IN-DEPTH: TRANSCRIPTION - UnderTheLens – 07-27-22 - AUGUST – Geo-Politics of the Commodity Super-Cycle

SLIDE DECK

TRANSCRIPTION

SLIDE 2

Thank you for joining me. I'm Gord Long.

A REMINDER BEFORE WE BEGIN: DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are COMMENTARY for educational and discussions purposes ONLY.

Always consult a professional financial advisor before making any investment decisions.

COVER

We haven’t talked about commodities in awhile, and with them recently correcting so significantly, I felt it important to bring our focus back to this major long-term opportunity.

SLIDE 4

As such I would like to cover the items listed here so we better understand:

- What we at MATASII.com believe is going on in commodities and

- How we presently expect the Commodity Super-Cycle to continue to unfold going forward.

SLIDE 5

We first started beating the Commodities Super-Cycle drum in 2020 with the initial video shown here that can be found on our YouTube Channel. We fully expected it to clearly show itself in 2021.

SLIDE 6

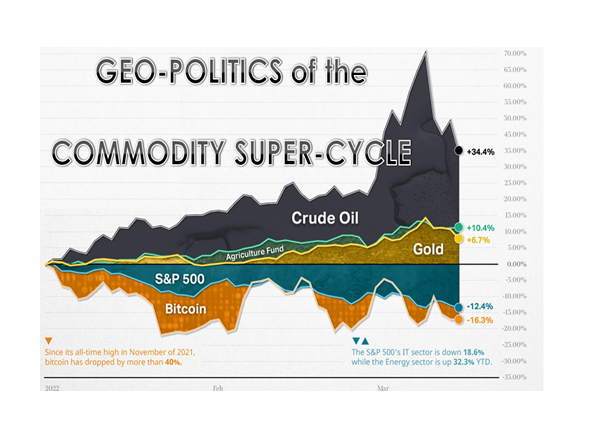

As you can see from this chart, that is exactly what did occur in a very dramatic fashion.

Frankly, it was even stronger than we felt it would initially be. Commodities overall quickly reached our initial overhead resistance zone – exploding through it before reaching our yellow overhead resistance zone.

We have been experiencing a “to be expected” consolidation since then with likely more still to come. We are expecting the consolidation to minimally test the 12 MMA shown here in red – maybe more before reversing and going higher.

We will get into the drivers behind this in a moment.

SLIDE 7

First we need to appreciate that the violent lift in Commodities we have witnessed, as well as the current Geo-Political changes we have been writing about in our newsletters, are only further confirming our belief in the Commodity Super-Cycle.

It is real and will be a dominate investment play this decade!

The current pull back should be seen as an opportunity to broaden your overall exposure to commodities in a targeted fashion. Not all areas should be expected to move together. It is a big sector!

SLIDE 8

We fully expect the Commodity Super-Cycle to mirror the developments we are anticipating in seeing with i) Inflation, ii) the US Dollar, iii) Fiat Currencies and iv) Global Growth overall.

We just recently released this schematic laying out our expectations for Inflation to unfold in three phases.

We refer you to our latest newsletter entitled “WHAT EVERYONE HAS SERIOUSLY WRONG ABOUT INFLATION!’ for further details.

SLIDE 9

Here we have overlaid our expectations for the major Commodity Super-Cycle legs. We will also go through it in a moment, but to better understand this chart we first need to understand the Global Geo-Politics currently at play to understand our expected development for the Commodity Super-Cycle.

SLIDE 10

We have talked about some of the Geo-Politics in prior videos and newsletters but I want to take a slightly different consolidating approach in this session. An approach that my colleague Charles Hugh Smith further surmised after we completed together our last Macro Analytic video entitled …..

SLIDE 11

“Tectonic Shift: Mercantilism Revalued”, where many of you will recall we discussed key changes underway.

SLIDE 12

These are structural changes that are currently having a profound impact on the global economy. I won’t revisit them here but rather how Charles restructured our thinking into another context but with the same conclusions.

I believe this will further clarify why Commodities are going to be a central driving development over the unfolding decade.

SLIDE 13

This requires a brief revisit of four distinct economic groups we discussed in the last two Macro Analytic videos.

- Colonialism

- Neo-Colonialism,

- Mercantilism and most importantly

- Importer by Choice.

SLIDE 14

You will recall that globalization initially started as Colonialism.

- Colonialism

- The colonial power expropriated commodities by force.

- The invaders took control of commodity-producing nations via military force and then oversaw the extraction of low-cost raw materials to provide the home markets with cheap materials to feed the colonial power's valued-added manufacturing.

- The manufactured goods were then sold in the captured markets of the colonial states

SLIDE 15

Then we had Neo-Colonialism where:

- The control mechanism wasn’t military force but rather became financialization and globalization.

- The Neocolonial Power basically extended cheap credit to the commodity exporting nation which gorged on this here-to-fore unavailable banquet of debt.

- Soon the state and its enterprises were creaking under unsustainable debt loads, and the Neocolonial Power swapped assets for debt, buying up the most valuable resources on the cheap or extracting the wealth via interest payments and refinancing.

SLIDE 16

Under Neo-Colonialism the West had been extracting wealth via the Neocolonial Model for decades, it suddenly had a competitor: China.

China has perfected the Neocolonial Model with its Belt and Road Initiative (BRI- which I discussed in some detail in the last video) which offered low-cost loans to commodity-producing nations which were in effect mortgages on their most valuable assets--harbors, etc.

Once the commodity-producing nation inevitably get into financial trouble, China forecloses on the loan' and takes ownership of the resources, ports, etc.

SLIDE 17

In parallel we need to consider Mercantilism.

Here we have:

- The optimization of an entire economy for exports of value-added manufactured goods.

- This is the model adopted by Germany and Japan in the early 1950s: national policies were designed to subsidize and promote exports to other nations as the primary means of achieving high rates of growth.

- The priority for U.S. foreign policy was to strengthen the war-torn free-market democracies West and East so they would not fall under Soviet control, and so the U.S. enabled these mercantilist policies to the detriment of domestic producers as one of the costs of the Cold War with the U.S.S.R

SLIDE 18

Next we have the Importer by Choice group:

- In effect, the U.S. accepted the role of importer by choice, becoming the market where the surplus production of our Cold War allies could be dumped without restriction, all for critically important geopolitical reasons.

- In the 1950s and 60s, the U.S. market was so large and the exports of the mercantilist economies so modest, this policy of being the dumping ground for allies' exports did not disrupt the domestic economy.

- Currencies play a critical role in mercantilism. As long as the US dollar (USD) was strong and the mercantilist currencies were weak, everyone benefited: the exporting nations' goods were cheap in the U.S. and soon carved out a niche in U.S. markets. Since the mercantilist economies sought to limit imports, the strong dollar was not much of a drag on their growth.

SLIDE 19

- In terms of expanding their tourist industries, the strong dollar was a rocket-booster: American tourists flocked to Europe, as the dollar went far in both Europe and Japan.

- To enable its vast industrial production, Japan became a major importer of necessity: lacking oil / natural gas and minerals / ores, Japan imported raw materials and turned these commodities into higher-value goods.

- All three dynamics changed dramatically in the 1970s and 1980s.

- The OPEC nations took control of pricing their hydrocarbon commodities at the critical point when U.S. oil production had peaked and was declining.

- This sent a shockwave of re-pricing energy through the global economy that helped generate a stagflationary decade of adjustment to higher input prices.

- At the same time, the external costs of industrialization (pollution, environmental damage) had to be priced in as well via regulations mandating higher efficiencies and the clean-up of industrialized nations' water, air and soil.

SLIDE 20

In this same juncture, the stream of allies' goods being imported into the U.S. became a flood, creating a permanently large negative balance of trade (i.e. trade deficit) and undercutting domestic manufacturers as a result of the strong dollar / weak currencies of Europe and Japan.

The permanent trade deficits were the result of 1) issuing the world's core reserve currency and 2) being the importer of choice who accepted virtually unlimited exports from allies.

This led to the political revaluation of currencies in the 1985 Plaza Accord which weakened the dollar and strengthened the currencies of Japan and the European Union (EU). Japan also agreed to limits on auto exports to the U.S., a move that led to Japanese auto manufacturers establishing assembly plants in North America.

The enormous success of Japan's mercantilist policies generated me-too Asian Tiger mercantilist economies in South Korea, Taiwan, Singapore and Hong Kong, later joined by Thailand, Indonesia, Malaysia and other nations.

The dynamics changed again with the collapse of the Soviet Union in 1991 and the emergence of China as "the workshop of the world." Just as the geopolitical reason to remain the importer by choice disappeared, the immense opportunities to boost corporate profits by offshoring production to China beckoned, eventually widening America's trade deficit to new extremes as its corporate profits soared to unprecedented heights.

As the mercantilist economy par excellence, China managed its currency with a direct, centrally-controlled currency peg to the U.S. dollar. This kept China's currency (RMB) set at levels that supported its hyper-mercantilist exports to the U.S. and other developed nations.

One often under-appreciated reason why the Soviet Union collapsed was low oil prices in the late 1980s. The Soviets' primary source of export revenues was oil and natural gas, and once the revenues fell below a critical level, the Soviet Union ceased to be financially viable.

China's fast-growing economy was soon sucking in unprecedented amounts of commodities: oil, copper, soy, etc. In other words, China became a vast importer of necessity like Japan. Even though China has large coal reserves, much of its highest-grade coal has already been depleted. Its modest oil reserves have also largely been drained.

What happens to mercantilist economies? They become importers of necessity, totally dependent on neocolonial sources of cheap commodities and import markets open enough and large enough to absorb their stupendous flood of exports.

SLIDE 21

The commodity-producing nations have finally wearied of being strip-mined by West and East, and are starting a long-delayed unified effort to take control of the resources being plundered by the developed / mercantilist economies. This is now being fueled by scarcities in commodities, scarcities fueled by many sources: depletion, supply chain disruptions, geopolitical blackmail, etc.

As financialization and globalization have reached the point of diminishing returns, they are now in the decline phase. These drivers of global growth are unraveling at the same time that commodity prices are rising in a secular trend and the global economy is entering stagflation.

These conditions are squeezing the mercantilist economies as their costs of materials rise while the markets for their exports contract. Another problem with the mercantilist strategy of depending on exports for growth is there's always a cheaper competitor on the rise. So Vietnam and other rising exporters are siphoning production from China and other mercantilist nations.

SLIDE 22

Meanwhile, back on the currency front, the U.S. dollar is gaining purchasing power at the expense of other currencies. This is adding a secondary "tax" on higher commodity prices, as the majority of commodities are priced in USD. A stronger USD moderates commodity inflation for the U.S. and exacerbates it for everyone using other currencies.

A stronger USD is also making China's currency less competitive, as it rises along with the USD due to its peg to the dollar.

The power shift is complicated: from mercantilist and importing nations to commodity exporters, and from mercantilist exporters to the issuer of the strengthening currency, the U.S. dollar.

The mercantilist dependence on exports for growth, a winner for the past 70 years, has reached diminishing returns. Rather than be a source of growth, it's a source of stagnation.

SLIDE 23

Conventional wisdom holds that geopolitical power is inevitably shifting from West to East. It isn't quite this simple. The real shift is occurring between three sources of power that are not so neatly geographic:

THREE COMPETING SPHERES

- The Consumer-Importing nations

- The Mercantilist Exporters of products

- The Commodity Exporters

The mercantilist dependence on exports for growth, a winner for the past 70 years, has reached diminishing returns. Rather than be a source of growth, it's a source of stagnation.

THE COMMODITY SUPER-CYCLE IS NOW FUNDMAENTALLY CONFIMRED!

SLIDE 24

These developments and what we have witnessed with Commodities over the last 2 years confirms to us we have a Commodity Super-Cycle that has completed Phase I of what wil be a three phase cycle dominating this decade.

SLIDE 25

Phase I has been a remarkable kick-off that frankly caught the global markets completely off guard … just as the major consolidation is currently!

SLIDE 26

The current dominate driver of Commodities is the strength of the US Dollar. This along with the Inflation driver will soon give way to the Geo-Political advancements we just outlined. These in turn will eventually give way to Global turmoil and financial re-balancing.

As such we currently expect:

- Commodities to continue to fall as the US Dollar Rises,

- Commodities to then rise as Global Scarcities steadily increase,

- Commodities to then fall as the developed commodities as represented by the G7 Fiat Currencies fall,

- Commodities then rise as export restrictions, allocations and restrictive trade blocs and agreements increase,

- And finally Commodities fall with the global economy as global growth craters and a New world Order emerges.

SLIDE 27

The reason the Dollar has moved up so sharply relative to the Euro and the Yen is very clear:

- The Fed is tightening Monetary Policy much more aggressively than the European Central Bank or the Bank of Japan.

- The ECB has been and will continue to be slower to tighten Monetary Policy than the Fed because Europe is facing a much more challenging economic environment than the US, given that Russia’s war on Ukraine has driven energy prices radically higher in Europe.

- The BOJ is reluctant to tighten Monetary Policy since Inflation in Japan remains under control at 2.5% and because Japan has been struggling against deflation for decades.

SLIDE 28

- With the interest rate being offered on Dollars already significantly

higher than that being offered on Euros and Yen – and with that

interest rate differential expected to widen much more during the

months ahead – it’s not at all surprising that the Dollar is strong and

strengthening.

- But there’s a further reason for the Dollar’s strength:

- The Fed has already begun destroying Dollars through Quantitative

Tightening, whereas the ECB is not expected to begin QT for several

more months and the BOJ is still carrying out Quantitative Easing to

keep the yield on the 10-Year JGB pegged at 25 basis points.

SLIDE 29

- This stark contrast in Monetary Policy between the Fed on the one

hand and the ECB and the BOJ on the other suggests that the Dollar

should continue to strengthen.

- If it does, it’s likely to have a profound impact on the global economy.

- Perhaps most significantly, it should put even more downward

pressure on Commodity Prices.

- It’s not a just coincidence that the price of many Commodities has

fallen sharply during recent weeks as the Dollar has strengthened.

SLIDE 30

As Dollar Strength has gained momentum in recent weeks, many

Commodities are experiencing a brutal selloff.

SLIDE 31

Though there is obviously fair bit of speculation here the unfolding Phase are likely to emerge in some fashion …

SLIDE 32

… as represented here.

SLIDE 33

In addition to putting downward pressure on Commodity Prices, a Strong Dollar tends to depress global economic growth, corporate earnings and stock market valuations, as well.

SLIDE 34

A Strong Dollar is bad for Emerging Market Economies for a number of reasons:

- First, as we’ve seen, a strong Dollar pushes Commodity Prices lower, and that inflicts significant damage on numerous countries across the developing world that are heavily reliant on Commodity production.

- Dollar appreciation also makes it more expensive for countries in the developing world to buy the US Dollars they need to service their foreign debt, making debt defaults more likely.

SLIDE 35

Emerging Market Problems Can Spread

- Next, a stronger Dollar makes imported goods more expensive, thereby adding to domestic inflationary pressure.

- And rising inflation frequently forces Emerging Market central banks to increase interest rates, resulting in higher borrowing costs which negatively impacts economic activity in those countries.

- Problems in Emerging Markets frequently spread to the advanced economies.

- For instance, weakness in Emerging Markets tends to contribute to a slowdown in world trade with damaging economic consequences for developed economies as well.

- Moreover, Emerging Market defaults on foreign loans can damage lenders in the more advanced economies, as during the Third World Debt Crisis of the early 1980s.

SLIDE 36

Bad for Corporate Earnings

- A Strong Dollar also tends to depress US corporate earnings since roughly 30% of all the earnings of the companies in the S&P 500 index are derived from abroad.

- There are two main reasons for this.

- First, a Strong Dollar makes US goods more expensive and, therefore, less competitive abroad.

- But also, US corporations earn less when their foreign revenues are exchanged into Dollars.

- In recent days, Coca-Cola, Microsoft and Saleforce have all warned of the negative effect the strong Dollar is having on their financial results.

SLIDE 37

We have outlined in our writings the mounting pressures towards global de-dollarization and the changing needs for Reserve Currencies in a Multi-Polar world order. We have also discussed the thinking of Zoltan Polzar’s “New Bretton Woods III” emerging economic order. I won’t spend time of these here but they all lead to the same conclusions about the role of Commodities going forward.

SLIDE 38

The signs couldn’t be clearer.

…. From under investment

SLIDE 39

… to long term cycles…

SLIDE 40

To shorter term cycles

SLIDE 41

We are at the early stages of a major Commodity Super-Cycle that you need to continue to recognize and prepare for.

As I said earlier it is likely not to be as we have outlined here but unfold slightly different with actual events. We believe it would be valuable to use this schematic as your starting point to better understand the unfolding roadmap ahead!

SLIDE 42

As I always remind you in these videos, remember politicians and Central Banks will print the money to solve any and all problems, until such time as no one will take the money or it is of no value.

That day is still in the future so take advantage of the opportunities as they currently exist.

Investing is always easier when you know with relative certainty how the powers to be will react. Your chances of success go up dramatically.

The powers to be are now effectively trapped by policies of fiat currencies, unsound money, political polarization and global policy paralysis.

SLIDE 43

I would like take a moment as a reminder:

DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are for educational and discussion purposes ONLY.

As negative as these comments often are, there has seldom been a better time for investing. However, it requires careful analysis and not following what have traditionally been the true and tried approaches.

Do your reading and make sure you have a knowledgeable and well informed financial advisor.

So until we talk again, may 2022 turn out to be an outstanding investment year for you and your family.

Thank you for listening.