|

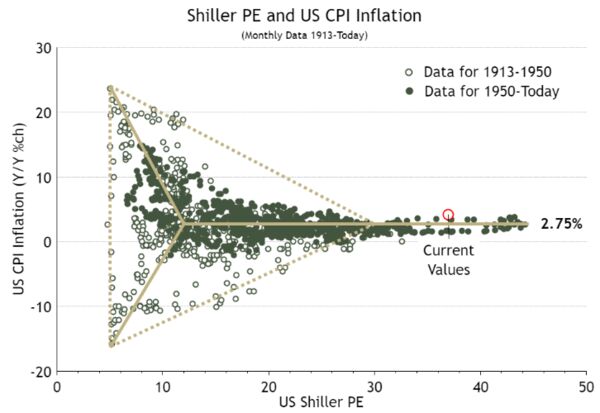

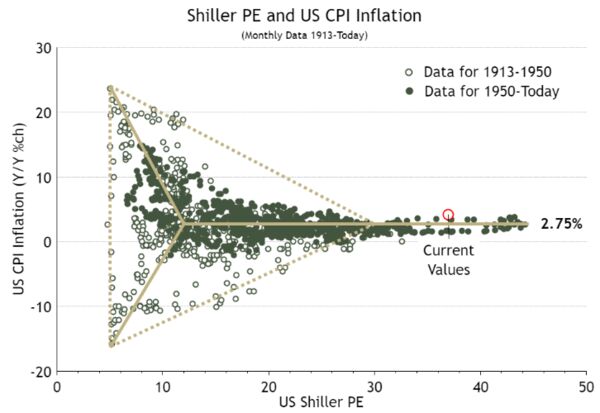

The chart to the right, from Ian Harnett of Absolute Strategy Research Ltd. in London, places inflation on the vertical axis and the Shiller price-earnings ratio on the horizontal axis. The chart to the right, from Ian Harnett of Absolute Strategy Research Ltd. in London, places inflation on the vertical axis and the Shiller price-earnings ratio on the horizontal axis.

This produces a relationship that John Authers at Bloomberg calls the “Inflation Dart” or perhaps preferably “Inflation Concorde.” The relationship between inflation and share valuations isn’t as tight as with bonds, of course, but at present the Shiller P/E is at the historically extreme level of 37 (slightly to the right of the red ring on the chart).

In the past, such valuations have only ever been achieved when inflation is positive and very low. With inflation at 5%, the latest reading is a massive outlier.

There is no precedent for the stock market being prepared to look through inflation this high and leave multiples at such an elevated level (or indeed set a new all-time record)??

SIMPLY TOO BIG A DISTORTION TO BE ANYTHING ELSE?

What is obvious is that this is an extremely strange set of conditions to combine with the worst inflation print in decades, even if that inflation is transitory.

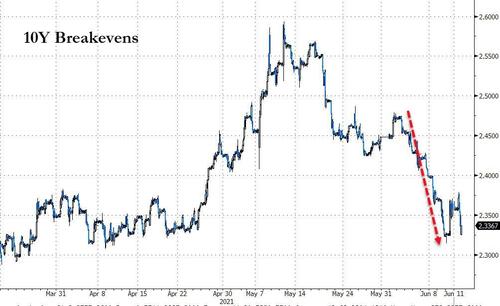

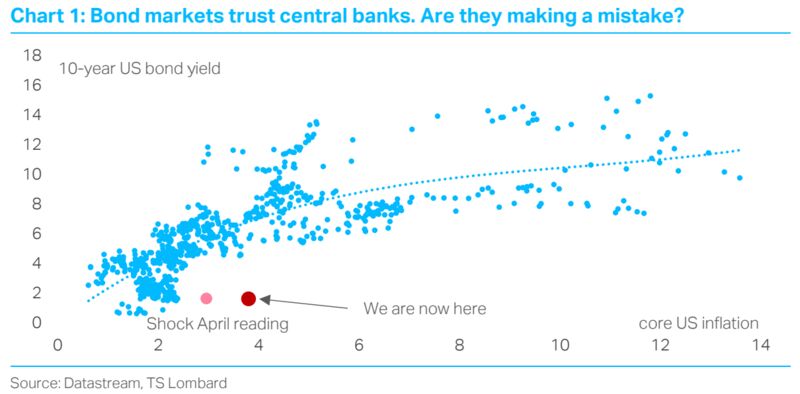

Another chart below from Dario Perkins of TS Lombard in London illustrates the extremity of the bond market nicely. It maps 10-year yields on the vertical scale against core inflation. Usually, and unsurprisingly, higher inflation tends to signify higher bond yields. The current yield looks like a historic outlier. Arguably, bond yields have never been this tolerant of high inflation. As Perkins suggests in the title of the chart below, bond markets are putting an awful lot of trust in central banks not to let inflation get going (which would damage longer-term bond returns).

|

The chart to the right, from Ian Harnett of Absolute Strategy Research Ltd. in London, places inflation on the vertical axis and the Shiller price-earnings ratio on the horizontal axis.

The chart to the right, from Ian Harnett of Absolute Strategy Research Ltd. in London, places inflation on the vertical axis and the Shiller price-earnings ratio on the horizontal axis.

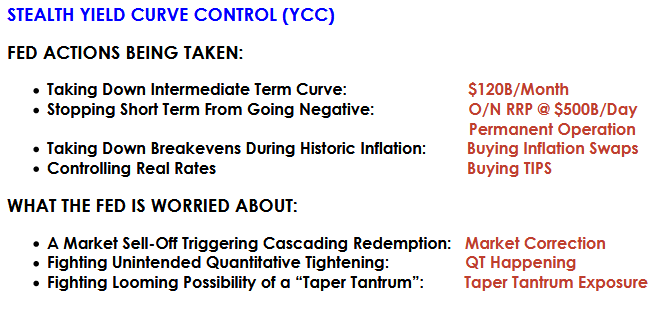

Global Central Banks appear to be caught in a trap of either:

Global Central Banks appear to be caught in a trap of either: