US ECONOMICS

FISCAL POLICY

CHINA TRADES IN, THEN OUT OF GOLD??

OBSERVATIONS: LEST WE FORGET!

Despite the never ending onslaught of media hysteria, Trump’s campaign pledges remain on course. Its ultimate fate will probably rest with the state of the economy by the November 2026 midterm elections. But its success also hinges on accomplishing what is right (and long overdue) and then making such reforms quietly, compassionately and methodically.

No country can long endure without sovereignty and security — or with 10 to 12 million illegal immigrants crossing the border and half a million criminal foreign nationals roaming freely. The prior administration found that it was easy to destroy the border and welcome the influx. However it is far harder for its successor to restore security, find those who broke the law and insist on legal-only immigration.

Trump is on the right side of all these issues and making substantial progress despite endless, misleading, and unfounded claims eerily familiar of “Russiagate”, Trump impeachment charges, the Mueller investigation et al. The same script, but this time with the aid of Federal activist judges hand selected by Obama and Biden administrations.

Forgotten is that everyone knew that a $2 trillion budget deficit, a $37 trillion national debt and a $1.2 trillion trade deficit in goods were ultimately unsustainable. Yet all prior politicians of the 21st century winced at the mere thought of reducing debts and deficits, given that it proved much easier just to print and spread around federal money.

As long as the Trump administration dutifully cuts the budget, sends its regrets to displaced federal employees, seeks to expand private sector reemployment and quietly presses ahead, it retains the moral high ground.

The economy remains strong, but its ultimate health depends on reaching a trade deal with a handful of nations that account for our $1.2 trillion trade deficit in goods: China, the EU, Canada, Mexico, the Southeast Asian trade bloc – Taiwan, Japan and South Korea.

These nations all know that their tariffs are not symmetrical. But our trade partners will not willingly change. They apparently, but wrongly, believe that the U.S. either welcomes its trade deficits, naively thinks they’re irrelevant, or is too wedded to libertarian trade ideology to demand accountability?

The Trump administration is in the right. Its only challenge is to avoid envisioning tariffs as a new, get-rich source of massive revenue. Data does not support the idea of such large tariff incomes.

The American people signed on for symmetry, fairness and reciprocity in trade, not tariffing those who run deficits with us or seeing high tariffs as a cash cow to fund our out-of-control government.

Enraged Democrats still offer no substantial alternatives to the Trump agenda.

-

- There are no shadow-government Democratic leaders with new policy initiatives.

- They flee from the Biden record on the border, the prior massive deficits and inflation, the disaster in Afghanistan, two theater-wide wars that broke out on Biden’s watch and the shameless conspiracy to hide the prior president’s increasing dementia.

Instead, the Left has descended into thinly veiled threats of organized disruption in the streets. It embraces:

-

- Potty-mouth public profanity,

- Profane and unhinged videos,

- Nihilistic filibusters, congressional outbursts, and

- Increasingly dangerous threats to the persons of Elon Musk and Donald Trump.

All that frenzy is not a sign that the Trump counterrevolution is failing. It is good evidence that it is advancing forward, and its ethically bankrupt opposition has no idea how, or whether even, to stop it.

WHAT YOU NEED TO KNOW!

AI WILL BE BIG, BUT HUMANOIDS MAY BE BIGGER?

AI WILL BE BIG, BUT HUMANOIDS MAY BE BIGGER?

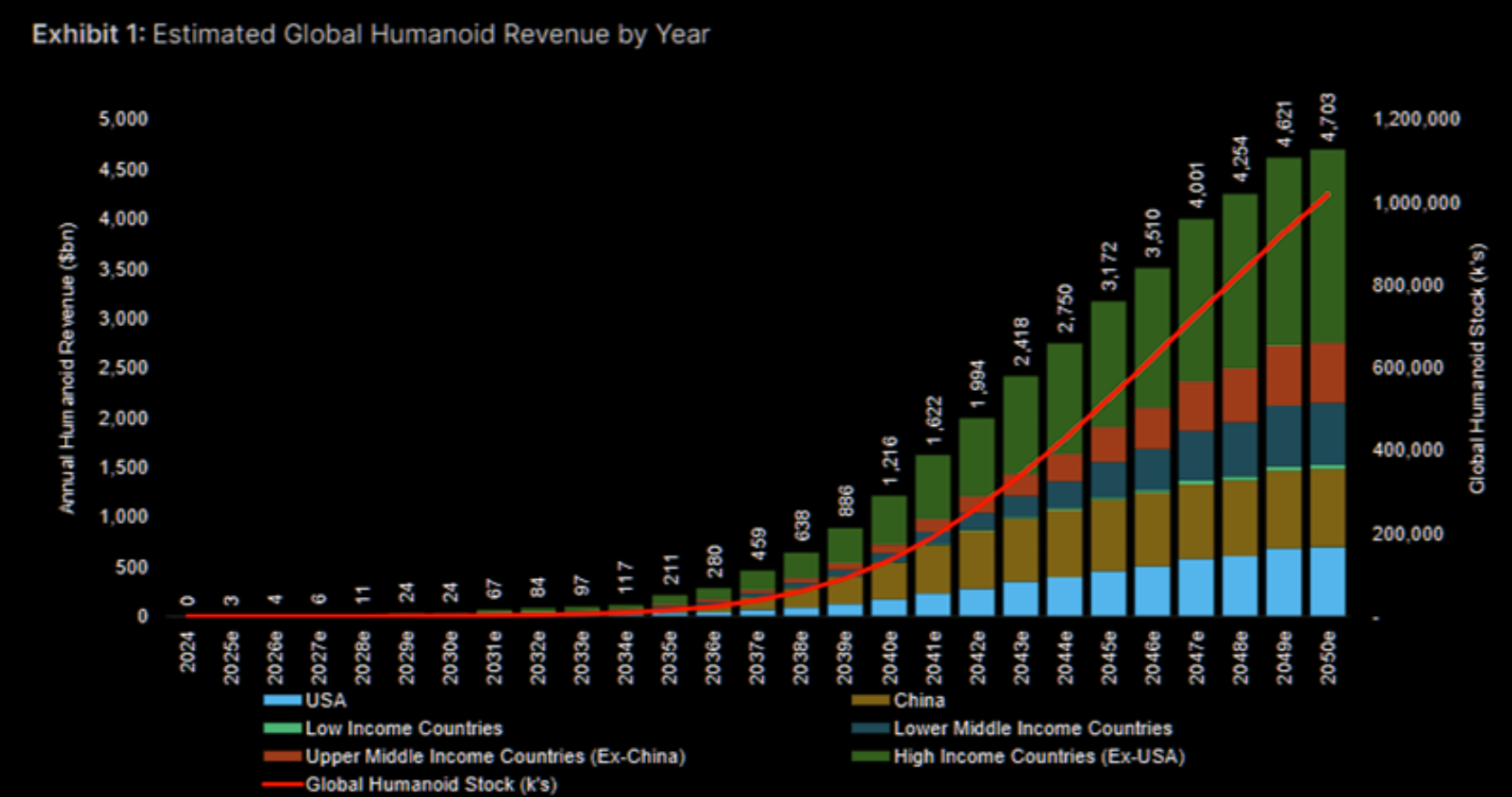

Morgan Stanley Humanoids Research sees a $5 Trillion global market by 2050 and has announced the best business models/ investment opportunities along the value chain. (CLICK HERE) Initial business adoption is expected to start gradually, reaching 13mn/130mn in 2035/40 globally, with household adoption starting later.

Among the various players, the team believes integrated humanoid OEMs that own robot brains, bodies, branding and ecosystems offer the highest value. Along the value chain, the robot model is the most valuable and consolidated over the long term, while component players vary on tech barriers. The team highlights 20 names to play the humanoid theme globally: 4 robot integrators, 7 robot brain and 9 body supply chain players. (CLICK HERE)

$5T in revenues by 2050, which would make it materially larger than the global auto industry. This expands upon previously published US and China TAM models, introducing assumptions for rest-of-world and household humanoids, and leveraging the updated cost and technological analysis led by our China Industrials Team. Among the various players, integrated humanoid OEMs that own robot brains, bodies, branding and ecosystems appear to offer the highest value.

RESEARCH – MARKET DRIVERS

1- CHINA TRADES IN, THEN OUT OF GOLD??

1- CHINA TRADES IN, THEN OUT OF GOLD??

-

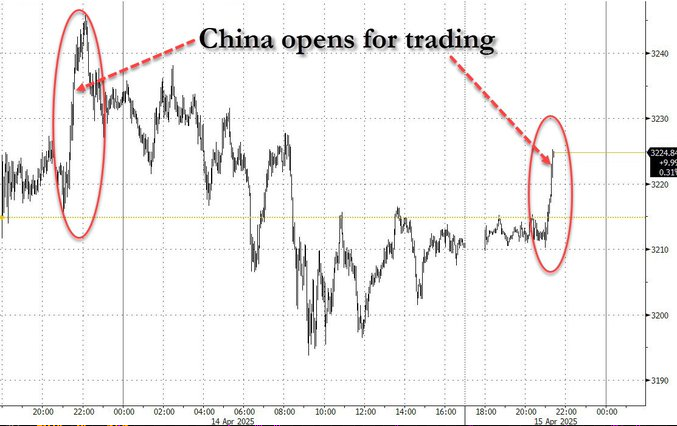

- There is something strange going on in the Gold market?

- Recent gold price moves are taking place exclusively around the time China markets open for trading.

- China as a result is having a disproportionate impact on the price of gold, because they execute during an illiquid part of the day (Asia morning), which is likely triggering ex China CTA trading signals.

- There are many possibilities of what is going on here. But it requires careful observation which we explore in our weekly Market Lab report.

2- THE MESSAGE FROM OIL IS CLEAR

-

- When energy and oil specifically fall significantly, it usually indicates slowing demand from a slowing global economy.

- A drop of over 50% in oil over the last two years, in concert with our observations on global activities we have been reporting on in this weekly report, suggests that it is a logical conclusion of what is occurring.

- The world economy is at a major turning point, which is why we should brace for rapid changes in the economy. The world is moving from having enough goods and services to go around, to not having enough to go around. The dynamics of the economy are very different with not enough to go around. The hoped-for solution of higher prices doesn’t fix the situation; after a point, adding more buying-power mostly produces inflation. Other solutions are needed. The world economy is reaching what has been called “Limits to Growth.”

- We have entered the Beta Drought Decade and are in the early stages of a major unfolding Bear Market.

DEVELOPMENTS TO WATCH – POLICY DRIVERS

1- THE QUARTERLY TREASURY REFUNDING REPORT

1- THE QUARTERLY TREASURY REFUNDING REPORT

-

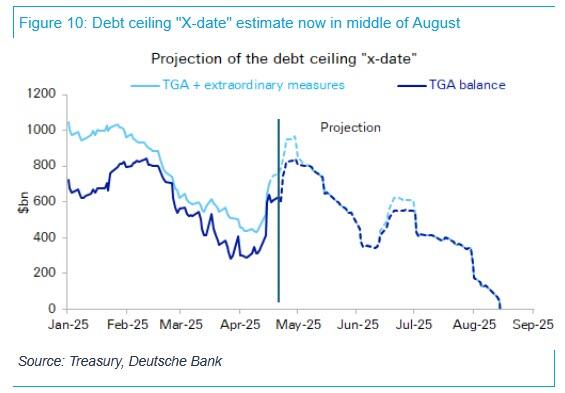

- The US Treasury published its debt borrowing estimates for calendar Q2 and Q3 and it was just as expected.

- During the April – June 2025 quarter, Treasury expects to borrow $514 billion in privately-held net marketable debt, assuming an end-of-June cash balance of $850 billion.

- The borrowing estimate is $391 billion higher than announced in February 2025, primarily due to the lower beginning-of-quarter cash balance and projected lower net cash flows, partially offset by lower QT (i.e. debt redemptions) to the tune of $60 billion.

- This was completely expected, which means it is completely distorted due to the ongoing debt ceiling standoff.

“The current quarter borrowing estimate is $53 billion lower than announced in February”, which indicates that DOGE is indeed working and the US funding needs are actually declining.

2- TRUMP POLICY DEVELOPMENTS

1- NEW $150B MILITARY CONTINUING RESOLUTION (CR): While DOGE may have saved $160 billion so far, the Pentagon now ‘needs’ $150 billion of new funding under the guise of supporting various Trump priorities. The House Armed Services Committee advanced the supplemental spending plan in a 35-21 vote during a markup hearing. The plan was unveiled on April 27 by House Armed Services Committee Chairman Mike Rogers (R-AL) and Senate Armed Services Committee Chairman Roger Wicker (R-MS), with Congressional Republicans preparing it for reconciliation – a process which allows Congress to pass legislation concerning taxation and government spending without requiring the 60 Senate votes typically needed to invoke cloture and avoid a filibuster. Republicans have several such reconciliation bills in the pipeline.

2- ENVIRONMENTAL PROTECTION AGENCY (EPA) ANNOUNCES 100 ACTIONS TAKEN: Environmental Protection Agency (EPA) administrator Lee Zeldin unveiled 100 actions the agency has undertaken since Trump’s inauguration to “power the American comeback.”

-

-

- “We are delivering on this mandate. Promises made, promises kept. At EPA, we are doing our part to Power the Great American Comeback. To mark this momentous day, we are proudly highlighting 100 environmental actions we have taken since January 20th to protect human health and the environment.”

-

3- TRUMP REVAMPS BUREAUCRATS’ PERFORMANCE STANDARDS: Performance reviews are about to become much more difficult for the upper echelon of federal government employees. The Trump administration will soon introduce rules to end what the Office of Personnel Management describes as an “everyone gets a trophy” culture permeating the federal workforce.

-

-

- The new OPM rule limits the number of bureaucrats who can earn top ratings, a metric tied to promotions and end-of-the-year bonuses.

- It also eliminates Biden-era requirements that evaluated executives based on their promotion of diversity, equity and inclusion.

- The stated goal is instead an evaluation of job performance, not political ideology. Now only top performers, acting OPM director Chuck Ezell told RCP, will earn top performance rankings.

-

GLOBAL ECONOMIC REPORTING – ECONOMIC DRIVERS

GROWING RECESSION ODDS

GROWING RECESSION ODDS

-

- Even a mild 5% contraction in earnings from 2024 would leave the aggregate earnings per share of the S&P 500 basket at $225, which would be roughly commensurate with a value of 3,874 on the index. The S&P 500 is almost 2,000 points higher than that level.

- The markets may well live in denial for a little while, but the longer they do so, the more pain is storing up for the future.

- President Donald Trump may have put many tariffs on hold, but with no signs of a trade deal with China, the prospect of empty shelves in the US, higher prices and an inevitable slowdown in the US economy is real.

- Former Treasury Secretary Janet Yellen is out warned that the chances of a recession are “way up” in the wake of tariffs. In turn, that points to shrinking earnings at Corporate America.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.