CONCLUSION

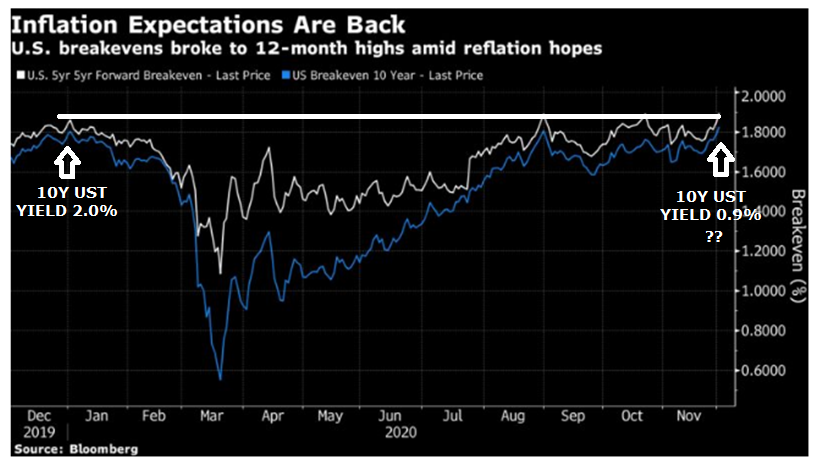

With yields rising amid renewed reflation prospects, the question is when does it become too much?

Bloomberg writes that:

“Renewed optimism about U.S. stimulus talks pushed the benchmark 10-year yield to a high of 0.94%, a move which if continued could spark a domino effect across risk assets trading at all-time highs thanks to low interest rates. …… at issue is whether the jump in yields is accompanied by an economic recovery and moderate levels of inflation that would allow the Federal Reserve to keep rates low.”

We highlight in this month’s LONGWave video the impact on and our expected yields for the 10Y UST.

It appears investors are positioning for improving global economic growth in the near term, with the Treasury curve steepening and U.S. stocks rallying to a fresh record. Meanwhile, 10Y Breakevens have risen to their highest level since May 2019 with what appears to be a distorted value for the 10Y UST Yield (See chart above). Something is soon going to give and the question is whether it will be the Market, Fed or both?