MACRO

US ECONOMICS

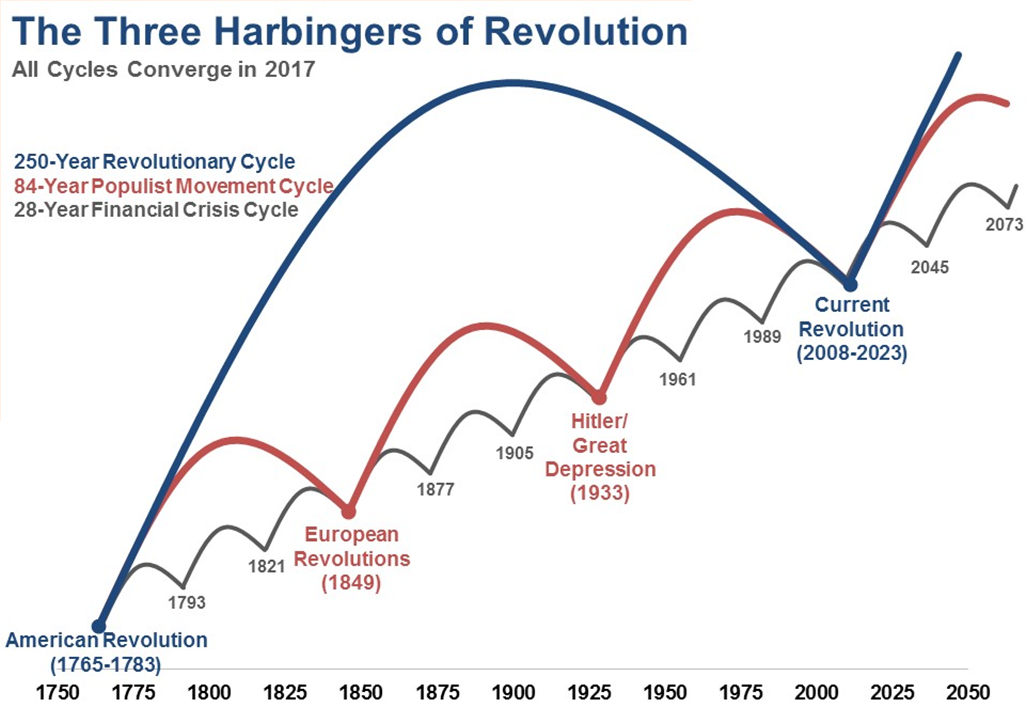

THE “FOURTH TURNING” IN THE MIDST OF A

FULL POLITICAL TURN!

OBSERVATIONS: BANKRUPTCIES SENDING EARLY WARNINGS

US corporate bankruptcies have hit their highest level since the aftermath of the global financial crisis as elevated interest rates and weakened consumer demand punish struggling groups.

At least 686 US companies filed for bankruptcy in 2024, up about 8 per cent from 2023 and higher than any year since the 828 filings in 2010, according to data from S&P Global Market Intelligence.

Out-of-court manoeuvres seeking to stave off bankruptcy also increased last year, outnumbering bankruptcies by about two to one, according to Fitch Ratings. As a result, priority lenders to issuers with at least $100mn of aggregate debt experienced the lowest recovery rates since at least 2016.

The collapse of party supply retailer Party City was typical of 2024 corporate failures. In late December, it submitted its second bankruptcy filing in as many years, after emerging from Chapter 11 proceedings in October 2023.

Party City said it would shut down its 700 stores nationwide after struggling “in an immensely challenging environment driven by inflationary pressures on costs and consumer spending, among other factors”.

Consumer demand has waned as the Covid-19 pandemic stimulus ebbed, hitting companies that rely on discretionary consumer spending particularly hard. Other major bankruptcies last year included food storage manufacturer Tupperware, restaurant chain Red Lobster, Spirit Airlines and cosmetic retailer Avon Products.

“The persistently elevated cost of goods and services is weighing on consumer demands.”

Gregory Daco, Chief Economist at EY.

The burden is especially heavy for families on the lower end of the income spectrum, “but even in the middle and on the higher end, you’re seeing more caution.”

The pressure on companies and consumers has eased somewhat as the Federal Reserve has begun to reduce rates, though officials have indicated they intend to cut by just half a percentage point more in 2025.

Peter Tchir, head of macro strategy with Academy Securities, said there were mitigating factors, including the relatively low spread between the rates for riskier corporate borrowing and government debt.

“Obviously, it’s not great that this is happening. But when I think about what could really have a knock-on effect to the broader economy or the banking system, this is not really getting me excited yet.”

Peter Tchir, Head of Macro Strategy – Academy Securities

There were only 777 bankruptcy filings in 2021 and 2022 combined, when the cost of money was much lower because of the Fed’s rate-cutting program.

That figure jumped up to 636 in 2023 and continued to climb last year even as rates started to come down in late 2024. At least 30 of last year’s bankruptcy filers had at least $1bn in liabilities at the time of filing, according to the S&P data.

Historically, there are generally the same number of bankruptcies as there are out-of-court actions to reduce the odds of insolvency.

These sorts of moves, euphemistically known as liability management exercises, have become increasingly common and have grown to represent a large portion of US corporate debt defaults in recent years, and that trend continued in 2024.

These debt manoeuvres are often considered a last resort to avoid filing for court protection. Yet in many instances, the companies wind up bankrupt anyway if they cannot fix their operational woes.

“Maybe their profitability will go up, or interest rates will go down, or a combination of both of those, really in order to stave off bankruptcy. Such liability workouts can negatively impact lenders by stacking more debt atop existing liabilities.”

Joshua Clark,Senior Director at Fitch Ratings

WHAT YOU NEED TO KNOW!

RISING RATES SLOWING MARKET ADVANCES

RISING RATES SLOWING MARKET ADVANCES

The higher that equity yields reached (compared to bonds) the cheaper stocks are. And vice versa. High bond yields made stretched equity valuations harder to justify.

We can illustrate this in the chart to the right with the spread of the S&P earnings yield over the 10-year Treasury. When it drops, or falls below zero, stocks are expensive. This simple model shows the degree which stocks are expensive. This measure now says that stocks are their most expensive since 2002 — and coincidentally at exactly the level on Dec. 5, 1996, that prompted former Fed Chairman Greenspan to sound his famous Dotcom Bubble warning of “irrational exuberance”.

RESEARCH

1- THE “FOURTH TURNING” IN THE MIDST OF A FULL POLITICAL TURN!

1- THE “FOURTH TURNING” IN THE MIDST OF A FULL POLITICAL TURN!

A CRISIS OF POLITICAL LEADERSHIP & POLICY PARALYSIS

RESULTING IN INEFFECTIVE HANDLING OF

INFLATION & IMMIGRATION

-

- Social Unrest Caused By Political & Economic Status Quo No Longer Working!

- GERMANY: New emerging AfD Party (anti-migration) increasingly taking control of Germany.

- FRANCE: Marie Le Pen’s Right leaning party taking control of failing Macron government.

- UK: Socialist Labor Party on verge of being defeated due to the grooming scandal of rape gangs by British Pakistanis.

- CANADA: Rejects Trudeau & Socialist NDP coalition government and their 8 years of hard left policies.

- US: Goes “Right” with election of Trump.

- Social Unrest Caused By Political & Economic Status Quo No Longer Working!

2- HAVE WE LOST CONTROL OF THE US ECONOMY?

The Goose that lays the Golden Egg has been hijacked by Keynesians!

“The market delivers goods and services. The state delivers sound money.”

(When the state stops delivering sound money, the markets stop delivering goods and services.)

-

- There is a pervasive misunderstanding of:

i) What money actually is and

ii) How it is created!

-

- Most still believe that Banks lend out customer deposits (Fractional Banking). Truth is the vast majority of money is created by the lending process itself and does not require prior customer deposits at all.

- Gone is fractional reserve banking, whereby banks had to maintain a fraction of their deposit liabilities in base money either in their vaults or an account at the central bank.

- By and large central banks provide all the reserves (base money) that the banks demand in order to satisfy their customers’ lending demands.

- Banks create new money when making loans, expanding both sides of their balance sheet.

- Governments create new money through spending and borrowing.

- Banks need some capital to lend to the private economy. None is required to lend to money-printing governments.

- Central bank reserves are not a constraint on bank lending; they are supplied on demand.

- This process of constant monetary expansion to justify the accumulation of risk is often referred to as “liquidity injections,” as if it were a much-needed blood transfusion, when most of the time it simply disguises rising debt and risks built into the financial system.

DEVELOPMENTS TO WATCH

THE EXPLOSIVE GROWTH IN PRIVATE EQUITY CONTROL

THE EXPLOSIVE GROWTH IN PRIVATE EQUITY CONTROL

-

- Over the last 25 years, the number of privately-held companies has grown and the number of public companies has dropped. Back in 2000, public companies were much more common. However, by the end of 2023, the majority of companies were funded by private equity firms. What’s been driving this shift?

- The growth of privately-held companies funded by PE has been driven by a number of factors:

- There are fewer regulatory requirements.

- Companies are able to keep their financials private.

- It is typically easier to access capital.

- Investors are looking for higher returns.

BANKRUPTCIES ON THE RISE

-

- At least 686 US companies filed for bankruptcy in 2024, up about 8 per cent from 2023 and higher than any year since the 828 filings in 2010, according to data from S&P Global Market Intelligence.

- Out-of-court manoeuvres seeking to stave off bankruptcy also increased last year, outnumbering bankruptcies by about two to one, according to Fitch Rating. As a result, priority lenders to issuers with at least $100mn of aggregate debt experienced the lowest recovery rates since at least 2016.

GLOBAL ECONOMIC REPORTING

CREDIT CARD SHOCK

CREDIT CARD SHOCK

-

- According to the Fed’s latest consumer credit data, in November consumer credit across US households tumbled by $7.5 billion to $5.102 trillion, a 1.8% annual rate of contraction and usually something one only sees in the middle of recessions (or worse).

- The average interest on credit card accounts across the US banking system as tracked by the Fed is at 22.8%, the second highest reading on record and a drop of 57bps from the highest rating on record taken in Q3 2024.

LABOR REPORT (DECEMBER NFP)

-

- The Biden Admin’s BLS shocked the analyst community as it took full advantage of its last report to trumpet the strong shape the US Economy was in as a result of Bidenomics! No one expected this high a 4 Sigma Beat (chart right bottom) employment number!

- With consensus expecting a 165K print today and the whisper number coming in about 20K higher at 187K, traders were expecting a cooler than last month’s 227K – but not too cool – and certainly not the hot jobs number this morning.

- Instead they got a red hot print at 256K.

FACTORY ORDERS

-

- US Factory Orders tumbled 0.4% MoM in November (from an upwardly revised +0.5% MoM change in October), dragging orders down 1.9% YoY (the worst since June).

- The final durable goods orders print tumbled 1.2% MoM (drastically worse than the 0.4% decline expected) with core Durables (ex-Transports) falling 0.2% MoM in November. The headline MoM drop dragged the YoY change in Durable Goods Orders down 6.4% YoY – the second worst since COVID lockdowns.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.