IN-DEPTH: TRANSCRIPTION - UnderTheLens- UnderTheLens- 07-24-24 - AUGUST - The Exploding Cost of Regulations

SLIDE DECK

TRANSCRIPTION

SLIDE 2

Thank you for joining me. I'm Gord Long.

A REMINDER BEFORE WE BEGIN: DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are COMMENTARY for educational and discussions purposes ONLY.

Always consult a professional financial advisor before making any investment decisions.

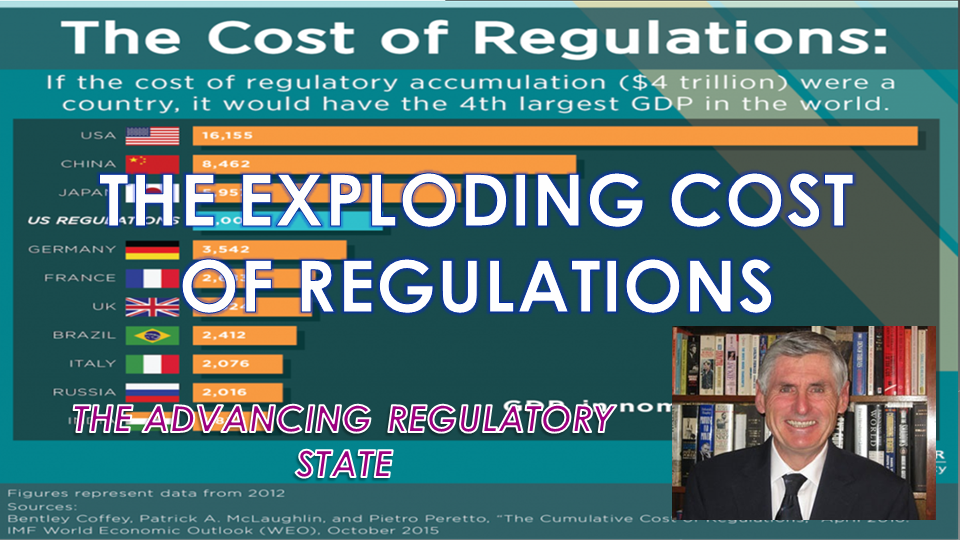

SLIDE 3 - COVER

In recovering from the Inflation ‘70’s President Ronald Reagan slashed regulations and taxes. This highly controversial approach launched the US on a trajectory of Economic Growth, Wealth creation and increasing Standards of Living.

President Donald Trump took the same approach which also began yielding quite significant improvements before Covid-19 almost completely shut down the US and global economies

SLIDE 4 – AGENDA

During the Biden administration the approach regarding increasing Regulations has become unprecedented. It is not my intent to dispute in this session any of the regulations but rather to discuss the economic impacts and costs that come with them.

Even if you fully support them, they are not free!

Too many of them can quite literally stall an economy and force increased fiscal deficit spending levels to counteract their impact.

As such I want to discuss the subjects outlined here.

SLIDE 5

Thought the mainstream media does little to even raise the awareness, economists, corporations and policy think tanks are screaming about the onslaught – an onslaught that has been steadily accelerating.

As examples:

- THE CONGRESSIONAL HOUSE COMMITTEE (In APRIL ’24 issued a report) that highlighted that Biden's Regulations were costing nearly $1.4 Trillion.

- THE NATIONAL ASSOCIATION OF MANUFACTURERS also recently issued a report highlighting:

- S. federal government regulations cost an estimated $3.079 trillion in 2022 (in 2023 dollars), an amount equal to 12% of U.S. GDP.

- $12,800 per employee per year in 2022 (in 2023 dollars).

- Small firms < 50 employees incur regulatory costs of $14,700 per employee per year – 20% greater than the cost per employee in large firms ($12,200).

- Amplified greatly in the manufacturing sector -- $50,100 versus $24,800 per employee.

- THE NATIONAL BUREAU OF ECONOMIC RESEARCH reported:

- An average firm spends 1.34 percent of its total labor costs on performing regulation-related tasks, according to the government's own

- THE CATO REASEARCH reported:

- Average US firm spends between 1.3 and 3.3 percent of its total wage bill on regulatory compliance.

- S. federal government regulations cost an estimated $3.079 trillion in 2022 (in 2023 dollars), an amount equal to 12% of U.S. GDP.

SLIDE 6

Obviously inflation. associated global supply chain re-alignments and finding skilled workers are affecting business but Federal Regulations is surging and nearly as impact full!

SLIDE 7

This year’s Thesis paper entitled: “The Regulatory State” outlined the growing size and role big government was increasing taking in our lives. The US is becoming a country of “bloated government”.

What we didn’t cover in the Thesis paper is what the regulations they are increasingly producing is costing!

SLIDE 8

The list is long but includes examples such as:

- EMISSIONS STANDARDS: These new standards are projected to cost some $870 billion and will raise prices for families already dealing with the impact of inflation.

- BENEFICIAL OWNERSHIP REPORTING: New beneficial ownership reporting requirements for businesses is expected to cost $84 billion.

- PFAS DRINKING WATER REGULATIONS are expected to cost 63.4 billion.

- TRANSPARENCY: New staffing and transparency requirements for Medicare and Medicaid ($43.1 billion).

- AUTOMOBILE REGULATIONS:A 2021 study published by Cambridge University found that auto regulations have added around $6,000 to $7,000 in costs per vehicle over the long term.

- Similarly, a Heritage Foundation report from 2016 found that President Obama’s fuel economy standards would raise prices for consumers by at least $3,800 per vehicle.

- HOUSEHOLD APPLIANCES: The Biden administration has unveiled a series of new regulations aimed at household appliances.

- An analysis by the Alliance for Consumers estimated that Biden’s new standards for washing machines will increase per-unit prices by $200 and new gas furnace efficiency standards will cost consumers $494 on average.

- Biden’s ban on certain refrigerants will increase the cost of refilling air conditioner units by $1,000 or more.

- BUREAUCRATIC RED TAPE

SLIDE 9

While the rate of growth of Private Sector job creation falls after the initial rebound from Covid, Government job growth rate is steadily rising.

SLIDE 10

Not only are new Government jobs on the rise but wages and benefits such as pension plans for them are growing much faster than the public sector.

If you aren’t living off the government transfer payments then you are better off working for them –whether at the Federal, State or Local level.

SLIDE 11

.. and it appears we are only at the beginning of what may be ahead of us?

SLIDE 12

What all these people do is create, administer and police compliance to

- Regulations,

- Rules,

- Laws,

- Policies,

- Standards

SLIDE 13

What we are witnessing is exploding bureaucratic overreach!

SLIDE 14

I encourage you to read the latest report put out by the Competitive Enterprise Institute.

It is 143 pages of facts on the growth of new regulations, rules and requirements.

It is well labeled as the “10 Thousand Commandments”!

SLIDE 15

The report details annual costs of just under $2 Trillion dollars in 2023 being spent on regulations and government intervention.

It includes:

- Economic Regulations ~400B

- Tax Compliance $316B

- Environment ~400B

- And a raft of other areas

SLIDE 16

- During calendar year 2022, while agencies issued 3168 rules, Congress enacted 247 laws. Thus, agencies issued 13 rules for every law enacted by Congress.

- The “Unconstitutionality Index”—the ratio of regulations issued by agencies to laws passed by Congress and signed by the president—highlights the entrenched delegation of lawmaking power to unelected agency officials. The average ratio over the past 10 years is 22 rules for every law

- Since January 2021 the Biden Administration finalized 923 federal rules costing $1.6T.

- The Biden Administration finalized regulations imposing costs of over $1 trillion in just the last few months as agencies rush to protect their regulatory actions from possible rollback measures in the event that Biden loses the 2024 election.

SLIDE 17

- Biden issued just 29 executive orders in 2022, after issuing 77 in 2021. This reduction reflects a change in strategy, rather than a more modest view of executive power.

- Biden’s "Memoranda" continue to outstrip recent predecessors; these typically escape formal review.

- U.S. households pay $14,514 annually on average in a hidden regulatory tax. This amount exceeds every item in the household budget except housing. A typical American household spends more on embedded regulation than on health care, food, transportation, entertainment, apparel, services, or savings.

- When regulatory costs are combined with federal outlays of $6.27 trillion, the federal government’s share of the entire economy reaches 31.4 percent. State and local spending and regulation would add to these costs.

SLIDE 18

- The Congressional Budget Office’s February 15, 2023 Budget and Economic Outlook, covering fiscal year 2022 and projections for 2023 to 2033, showed discretionary, entitlement and interest spending of $6.272 trillion in fiscal year 2022, with spending projected to top $7 trillion in 2026 and hit nearly $10 trillion by 2033. Unprecedented open-ended deficits now standing at $1.4 trillion annually are expected to top $2 trillion annually by 2030. The national debt now tops $34 trillion, up from almost $20 trillion since 2017.

- Of 99,429 final rules issued since the Congressional Review Act passed in 1996 during the Clinton administration, just 20 rules have been revoked, including one guidance document.

- Economically, significant regulations are a special category of significant regulations. These rules each have at least $100 million of economic impact. The Biden administration’s spring and fall 2022 editions of the Unified Agenda contained a combined 89, (compared with 105 in 2021), completed economically significant rules. Even taking the dip into account, Biden’s count of completed economically significant rules is higher than anything seen in the Bush, Obama and Trump years.

SLIDE 19

We see a massive amount of growth in bureaucratic overreach what about the actual costs of the regulations?

SLIDE 20

According to the House Budget Committee report on April 24th, 2024

and I quote:

"Biden’s burdensome regulations along with his tax hikes and unbridled spending are fueling the cost of living crisis under which working Americans are suffering."

SLIDE 21

.. again I quote:

“President Biden is on track to impose more regulatory cost on our economy than any President in history, adding $1.4 trillion since coming to office. This is a staggering 45 times the regulatory costs accumulated under President Trump and almost five times the regulatory costs added under President Obama."

SLIDE 22

I further quote the committee:

"Cutting Washington’s wasteful spending and reducing taxes and regulations will spur economic growth and reduce our unsustainable deficits.”

- The most costly of President Biden’s regulations was the Environmental Protection Agency's (EPA) tailpipe vehicle emissions rule, which came in at $870 billion just by itself.

- President Biden increased his regulatory burden by $875.3 billion in just one week. That nearly matches the $890 billion total of President Obama’s regulations during his entire presidency.

- The average cost of one of Biden’s regulations is over $1.5 billion. In comparison, the regulations under Obama averaged $250 million.

SLIDE 23

A concerned National Association of Manufacturers recently put out a major report entitled The Cost of Federal Regulation to the U.S. Economy

They outline how

- S. federal government regulations cost an estimated $3.079 trillion in 2022 (in 2023 dollars), an amount equal to 12% of U.S. GDP.

- This is significantly larger than government accounting.

- These costs fall unevenly on the major sectors of the economy and on firms of different size.

SLIDE 24

- The findings indicate that compliance costs fall disproportionately on small businesses.

- Federal regulations cost an estimated $12,800 per employee per year in 2022 (in 2023 dollars).

- Small firms with fewer than 50 employees incur regulatory costs of $14,700 per employee per year – 20% greater than the cost per employee in large firms ($12,200).

SLIDE 25

- The regulatory cost disadvantage confronting small firms is amplified greatly in the manufacturing sector, with small manufacturing firms bearing more than double the cost of large manufacturing firms, or $50,100 versus $24,800 per employee.

- Overall, small manufacturers incur regulatory costs that are more than three times the costs borne by the average U.S. Company. Medium and large manufacturers in the United States face regulatory costs that are double the costs borne by the average U.S. firm.

SLIDE 26

Separate research from the Cato Institute and House Budget Committee point others costs that are being overlooked but increasingly are becoming costly.

SLIDE 27

Because of the complexity, vagrancies and sheer number of rules and regulation more companies have to hire outside specialists and contractors to ensure compliance. This is killing smaller companies who can ill afford these costs.

I have chronicled in my weekly newsletter the direct feedback I have personally received from frustrated small business owners, having worked a 12 hour day going home to spend time at night reviewing mandated government education videos. Videos on subjects that they feel the government have no business requesting of them or their employees regarding reporting on the activities of THEIR clients or customers. As one angrily told me “I am not the police, have no proof and could get sued by my client if I did what the government was asking” – however they are told they must comply with.

SLIDE 28

The House Budget Committee points out that Regulatory expenses can range from the cost of hiring compliance officers, investing in compliance software, and training staff to the financial penalties incurred for non-compliance.

The CATO Research points out that:

- Data on occupational tasks and firms’ wage spending finds that the average US firm spends between 1.3 and 3.3 percent of its total wage bill on regulatory compliance.

- 9 percent of compliance costs in the US financial sector are labor-related and 3.3 percent are equipment-related.

- Survey estimates in 2014 that 68.4 percent of compliance costs in the US manufacturing sector are labor-related and 13.4 percent equipment-related.

SLIDE 29

- An average firm spends 3.33 percent of its total labor costs on performing regulation-related tasks per year. Using our most conservative measure, the average is 1.34 percent. Our research shows that regulatory compliance costs of US businesses have grown by about 1 percent each year from 2002 to 2014 in real terms.

- The inclusion of firms’ equipment expenditure related to compliance increases compliance costs by about 20 percent.The total wage bill devoted to regulatory compliance workers in 2014 was between $79 billion and $239 billion, depending on the stringency of the regulatory compliance measure, and up to $289 billion when equipment is included.

SLIDE 30

What legislators and the Regulatory State must fully understand that excess or poorly constructed regulations can negatively impact a country’s competitive advantage.

The appropriate goal of regulation is to enhance, not undermine, societal well-being. In other words, regulation should do more good than harm. Without a counterfactual, it is impossible to know what a more disciplined regulatory environment would have meant for economic growth and well-being. However, evidence suggests that a smarter regulatory approach targeted at problems that cannot be solved by other means could have enormous benefits for current and future generations.

SLIDE 31

Regulations can obviously create barriers to entry, which can reduce competition and increase prices for consumers.

These barriers can include:

- Startup costs,

- Licensing procedures,

- Regulatory compliance,

- Expensive education, testing, and fees

Regulations can also create other challenges for companies, including:

- Timeliness: Regulations can change quickly, and companies may not be aware when new regulations come into effect.

- Cost: Companies may incur significant costs when monitoring legislative changes.

- Data: It can be burdensome for companies to stay up-to-date with the changes.

SLIDE 32

- Though difficult to measure, it is widely recognized that the quality and extent of government regulation is “a major determinant of prosperity.” The World Bank conducts annual Doing Business surveys measuring government policies and the ease of doing business in different countries. Over the last decade, the U.S. has dropped from #4 to #8 on the World Bank’s list.

- The World Bank finds that the highest ranked countries in its survey regulate, but “they do so in less costly and burdensome ways, and they focus their efforts more on protecting property rights than governments in other countries.” It observes, “a thriving private sector—with new firms entering the market, creating jobs and developing innovative products—contributes to a more prosperous society,” “promotes growth and expands opportunities for poor people.”

- Empirical studies of deregulated industries in the U.S. demonstrate the impact of regulation on innovation; they consistently find that deregulation enables greater innovation and larger price reductions than economists predicted based on pre-deregulation costs and market conditions.

- A few studies have attempted to quantify the effect of regulation on economic growth, productivity, and innovation. For example, in a classic analysis from the 1980s, Jorgensen & Wilcoxen simulate the long-term growth of the U.S. economy with and without environmental regulation and conclude that “the cost of environmental regulation is a long run reduction of 2.59 percent in the level of the U.S. gross national product.”

SLIDE 33

The Supreme Court recently overturned a 40 year precedent. In a case brought by New England fishermen, the court reversed what’s been know as Chevron Deference.

SLIDE 34

In the 1984 case, the courts said judges should generally defer to federal agencies when rules they make are reasonable, and the enabling law was ambiguous. It was a unit of the Commerce Department, which forced the fishermen to pay the salaries and costs of having a federal overseer aboard their fishing boats that initiated the case being taken to the US Supreme Court (SCOTUS).

- This case is important in both administrative law and constitutional law.

- This is a sea change for what courts do when they’re reviewing agency actions, in this case enforcement actions.

- The Supreme Court said, it’s really getting back to what courts have always done and should do, and that is to interpret the law, and not leave that to administrative agencies.

- It’s going to wind up in more enforcement action being reversed by federal courts.

- The EPA lost in court a few years ago, on whether it actually has the statutory authority to regulate carbon and carbon dioxide, even though it seemed natural. But it wasn’t really in the law.

- Same thing for the FDA to try to ban tobacco, or cigarettes and so forth.

- They can regulate it, but they can’t ban it.

- The Supreme Court is affecting the balance in two ways:

- One, it’s between agencies and the courts.

- And the other, like the EPA case, is between agencies and the Congress.

- If the law that the Congress has passed is clear, then agencies take action based on that. But if you find that it’s unclear, the Chevron two step doctrine kicks in.

SLIDE 35

“It's going to be much, much harder for federal agencies to invoke major, incredibly complex regulations that are clearly outside the original intent and scope of the governing statute.”

“This ruling is long overdue. To allow agencies to pick the pocket of the regulated without congressional authorization is against all the principles of representative government and our constitutional structure.”

“Chevron encourages agencies — not neutral and impartial judges — to interpret the law, and sometimes those agencies are afflicted with institutional self interest."

"It’s a huge step for self-government and dethrones federal agencies.”

“This is a welcome decision by the Court. It amounts to the Justices telling the rest of the government: do your job and stay in your lane.”

SLIDE 36

Hopefully what we will see going forward is regulations that truly:

- Respect market forces and the beneficial effects of competition.

- Do more good than harm.

- Base decisions on the best available information and transparency.

- Gather better feedback.

- Encourage experimentation and learning.

- Regulatory humility.

- Address regulatory accumulation.

SLIDE 37

So what can we conclude?

SLIDE 38

Though the Chevron Deference Ruling is extremely positive and gives us hope the realty is Regulations will increase as government grows and there appears no sign of that happening

Unfortunately, until I see clear evidence to the contrary I see the Macroprudential policies of Financial Repression being slowly expanded in the form of Regulatory Repression!

SLIDE 39

Will we choose reduced regulations or increasing Regulatory Repression??

In this election year we need to be reminded that elections have consequences

SLIDE 40

As I always remind you in these videos, remember politicians and Central Banks will print the money to solve any and all problems, until such time as no one will take the money or it is of no value.

That day is still in the future so take advantage of the opportunities as they currently exist.

Investing is always easier when you know with relative certainty how the powers to be will react. Your chances of success go up dramatically.

The powers to be are now effectively trapped by policies of fiat currencies, unsound money, political polarization and global policy paralysis.

SLIDE 41

I would like take a moment as a reminder

DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are for educational and discussions purposes ONLY.

As negative as these comments often are, there has seldom been a better time for investing. However, it requires careful analysis and not following what have traditionally been the true and tried approaches.

Do your reading and make sure you have a knowledgeable and well informed financial advisor.

So until we talk again, may 2024 turn out to be an outstanding investment year for you and your family?

I sincerely thank you for listening!