MACRO

US ECONOMICS

DID WAVE 2 OF INFLATION JUST BEGIN?

OBSERVATIONS: BIDEN’S FAREWELL ADDRESS

I remember as a boy listening to President Dwight D. Eisenhower, the 34th U.S. President, giving his farewell speech. He warned America about the powers of the Military-Industrial Complex. I didn’t fully grasp the message as a boy, but I do remember clearly the stearness of tone – a tone eerily familiar to that which came from my military father before he applied punishment!

On Wednesday evening US President Joe Biden delivered his farewell address. President Biden also warned in his farewell address that:

-

- He is concerned about a dangerous concentration of power in the hands of a few wealthy people. He felt that this excessive wealth was creating an oligarchy which threatens democracy.

- Biden was also concerned about the Tech-Industrial complex and said Americans are buried in disinformation and the free press is crumbling.

- He additionally warned that AI needs safeguards and that they must make AI safe and trustworthy and America must lead on AI and not China.

Though I have disagreed with Biden’s thinking on almost everything, he got this right! If his presidency got one thing right it was his departing warning. History may remember it as his prescient crowning legacy.

As he prepares to leave office, according to a recent Gallup Poll, Americans offer a largely negative assessment of the progress the U.S. has made during his presidency on 18 economic, national and international issues. The majorities of Americans think the U.S. has lost ground in six areas over the past four years:

-

- The federal debt (67%)

- Immigration (64%)

- The gap between the wealthy and less well-off (60%)

- The economy (59%)

- The United States’ position in the world (58%) and

- Crime (51%).

Pluralities also say the nation has fallen behind in six other areas: i)education, ii) terrorism, iii) trade relations with other countries, iv) race relations, v) the nation’s infrastructure and vi) energy.

Meanwhile, U.S. adults are more likely to see progress (39%) than regression (23%) or steadiness (31%) on just one of the issues — the situation for gay, lesbian and transgender people. More Americans believe the country has stood still on two issues — climate change and racism – than think it has made progress or lost ground.

U.S. adults are about evenly divided on whether the U.S. has lost ground or stood still on healthcare, national defense and the military, and taxes, with relatively few seeing progress in these areas.

Biden Viewed Less Positively Than Predecessors on Many Issues

Gallup also measured Americans’ views of the nation’s progress at the end of Trump’s first presidential term in 2021, as well as Barack Obama’s and George W. Bush’s second terms in 2017 and 2009, respectively. Twelve of the issues measured in the December poll were likewise tracked at the end of these three presidents’ terms in office, another five were asked after Obama’s and Trump’s presidencies, and one (the nation’s infrastructure) was only measured in the latest poll.

In general, Americans’ assessments of presidents’ progress on issues at the end of their term have been more negative than positive.

WEALTH IN THE BIDEN ERA

The very richest Americans are among the biggest winners from Biden’s time in office, despite his farewell address warning of an “oligarchy” and a “tech industrial complex” that threaten US democracy.

-

- The 100 wealthiest got more than $1.5 trillion richer over the last four years, with tech tycoons including Elon Musk, Larry Ellison and Mark Zuckerberg leading the way, according to the Bloomberg Billionaires Index.

- Biden warned of “a dangerous concentration of power in the hands of a very few ultra wealthy people” and said “an oligarchy is taking shape in America.”

- The top 0.1% gained more than $6 trillion during the Biden years, Federal Reserve estimates show, though the share of households in the 90-99.9% bracket fell.

- Biden ran for office promising to boost taxes on the wealthy and close loopholes, but most of his proposals weren’t adopted by Congress—including an idea to tax the unrealized gains of billionaires.

Democrats’ views of the progress Biden has made are generally muted compared with Republicans’ views of Trump four years ago and Democrats’ perceptions of Obama in 2017, but somewhat similar to Republicans’ perceptions of Bush in 2009.

BOTTOM LINE

Given Biden’s relatively low job approval rating and the expectation that history will judge his presidency negatively, it follows that Americans do not think the U.S. has improved during his time in office. However, Americans’ end-of-term assessments for prior presidents have also been largely negative — even for Obama, who left office with relatively high job approval ratings. Democrats’ generally subdued endorsement of Biden’s handling of a wide range of economic, national and international areas contribute to his unusually low net-positive ratings.

WHAT YOU NEED TO KNOW!

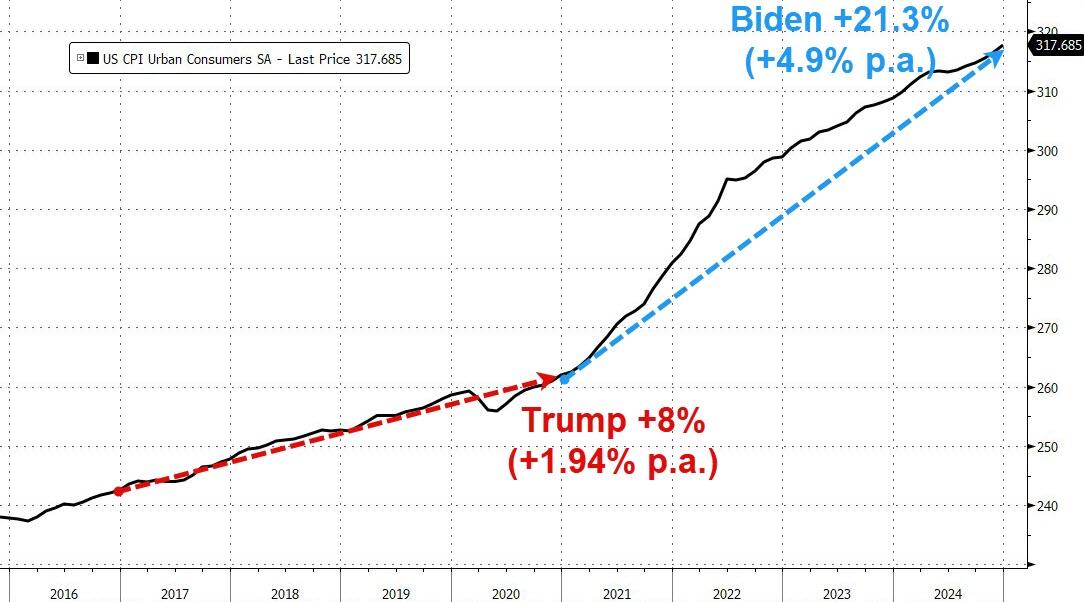

BIDEN’S 21.3% INFLATION LEGACY

One of the main reasons that central banks target 2 percent inflation is that 2 percent is the highest rate of inflation that goes largely unnoticed. Going largely unnoticed, households and firms do not consciously factor sub-2 percent inflation into their price and wage setting processes. This prevents an ‘inflation spiral’ taking hold. The reason that sub-2 percent inflation goes largely unnoticed is that economic productivity also tends to rise at 1-2 percent. And to the extent that wages rise in line with productivity, people will not suffer a loss of purchasing power when prices rise at 2 percent or below. So, the inflation goes unnoticed.

One of the main reasons that central banks target 2 percent inflation is that 2 percent is the highest rate of inflation that goes largely unnoticed. Going largely unnoticed, households and firms do not consciously factor sub-2 percent inflation into their price and wage setting processes. This prevents an ‘inflation spiral’ taking hold. The reason that sub-2 percent inflation goes largely unnoticed is that economic productivity also tends to rise at 1-2 percent. And to the extent that wages rise in line with productivity, people will not suffer a loss of purchasing power when prices rise at 2 percent or below. So, the inflation goes unnoticed.

The thing that people notice and hate, is the cumulative loss of purchasing power when prices keep rising at above 2 percent. Telling people that inflation is back down in the low-single digits will not make them feel any better when they have just suffered a cumulative loss of purchasing power of 25 percent (or more)!

RESEARCH

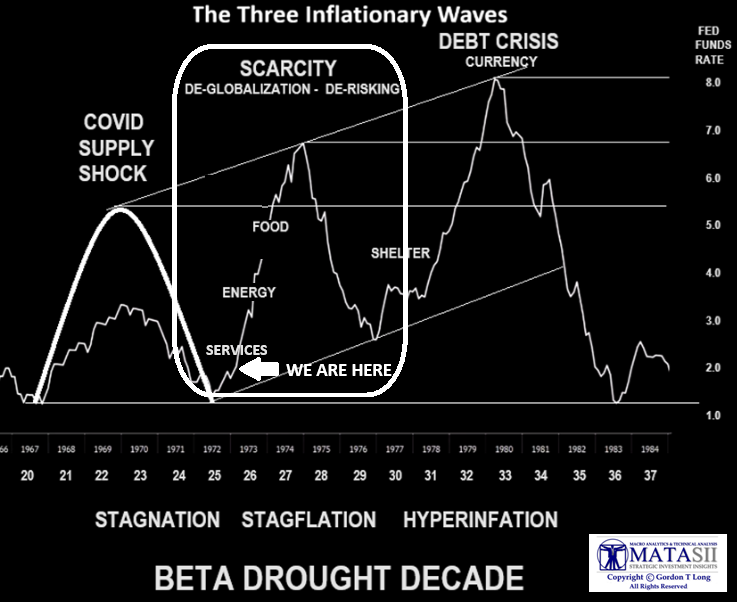

1- DID WAVE 2 OF INFLATION JUST BEGIN?

1- DID WAVE 2 OF INFLATION JUST BEGIN?

-

- WHAT EVERYONE NEEDS TO BE REMINDED OF IS:

-

-

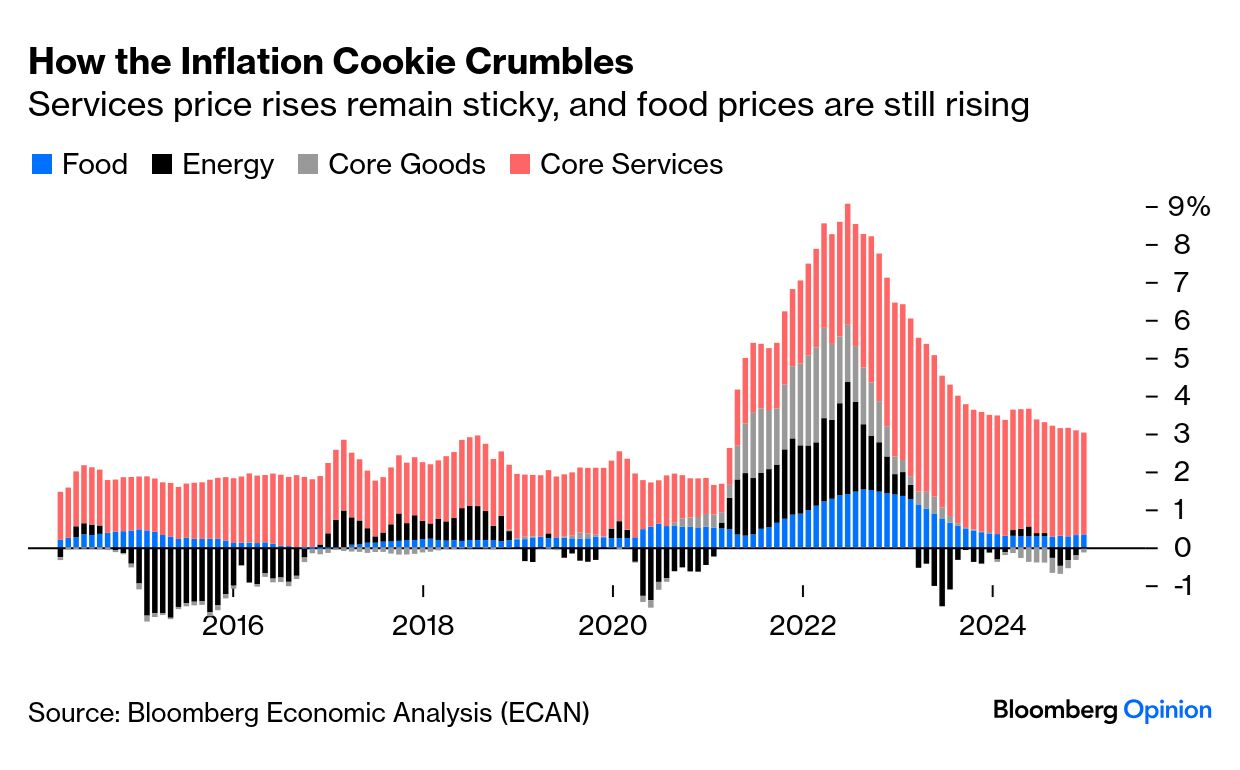

- THE US IS A SERVICE ECONOMY.

- IT’S CUMULATIVE INFLATION THAT MATTERS!

-

-

- The US is now well recognized as dominantly a Service Economy. Why then do we always add Service Inflation as a tail end discussion to Inflation after consumer items such as goods, food and energy?

- For the “Supercore” measure of services inflation, excluding shelter a favorite of the Fed itself, a slight decline last month still leaves the overall annual increase unacceptably high at a little above 4%.

- We can expect:

- A 5% bond yield in the US that makes sense and may even be too low for a long-term view.

- Inflation likely averaging 3%, real GDP growth around 3%, and a term premium of at least 0.5pp (potentially higher due to uncertainty).

- Nominal GDP growth would be hitting 6%, outpacing interest rates.

- Debt ratios stabilizing unless the government continues excessive deficit spending.

2- Q4/YE EARNINGS SEASON

-

- Rising Equity Market due to: i) Buybacks (EPS), ii) Strong Margins (Low Non-Operating Interest Costs), iii) Productivity Growth, iv) Investor Confidence

- Falling Investor Sentiment due to: i) Slowing Global Growth, ii) US Dollar Strength (Earnings Repatriation), iii) Margin Pressures from Cumulative Inflation, iv) Valuation Levels, v) Market Concentration

- US Equities are vulnerable increasingly to:

- The easy gains are now behind us. US growth and EPS expectations are much stronger than in the previous years at a time when policy uncertainty is elevated, and tighter financial conditions are starting to pressure valuations.

- 41% of revenues in the S&P 500 come from abroad. This becomes a problem when: 1- Dollar Strengthens (currently going ballistic!), 2- Economic Growth slows globally (the US is currently the only DM with a strong economy, China, Japan and EU currently incurring major issues).

DEVELOPMENTS TO WATCH

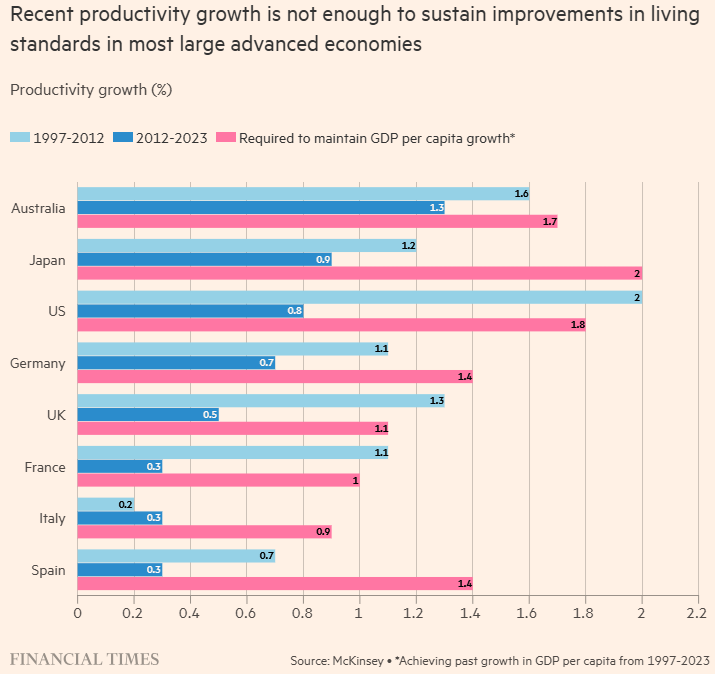

DECLINING STANDARDS OF LIVING COME WITH SHRINKING BIRTH RATES

DECLINING STANDARDS OF LIVING COME WITH SHRINKING BIRTH RATES

-

- Many of the world’s richest economies will need to at least double productivity growth to maintain historical improvements in living standards amid sharp falls in their birth rates.

- A McKinsey report investigating the economic impact of declines in birth rates found that the UK, Germany, Japan and the US would all have to see productivity rise at double the pace seen over the past decade to maintain the same growth in living standards witnessed since the 1990s.

- The consultancy’s report showed that, to match GDP per capita growth between 1997 and 2023, productivity growth in France and Italy would need to triple over the coming three decades. In Spain, it would need to rise fourfold between now and 2050.

- The report highlights the stark impact of declining birth rates on the world’s most prosperous economies, leaving them vulnerable to a shrinking proportion of the population of working age.

- Without action, “younger people will inherit lower economic growth and shoulder the cost of more retirees, while the traditional flow of wealth between generations erodes”, said Chris Bradley, director of the McKinsey Global Institute.

FIDUCIARY FAILURE

-

- Since we wrote our 2015 Thesis paper on the US Social Security System and its unfunded liabilities it has only steadily got worse – with absolutely nothing being done about it!

- Meanwhile we have spent Trillions on endless Middle East Wars and funding conflicts such as Ukraine War?

- We attach a list, recently prepared by author Michael Snyder, that could simply be added as an Appendix to the 10 year old paper with no change to the original paper.

GLOBAL ECONOMIC REPORTING

CONSUMER PRICE INDEX: CPI

CONSUMER PRICE INDEX: CPI

-

- Y-o-Y CPI +2.9%, Worst since July,

- M-o-M CPI +0.39% (+4.8% Annualized), Worst since February.

- Core CPI Stuck for 7th Month at 3.1% to3.3%

PRODUCER PRICE INDEX (PPI)

-

- PPI Inflation Accelerates to +3.3%, Driven by “Core Services,” +4.0%

- Both the Worst Readings in Nearly 2 Years

- 2024, the year of sharp acceleration.

- Services, accounting for two-thirds of PPI, are where inflation is festering and accelerating.

RETAIL SALES

-

- US Retail Sales MM (Dec) 0.4% vs. Exp. 0.6% (Prev. 0.7%, Rev. 0.8%)

- US Retail Control (Dec) 0.7% vs. Exp. 0.4% (Prev. 0.4%)

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.