Strategic Investment Insights are a product of Gordon’s MACRO Research and the HPTZ Methodology. MACRO identifies market sectors that are “in play” and likely to offer investment and trade opportunities. Specific securities are then marked up with Market Road Maps for technical timing considerations. Road Maps identify significant technical levels and structures, as well as offer potential target considerations (HPTZ’s).

PROCESS & PRODUCT

Extensive research from mainstream and alternative sources.

Organization & association of research.

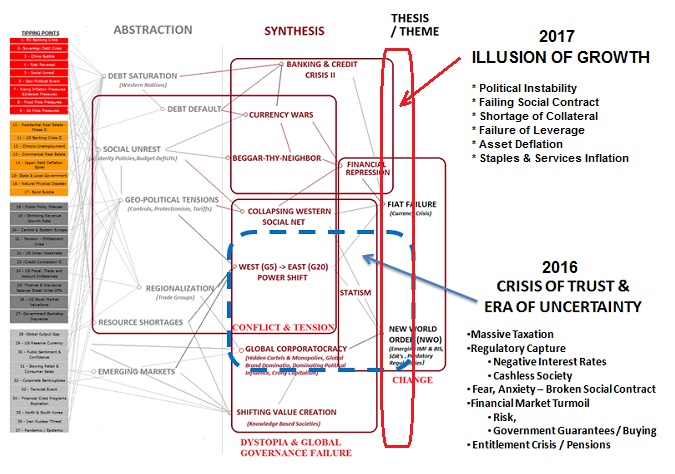

Abstraction & Synthesis reveals new market themes and insights.

Numerous instruments associated with Insights given.

Master Lists scanned for best Technical set-ups.

WATCH LISTS

The most favorable prospects from Master Lists are used to create a Watch List.

Watch lists:

(1) link to each individual securities SII page with more information, research, charts, and trade / investment IDEAS;

(2) show current market price (as per Google finance, delayed);

(3) show potential technical entry levels, long & short

(4) dynamic: current price lights up when near technical entry level warning of possible action to be taken

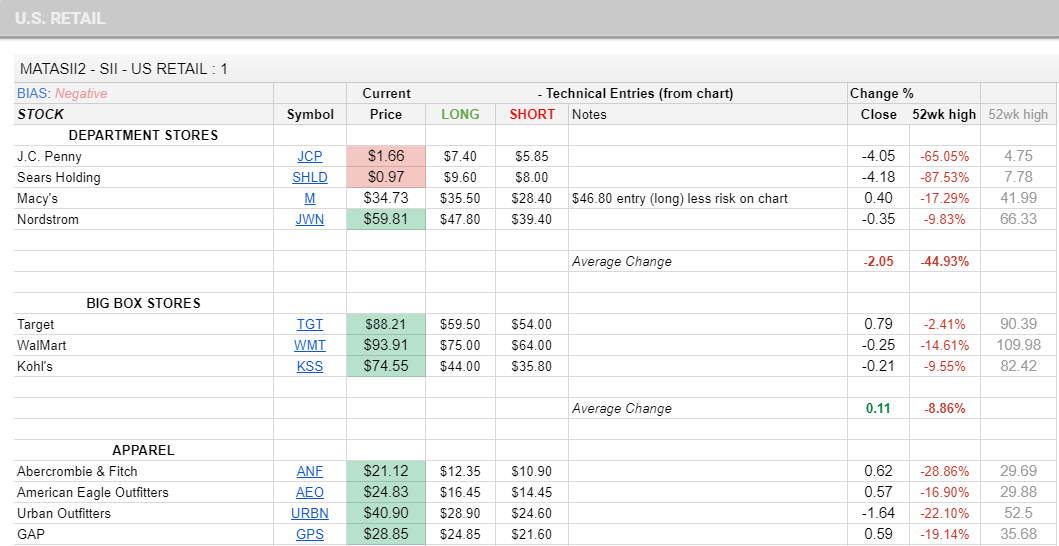

The SAMPLE (right) shows our previous US Retail Watch List. Note the red and green highlights of Current Price. These “illuminated” because the current price had neared or crossed a Long or Short potential Technical Consideration. These are not “Buy Now!” or “Sell Now!” indications, rather they warn of the market reaching significant technicals, and potential opportunities may exist. The symbols link to individual pages where the charts can be accessed.

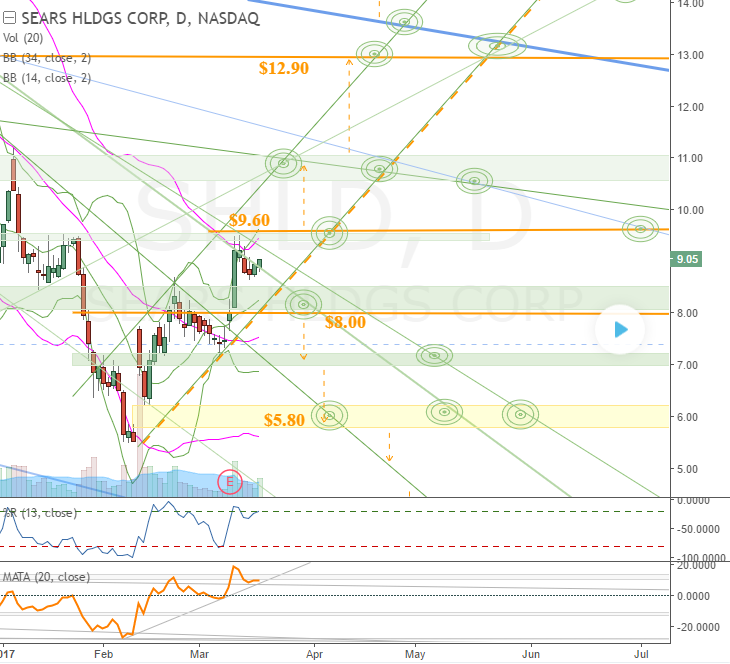

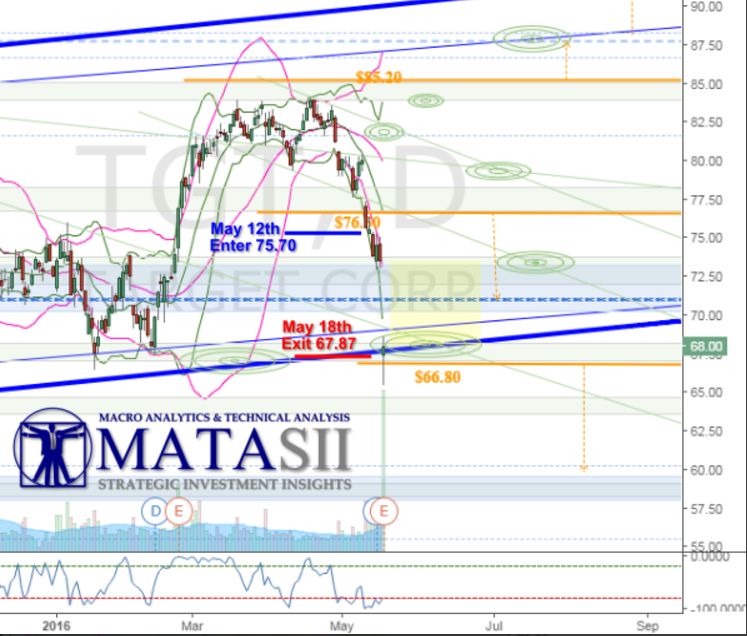

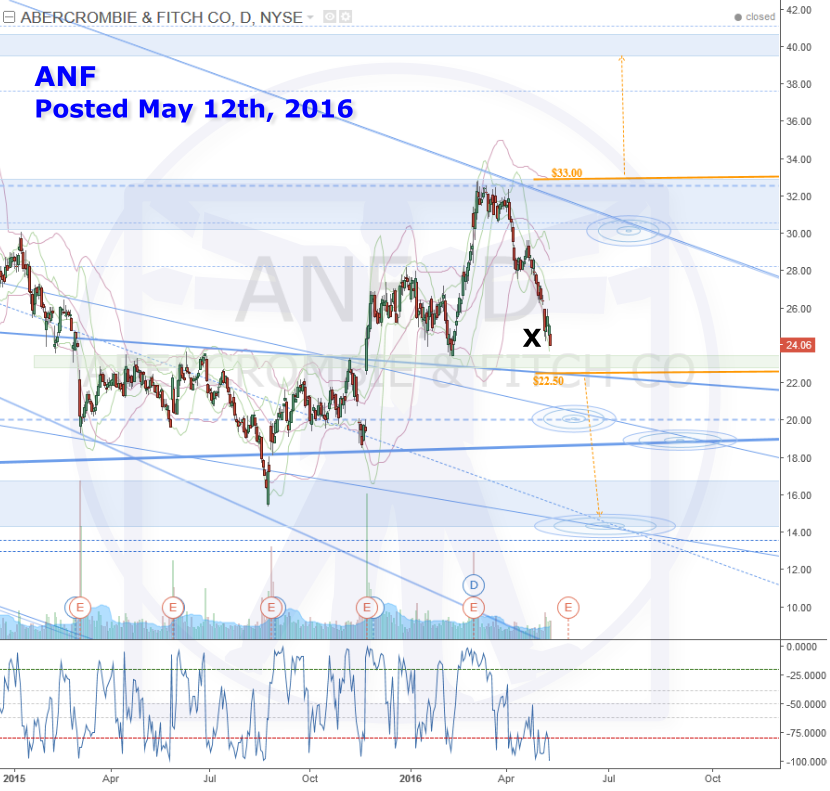

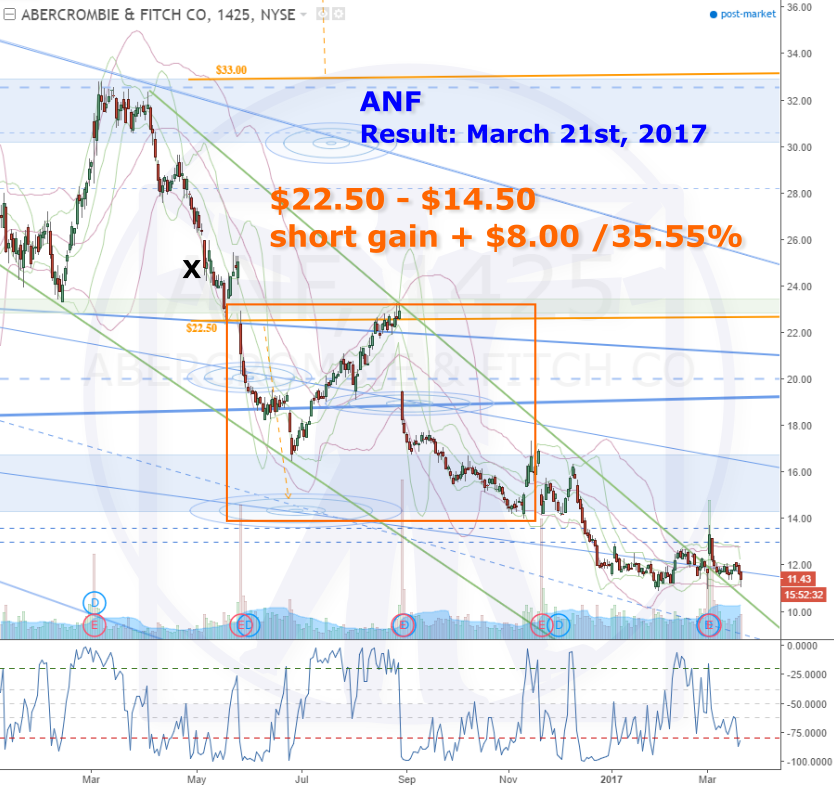

ACTIONABLE CHARTS Market Road Maps, Technical Set-Ups & IDEAS

Note the movement of the market from technical to technical. Consolidations and Reversals usually occur at a technical, when these complete, the market then moves to the next. These provide opportunities for short term trading or longer term investment strategies. The market road map created by the technicals makes opportunities obvious and clearly identifies areas of risk.

SII IDEAS – Investment & Trading Ideas (public)

MATASII Subscription Options

Full Site Access (all sections)

SUBSCRIBE

FULL SITE ACCESS

$55/monthly

SUBSCRIBE

FULL SITE ACCESS

$550/yearly

Gordon T Long Macro Research (only)

SUBSCRIBE

GTL MATA

$35/monthly

SUBSCRIBE

GTL MATA

$350/yearly

SII – Strategic Investment Insights (only)

SUBSCRIBE

SII

$35/monthly

SUBSCRIBE

SII

$350/yearly

TRIGGER$ HPTZ Technical Analysis (only)

SUBSCRIBE

TRIGGER$

$35/monthly

SUBSCRIBE

TRIGGER$

$350/year

Pay-Per-View

– single serving analysis starting at $0.99!