US ECONOMICS

MONEY SUPPLY

EXCESS LIQUIDITY BECOMES LIQUIDITY SLUMP

OBSERVATIONS:THE POLITICAL CAPTURE OF THE FEDERAL RESERVE

If you are reading these newsletters for any period of time, then you know the US has a spending problem! This spending problem has recently resulted in the Federal Reserve being trapped and as a consequence has lost control of Monetary Policy. Let me explain…

The US is fighting two core problems:

-

- The US Consumes more than it Produces and has for decades, resulting in increasingly destabilizing global US twin deficits funding bleed.

- US Deficit Spending no longer generates the GDP growth it once did. Specifically Debt Growth no longer produces economic growth at a sufficient rate.

• In the US it now takes as much as $2.50 of New Debt to produce the $1 of economic growth.

• In the US it now takes as much as $1.50 of Deficit Growth to produce $1 of economic growth.

• Velocity of Money has become chronically smaller than Money Supply growth resulting in further GDP headwinds.

What this means is the Federal Reserve is no longer operating solely within its twin mandated goals of: i) Price Stability, ii) Maximum Employment.

Since 2020 these two mandates have become effectively a single mandate which is to maintain the government debt bubble at all costs. It happened with Covid and the policy mistakes of 2020-2024.

Massive quantitative easing in 2020 created the inflationary crisis we have lived through since. Cumulative inflation since 2021 stands at 24.7%. This is hardly “price stability.”

By ignoring monetary aggregates, the Fed made a string of mistakes that have led the United States to a debt crisis and an inflation disaster. Saying that inflation was transitory and continuing with easing policies despite all warning signs, then only to hike rates too fast and destroy families and small businesses, was the first mistake. But to keep enormous liquidity injections being made to bail out regional banks and government debt issuances was to entrap the Fed.

The reason why a central bank must be independent from government and has price stability as its mandate is because governments WILL ALWAYS increase their imbalances if they can use the monetary system. This is the continuous threat to a Democratic System.

Inflationism is a result of policy decisions. Left unchecked, Governments can be expected to slowly take control of the entire economy and swallow the productive capacity of the country, issuing a promissory note — its currency — that constantly loses purchasing power.

By prioritising government debt management over inflation control, central banks have compromised their independence and credibility. The mistaken tendency to blame inflation on various factors rather than acknowledging the role of government spending and money supply growth is problematic.

During the January–March 2025 quarter, the Treasury expects to borrow $823 billion in privately held net marketable debt, according to their own estimates. The Congressional Budget Office (CBO) projects that the annual budget deficit will rise from $1.7 trillion in 2026 to $2.5 trillion in 2035.

Implementing a decisive reduction in government spending is the only way to prevent the destruction of the US dollar and a debt crisis. No revenue measure will halt the damage.

The current self-perpetuating cycle where government spending drives monetary policy, which in turn enables more government spending, is destructive in every aspect. It puts the US dollar’s reserve status in danger, and it accelerates a debt crisis as demand for Treasuries declines globally.

The Fed must stop inflating the government debt bubble over their mandated responsibility to ensure price stability.

Failing to do it will mean more: i) inflation, ii) lower growth, iii) higher debt, and iv) a weaker economy.

WHAT YOU NEED TO KNOW!

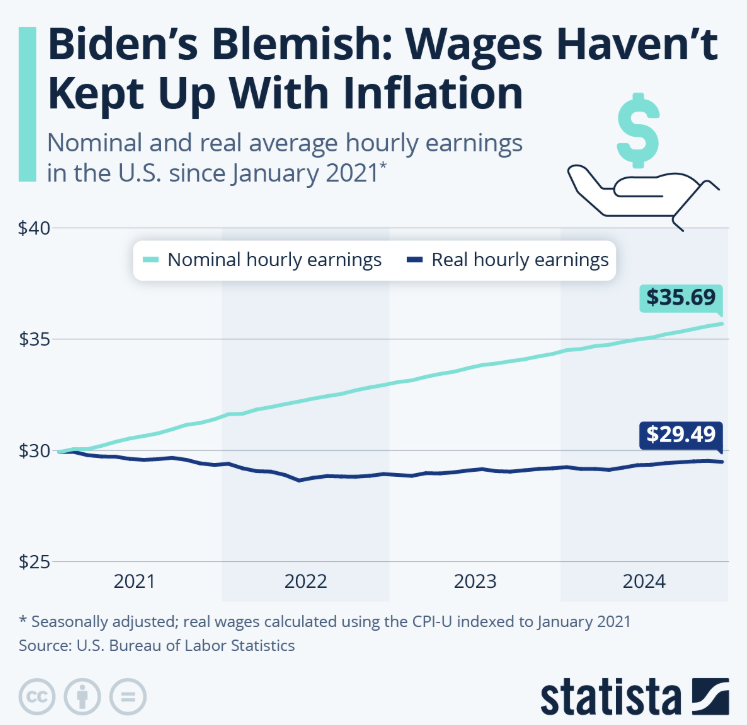

REAL WAGES HAVEN’T KEPT UP WITH INFLATION

Bringing down inflation, i.e. disinflation, is not to be mistaken for falling prices, which would be deflation.

Bringing down inflation, i.e. disinflation, is not to be mistaken for falling prices, which would be deflation.

While (moderately) rising prices are no problem per se and actually wanted in a functioning economy, hence the Fed’s 2-percent inflation target, inflation becomes a problem if it outpaces wage growth for a protracted period of time. According to data from the U.S. Bureau of Labor Statistics, this has been the case in the U.S. from April 2021 to April 2023, when prices increased faster than nominal wages did for 25 consecutive months, at least on a year-over-year basis.

That resulted in an actual decline in real wages as nominal wage growth still hadn’t fully caught up with price increases by December 2024. As the chart shows, nominal average hourly earnings grew from $29.93 in January 2021 to $35.69 in December 2024 – a 19.2 percent increase. During the same period, prices, as measured here by the Consumer Price Index for all Urban Consumers (CPI-U), climbed 21.0 percent, leading to a 1.5 percent decline in real wages. That means adjusted for price increases, people went from $29.93 an hour to $29.49 an hour during the Biden years. Considering that these are average earnings, it’s fair to assume that many people suffered considerably larger and actually noticeable declines in real wages, leading to the widespread frustration with the Biden economy.

RESEARCH

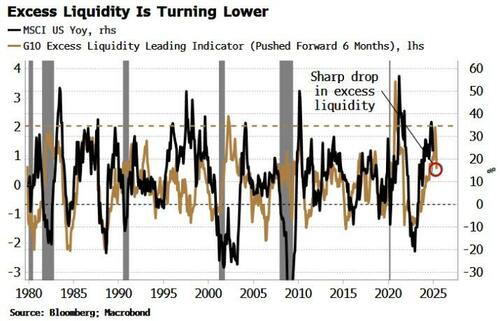

1- EXCESS LIQUIDITY BECOMES A LIQUIDITY SLUMP

1- EXCESS LIQUIDITY BECOMES A LIQUIDITY SLUMP

-

- Excess Liquidity, which leads US stock-market growth by 3-6 months, has turned sharply lower.

- Excess Liquidity has tightened notably recently. (See Chart Right)

- It’s been a tailwind for the market since the October 2022 bottom, but if unchecked its turn lower will soon jeopardize the rally.

- Pressure will intensify on the Fed to revert to a more accommodative stance from a president renowned for equating his success with the health of the stock market.

2- Q4/YE EARNINGS SEASON

-

- What we have is the Welch effect on steroids! Once again corporate America has managed to lower the bar ahead of upcoming earnings.

- Everyone is following the old Jack Welch playbook. Massage, beat & repeat!

- US expectations have been cut meaningfully. Y-O-Y growth rate is now down to 8% vs 18% at one point last year.

- The S&P 500 EPS level for Q4 is outright below where it was in Q3.

DEVELOPMENTS TO WATCH

-

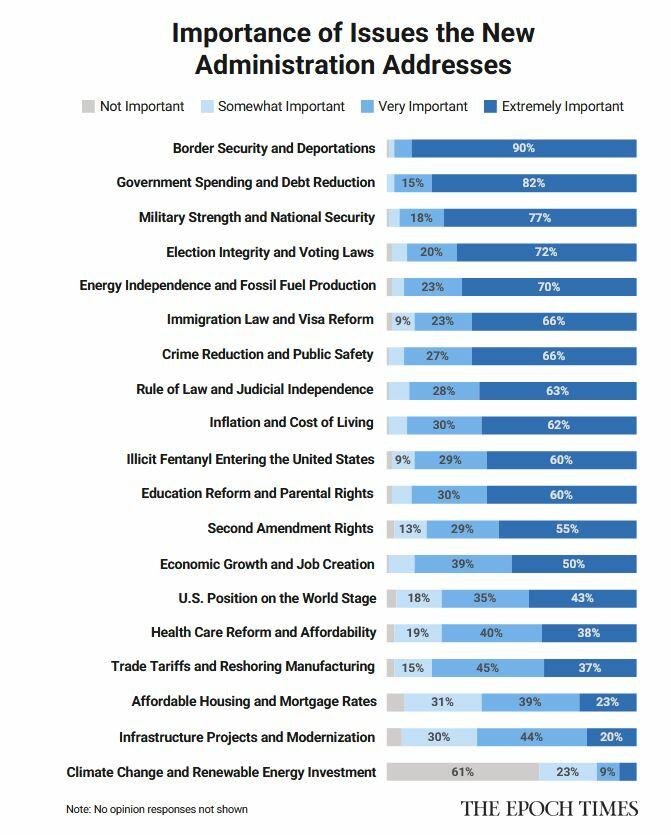

- Readers of The Epoch Times have identified border security, fiscal responsibility and national defense as the top priorities for President-elect Donald Trump’s incoming administration.

2- TRUMP’S DAY 1 EXECUTIVE ACTIONS & ORDERS

-

- 80 Executive Orders

- 200 Executive Actions

-

- You can scour the Founding documents all day and find very little support for government-by-executive-order. It was not supposed to be this way. It should not have to be this way. The President under the Constitution has a very limited role.

- Most of the many executive orders issued by President Trump are purely restorative, a reaffirmation of core constitutional structures that had been previously ignored or overthrown. Therefore, these are not acts of executive imposition so much as deployments of power in order to give power back to the people. In other words, most of the actions are not about the “imperial presidency.” They are about returning power to where it belongs and never should have left, namely to the U.S. Constitution and to the voters in a republican system of government.

- This is why all the chatter about Trump’s use of power, (“He’s behaving like a dictator!”), misses the mark. Completely. Someone had to enforce the law against government overreach. That someone is President Trump.

GLOBAL ECONOMIC REPORTING

US SERVICE PMI

US SERVICE PMI

-

- S&P Global US Manufacturing PMI jumped back above 50 (50.1) from 49.4 (better than the 49.8 expected).

- S&P Global US Services PMI tumbled to 52.8 from 56.8 (well below the 56.5 expected).

EMPLOYMENT – JOBLESS CLAIMS

-

- Initial jobless claims, for the week ending 18th January (coincides with NFP survey week), rose to 223k from 217k, a touch above the 220k consensus while the 4wk average ticked up to 213.5k from 212.75k.

- Continued claims, for the week ending 11th January (does not coincide with NFP survey window), jumped to 1.899mln from 1.853mln, well above the 1.862mln forecast and above the highest analyst estimate (1.891mln).

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.