MACRO ECONOMICS

CHINA

WHAT IS FLAWED ABOUT THE CHINESE ECONOMIC MODEL?

OBSERVATIONS: ADAPTING THE “ART OF THE DEAL” TO POLITICS

April was one of the most volatile months in stock market history, thanks to the Trump administration’s botched rollout of its so-called reciprocal tariff rates. However, this tariff threat has at least succeeded in bringing other nations to the negotiating table — and now, the best way to restore calm is by letting Trump do what he does best: negotiate.

That’s a difficult pill to swallow for businesses like Amazon, which is addicted to artificially cheap imports from nations like China. Instead of pressuring Chinese vendors to cut costs or force the Chinese Communist Party (CCP) to the negotiating table, Amazon has been flirting with pressuring the Trump administration to drop the whole tariff fight altogether.

Recently, for example, officials in the company were debating whether to display a so-called “tariff cost” along with the price of items for sale. Amazon called this transparency — but nothing could be further from the truth.

For one thing, where was this “transparency” when former president Joe Biden’s four-decade-high inflation caused consumer prices to explode? Anecdotally, some products that I used to buy on the site doubled in price during Biden’s tenure. Yet Amazon never dared tell consumers what portion of these price increases was caused by Biden’s overspending.

Similarly, when Biden exploded regulatory compliance costs, (which also directly impacted consumer prices), Amazon never told consumers how much of their bill at checkout was from overregulation. Folks never saw an “inflation cost” or “regulation cost” while Biden was president.

Not only that, but where would Amazon even get the data needed to display the effect of tariffs on the cost of individual items?

This information certainly can’t come from Chinese vendors. Anyone attached to the CCP is consistently pressured to lie and publish falsified data.

Instead, finding information about (for example) the amount China exports requires finding how much every other nation is importing from China and adding those figures. Only then can one gain a better sense of whether the “official” CCP data is accurate.

Unfortunately, even such a painstaking method is imperfect, because the CCP can pressure other totalitarian states to either falsify or neglect to publish relevant data. China itself simply stopped publishing unemployment data when the figures got too ugly for the CCP’s liking.

Amazon has since backed away from the idea of displaying estimated “tariff costs” on its site. But even the discussion of such an idea speaks to how spooked markets are about potential tariffs.

If President Donald Trump is not able to make any deals before the end of the 90-day pause, the ensuing tariffs will amount to a massive tax increase on American consumers and foreign producers alike, grinding economic growth to a halt.

But Trump failing to negotiate isn’t at all a foregone conclusion. In fact, we’ve recently seen extremely positive developments with key trading partners like China, India and Japan.

In other words, there’s plenty of economic runway left, (as Treasury Secretary Scott Bessent put it recently), and Trump can still safely land this plane.

What exactly does that look like? In short, it means signing bilateral trade deals with key trading partners to both:

-

- Guarantee American consumers can still access a wide variety of affordable products from abroad and

- Ensure that American exporters can finally access foreign consumer markets.

Ironically, it’s more important that we make these trade deals with China’s key trading partners than with our own. By peeling nations like India, Japan, and Australia out of China’s sphere of influence, Trump isolates the CCP and forces them to their knees. Despite what China’s government reports may say, the country’s economy is already vulnerable and hurting — it cannot afford a drawn-out trade war.

Trump and Bessent still have economic runway to get this done and alleviate all the tariff turmoil in the coming weeks and months. If they succeed in doing so — at the same time as they seek to shepherd a massive tax cut through Congress and deregulate at breakneck speed — America will be headed to the promised Golden Age, meaning more American jobs and a lower cost of living.

If the Trump administration pulls this off, will Amazon show consumers how much their prices have decreased thanks to Trump’s success?

Let’s not hold our breath. (via The Heritage Foundation)

WHAT YOU NEED TO KNOW!

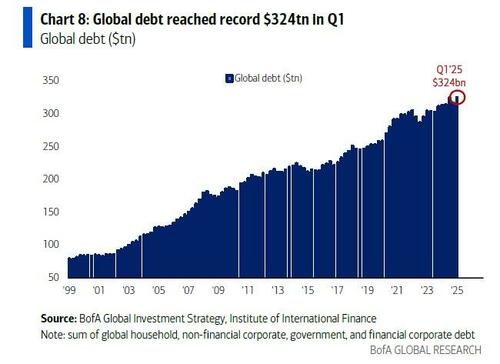

GLOBAL DEBT / GLOBAL GDP = $324T /$110T = 295%

GLOBAL DEBT / GLOBAL GDP = $324T /$110T = 295%

The renowned work of Rogoff & Reinhart suggests that when Debt surpasses 90% a country seldom (actually so far: NEVER) survives the ravages of debt destruction.

Rogoff & Reinhart’s work was for a country’s government debt on GDP. However, when we look at it globally a 295% level begs the question whether the world can actually sustain these debt levels?

Can Credit Growth secured by Unencumbered Collateral continue at these levels? Any slowing in the Wealth Effect (New “Apparent” Collateral) could bring this house of cards down very quickly through falling Fiat Currency values against Gold or a Crypto like Bitcoin!

RESEARCH – MARKET DRIVERS

1- WHAT IS FLAWED ABOUT THE CHINESE ECONOMIC MODEL?

1- WHAT IS FLAWED ABOUT THE CHINESE ECONOMIC MODEL?

-

- The Chinese manufacturing sector has followed a strategy that simply cannot subsist without an enormous trade surplus with the United States. Trump the businessman spotted this.

- Chinese manufacturing sector overcapacity is the norm and strategy. This means it must sell its excess production to avoid a massive problem of WORKING CAPITAL.

- Overcapacity in China was created by political design, with local and national authorities trying to boost GDP at any cost.

- The Chinese model is aimed at keeping full employment and economic growth, even with Economic returns below the cost of capital. It almost works if the excess capacity:

- Can be sold globally

- Receives Reserve Currency

- Maintains Low Costs by

- Passing the working capital cost to global consumers and

- Maintaining low production expenditure with currency controls and exchange rate fixing.

- China can only begin to address its enormous working capital problem through a quick and successful trade deal with the United States.

2- IS THERE SOMETHING NOW STRUCTURALLY WRONG WITH THE US DOLLAR?

-

- The easiest way to solve the US Debt burden is to pay it back in devalued dollars. Politicians ALWAYS take the easiest way! Expect a US currency devaluation before Trump’s term is over!

- If you’re holding US dollars and worried about weakening, there are a couple of options, (for educational purposes only, not financial advice):

-

-

- Diversify your currency risk: If you have significant cash, spread it across multiple currencies.

- The Swiss franc is one attractive option. It doesn’t offer much yield, but it has a strong history of holding value vs. the US dollar. Switzerland has very low government debt, which supports long-term currency strength and investor confidence.

- Buy assets: A dollar devaluation would create major tailwinds for: i) Housing, ii) Stocks, iii) Gold, iv) Bitcoin, and v) Oil prices. These hard assets tend to preserve value during currency devaluations.

-

DEVELOPMENTS TO WATCH – POLICY DRIVERS

1- SOME INTERESTING OBSERVATIONS ON CHINA

1- SOME INTERESTING OBSERVATIONS ON CHINA

-

- “China discovered that if you produce less advanced chips but use more of them, you can still produce pretty good results. You just need more power. China is long power, while the US faces a shortage in 2026-27 based on forecasts for new data center demand.”

- “If China is able to establish Huawei hardware and a Huawei operating system on an AI datacenter stack running DeepSeek or Tencent or Alibaba at the LLM level, and if it works in SE Asia and Africa and Russia and other places, they become the defacto stack.”

- “China discovered that if you produce less advanced chips but use more of them, you can still produce pretty good results. You just need more power. China is long power, while the US faces a shortage in 2026-27 based on forecasts for new data center demand.”

- “If China is able to establish Huawei hardware and a Huawei operating system on an AI datacenter stack running DeepSeek or Tencent or Alibaba at the LLM level, and if it works in SE Asia and Africa and Russia and other places, they become the defacto stack.”

- “China’s private financial markets have been replaced by the government, and they seed hundreds of companies in an industry and let them fight it out. 2-3 win. The others die. They did it in robotics, EVs, smartphones, etc. And DeepSeek may have even gotten into Xi Jinping’s head. To innovate well you need a lot of smart people throwing spaghetti at the wall. DeepSeek showed him that a breakthrough might come from some obscure hedge fund. You never know.”

2- WHEN DOES NATIONAL DEBT BECOME TOO MUCH?

-

- Studies show every 1% rise in debt-to-GDP increases bond yields by 4 basis points.

- So with today’s debt-to-GDP ratio level, it suggests that yields could be 400 basis points (or 4%) higher.

- If we apply that to today’s bond market, we could be looking at 10-year yields rising to 9%, without inflation even needing to move higher.

- That alone would obviously create extreme economic reactions and market volatility.

GLOBAL ECONOMIC REPORTING – ECONOMIC DRIVERS

CPI

CPI

-

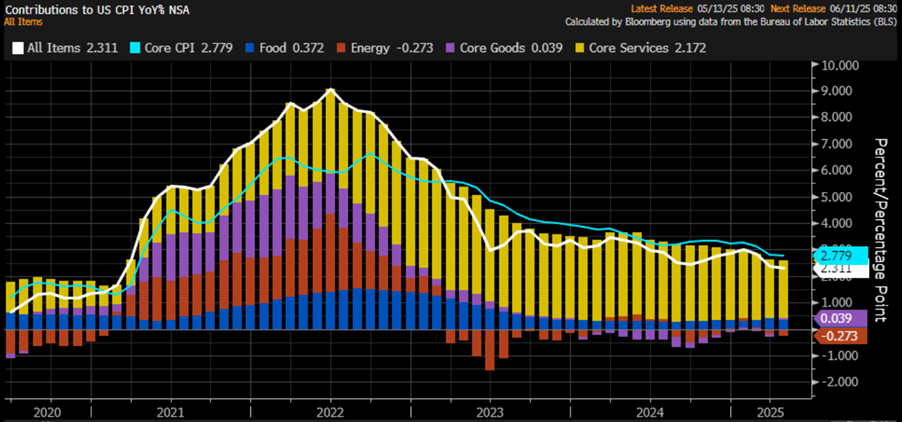

- The fourth U.S. CPI release of this Jubilee Year rolled in with a modest +0.2% month-on-month rise — below the +0.3% forecast and a bounce from March’s miraculous -0.1% dip.

- Year-on-year, inflation clocked in at +2.3%, just shy of the +2.4% expectation and a tick down from March’s +2.4%.

- Energy kept playing the deflation hero; goods stayed in their deflationary funk (just a little less gloomy); food prices took a breather, and services delivered their smallest monthly increase since the ancient times of December 2021.

- All in all, a Goldilocks report… if you squint hard enough.

PPI

-

- Following the cooler than expected CPI, US Producer Prices plunged in April, down 0.5% MoM (vs +0.2% MoM exp) – the biggest drop since April 2020.

- The headline print was dragged down to +2.4% YoY (the lowest since Sept 2024)

US WEEKLY JOBLESS CLAIMS

-

- The number of Americans filing for jobless benefits for the first time was flat from the prior week at 229k (the same level it was at in Jan 2022).

- Headline continuing claims remains below the Maginot Line of 1.9 million Americans.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.