MACRO – CHINA

MONETARY & FISCAL POLICY

GLOBAL LIQUIDITY AT UNPRECEDENTED LEVELS – INFLATION RE-IGNITED

OBSERVATIONS: THE “GREED THEORY” OF INFLATION

I felt this note from The American Institute for Economic Research is worth posting unedited.

The inflation outlook has improved, but it is still very much in the news. Although the rate of increase has slowed, prices remain more than 20 percent above what they were four years ago. At the same time, most analysts understand that the slow and at times negative growth of the money supply, which has tamed inflation somewhat for now, cannot be sustained.

Now that the Fed has announced its 50-basis-point cut in the federal funds rate, it will be opening the money spigot again. To be fair, the increase in the rate of growth of the money supply needed to achieve this reduction in the federal funds rate is modest. But as the Fed continues to reduce rates, the rate of money growth will increase, and so the likelihood of future inflation will rise. Since the Fed has given every indication that many more rate cuts are coming, what either presidential candidate has to say about inflation has never been more important.

Several weeks ago, Kamala Harris offered us her Greed Theory of Inflation. In short, people are suffering from high prices today because of greedy corporations. That’s it. As the estimable economist and policy analyst, John Goodman, documented recently (The Greed Theory of Inflation), she is rather alone on this one. Even very liberal economists, who vociferously support Democrats, do not make this argument and most will refute it if queried.

Harris either believes what she is saying, or she doesn’t. Having an undergraduate degree in economics and exposure to highly educated people for many years in her various roles in government, truly believing what she is saying should be impossible.

But if she doesn’t believe what she is saying, then this might go down as one of the most cynical acts of political dishonesty of all time. Even worse than either possibility is that it is a little of both.

Economists used to enjoy a very good reputation among ordinary citizens and elected officials. In the popular television show The West Wing, for example, President Jed Bartlet was a Nobel Prize-winning economist, who established from the beginning that there was no question about his intelligence, academic achievement and intellectual honesty.

Today, economists no longer receive that kind of automatic respect, and for good reason: too many have traded on the respect normally accorded to their discipline to advance their own political views. But a competent professional economist of integrity cannot possibly believe the Harris Greed Theory of Inflation. Competent economists understand that if greed simply means wanting things badly, then by the very structure of their own paradigm, everyone is greedy, so the word is useless.

In June of 2020, inflation was 0.6 percent. It then rose to a peak of 9.1 percent in June of 2022. It fell steadily from that peak to 3 percent in June of 2023 and has stayed low ever since (it was 3 percent in June of 2024). By the Harris Greed Theory, corporations became increasingly greedy from June 2020 to June of 2022, and then became less greedy over time.

A much better and very well-known explanation for our recent whipsaw of inflation is money growth. The Fed was worried about disruption during COVID, so it dramatically increased the money supply. Inflation caused by supply disruptions began rising even more rapidly, precisely as monetary theory predicts, so the Fed hit the brakes hard on money growth; so hard, in fact, that the money supply began to contract. Predictably, inflation then began to come down.

If greed and not monetary policy were the culprit, why did the federal government fail to rein in corporate greed at the beginning of the Biden-Harris administration, but then successfully do so over the last year? Kamala Harris should be asked this question by the media since she proposed the Greed Theory. Even if that never happens, economists with integrity should not wait to be asked that question. They should call out such nonsense unilaterally.

The Trump-Vance ticket is playing the same kind of game with foreign trade policy. But there has been no shortage of economists from every political persuasion raising great objection to increasing tariffs in service to government led industrial planning. Economists should not be exacting about things they politically disagree with, but generous with things they do. With respect to economics per se, they should call balls and strikes with the utmost of intellectual neutrality.

WHAT YOU NEED TO KNOW!

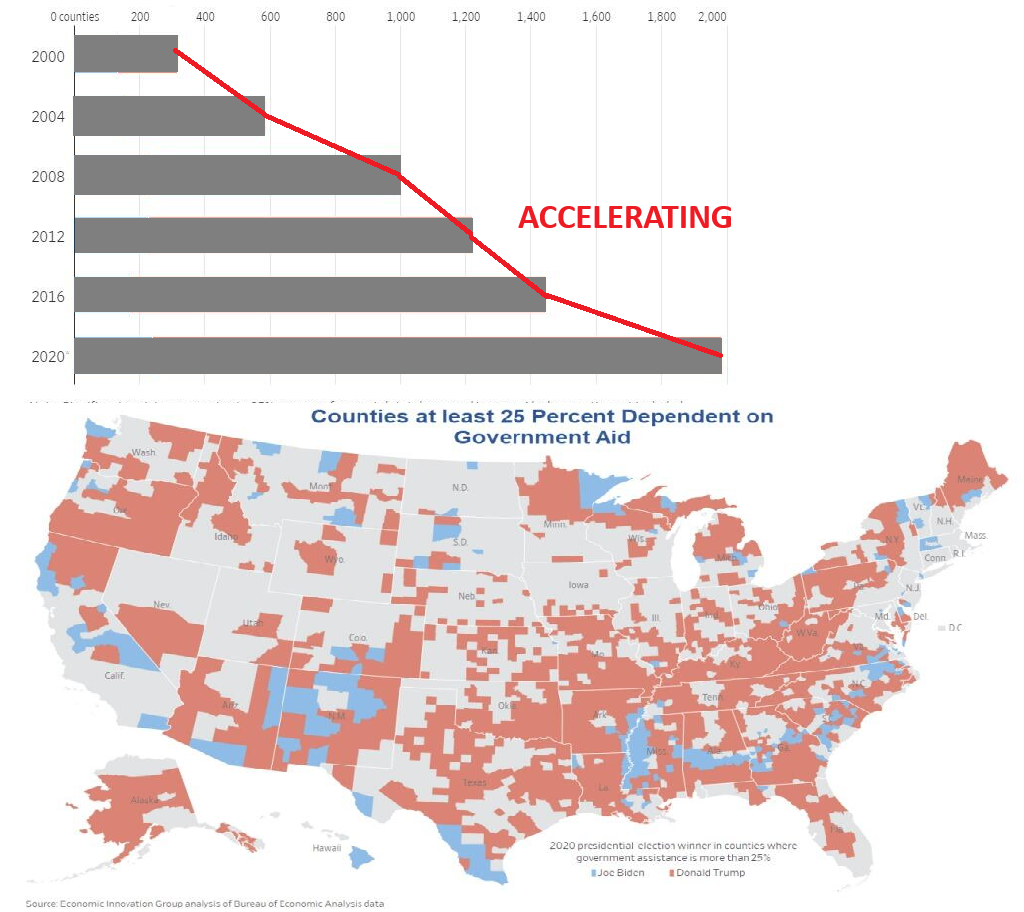

ACCELERATING GOVERNMENT DEPENDENCY

ACCELERATING GOVERNMENT DEPENDENCY

The number of counties dependent on government aid has surged over time. The Wall Street Journal has a great article on the Growing Reliance of Americans Are Dependence on Government Aid over time.

“Americans’ reliance on government support is soaring, driven by programs such as Social Security, Medicare and Medicaid. That support is especially critical in economically stressed communities throughout the U.S.

The big reasons for this dramatic growth: A much larger share of Americans are seniors, and their healthcare costs have risen. At the same time, many communities have suffered from economic decline because of challenges including the loss of manufacturing, leaving government money as a larger share of people’s income in such places. This spending accounts for a big and growing share of the national debt. Though counties that rely significantly on government spending tend to be small, they are still home to nearly 22% of the U.S. population.”

RESEARCH

1- GLOBAL LIQUIDITY AT UNPRECEDENTED LEVELS – INFLATION RE-IGNITED

-

- Liquidity conditions in the US and globally are going from strength to strength, with excess liquidity of the G10 reaching highs breached only twice before in the last 50 years.

- Stimulus in China and easing in the US will further bolster an already very positive backdrop for risk assets.

- Too much liquidity will be a problem if it leads to even more stretched valuations and frothy markets liable to correcting.

- It’s been a wild ride through the post-pandemic cycle, and it might be about to get wilder. Excess liquidity — by how much real money growth outperforms economic growth — has again risen to a new recent high. It has only been greater twice over the last half-century, in 2001 and in 2020.

- Excess liquidity is one of the best medium-term leading indicators for stocks and other risk assets. Only last month I discussed the increasingly favorable liquidity backdrop. But with the latest release of monthly data, G10 excess liquidity has hit levels that demand an update – even more so as Federal Reserve easing and recently announced stimulus in China is primed to take it yet higher.

2- WALL STREET MOVING TRADING MONEY TO FDIC INSURED BANKS

-

- Taxpayer-backstopped federal deposit insurance at commercial banks in the U.S. was never meant to be a get-rich scheme for the wild and voracious appetites of traders on Wall Street.

- A quarterly report produced by the federal regulator of national banks – those operating across state lines – shows that vast amounts of trading on Wall Street is now taking place inside the federally-insured commercial banks that are owned by the trading powerhouses on Wall Street: JPMorgan Chase, Goldman Sachs, Citigroup and Bank of America.

- Do the millions of Americans that are depositing their paychecks at the 5,143 branches of Chase Bank that are spread coast to coast have any idea that the OCC reported that this federally-insured banking unit of JPMorgan Chase was sitting on $54 trillion in notional derivative contracts as of March 31, 2024?

- Even more eye-popping, federally-insured banks reported revenues of $7.551 billion from foreign exchange trading, which represented 87 percent of all foreign exchange trading at the bank holding company level, registering a total of $8.638 billion for the first quarter.

- Why should a federally-insured bank be engaged in trading activities? How is it even legally allowed to do that?

DEVELOPMENTS TO WATCH

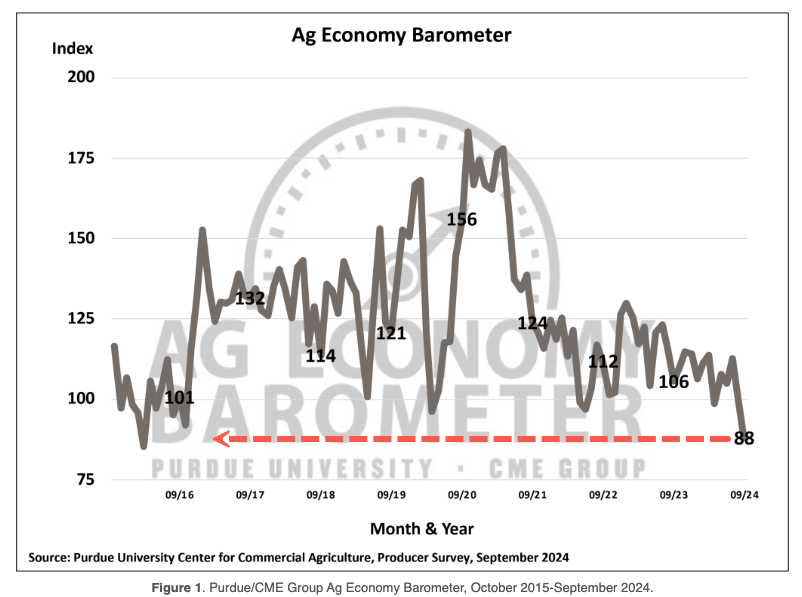

IMPLODING US FARM ECONOMICS & CONFIDENCE

IMPLODING US FARM ECONOMICS & CONFIDENCE

-

- A new reading from the Purdue University-CME Group Ag Economy Barometer Index shows sentiment across the Heartland, more specifically, on America’s farms, has tumbled to the lowest levels since 2016 as incomes pressured lower on concerns of:

-

-

- Commodity prices

- Input costs

- Future of trade after upcoming elections.

-

-

- Concerns about low commodity prices coupled with high input costs leading to poor financial performance expectations weakened farmer sentiment for the second month in a row.

- This month’s sentiment decline pushed the Ag Economy Barometer index below 100, indicating farmer sentiment is lower than during the barometer’s base period of late 2015-early 2016 when farm incomes were very weak.

- Producers expect markedly worse financial performance for their farms in the upcoming year compared to their expectations at this time last year. Weak farm income expectations combined with lingering interest rate concerns and a pessimistic agricultural export outlook helped push the Short-Term Farmland Value Expectations Index below 100 for the first time since 2020.

FOR US MEGA-BANKS IT IS 2008 ALL OVER AGAIN!

-

- All the Devils from 2008 Are Back at the Megabanks:

- Leverage

- Off-Balance-Sheet Debt

- Over $192 Trillion in Derivatives, Shaky Capital Levels.

- As of December 31, 2023, Goldman Sachs Bank USA, JPMorgan Chase Bank N.A., Citigroup’s Citibank and Bank of America held a staggering total of $168.26 trillion in derivatives out of a total of $192.46 trillion at all federally-insured U.S. banks, savings associations and trust companies.

- That’s just four banks holding 87 percent of all derivatives at all 4,587 federally-insured financial institutions in the U.S. that existed as of December 31, 2023.

- All the Devils from 2008 Are Back at the Megabanks:

GLOBAL ECONOMIC REPORTING

SEPTEMBER LABOR REPORT (NFP)

SEPTEMBER LABOR REPORT (NFP)

-

- In September the US unexpectedly added a whopping 254K jobs, the biggest monthly increase since March and above the highest estimate. In fact, the number was a 4-sigma beat to the median estimate!

- In September, the number of government workers, as tracked by the Household Survey, soared by 785K, from 21.421 million to 21.216 million, both seasonally adjusted (source: Table A8 from the jobs report). This was the biggest September surge in government workers on record (excluding the outlier print in June 2020 which was a reversal of the record plunge from the Covid collapse months before).

- While government workers soared by the most on record, private workers rose by just 133K.

- What is odd is that while September traditionally sees a huge jump in not seasonally adjusted government workers (as teachers go back to school), the BLS has traditionally smoothed over this jump using seasonal adjustments.

- Only not this time, while historically the September adjusted number has been relatively tame, regardless of how large or small the unadjusted number was, this time something changed as the unadjusted number of government workers absolutely exploded by a record 1.322 million, leading to a record September increase in adjusted government workers.

ISM SERVICES – Prices Paid

-

- ISM Prices Paid spikes to its highest since Feb 2023. Price pressures increased (59.4 vs 57.3).

- ISM Services overall saw the biggest beat since January 2023. …an 8 sigma beat!! Strong Services growth, but soaring services prices paid … not exactly 50-bps-rate-cut time!!

- You don’t cut rates by a panic 50 bps in this scenario unless you are highly concerned about something else that outweighs these obvious inflation concerns!

JOLTS REPORT

-

- The August jump in construction job openings was the biggest on record, yet new home starts is the lowest in years? Yeh right!

- The balance of the job openings surge in August came from state and local government jobs, which surged by +78,000 (the usual unverifiable plug number).

- Since more than two thirds, or 70% of the final number of job openings, is actually “made up” or are guesstimates – do you really trust these numbers?

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.