FOCUS

STAGFLATION

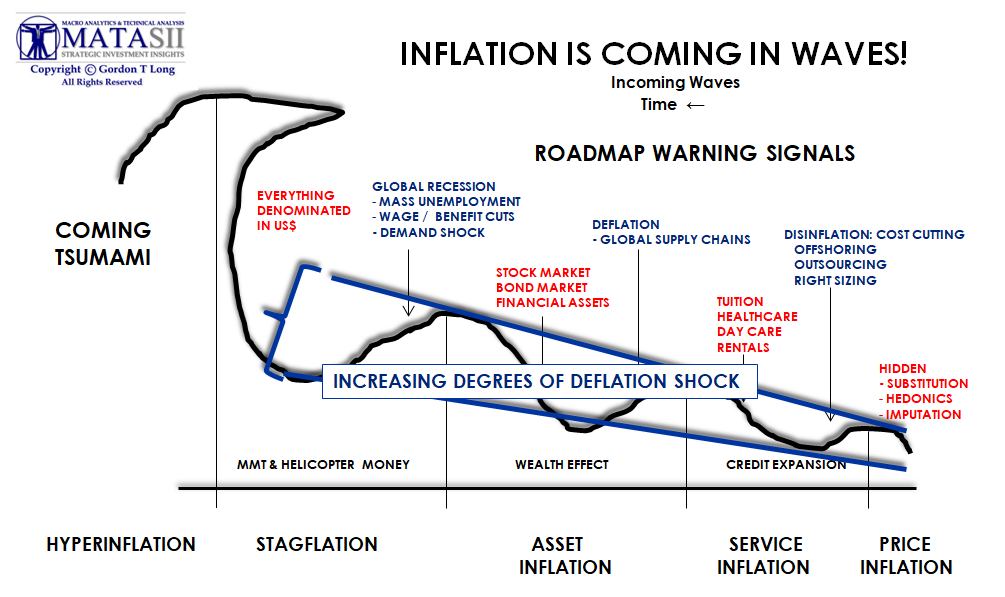

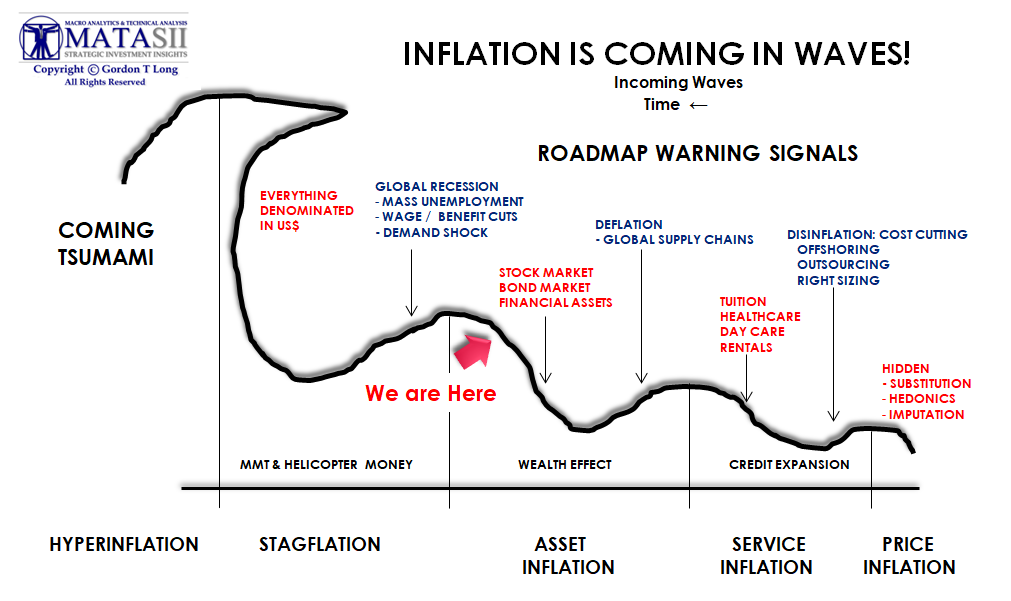

INFLATION IS QUIETLY & RELENTLESSLY COMING IN DIFFERING WAVES

If the Treasury borrows $2,163 during the second half, that would amount to an average of $360 billion per month. The Fed, however, has led the market to believe that it will create “only” $120 billion per month, which would amount to $720 billion during the second half.

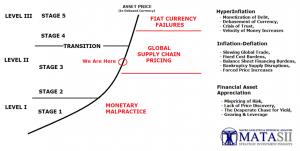

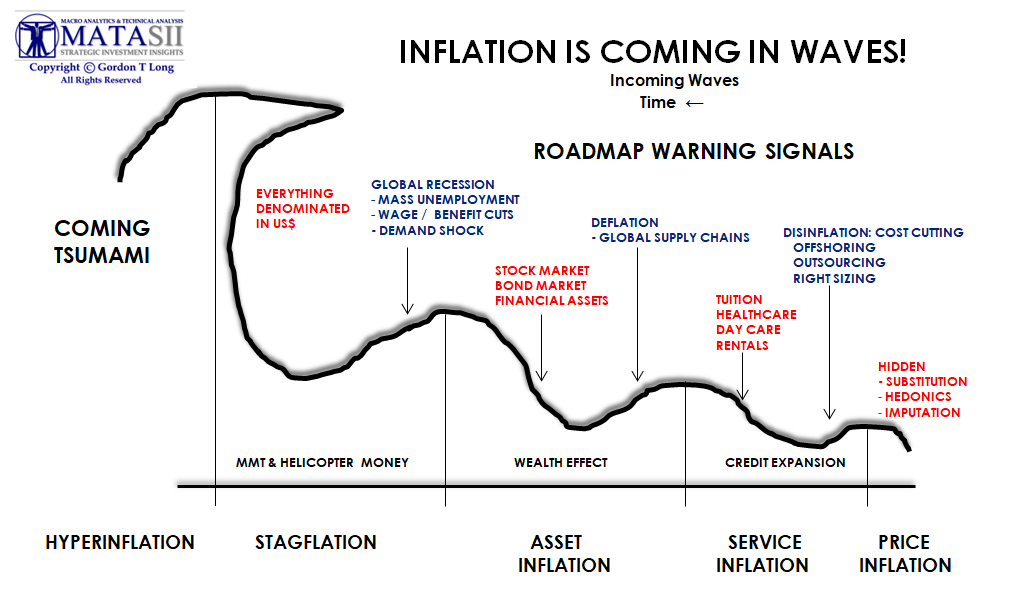

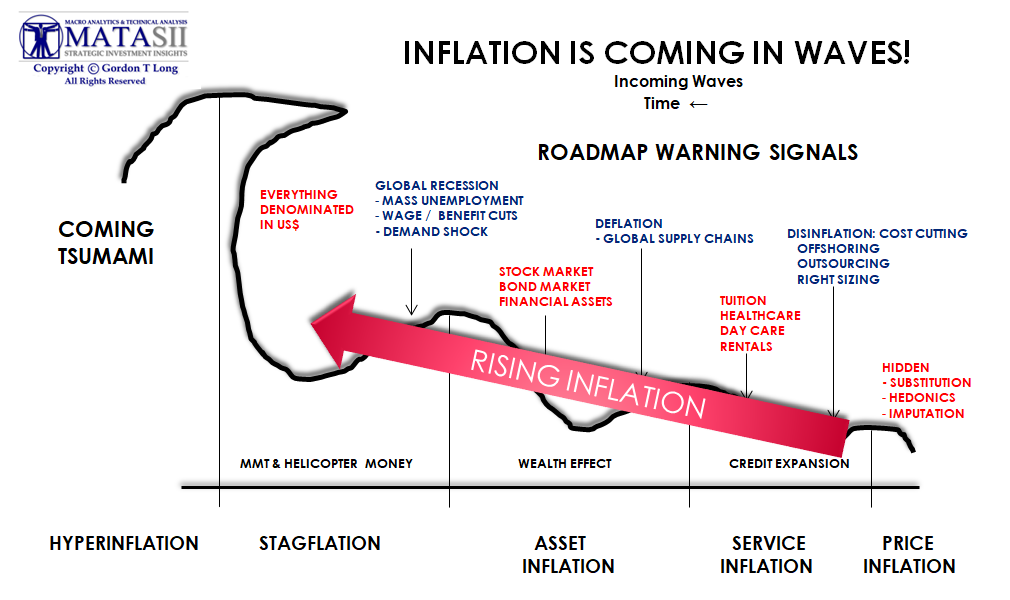

Due to Monetary & Fiscal Policy intended to offset lack of economic growth and forestall the impacts of business cycle impacts on an over-leveraged and over indebted financial system, the Central banks have been trapped into ever increasing inflationary waves.These waves are bringing inflation to an ever broadening global economic constituency.

-

- Price Inflation,

- Services Inflation,

- Asset Inflation,

- Stagflation,

- Hyperinflation.

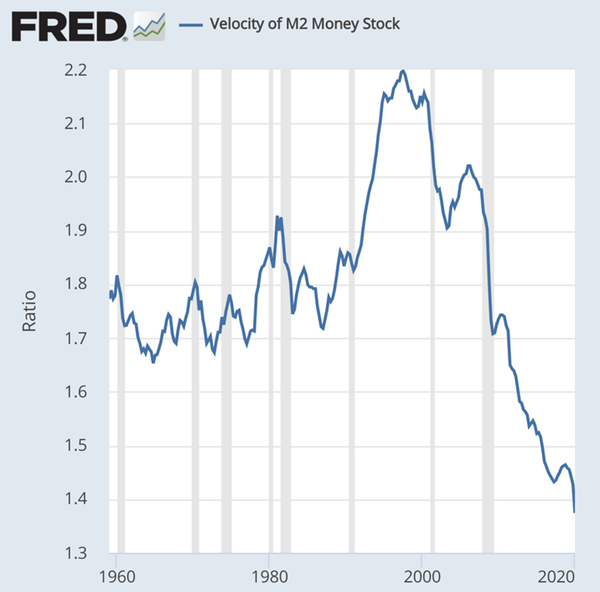

The We should expect that by YE 2020 to see the Velocity of Money to normalize back to rates slightly higher than we are currently experiences due in large part to massive stimulus “floating” out in the global economy.

-

- This projection is primarily based on expectations of a normalization of the Velocity of Money.

- Velocity in the US is probably at around 0.8 right now. The lowest recorded number before that was 1.4 in December 2019, which was at the end of a multi-year downward trend.

- Quantitative easing was an important factor in that shrinking velocity, because central banks handed money to savings institutions in return for their Treasury securities. And all the savings institutions could do was buy financial assets.

- They couldn’t buy goods and services, so that money couldn’t really affect nominal GDP.

-

- For the last three decades, China was a major source of deflation.

- We are at the beginning of a new Cold War with China, which will mean higher prices for many things.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.