MACRO

US FISCAL POLICY

THE TRUMP TRADE DEFICIT CHALLENGE

OBSERVATIONS: I REMEMBER WHEN WE WERE ALL KENNEDY DEMOCRATS!

Attending a Canadian University, I can vividly recall my first year Political Science class like it was yesterday. I walked into the initial lecture to unexpectantly realize half of the amphitheater was filled with US draft dodgers who had fled the US rather than fight in Vietnam. I had mixed reactions since I had just completed my first training summer with the Canadian Air Force.

I got more of a political science education than I had expected that fall with the rancor of the US Presidential election being fought between Richard Nixon and Hubert Humphrey’s spilling over into the lectures and “heated” study groups. As a holder of a freshly minted Queen’s Commission I often found myself greatly outnumbered in defending anything military, war fighting, institutional or even status quo. This naive Saskatchewan farm boy was under continuous attack as apparently embodying anything and everything wrong with the system.

To make things worse this all occurred during the era of Canada’s Prime Minister Pierre Elliott Trudeau fashioning his “Just Society” of universal health coverage and government social expansion, (Canada’s version of President Lyndon Johnson’s Great Society on steroids) . Canada was moving hard to the left! All this was very confusing coming from a world of self reliance and independence that surviving the Canadian prairies instilled.

The bottom line of all this was a “fire hose” indoctrination into the Liberal or Left leaning view of the world. In American parlance I began to view myself as fundamentally a Kennedy Democrat.

This background came with me when I eventually immigrated to the US after experiencing the International side of two major corporations.

I came to the US with:

-

- Core Liberal Ideas — individual freedom, protecting the vulnerable, questioning authority, and the fundamental belief that consenting adults should be free to live their lives however they choose as long as they’re not harming others

- Genuine free speech, not the controlled corporate version we see today

- Standing against establishment overreach

- Opposing unchecked corporate power

- Fighting against unnecessary wars

- Complete bodily autonomy – your body, your choice, in ALL contexts

- Defending individual rights consistently, not selectively

These aren’t political positions to me; they’re basic human principles. Call them left leaning if you must.

I therefore suspect you would expect me to be a hardened Democrat – right? Especially if I tell you I lost money with investments in Trump’s Atlantic City Casino debacles and was left with a very bad taste on Trump’s sly, slick New Yorker methods – long before he became a political figure. I even remember telling colleagues that Trump’s personality was ill suited to politics since bullying, a massive ego and uncivilized behaviour were not generally received well by most.

So what is my point of this background as frankly, the game of politics itself repulses me having spent my adult life in a world of Entrepreneurship, Finance, Economics and the creation of wealth (some of which I got to keep)?

I need to tell you I voted Republican in the last election!

Why – because the Democrat Party is no longer the party of John F Kennedy. The party left me and my core beliefs.

The Republican party is also no longer the party of Bush and Cheney (thank God!), the wealthy nor the establishment. It is a new party of the working class and “have nots” – the “deplorables”, (as Hillary Clinton describes them) and the “Garbage People” (Biden’s characterization). It is a party of patriots, believers in the American way of life and people desperate to know that the American Dream is still alive.

I personally know this to be true!

The last election was a resounding call that the system must change as it is not working for the American people. 3000 of 3200 counties went red. Red blooded American’s wanting the American way of life back!

Our republic is incredibly fragile — more fragile than most people realize. Out founders knew this, warning us about the difficulty of maintaining a democratic republic. Many people still don’t see what’s happening — the censorship, the mandates, the war-mongering, what appears to be intentional schismogenesis – will they ever?

The powers that profit from our division; they’ve mastered the art of keeping us fighting each other so we don’t look up to see who’s really pulling the strings. These aren’t just political issues — they’re existential challenges that require reasonable people to discuss complex solutions. Your neighbor who voted differently isn’t your enemy — they likely want many of the same things you do: safety, prosperity, freedom and a better future for their children. They might just have different ideas about how to get there.

I know this is heavy stuff. You might disagree with everything I’ve said, and that’s okay. What’s not okay is letting these disagreements destroy our relationships and communities. The choice isn’t just about who we vote for — it’s about how we treat each other, how we discuss our differences, and whether we can find common ground in our shared humanity. I learned this in my heated first year political science battles!

The way forward isn’t through hatred or fear. It’s through understanding, open dialogue, and most importantly love. We might be living through the death throes of the American experiment, or we might be witnessing its rebirth. Either way, we’re in this together, and our strength lies in our ability to work through these challenges as a community, as neighbors and as friends. Let’s choose wisdom over reaction, understanding over judgment and love over fear. Our future depends on it. We are Americans – not Democrats or Republicans!

WHAT YOU NEED TO KNOW!

WHAT DOES THE FED SUDDENLY SEE??

The Fed lowered the Fed Funds Rate 25 bps on Wednesday as it had previously signaled. With unemployment levels barely over 4% and Inflation apparently on the expected glide path towards the 2% target rate, this action is 180 degrees to what is the normal FOMC drill!

The Fed lowered the Fed Funds Rate 25 bps on Wednesday as it had previously signaled. With unemployment levels barely over 4% and Inflation apparently on the expected glide path towards the 2% target rate, this action is 180 degrees to what is the normal FOMC drill!

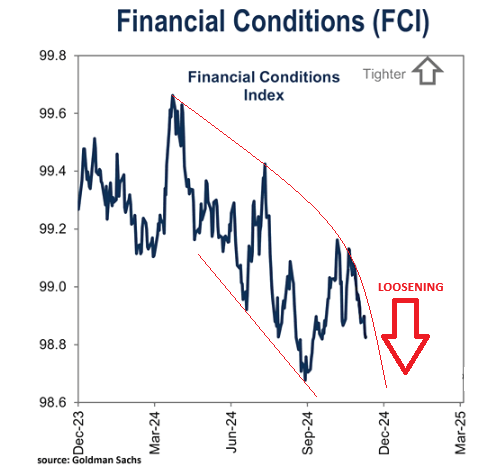

What is it that the Fed sees that would merit its Financial Conditions Index to be as loose as it currently is?

The answer is quite easy to answer. Neither the Fed nor private sector believe any of the data that has been coming from the Biden administration’s BLS reporting (now abbreviated to simply the BS shop). The market as a consequence was shaken Wednesday by the FOMC’s dramatic shift in its dot plot for 2025 signalling serious concerns about Inflation and reports this week that the labor market is much worse (by yet another 250K jobs adjustment) than has been previously reported — The economy is screaming STAGFLATION!

RESEARCH

THE TRUMP TRADE DEFICIT CHALLENGE

THE TRUMP TRADE DEFICIT CHALLENGE

-

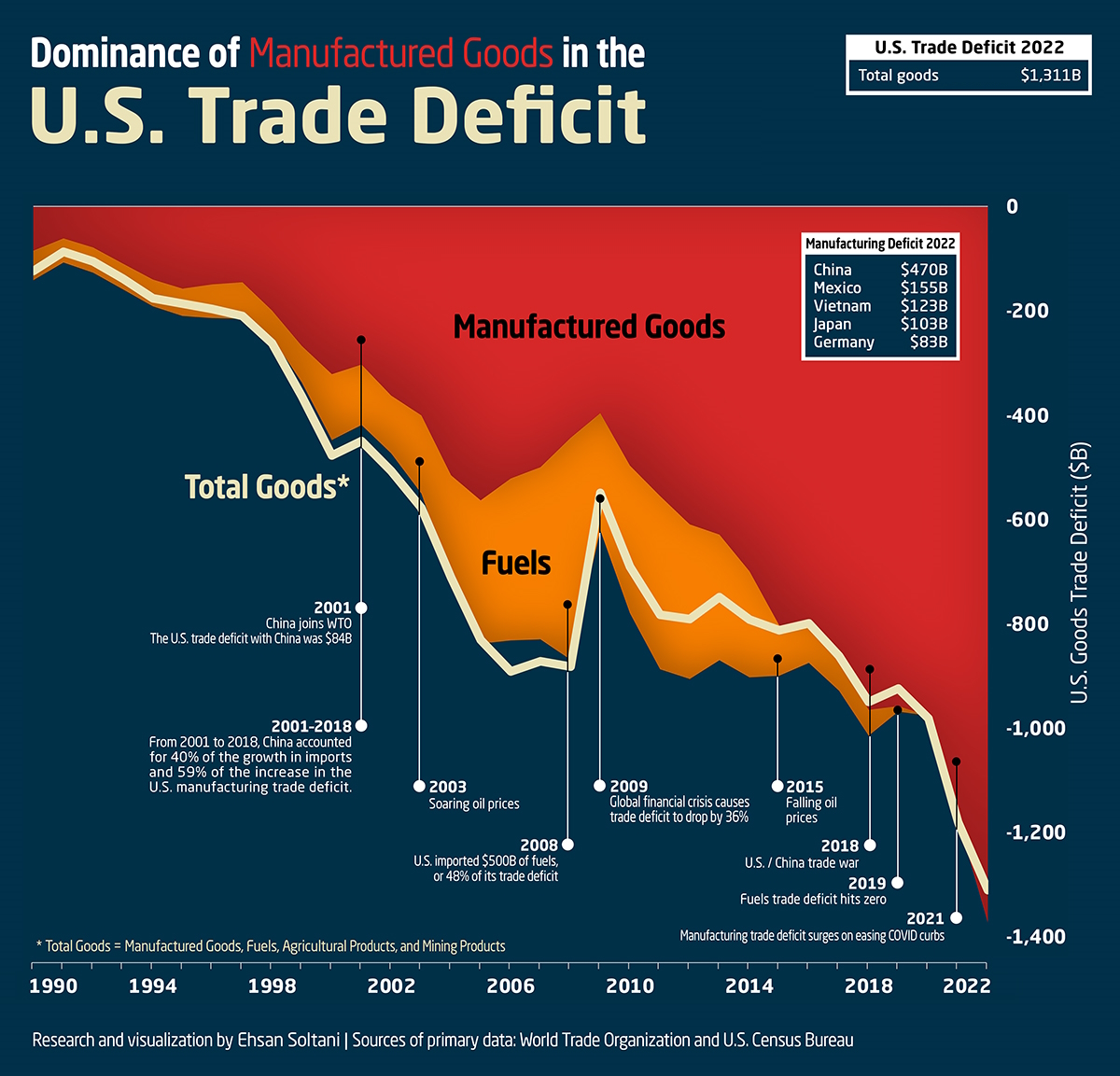

- The central problems in the US can be distilled down to two core issues:

-

-

- The US Consumes more than it Produces.

- The US Government chronically spends more than it takes in as revenue.

-

-

-

- The result of this is an exploding fiscal & trade deficit with resulting growth in Debt-to-GDP and Deficit-to-GDP Ratios.

- The US must address its chronic trade deficit problem!

- President-elect Trump showed clearly this week how he intends to solve this problem in what is an academically unorthodox approach.

- Trump demonstrates the “Art of Threat & Intimidation!”

-

THE FED PIVOTS AS DISINFLATION DIES

-

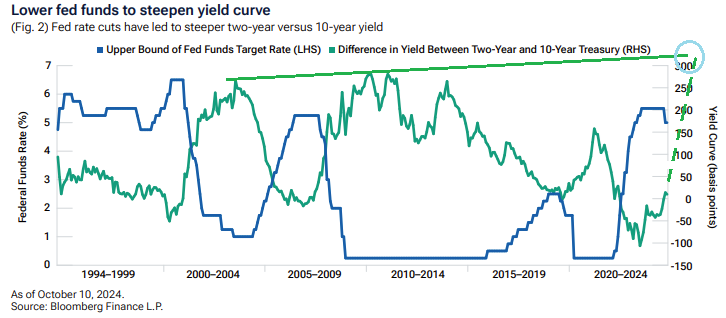

- The Fed cut interest rates by a quarter point Wednesday, but issued a statement and dot plot updates suggesting that rate-cutting would be far more subdued next year than the market had expected.

- In response, the Dow Jones Industrial Average fell 1123 points, closing near its lows of the day and marking its 10th consecutive day of losses.

- The megabanks on Wall Street were among the big losers of the day. Morgan Stanley dropped 5.25 percent; Goldman Sachs was down by 4.25 percent; Citigroup gave up 4.22 percent; Bank of America lost 3.44 percent while JPMorgan Chase shed 3.35 percent by the closing bell.

- These five megabanks are the banks most heavily exposed to tens of trillions of dollars in derivatives. What the Fed does with interest rates has a major impact on their existing derivative trading positions. The broad selloff in these names suggests these banks have some wrong-way bets in their derivative books, or at least that is the market’s perception.

- The Fed was forced to concede by its actions that the steady decline in the job-finding rate over the last year is consistent with a labor market that has loosened significantly in 2024, “has yet to stabilize” and signals that a labor market recession is imminent if not already here!

DEVELOPMENTS TO WATCH

6% 10Y TREASURY YIELDS?

6% 10Y TREASURY YIELDS?

-

- The U.S. are not the only people who need to sell a lot of debt. A huge, huge amount of debt is increasingly needed.

- Fed rate cuts will likely limit yield increases on short-maturity Treasury bills.

- The ongoing issuance by the Treasury to fund the government’s deficit spending is continuing to flood the market with new supply.

- The Fed’s quantitative tightening has taken a large, reliable buyer of Treasuries out of the market, further skewing the balance of supply and demand in favor of higher yields.

- Without YCC and QT, 6% Yields are a strong possibility (driven by the “bond vigilantes”) to force this to occur!

$663B OF BANK CASH GOES “POOF”

-

- Cash assets at the 25 largest U.S. banks have dropped by a stunning $663 billion from their peak levels on December 15, 2021. Where is all of this cash going?

- Since a major part of what these federally-insured megabanks do today is trading, we suspect – but can’t say for sure – that the cash is being used in part to post cash collateral on the tens of trillions of dollars in derivative trades held by a handful of these megabanks.

- The Federal Reserve’s 2007-2010 bailout was conceived by Wall Street, run by Wall Street for its own benefit, and controlled behind a dark curtain at the Federal Reserve Bank of New York – which is, literally, owned by the megabanks on Wall Street.

- A very similar scenario played out during the repo crisis in the last quarter of 2019 when the Fed pumped more trillions of dollars into Wall Street megabanks. That crisis transitioned into the COVID-19 pandemic crisis of 2020 and beyond, which resurrected the emergency loan programs of 2008 by the Fed plus a bunch of new ones.

GLOBAL ECONOMIC REPORTING

LEADING ECONOMIC INDICATOR (LEI)

LEADING ECONOMIC INDICATOR (LEI)

-

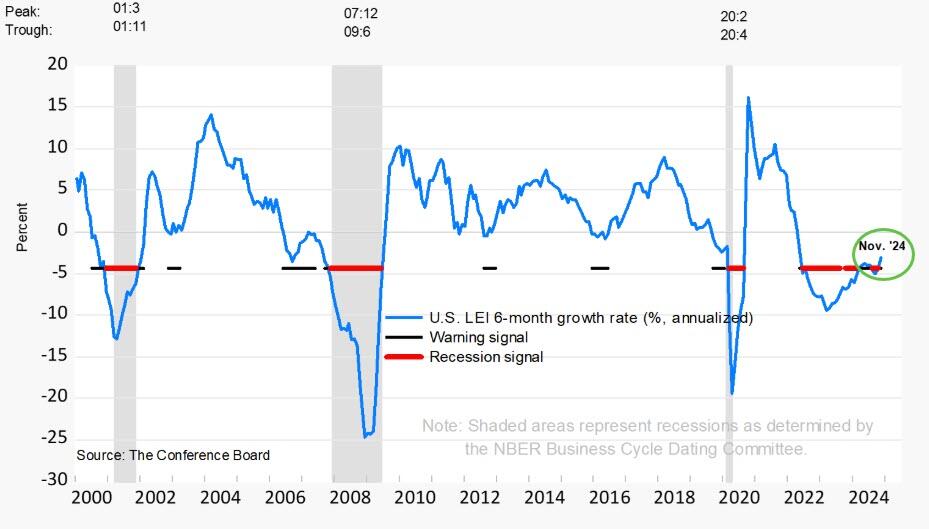

- For the first time since February 2022, US Leading Economic Indicators was positive in November (post-election). With November’s gain, the LEI no longer signals an impending recession.

DECEMBER FOMC

-

- The Fed cut interest rates by a quarter point Wednesday, but issued a statement suggesting that rate-cutting would be far more subdued next year than the market had expected.

- In Chair Powell’s pre-prepared remarks he stated the Fed is squarely focused on two goals, and that the economy is strong, the labour market remains solid, and inflation is much closer to the 2% goal.

- The Chair added that the policy stance is now significantly less restrictive, and going forward they can be more cautious, something which was indicated from the updated SEPs and statement tweak.

- Powell said that today’s decision was a “closer call”, but the “right call”, suggesting there was a discussion surrounding holding rates at this meeting. Powell added risks are two-sided, and trying to steer between those two risks.

PHILLY FED

-

- US Philly Fed Business Indx (Dec) -16.4 vs. Exp. 3.0 (Prev. -5.5)

- US Philly Fed 6M Index (Dec) 30.7 (Prev. 56.6)

- US Philly Fed Capex Index (Dec) 18.8 (Prev. 24.9)

- US Philly Fed Employment (Dec) 6.6 (Prev. 8.6)

- US Philly Fed Prices Paid (Dec) 31.2 (Prev. 26.6)

- US Philly Fed New Orders (Dec) -4.3 (Prev. 8.9)

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.