MACRO

US ECONOMIC POLICY

THE UNSHACKLING OF AMERICA

OBSERVATIONS: CHANGE IS UNDERWAY

The president-elect has wasted no time in assembling his team of disciples. You can break the forces of change down into four discrete buckets: i)Justice, ii) Health, iii) National security and iv) Economic Revitalization. If President-Elect Trump gets his way his second term could be historic! Throw in the government Waste, Cuts and Removal project spearheaded by entrepreneurs Elon Musk and Vivek Ramaswamy and you are well on your way to a potential revolution in the fourth arm of the separation of power – the administrative state or what I wrote about in the 2024 Thesis paper – The Regulatory State!.

No wonder the political establishment will stop at nothing to crush Trump and his appointees before they can begin the reforms they promised.

1- JUSTICE

The old guard may have celebrated when they took down the proposed appointment of Rep. Matt Gaetz as attorney general, but they won nothing. Trump’s replacement nominee, former Florida attorney general Pam Bondi, will work just as hard as Gaetz to shake up the Department of Justice. As one of Trump’s attorneys in his first impeachment trial, she has intimate knowledge of how the Deep State can aim the full force of the federal bureaucracy on an individual to destroy him or her.

It’s no accident that the Trump transition team has declined FBI background checks on his nominees and appointees. Remember, this is the same FBI that entrapped Trump’s national security adviser Michael Flynn in the early days of his first administration. Not to mention the FBI that let President Trump be impeached for questioning Joe Biden’s role in Ukrainian corruption, even though the agency was in possession of Hunter Biden’s laptop that would have vindicated Trump if it had been released.

You can bet that Bondi, assisted by Trump’s criminal lawyer Todd Blanche in the role of deputy attorney general, will remove any Justice Department employees who pursue charges against anyone for political purposes. Those days are over.

2- HEALTH

Although the Justice Department overhaul may bring the most significant changes immediately, the appointment of Robert F. Kennedy Jr. as secretary of Health and Human Services could result in long-term changes of even greater impact.

Anyone who has noticed the prevalence of advertising for wonder drugs on cable news probably can understand the concern that Big Pharma has an outsized impact on the health narrative being told in mainstream media. Multiply that concern by a dozen when you measure the influence that drug companies have not just on Congress and health regulatory agencies, but on the medical industry itself.

Bobby Kennedy has no fear of Big Pharma or the scientific establishment. He is willing to demand accountability for the kinds of policy decisions that led to our disastrous COVID policies four years ago. Is he right about everything? No, but he asks the right questions – questions that until now no one in power has dared to raise.

3- NATIONAL SECURITY

What about national security? There are problems everywhere, none bigger than China, which has been the missing link in U.S. foreign policy for the past four years. Does President Biden even have a China policy? You would be hard-pressed to find it, unless it is appeasement.

-

- No response to the flow of fentanyl into the U.S.

- No response to the increasing pressure tactics employed against our crucial trading partner, Taiwan.

-

- No response to the cold war with the Philippines or the creation of Chinese naval bases in the South China Sea.

- No response to China cracking down on human rights and free speech in Hong Kong.

- No response to China’s creation of a spy base in Cuba in violation of the Monroe Doctrine.

- No response to China’s predatory trade practices using slave labor.

You can expect the silence from the State Department to end when Sen. Marco Rubio is approved by the Senate as the new secretary of state. China is on notice, but other hot spots around the globe will also be addressed by Trump’s national security team, which includes former Rep. Tulsi Gabbard as director of national intelligence and Rep. Michael Waltz as national security adviser. Trump promised to negotiate a settlement to the frightful war in Ukraine, and by appointing Gen. Keith Kellogg as special envoy to Ukraine and Russia, Trump is signaling that the killing has to end.

4- ECONOMIC REVITALIZATION

National security and the economy overlap in at least two crucial areas – illegal immigration and Trump’s plan to use tariffs as a tool to tame our allies and confound our adversaries. Treasury Secretary-designate Scott Bessent has made it clear that he will work with Trump to use tariffs to reshape the global economy and lessen the national debt.

That will be a key ingredient as Trump’s national security team works to deport the millions of illegals who have developed a dangerous symbiosis with the labor economy. Trump knows we can’t merely overlook the lawbreakers without surrendering our moral superiority. But the trick will be to find economic resources to make whole the industries like agriculture that will need to reinvent themselves with a legal work force.

In the first Trump administration, the response to Trump’s plans for massive change was “Why?” But now the response is “Why not?” As Trump asked black voters in 2016, “What do you have to lose?” Now that question is being posed to the entire nation, which has been sleepwalking toward the abyss for too long. If we don’t solve illegal immigration, the national debt and the corporate stranglehold on our regulatory agencies and Defense Department, then there won’t be anything left to lose. That’s why nearly 60% of Americans support Trump’s transition, despite the fear-mongering of Rachel Maddow, the New York Times and Biden’s White House.

WHAT YOU NEED TO KNOW!

A MODIFIED BUFFETT INDICATOR VIEW

A MODIFIED BUFFETT INDICATOR VIEW

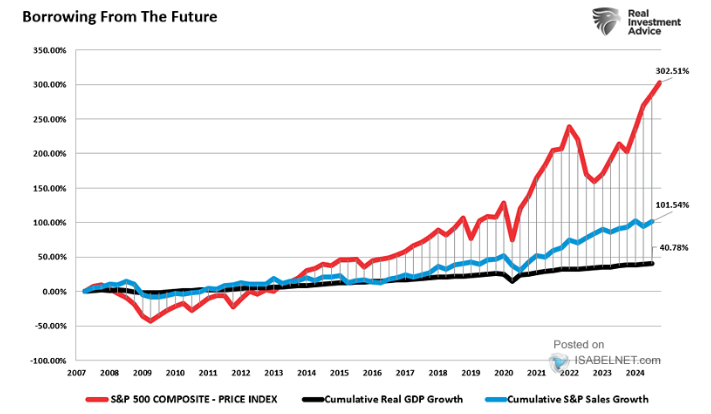

To the right is another way of looking at the Buffett indicator, where we look at Cumulative Sales Growth versus Cumulative Price Growth versus Real GDP Growth. Is it any wonder Buffett has moved to cash in a larger way than he has EVER done historically?

Warren Buffett has grown Berkshire Hathaway’s cash pile to more than $300 billion — a record high. The famed investor has halted stock buybacks and pared key holdings such as Apple and Bank of America. Buffett, 94, is facing a bargain drought.

RESEARCH

1- WHY DOES TRUMP WANT TO BE THE CRYPTO PRESIDENT?

1- THE UNSHACKLING OF AMERICA

1- THE UNSHACKLING OF AMERICA

-

- INVESTING IN AMERICA

- We are beginning to see a narrative focus by the Trump administration nominees on programs that create and instill:

- OPTIMISM

- OPPORTUNITY

- RISK TAKING

- SMALL BUSINESS

- This is based on a fundamental shift towards Productive Investment in people versus Fiscal Investment (Spending) on transfer payments for Consumption.

- We are beginning to see a narrative focus by the Trump administration nominees on programs that create and instill:

- FOSTERING

- If this is actually carried out then we should expect to see growth in:

- INNOVATION

- PRODUCTIVITY

- If this is actually carried out then we should expect to see growth in:

- REVITALIZATION OF AMERICA

- The result of the above directional approach will be the potential Revitalization of America and the Unshackling of America.

- INVESTING IN AMERICA

AMERICAN EXCEPTIONALISM: THE CLEANEST DIRTY SHIRT

-

- Global economic stress is showing everywhere resulting in effectively a growing “flight to safety”.

- This is most evident as shown by the increasing strength of the US Dollar and the dramatic increase in risk capital being employed.

- This has resulted in the biggest overshoot in analysts’ annual estimates in years! The S&P 500 is now over 680 points above the highest 2024 year-end price target from Wall Street strategists and 25% above the average target (4,861).

- The economies of China, Japan and the EU are in trouble and historic levels of money flows are heading to the US. (See Weekly Current Market Perspectives – Flows.)

DEVELOPMENTS TO WATCH

TWO TRUMP STRUCTURAL FISCAL CHANGES PLANNED:

TWO TRUMP STRUCTURAL FISCAL CHANGES PLANNED:

1- SCHEDULE F

-

-

- Trump has audacious plans to alter the federal government’s modus operandi and its entrenched culture.

- The linchpin for his game-changing reforms is reinstating the innocuous-sounding Schedule F, instituted by Trump in the waning days of his first term, but immediately reversed by Joe Biden upon taking office. It will:

-

-empower massive changes in the bureaucracy

-re-classify thousands of careerists as political appointees.

2- IMPOUNDMENT

-

-

- For 200 years under the US system of government, it was undisputed that the president had the constitutional power to stop unnecessary spending through what is known as “impoundment”. The success of his “Department of Government Efficiency”, run by Elon Musk and Vivek Ramaswamy, depends heavily on Trump being able to spend less than Congress appropriates.

- In 1974 Congress stripped the president’s ability to impound funds. That year, lawmakers used the Watergate scandal and President Richard Nixon’s aggressive use of impoundment as an excuse to pass the Impoundment Control Act. The law also created the Congressional Budget Office and the budget committees in the House and Senate, and “reasserted Congress’ power of the purse,” according to Democrats on the House Budget Committee.

- Trump is likely to challenge the Impoundment Control Act as unconstitutional.

-

THE FED RINGS WARNING BELL ON LEVERAGE

-

- The semi-annual Financial Stability Report released recently by the Federal Reserve Board of Governors rang a loud warning bell about high levels of leverage at hedge funds and life insurers.

- The New York Fed had told the public in October that 27 percent of bank capital is “extend and pretend” commercial real estate loans.

- “Comprehensive data collected through SEC Form PF indicated that measures of leverage averaged across all hedge funds were at or near the highest level observed since these data became available in 2013. Relative to the previous report, leverage increased”.

- The delinquency rate of office mortgages that have been securitized into commercial mortgage-backed securities (CMBS) spiked by a full percentage point in November for the second month in a row to 10.4%. It is now just a hair below the worst months during the Financial Crisis meltdown, when office CMBS delinquency rates peaked at 10.7%, according to data by Trepp, which tracks and analyzes CMBS.

- The office sector of commercial real estate has entered a depression.

GLOBAL ECONOMIC REPORTING

US LABOR REPORTING FOCUS

US LABOR REPORTING FOCUS

-

- A highly suspect surge in Construction jobs hid the dramatic slowdown in US Manufacturing.

- Wage growth is starting to rise again, (after unions scored huge wage increases).

- Job-changer wage growth rose to 7.20% Y-o-Y from 6.70%, highest since August.

- Job-stayer wage growth 4.80%, highest since June; Y-o-Y pay gains for job-stayers edged up for the first time in 25 months.

NOVEMBER LABOR REPORT (NFP)

-

- While the Establishment report gain of 227K payrolls was solid (always highly suspect), the Household survey (normally less manipulated) indicated a much larger weakness, with the number of people employed tumbling by 355K to 161.141 million???

ADP EMPLOYMENT REPORT

-

- US Manufacturing saw the biggest Job Losses Since June 2023.

- The reality was a double whammy of pain with October’s surge revised down to just +184k and November’s print missing expectations at +146k.

THE ILLEGAL IMMIGRANT US WORKFORCE

-

- Since October 2019, native-born US workers have lost 1.4 million jobs; over the same period foreign-born workers have gained 3 million jobs.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.