STAGFLATION STRATEGY CONSIDERATIONS

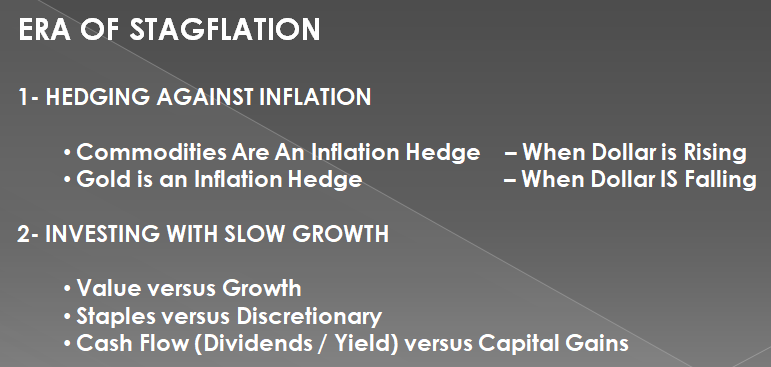

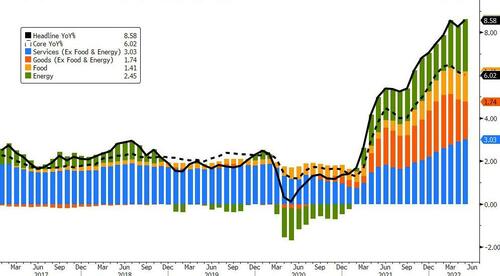

There are two elements of Stagflation that require focus: i) Growth and ii) Inflation.

INVESTING WITH SLOW GROWTH

We are already witnessing investor shifts towards areas that perform better during slow growth such as Consumer Staples and Utilities. This is part of what we can expect regarding ongoing importance of a preference towards value versus growth, staples versus discretionary and dividend/yield versus capital gains. All these investment areas must however be examined under the light of inflation – both domestic and global.

HEDGING AGAINST INFLATION

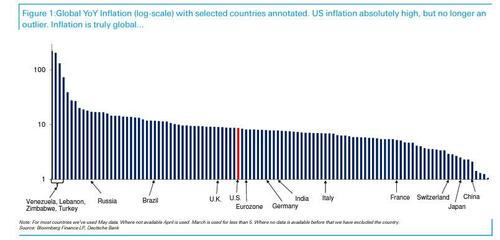

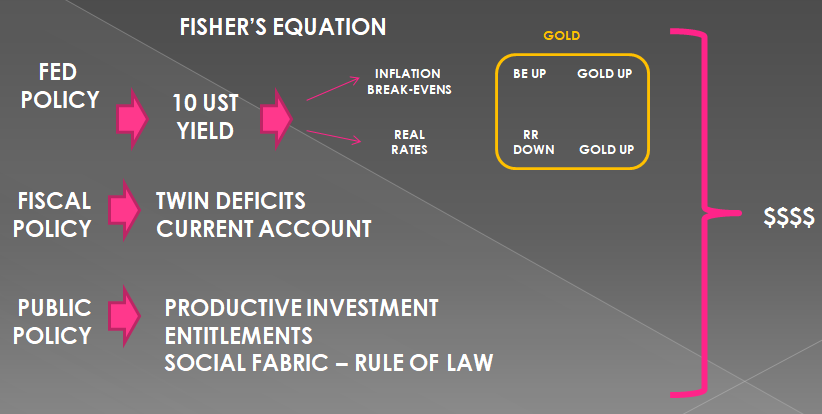

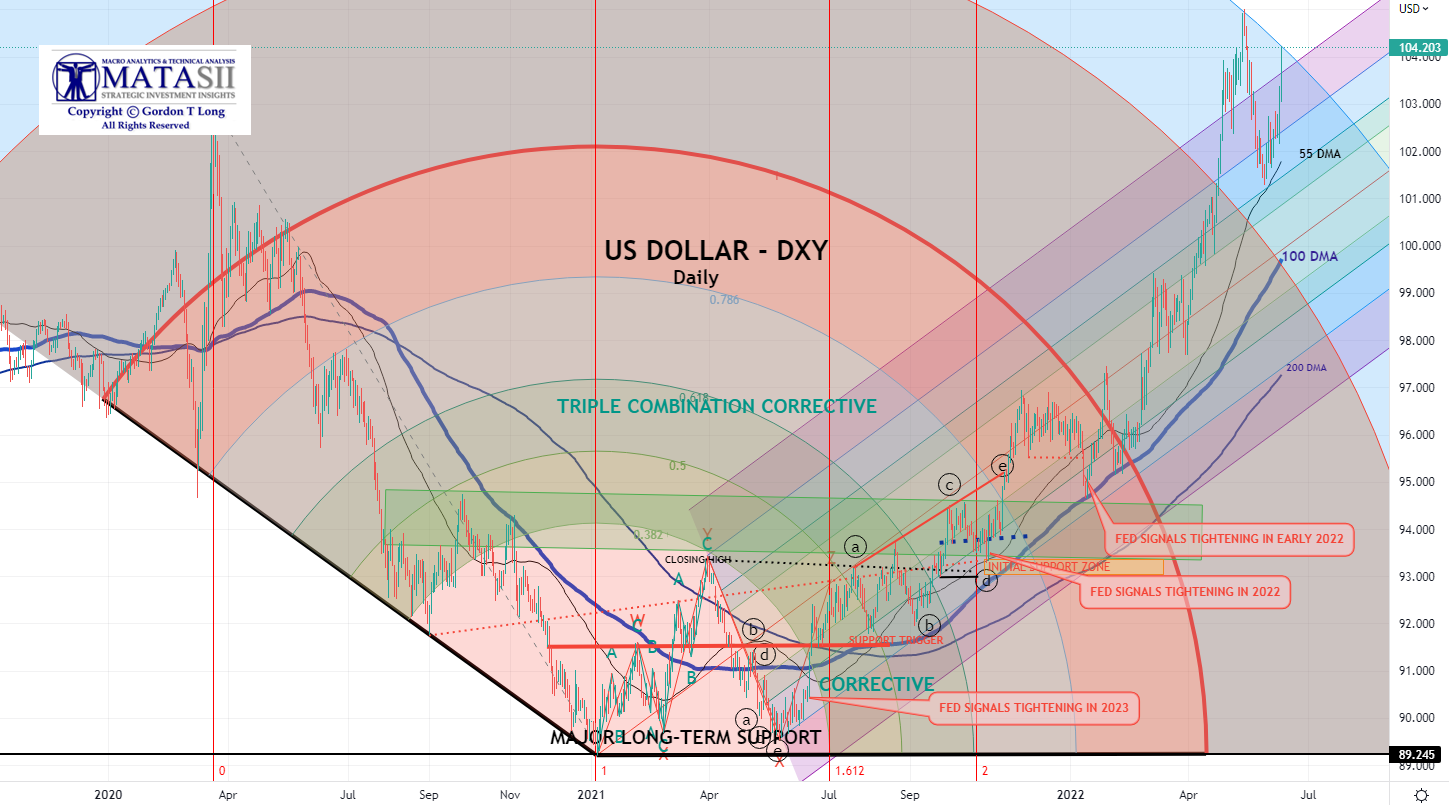

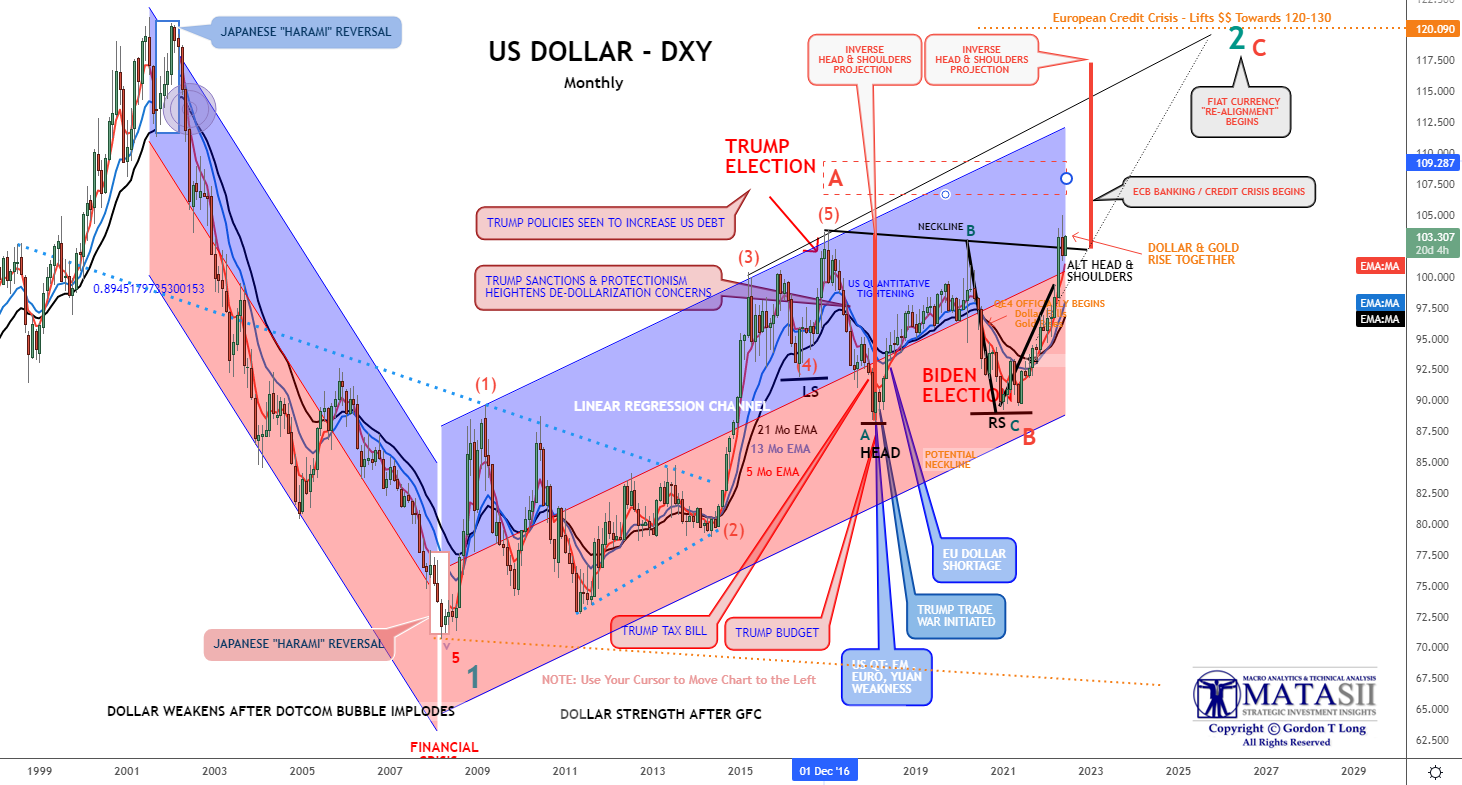

If the US was a self-sufficient, autonomous island, then approaches to inflation investing would be simpler. However, this is not the case in a highly interconnected and competitive world of imports and exports. This is the domain of Currencies. The value of a country’s currency has a profound impact on the realities of inflation and pricing.

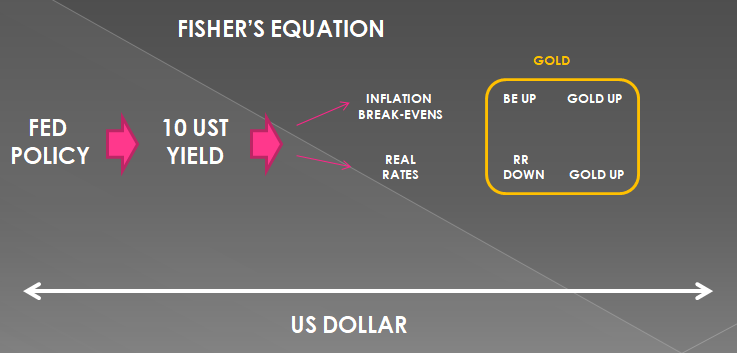

In this month’s LONGWave video: “

Peak Inflation versus Gold“, we spent time on understanding the relationship of the volatility and pricing of gold. What we didn’t spend time on was the impact of currency and how the US dollar’s value impacts the price of gold.

Gold like Commodities is traded globally and hence its price is a function of the currency being used for its purchase and sale.

-

- When the US Dollar rises in value, it buys more gold than when priced lower against a basket of global currencies.

- When the US Dollar falls in value, it buys less gold than when priced higher against a basket of global currencies.

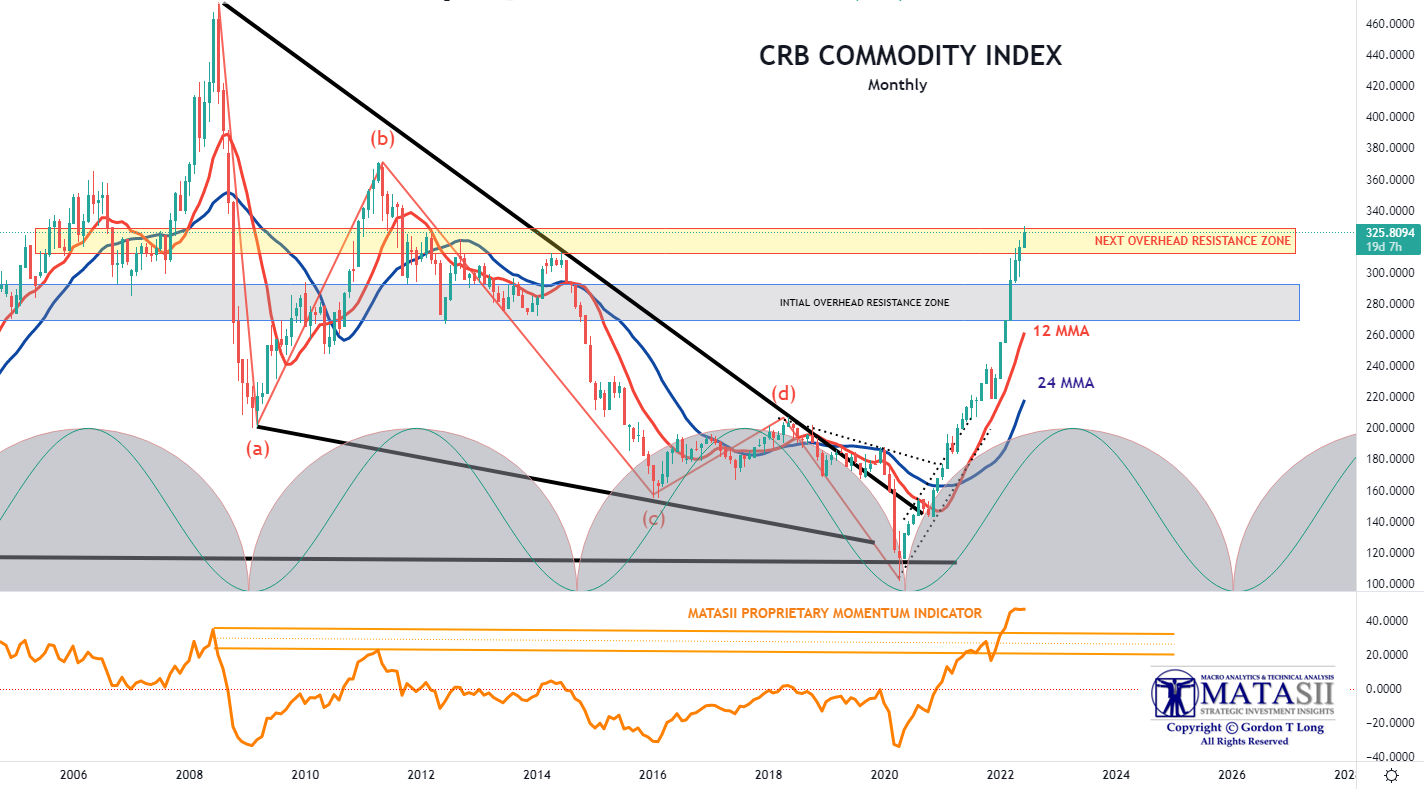

This is pretty obvious and well understood. However, Commodities historically perform differently because of the powerful role of the US Dollar being the dominant Global Reserve currency, which many commodity producing countries are very dependent on in managing their current accounts. With many commodity countries dominantly dependent on exports of a single or a few commodities, their economic current account and balances are tied to the pricing of those commodities.

The dollar, as their primary foreign exchange reserve holding, plays an outsized role in pricing their commodities for export. US Foreign aid and dollar denominated debt further ‘hardens’ this relationship. Therefore, historically we see that:

-

- When the US Dollar rises in value, then Commodities rise in value,

- When the US Dollar falls in value, then Commodities fall in value.