-

July 26, 2024

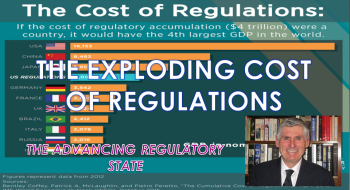

Under The Lens: AUGUST 2024 PPV Promo

Under The Lens August 2024PAY-PER-VIEW $4.99Watch Preview below (5min): FULL Content 25min Gordon T Long Macro Research PROFESSIONAL MARKET ANALYSIS Under The Lens Aug 2024 The Exploding Cost of Regulations PREVIEW: Under The Lens August 2024 The Exploding Costs of Regulations ANALYSIS INCLUDES FULL 25min Under The Lens Video:The Exploding Costs of Regulations PLEASE READ: PURCHASING […]

Under The Lens August 2024PAY-PER-VIEW $4.99Watch Preview below (5min): FULL Content 25min Gordon T Long Macro Research PROFESSIONAL MARKET ANALYSIS Under The Lens Aug 2024 The Exploding Cost of Regulations PREVIEW: Under The Lens August 2024 The Exploding Costs of Regulations ANALYSIS INCLUDES FULL 25min Under The Lens Video:The Exploding Costs of Regulations PLEASE READ: PURCHASING […] -

July 24, 2024

IN-DEPTH: TRANSCRIPTION – LONGWave – 07-10-24 – JULY – An Inflationary Depression

IN-DEPTH: TRANSCRIPTION - LONGWave - 07-10-24 - JULY – An Inflationary Depression SLIDE DECK Download Slide Deck TRANSCRIPTION SLIDE 2 Thank you for joining me. I'm Gord Long. A REMINDER BEFORE WE BEGIN: DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are COMMENTARY for educational and discussions purposes ONLY. Always consult a […]

IN-DEPTH: TRANSCRIPTION - LONGWave - 07-10-24 - JULY – An Inflationary Depression SLIDE DECK Download Slide Deck TRANSCRIPTION SLIDE 2 Thank you for joining me. I'm Gord Long. A REMINDER BEFORE WE BEGIN: DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are COMMENTARY for educational and discussions purposes ONLY. Always consult a […] -

July 22, 2024

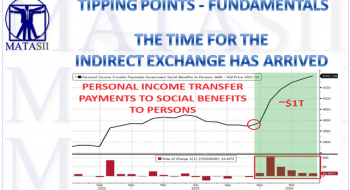

THE TIME FOR THE INDIRECT EXCHANGE HAS ARRIVED

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINT FUNDAMENTALS THE TIME FOR THE INDIRECT EXCHANGE HAS ARRIVED OBSERVATIONS: NEXT UP - PROPERTY TAX INFLATION Small Businesses predominately fail because of Cash Flow problems. They don't fail due to a bad business plan, bad strategy, bad product - they fail because unexpected […]

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINT FUNDAMENTALS THE TIME FOR THE INDIRECT EXCHANGE HAS ARRIVED OBSERVATIONS: NEXT UP - PROPERTY TAX INFLATION Small Businesses predominately fail because of Cash Flow problems. They don't fail due to a bad business plan, bad strategy, bad product - they fail because unexpected […] -

July 15, 2024

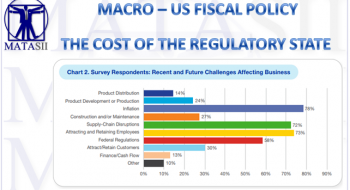

THE COST OF THE REGULATORY STATE

Gordon T Long Global Macro Research | Macro-Technical Analysis MACRO US ECONOMICS - FISCAL POLICY THE COST OF THE REGULATORY STATE OBSERVATIONS: RIGHT DIRECTION, WRONG STRATEGY, TERRIBLE IMPLEMENTATION Let me make it perfectly clear that I am a strong believer in Sustainability and Safe Guarding the environment. I believe it is the morally right […]

Gordon T Long Global Macro Research | Macro-Technical Analysis MACRO US ECONOMICS - FISCAL POLICY THE COST OF THE REGULATORY STATE OBSERVATIONS: RIGHT DIRECTION, WRONG STRATEGY, TERRIBLE IMPLEMENTATION Let me make it perfectly clear that I am a strong believer in Sustainability and Safe Guarding the environment. I believe it is the morally right […] -

July 12, 2024

LongWave JULY 2024 PPV Promo

LONGWave JULY 2024PAY-PER-VIEW $4.99Watch Preview below (4min): FULL Content 29min Gordon T Long Macro Research PROFESSIONAL MARKET ANALYSIS LONGWave JULY 2024 An Inflationary Depression? PREVIEW: LONGWave July 2024 An Iflationary Depression? ANALYSIS INCLUDES FULL 29min LONGWave video:An Inflationary Depression? PLEASE READ: PURCHASING ACCESS ACKNOWLEDGES YOU HAVE READ, UNDERSTOOD, AND AGREE TO THE DISCLAIMER, TERMS OF USE […]

LONGWave JULY 2024PAY-PER-VIEW $4.99Watch Preview below (4min): FULL Content 29min Gordon T Long Macro Research PROFESSIONAL MARKET ANALYSIS LONGWave JULY 2024 An Inflationary Depression? PREVIEW: LONGWave July 2024 An Iflationary Depression? ANALYSIS INCLUDES FULL 29min LONGWave video:An Inflationary Depression? PLEASE READ: PURCHASING ACCESS ACKNOWLEDGES YOU HAVE READ, UNDERSTOOD, AND AGREE TO THE DISCLAIMER, TERMS OF USE […] -

July 10, 2024

IN-DEPTH: TRANSCRIPTION – UnderTheLens – 06-24-24 – JULY – The US Inflationary Black Hole

IN-DEPTH: TRANSCRIPTION - UnderTheLens - 06-24-24 - JULY - The US Inflationary Black Hole SLIDE DECK Download Slide Deck TRANSCRIPTION SLIDE 2 Thank you for joining me. I'm Gord Long. A REMINDER BEFORE WE BEGIN: DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are COMMENTARY for educational and discussions purposes ONLY. Always […]

IN-DEPTH: TRANSCRIPTION - UnderTheLens - 06-24-24 - JULY - The US Inflationary Black Hole SLIDE DECK Download Slide Deck TRANSCRIPTION SLIDE 2 Thank you for joining me. I'm Gord Long. A REMINDER BEFORE WE BEGIN: DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are COMMENTARY for educational and discussions purposes ONLY. Always […] -

July 1, 2024

IS AN INFLATIONARY DEPRESSION POSSIBLE?

Gordon T Long Global Macro Research | Macro-Technical Analysis MACRO US ECONOMICS - MONETARY POLICY IS AN INFLATIONARY DEPRESSION EVEN POSSIBLE? OBSERVATIONS: IS AN INFLATIONARY DEPRESSION POSSIBLE? Two weeks ago I described in this column what I recently witnessed at our major Town Meeting to address a $6.5 Million dollar town budget deficit. As I think […]

Gordon T Long Global Macro Research | Macro-Technical Analysis MACRO US ECONOMICS - MONETARY POLICY IS AN INFLATIONARY DEPRESSION EVEN POSSIBLE? OBSERVATIONS: IS AN INFLATIONARY DEPRESSION POSSIBLE? Two weeks ago I described in this column what I recently witnessed at our major Town Meeting to address a $6.5 Million dollar town budget deficit. As I think […] -

June 28, 2024

Under The Lens: JULY 2024 PPV Promo

Under The Lens July 2024PAY-PER-VIEW $4.99Watch Preview below (5min): FULL Content 26min Gordon T Long Macro Research PROFESSIONAL MARKET ANALYSIS Under The Lens July 2024 The US Inflationary - Stagflationary Black Hole PREVIEW: Under The Lens July 2024 The US Inflationary - Stagflationary Black Hole ANALYSIS INCLUDES FULL 26min Under The Lens Video:The US Inflationary - […]

Under The Lens July 2024PAY-PER-VIEW $4.99Watch Preview below (5min): FULL Content 26min Gordon T Long Macro Research PROFESSIONAL MARKET ANALYSIS Under The Lens July 2024 The US Inflationary - Stagflationary Black Hole PREVIEW: Under The Lens July 2024 The US Inflationary - Stagflationary Black Hole ANALYSIS INCLUDES FULL 26min Under The Lens Video:The US Inflationary - […] -

June 26, 2024

IN-DEPTH: TRANSCRIPTION – LONGWave – 06-12-24 – JUNE – The Great Debt for Equity Swap

IN-DEPTH: TRANSCRIPTION - LONGWave - 06-12-24 - JUNE - The Great Debt for Equity Swap SLIDE DECK Download Slide Deck TRANSCRIPTION SLIDE 2 Thank you for joining me. I'm Gord Long. A REMINDER BEFORE WE BEGIN: DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are COMMENTARY for educational and discussions purposes ONLY. […]

IN-DEPTH: TRANSCRIPTION - LONGWave - 06-12-24 - JUNE - The Great Debt for Equity Swap SLIDE DECK Download Slide Deck TRANSCRIPTION SLIDE 2 Thank you for joining me. I'm Gord Long. A REMINDER BEFORE WE BEGIN: DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are COMMENTARY for educational and discussions purposes ONLY. […] -

June 24, 2024

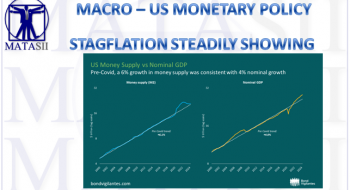

STAGFLATION STEADILY SHOWING

Gordon T Long Global Macro Research | Macro-Technical Analysis MACRO US ECONOMICS - MONETARY POLICY STAGFLATION STEADILY SHOWING OBSERVATIONS: "THERE IS TOO MUCH MONTH LEFT AT THE END OF THE MONEY!" I am witnessing young Americans increasingly dissatisfied! For them, like the elderly, the recent surge in prices for goods and services of everything […]

Gordon T Long Global Macro Research | Macro-Technical Analysis MACRO US ECONOMICS - MONETARY POLICY STAGFLATION STEADILY SHOWING OBSERVATIONS: "THERE IS TOO MUCH MONTH LEFT AT THE END OF THE MONEY!" I am witnessing young Americans increasingly dissatisfied! For them, like the elderly, the recent surge in prices for goods and services of everything […] -

June 17, 2024

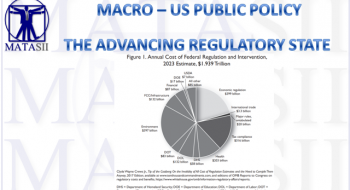

THE ADVANCING REGULATORY STATE

Gordon T Long Global Macro Research | Macro-Technical Analysis MACRO US ECONOMICS - PUBLIC POLICY THE ADVANCING REGULATORY STATE OBSERVATIONS: BIDEN'S POLL NUMBER ADJUSTED DOWN FOR INFLATION LIKE YOUR PAY CHECK! When President Joe Biden was told by an interviewer that food prices are up 30 percent in four years, he completely dismissed it, countering […]

Gordon T Long Global Macro Research | Macro-Technical Analysis MACRO US ECONOMICS - PUBLIC POLICY THE ADVANCING REGULATORY STATE OBSERVATIONS: BIDEN'S POLL NUMBER ADJUSTED DOWN FOR INFLATION LIKE YOUR PAY CHECK! When President Joe Biden was told by an interviewer that food prices are up 30 percent in four years, he completely dismissed it, countering […] -

June 14, 2024

LongWave JUNE 2024 PPV Promo

LONGWave JUNE 2024PAY-PER-VIEW $4.99Watch Preview below (4min): FULL Content 18min Gordon T Long Macro Research PROFESSIONAL MARKET ANALYSIS LONGWave JUNE 2024 The Great Debt for Equity Swap PREVIEW: LONGWave June 2024 The Great Debt for Equity Swap ANALYSIS INCLUDES FULL 18min LONGWave video:The Great Debt for Equity Swap PLEASE READ: PURCHASING ACCESS ACKNOWLEDGES YOU HAVE READ, […]

LONGWave JUNE 2024PAY-PER-VIEW $4.99Watch Preview below (4min): FULL Content 18min Gordon T Long Macro Research PROFESSIONAL MARKET ANALYSIS LONGWave JUNE 2024 The Great Debt for Equity Swap PREVIEW: LONGWave June 2024 The Great Debt for Equity Swap ANALYSIS INCLUDES FULL 18min LONGWave video:The Great Debt for Equity Swap PLEASE READ: PURCHASING ACCESS ACKNOWLEDGES YOU HAVE READ, […] -

June 10, 2024

WARNING SIGNALS WORSEN WHILE FEW PAY ATTENTION!

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS US ECONOMICS - RECESSION WARNING SIGNALS WORSEN WHILE FEW PAY ATTENTION! OBSERVATIONS: WHY DON'T WE JUST DEFAULT ON THE US DEBT? As irresponsible as it sounds, in a number of recent conversations the question of "Why don't we just default on the US Debt?" was […]

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS US ECONOMICS - RECESSION WARNING SIGNALS WORSEN WHILE FEW PAY ATTENTION! OBSERVATIONS: WHY DON'T WE JUST DEFAULT ON THE US DEBT? As irresponsible as it sounds, in a number of recent conversations the question of "Why don't we just default on the US Debt?" was […] -

June 5, 2024

MACRO ANALYTICS – 05 30 24 – JUNE – Financial Nihilism, Inflation & The Collapsing American Dream

VIDEO: 42 Minutes with 46 Supporting Slides NIHILISM, INFLATION & THE COLLAPSING AMERICAN DREAM KEY MESSAGE Surviving & Prospering for the 2020's will require Self Reliance built on: Communication Skills Common Sense, Problem-Solving Attitude, Resilience, and Adaptability TENETS OF SELF-RELIANCE THAT PAY OFF IN ERAS IF RPAID CHANGE Own your skills, experience and work: each […]

VIDEO: 42 Minutes with 46 Supporting Slides NIHILISM, INFLATION & THE COLLAPSING AMERICAN DREAM KEY MESSAGE Surviving & Prospering for the 2020's will require Self Reliance built on: Communication Skills Common Sense, Problem-Solving Attitude, Resilience, and Adaptability TENETS OF SELF-RELIANCE THAT PAY OFF IN ERAS IF RPAID CHANGE Own your skills, experience and work: each […] -

June 5, 2024

IN-DEPTH: TRANSCRIPTION – UnderTheLens – JUNE – 05-22-24 – Election Economics by the Unelected, Indentured Triumvirate

IN-DEPTH: TRANSCRIPTION - UnderTheLens - JUNE - 05-22-24 - Election Economics by the Unelected, Indentured Triumvirate SLIDE DECK Download Slide Deck TRANSCRIPTION SLIDE 2 Thank you for joining me. I'm Gord Long. A REMINDER BEFORE WE BEGIN: DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are COMMENTARY for educational and discussions purposes […]

IN-DEPTH: TRANSCRIPTION - UnderTheLens - JUNE - 05-22-24 - Election Economics by the Unelected, Indentured Triumvirate SLIDE DECK Download Slide Deck TRANSCRIPTION SLIDE 2 Thank you for joining me. I'm Gord Long. A REMINDER BEFORE WE BEGIN: DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are COMMENTARY for educational and discussions purposes […]

NEXT PAGE & Previous 15 Public Posts

MATASII Subscription Options

Full Site Access (all sections)

SUBSCRIBE

FULL SITE ACCESS

$55/monthly

SUBSCRIBE

FULL SITE ACCESS

$550/yearly

Gordon T Long Macro Research (only)

SUBSCRIBE

GTL MATA

$35/monthly

SUBSCRIBE

GTL MATA

$350/yearly

SII – Strategic Investment Insights (only)

SUBSCRIBE

SII

$35/monthly

SUBSCRIBE

SII

$350/yearly

TRIGGER$ HPTZ Technical Analysis (only)

SUBSCRIBE

TRIGGER$

$35/monthly

SUBSCRIBE

TRIGGER$

$350/year

Pay-Per-View

– single serving analysis starting at $0.99!