US ECONOMICS

INVESTMENT CYCLE

DEEPSEEK & A BURSTING CAPEX BUBBLE

OBSERVATIONS: THE US MORAL & STRATEGIC IMPERATIVE

This year’s MATASII 2025 Thesis Paper was entitled “The Strategic Imperative” and addressed the revitalization and unshackling of America’s industrial strength.

To do this is both a moral & strategic Imperative for national security, as well as to secure our nation’s future while being good stewards of our resources – which includes the people of this great country.

Our nation has traded its manufacturing might for financial gains across all sectors via policing that have fostered globalization, financialization and the new form of Mercantilism – all of which I have talked about on numerous occasions in my writings and videos.

American Innovation and Determination are the key value- add pillars America possess that are being shackled by the ever expanding Regulatory State. The government needs to be right-sized similarly to corporations were after the Dotcom Bubble burst in 2000 and China entered the World Trade Organization (WTO) in 2002.

We will need to empower the US worker with technology to manufacture for America faster and better than ever before while creating new and better jobs.

The Trump administration’s commitment to reindustrialization of American manufacturing and our workforce began on Day One with over 80 Executive Orders and 385 Executive Actions in the first week alone. These changes were aimed at specifically regaining our competitiveness and financial stability.

We need the incoming administration according to Chris Power, Founder and CEO of Hadrian, an advanced manufacturing company, and co-founder of the New American Industrial Alliance (NAIA), to immediately take four broad steps. (I have captioned his steps below for clarity):

1- THE REGULATORY PERMITTING PROCESS

Dramatically reform our permitting process for strategic manufacturing facilities. While China can build a factory in months, American companies often wait years for permits. This regulatory burden is crushing our ability to rapidly scale the production of critical components.

2- PREDATORY PRACTICES

Second, we need to level the playing field against China’s predatory practices. This means addressing everything from raw material costs to energy rates to shipping subsidies. These artificial costs squeeze what American companies can pay their workforce.

When Chinese manufacturers can access materials and energy at a fraction of what American companies pay, we’re not competing on merit – we’re competing against a government-subsidized adversary that has been intentionally de-industrializing the U.S. for 30 years. Americans can compete, but not against the Chinese Communist Party making everything from energy to raw materials free. One hundred billion dollars of currently offshored manufacturing business from American companies sourcing in China could return overnight as a result of a more level playing field, creating a jobs boom unlike anything we’ve seen since the ’40s.

3- AN AMERICAN SUPPLY CHAIN

Third, we must ensure that manufacturers who receive government subsidies or revenue from the Department of Defense (DOD) make their supply chain 100% American. Too many of our tax dollars end up being outsourced to China and other competitive nations for 20% cheaper components from bad supply chain incentives. Tariffs will help, but we need a mandate to “make in America if you want to get paid by American taxpayers!”

4- BOLDNESS OF DEINDUSTRIALIZATION EFFORT

We need to stop missing crucial opportunities and take big, bold bets on American manufacturing to signal to the CCP that we are serious about any offensive moves in Europe or the Pacific Theatre.

WHAT YOU NEED TO KNOW!

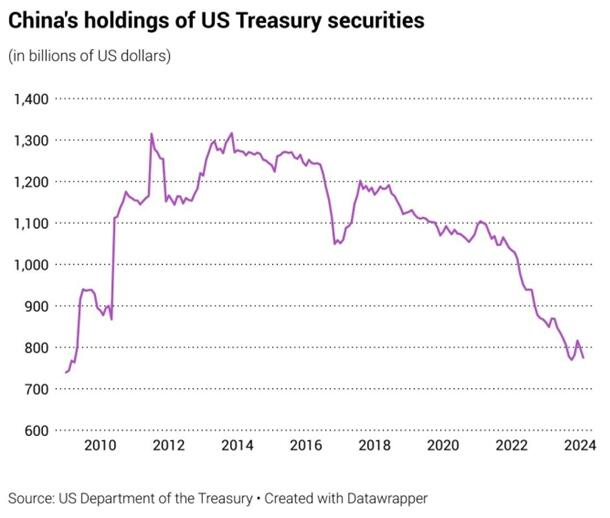

SHRINKING CHINESE HOLDINGS OF US TREASURY DEBT

SHRINKING CHINESE HOLDINGS OF US TREASURY DEBT

China has reduced its holdings of US Treasury Debt by over 50% over the last 10 years. Japan and China were then the top 2 holders of US Treasury debt with comparable holdings.

By China selling its holding, it placed more supply on the market while at the same time reducing demand. This supply / demand mix usually equates to rising yields and falling prices for US Treasury. The real problem Is that as China accelerated its reduction in holding the US increased its needed supply of debt due to massive increases in spending and $2T budget deficits with over $1T in increased interest payments.

If you are wondering why the Trump Administration is acting at such a rapid fashion is because the urgency of the problem has become central to the success of his administration!

RESEARCH

1- DEEPSEEK & A BURSTING CAPEX BUBBLE

1- DEEPSEEK & A BURSTING CAPEX BUBBLE

-

- A new Chinese AI model called DeepSeek shook the financial markets last week.

- DeepSeek’s impact comes down to economics. Compared to ChatGPT, the U.S. AI leader, DeepSeek’s input processing costs just $0.27 per million tokens versus ChatGPT’s $2.50 – making it 9.3x cheaper. For output processing, the cost difference is similarly dramatic, with DeepSeek running 9.1x cheaper than ChatGPT. This order-of-magnitude cost reduction could fundamentally reshape how companies approach their technology investments.

- The real story here isn’t about DeepSeek killing large-cap tech. Instead, it’s about making AI more accessible to smaller tech companies, leveling the playing field.

- DeepSeek likely won’t trigger a massive decline in US stocks. Instead the DeepSeek announcement suggests much of the AI spending might be unnecessary.

- DeepSeek doesn’t pop the AI bubble – it pops the capital expenditure bubble.

2- Q4 MAG-7 EARNINGS

-

- META, MICROSOFT & TESLA reported earnings on Wednesday with Apple on Thursday. To come for the Mag-7 is Amazon (Thursday Feb 6th), Google (Tuesday Feb 4th) and Nvidia’s later in the month (Feb 26th)

DEVELOPMENTS TO WATCH

1- THE JUNK BOND BUBBLE

1- THE JUNK BOND BUBBLE

-

- We are Mispricing Risk!

- Hopes of favorable policies from the new US administration are galvanizing demand for a constrained supply of corporate debt, bringing credit markets to a boil while raising the odds of a blowup if the riskiest borrowers buckle under elevated yields.

- It’s debatable whether policy makers will stoop to save the highest-risk zombie borrowers. Excess liquidity can’t sustain a bad business indefinitely.

- Disregard for risk is pushing corporate bonds to levels that signal a more pronounced reversal when the bubble pops.

2- EARLY “TELLS” SHOWING

-

- There is clear evidence of a major “Trade-Down” phenomenon underway in America with WalMart being the biggest recipient.

- While labor market data is generally good, there are signs the labor market is at a standstill.

- Continuing jobless claims are steadily rising and at their highest level in over three years.

- The JOLTS hires rate is at ten-year lows.

- While the number of layoffs remains low, employers aren’t hiring either.

- Employment expectations are also plummeting. Similar changes in expectations have led to a higher unemployment rate previously.

- The broad labor market data may currently seem good on the surface, but other warning data is suggesting the Fed should focus on the fact that consumers have already started to spend less and save more, which is a major problem in a nearly 70% Consumption Economy!

GLOBAL ECONOMIC REPORTING

US Q4 GDP

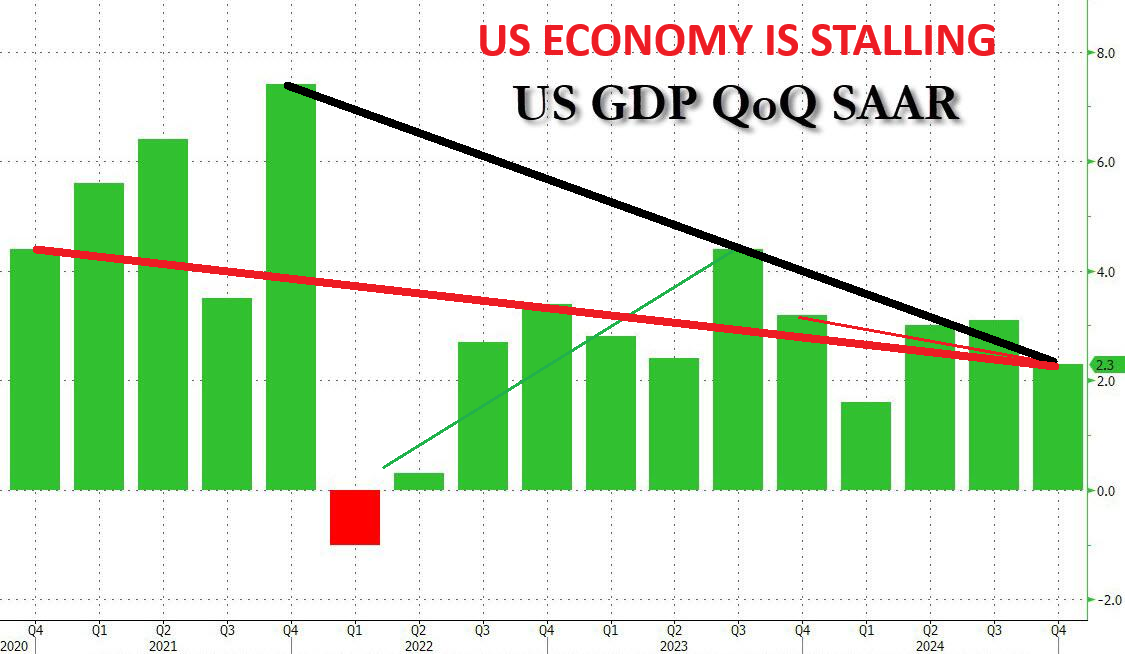

US Q4 GDP

-

- The first estimate of Q4 GDP was softer than expected, falling to 2.3% from 3.1%, beneath the advance estimate from the BEA.of 2.6%.

- The US economy expanded at the slowest growth in three quarters.

PCE

-

- Core PCE – print at +2.8% YoY, (flat from the prior month).

- Headline PCE rose to +2.6%, (as expected).

- The SuperCore inflation remains very sticky, well above The Fed’s mandate.

US TRADE BALANCE

-

- The US Advance Goods trade balance saw the deficit in December widen to USD 122.1bln from 103.5bln.

- Exports declined by USD 7.8bln from November, while Imports rose by USD 10.8bln.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.