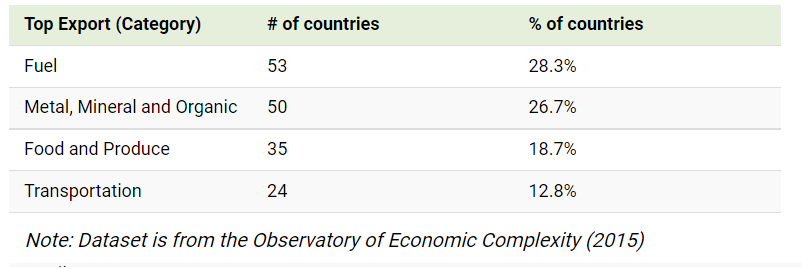

The vast majority of exports of many nations are derived from natural resources. Fuels, metals, minerals, and organics make up over half of all top national exports. Meanwhile, food and produce, which includes commodities like sugar, coffee, fish and soybeans, also could be classified this way as well – and they make up a further 18.7% of top exports. Control now rests with the aligned nations shown above and led by China and Russia.

THE GLOBAL”MULTI-POLAR” SHIFT

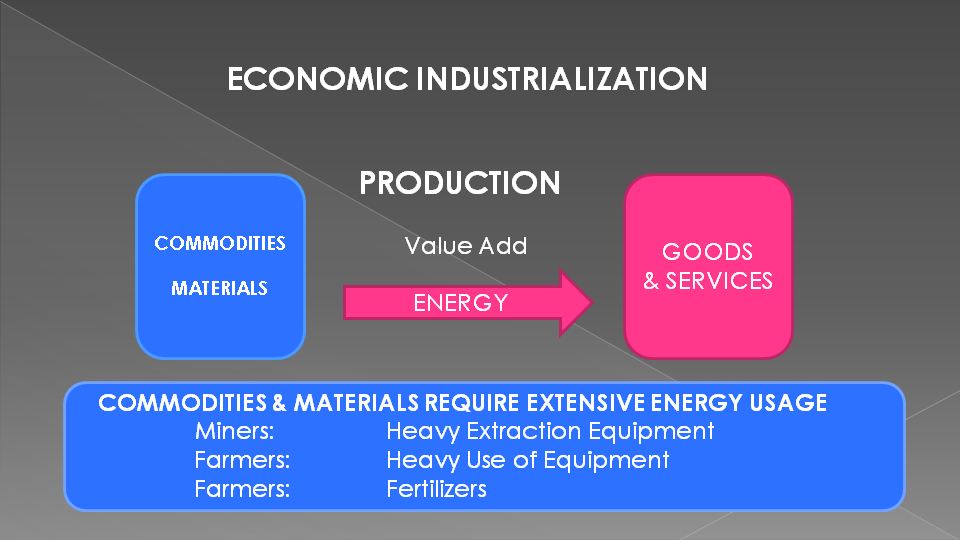

We have written extensively of the coming New World Order, which is centrally about the inevitable shift from a Uni-Polar to Multi-Polar world. The incumbent Uni-Polar is centered around the US and the aligned developed G-7 nations. The shift presently underway is to a Multi-Polar world dominated by non-dollar economies led by China and Russia and centered on Commodity controlled financing. Let me explain, since the western media is under the control of a different narrative.

“The Global economy has reached the stage of such serious imbalances that Central banks now have a very hard task at hand – they can slow/stimulate demand via the nominal credit channel by playing with the the price of money, but they cant do a thing about commodities.They can print money but they can not print oil, iron, or wheat, nor VLCCs or other ships.The price level of commodities is presently underpinned by a healthy, well-functioning banking system (demand needs credit; if there is no credit, there is no demand and prices fall), but also a healthy, well-functioning world with efficient and open sea routes (demand needs commodities, and if there are no commodities, prices rise fast).

The core problem is If the banking system gets gummed up and OIS-OIS bases widen, credit gets more expensive and that saps demand, and if the commodity trading system gets gummed up, commodities get more expensive, and that saps demand too. But the former is a nominal (credit) shock that leads to much lower prices, and the latter is a real (trade) shock that leads to much higher prices. Real growth slows either way, but in the former case, nominal activity falls faster than prices, and in the latter case, prices rise faster than nominal activity which means stagflation.”

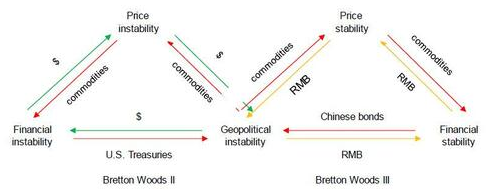

As I mentioned, the leading global thinker in this area is acknowledged to be

Zoltan Pozsar who believes the shift to a Multi-Polar world will usher in a new Bretton Woods III, (whether officially or just practically).

He envisages it evolving into the following systemic representation:

“Three points make a triangle