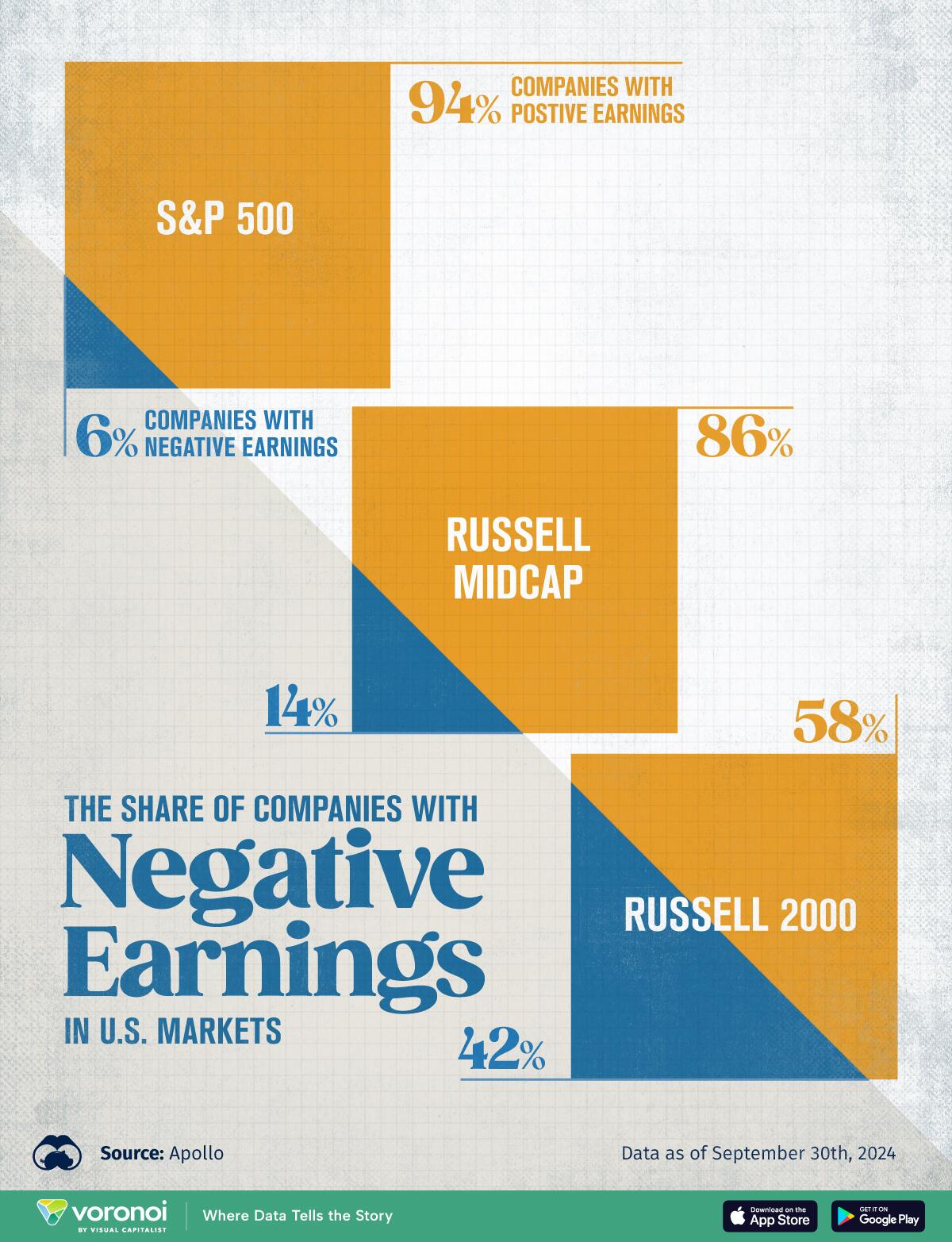

This graphic, via Visual Capitalist’s Dorothy Neufeld, shows the share of companies with negative earnings in U.S. markets, based on data from Apollo.

For mid-cap companies, seen in the Russell Midcap Index, the share of companies with negative earnings stands at 14%, given their higher debt loads. Over the last decade, mid-cap stocks have lagged behind large-caps, largely due to the outperformance of big tech. However, earnings growth across mid-cap stocks has typically risen at a faster pace since many are developing breakthrough technologies.

Additionally, monetary easing and Trump’s proposed corporate tax cuts could have an outsized effect on small and mid-cap companies due to lower borrowing costs. While small-cap stocks have been on an impressive run this year, the share of unprofitable companies is considerably high, at 42% of firms in the Russell 2000—up from 14% two decades ago. Like mid-cap stocks, they have underperformed large-caps since 2014, but increasing investor risk appetite may drive an upswing looking ahead.

RESEARCH

2024 HANGOVER: ELECTION GAMESMANSHIP & THE WEALTH EFFECT

2024 HANGOVER: ELECTION GAMESMANSHIP & THE WEALTH EFFECT

-

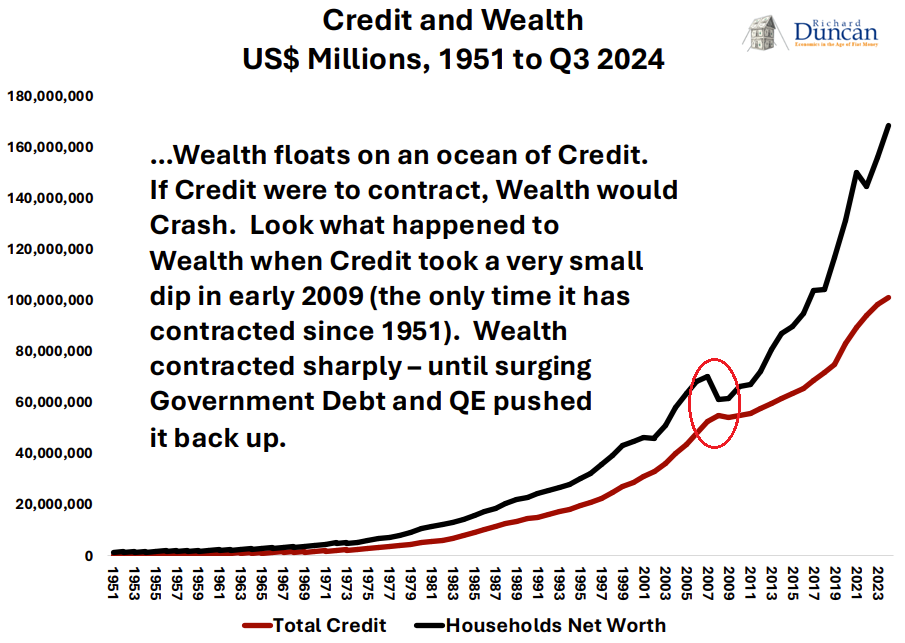

- Labor (False Employment Rates) & Inflation (Substitution, Hedonics, Imputation et al) have camouflaged the fact that the US Economy in real terms is in Stagnation heading quickly towards Stagflation.

- A weakening economy, slowing rates of earnings increase, falsing PE’s foretell of a weakening Wealth Effect.

- A weakening Wealth Effect will have a major impact on Credit Growth with potentially major consequences.

US MEGA-BANKS SEND LEGAL THREAT TO THE FED & BANKS’ REGULATORS

-

- Federal banking regulators had originally planned to increase JPMorgan Chase’s capital requirement by 25 percent as part of Basel III. (Endgame)

- But instead of 25 percent, when the Fed released its new capital requirements for the megabanks on August 28, the Fed raised JPMorgan Chase’s capital requirement by just 7.89 percent from the 2023 level, taking it from a total capital requirement of 11.4 in 2023 to just 12.3 in 2024. Had the 25 percent increase been imposed, JPMorgan Chase’s capital requirement would have totaled 14.25.

- The strategy may be to send a permanent message to the other federal banking regulators and any future Fed Chair that you might find your agency hauled into federal court by a Big Law firm if you don’t do the bidding of the Wall Street megabanks. Scalia is one of the lawyers representing multiple plaintiffs in the newly filed lawsuit.

DEVELOPMENTS TO WATCH

WATCH TRUMP’S TREASURY FOR HOW THE DEBT CEILING MIGHT PLAY OUT

WATCH TRUMP’S TREASURY FOR HOW THE DEBT CEILING MIGHT PLAY OUT

-

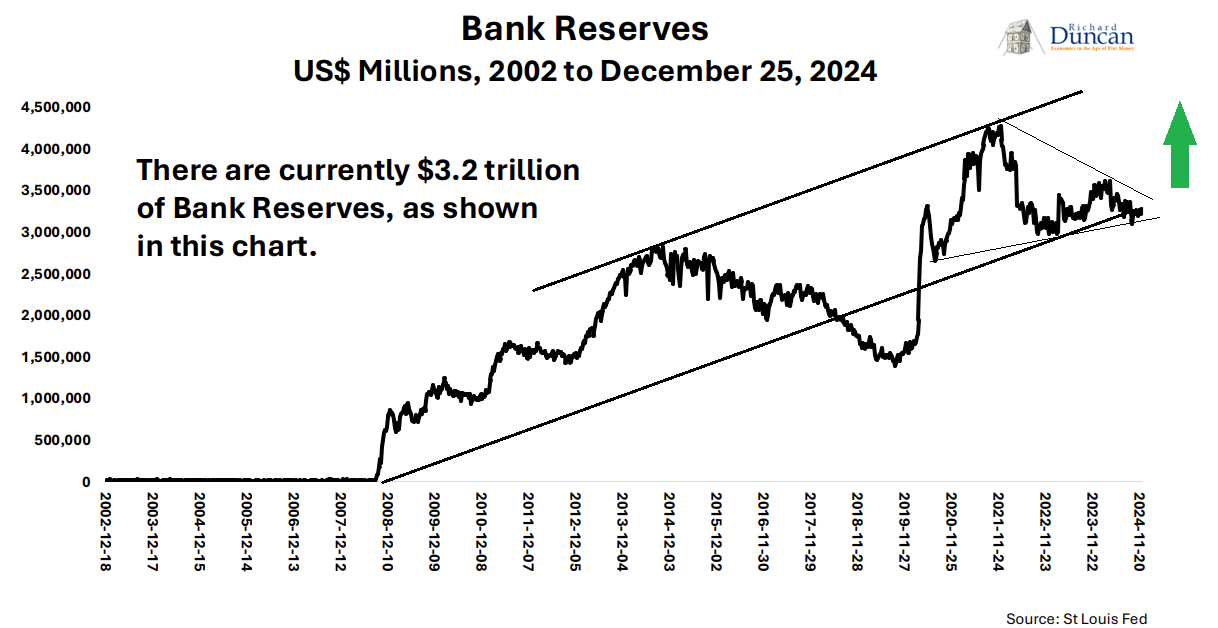

- The Debt Ceiling’s Dual Impact – The 2025 debt ceiling crisis is a double-edged sword. While it creates risks of market instability and economic uncertainty, the liquidity injection from the TGA could temporarily fuel asset price gains. These dynamics, coupled with Quantitative Tightening and potential credit rating changes, make the debt ceiling standoff one of the most critical financial developments of the year.

- The Treasury General Account (TGA) – With the debt ceiling limiting additional borrowing, the Treasury Department must rely on the Treasury General Account (TGA) to meet its obligations. The TGA, which contained $735 billion as of December 25, 2024, will act as a temporary lifeline.

- The Fed’s QT – is currently reducing bank reserves by $60 billion per month. Over the next six months, QT could remove $360 billion of liquidity, leaving a net liquidity increase of approximately $375 billion. This dynamic will play a critical role in shaping market trends in the first half of 2025.

- $375 billion is still a very meaningful amount of Liquidity, averaging $62.5 billion a month between now and June.

GLOBAL ECONOMIC REPORTING

CHICAGO PMI

CHICAGO PMI

-

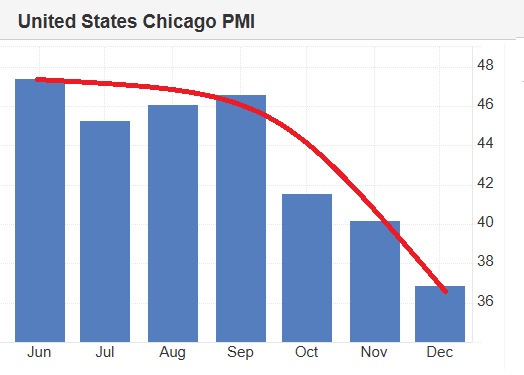

- The Chicago Business Barometer, also known as the Chicago PMI, dropped further to 36.9 in December 2024, compared to November’s 40.2 and missing market forecasts of 42.5.

- The latest data indicated that Chicago’s economic activity contracted for the 13th consecutive month, recording its steepest decline since May.

- New orders fell 13.5 points to the second lowest since May 2020, with more than half of respondents reporting fewer new orders for the first time since June 2020.

ISM MANUFACTURING

-

- ISM Manufacturing Prices in the United States increased to 52.50 points in December from 50.30 points in November of 2024.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.