THESIS PAPERS

UPDATE – 2018, 2019, 2020, 2021

THE FOURTH TURNING IS HAPPENING!

In my daily exchanges with colleagues and subscribers it is quite clear there are opposing views of what is happening on the global stage. Feelings differ significantly from those held within America versus those outside America. The reality is that the world is rapidly transitioning from a Uni-Poiar world to a Multi-Polar world. From a world dominated by American Policy to a world not inviting America to the table, simply to avoid the expected tirade, belligerance and bullying. These are the reactions of a power in denial and decline versus a power of diplomacy, persuasion and partnering, A respected colleague said it to me in disbelief:

“I would have never have believed the US could go 180 degrees faster in alienating our friends and foes alike! That we could be left off the global stage so quickly. That our economy could so quickly spiral out of what feels uncontrolled and leadership preoccuppied with all the wrong things!” Not the kind of call that makes your day!

How could a well read and inforrmed US patriot be made to feel this way? It comes with the Fourth Turning! We need to revisit it.

=========

WHAT YOU NEED TO KNOW

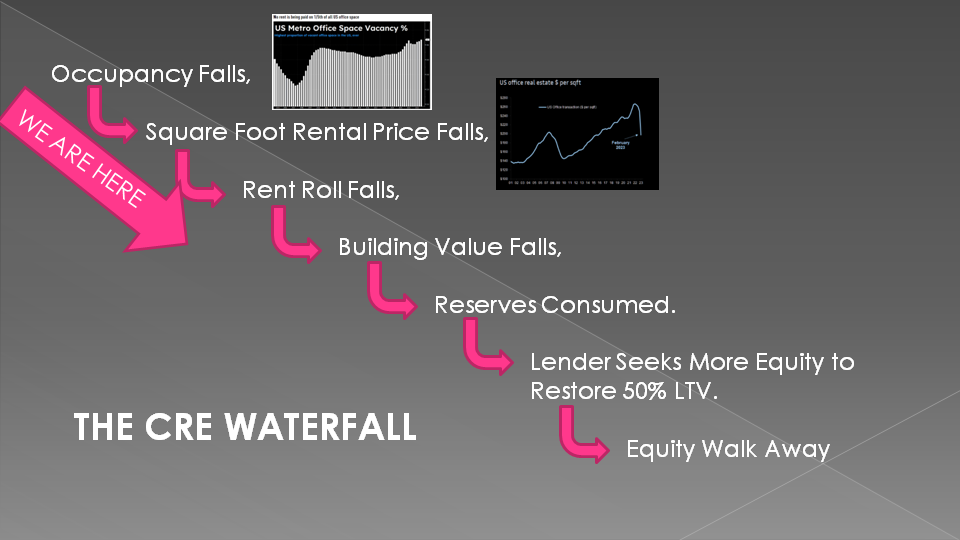

THE BANKING CRISIS IS BROADENING UNDERNEATH ALL THE MEDIA “REASSURANCES”: I just completed a Macro Analytics video with Charles Hugh Smith entitled: “IT’S A WATERFALL – Risk, Collateral & Productivity”. This 50 minute video builds off of this month’s LONGWave video on the serious problems now facing Commerical Office Real Estate. We are in the midst of a waterfall of the predictable and unfolding cascading consequences of tightening credit.

THE BANKING CRISIS IS BROADENING UNDERNEATH ALL THE MEDIA “REASSURANCES”: I just completed a Macro Analytics video with Charles Hugh Smith entitled: “IT’S A WATERFALL – Risk, Collateral & Productivity”. This 50 minute video builds off of this month’s LONGWave video on the serious problems now facing Commerical Office Real Estate. We are in the midst of a waterfall of the predictable and unfolding cascading consequences of tightening credit.

THE FOURTH TURNING: Our Thesis Papers Have Been Warning!

-

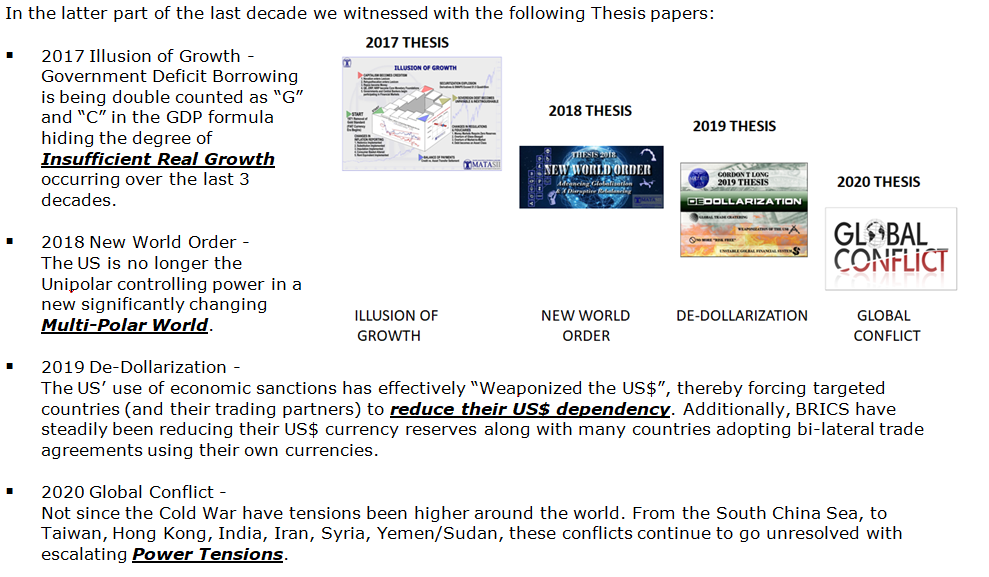

- Warnings of some key elements of the Fourth Turning: THESIS 2018: A New World Order, THESIS 2019: De-Dollarization, THESIS 2020: Global Conflict, THESIS 2021: Social Suppression.

- Virtue gives birth to tranquility, tranquility to leisure, leisure to disorder, disorder to ruin… and similarly from ruin, order is born, from order virtue, from virtue, glory and good fortune.

US PERSPECTIVE: Avoiding Domestic Problems

-

- Within the US there is a continually broadening belief by the public that government is no longer serving the people’s needs and addressing real “Kitchen Table” concerns!

- Three issues are often cited as to why this is: 1- Confidence in Leadership & Direction, 2- Political Polarization & Gridlock, and 3- Preoccupation wth and Distraction by Cultural Wars.

GLOBAL PERSPECTIVE: The Void In Global Leadership Will Be Seized!

-

- Our enemies do not fear us, our allies judge us unreliable, and neutrals assume America is in descent and too dangerous to join.

- There are 10 clearly evident ways by which America has lost all deterrence.

CONCLUSION

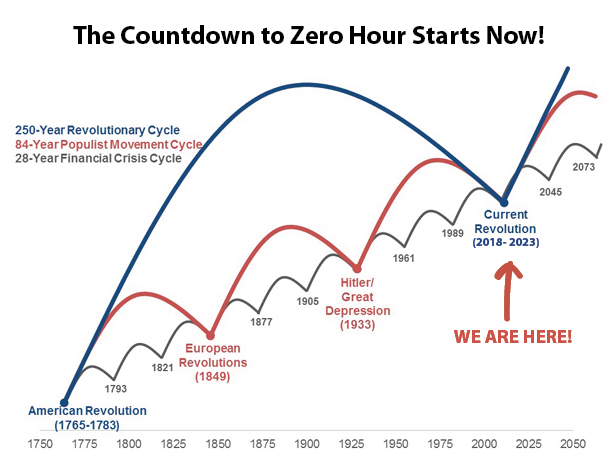

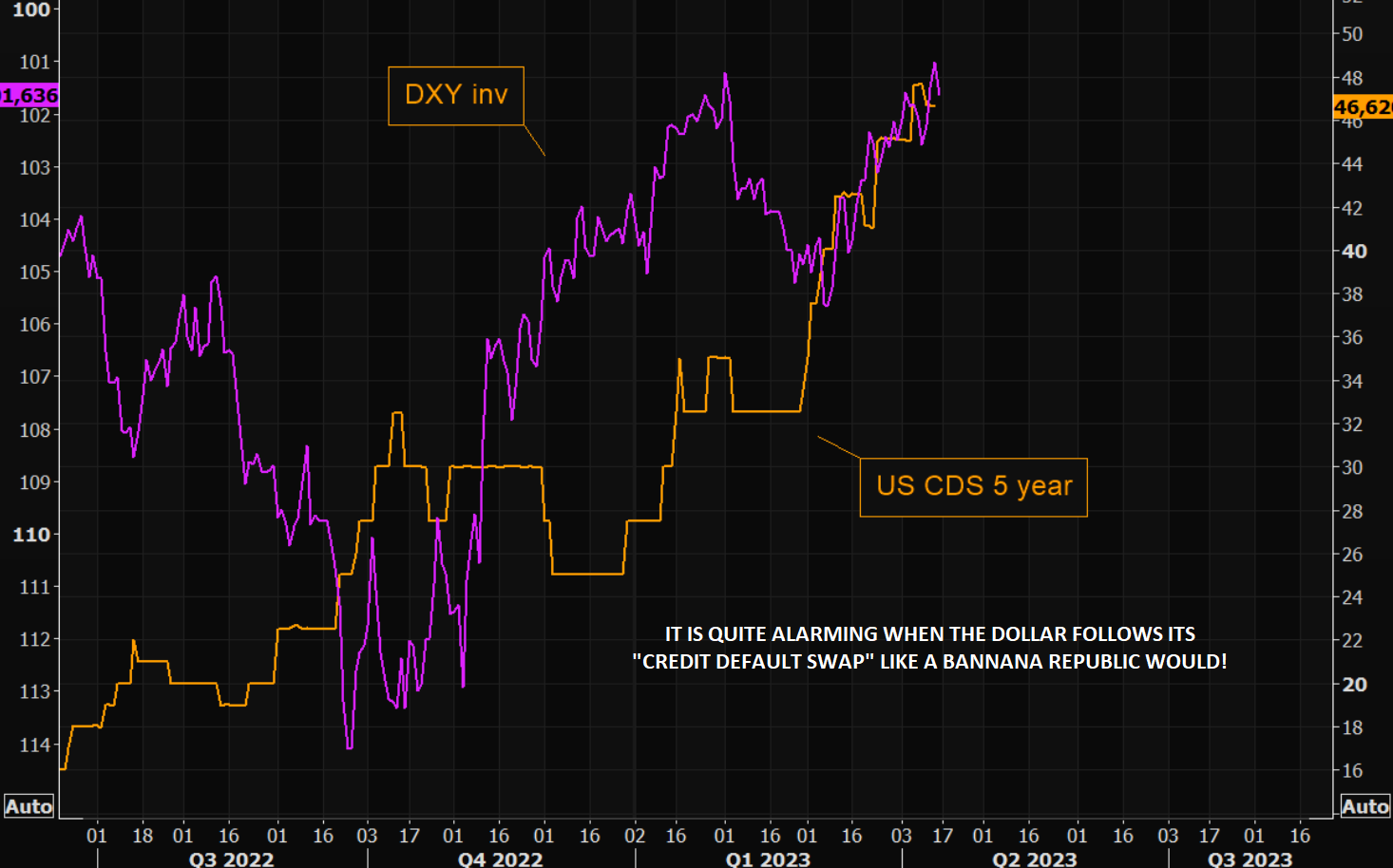

It is quite alarming when the US$ follows the movements in the US Credit Default Swap Rate!

CURRENCIES: Currencies Mirror Political & Economic Strength

CURRENCIES: Currencies Mirror Political & Economic Strength

-

- Over time a Currency will mirror the political strength of a country as shown by policies that deliver a strong economy, the strength of its military and social stability.

In this week’s expanded “Current Market Perspectives” we focus on the US Dollar as a follow on from our disucssions in the body narrative as an adjunct to what is happening as a result of, and in concert with, the “Fourth Turning”.

=========

THE FOURTH TURNING: Our Thesis Papers Have Warned!

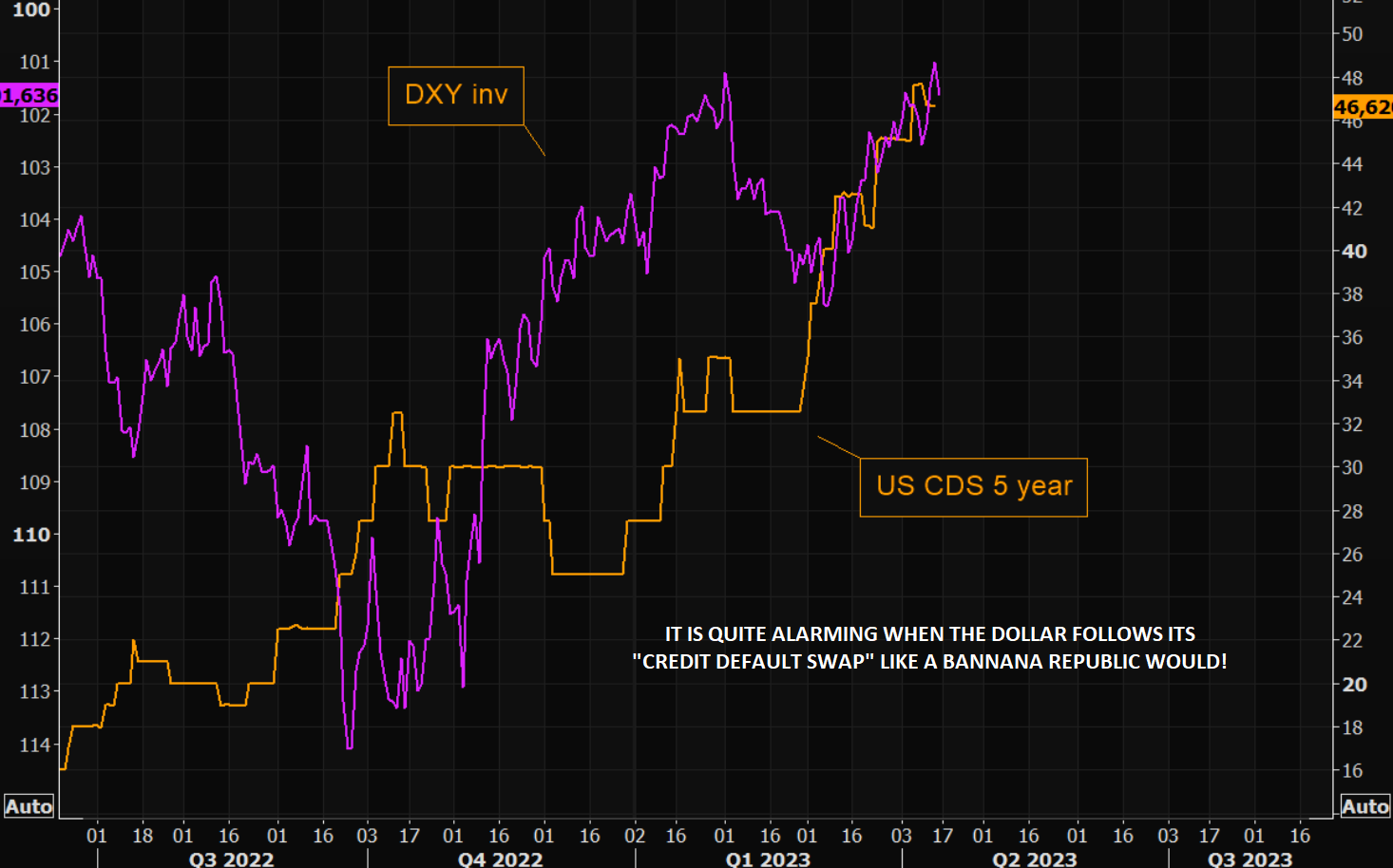

I have written extensively over the last few years about how a multitude of cycles along with the Fourth Turning are all converging at this period in time!

I have written extensively over the last few years about how a multitude of cycles along with the Fourth Turning are all converging at this period in time!

They all mark major change as, for somewhat mysterious reason, they all exhibit a significant shift in social sentiment and are marked by a high level of disruption, chaos to various degrees and major change.

The attitude of the friend I mentioned above is an example.

CHART RIGHT: Cycles have been long been pointing to an era from 2018-2023

New beliefs, as represented by the movements pushing ideas such as Woke, Transgender, CRT, DEI, ESG, Open Borders, merge with increases in crime, criminal justice leniency, mass killings, domestic terrorism, cancel culture … and the list goes on.

He is confused, frustrated, disillusioned and just wants things to go back to what he had been accustomed to as his “stable reality”.

He is confused, frustrated, disillusioned and just wants things to go back to what he had been accustomed to as his “stable reality”.

That is not going to happen; it is going to get worse before it gets better. This is how society changes.

In the long run society advances, but often in the shorter term history shows sometime there are detours that are not for the better.

Only tme will tell what paths we choose…

VIDEO RIGHT: “FOLLOW THE CYCLE” video – May 9th, 2018

Starting in 2018 (video above), we began warning of the coming Era of Disruption and Turmoil. We obviously couldn’t know for sure the forms it would take, but there were some clear “sign posts” where troubles were brewing and change was going to happen – whether by plan or through turmoil.

GUIDELINES FOR THE ‘FOURTH TURNING’ AND CYCLES

FOURTH TURNING

-

- Niccolò Machiavelli, in his Florentine Histories, said:

Virtue gives birth to tranquility, tranquility to leisure, leisure to disorder, disorder to ruin… and similarly from ruin, order is born, from order virtue, from virtue, glory and good fortune.

-

- The bottom line is that societies arise from poverty through moral strength—and that brings them prosperity.

- But that prosperity brings on arrogance, and the arrogance brings on laziness, which brings on weakness and moral decline. Then they’re reduced to a condition of slavery and poverty again. Change is the only constant – except in human nature.

- Strauss and Howe take a cyclical point of view over the course of roughly 80 years, four generations. There are four “turnings”: a “high,” an “awakening,” an “unraveling,” and a “crisis.”

US EDUCATION SYSTEM

-

- Saint Ignatius said this in the 17th century, and Lenin repeated it in the 20th century, that if you indoctrinate someone in his youth, chances are you’ve directed his worldview for the rest of his life.

- A lot of the way a society acts comes from the way kids are brought up—the values that are inculcated in them when they’re young. And increasingly, kids are taught what I would call the wrong values.

- Cultural Marxists are increasingly in control of the US educational system, and have been for a couple of generations. That’s absolutely the case in the colleges and universities, but also in the high schools and even in the grade schools. Kids are being taught to be socialists, ecowarriors, social justice warriors and “woke” from an early age. A mainstay development in the Fourth Turning.

- The trend towards collectivism and statism seems to be a secular long-term trend that’s still accelerating versus a cyclical phenomenon.

CURRENT SITUATION

-

- Americans have increasingly very little faith in “the system”, the society or the government.

- If we study the beginning of the 20th century, the US wasn’t very political. People worried about their own lives, their own families and their own local communities. Americans shared a common culture, beliefs and values—that’s no longer true.

- Now the country has become very politicized—everybody has a loud voice and they use votes as weapons against their neighbors. It’s become a nation of “nasty busybodies”.

- The next upset is likely to be something like a revolution. It’s likely to be really ugly, because we’re looking, simultaneously, at an economic catastrophe, political chaos, and a social and demographic upset—and probably a military situation as well.

- Government often sees war as a way to unite the country.

MATASII THESIS PAPERS HAVE SPECIFICALLY BEEN WARNING OF THIS UNFOLDING TRANSITION.

THESIS 2018: New World Order

DOWNLOAD: 82 Page Paper

DOWNLOAD: 82 Page Paper

Advancing Globalization & A Disruptive Rebalancing

Some of the extensive list of articles in last 60 days:

THESIS 2019: De-Dollarization

The Inevitable End of US Dollar Domination

DOWNLOAD: 153 Page Paper

DOWNLOAD: 153 Page Paper

Some of the extensive lsit of articles in last 60 days:

-

- BRICS Nations Developing -New Currency- As Quest For Global De-Dollarization Accelerates

- Here Are 7 Signs That Global De-Dollarization Has Just Shifted Into Overdrive

- China And Brazil Strike Deal To Ditch The US Dollar

- India Takes A Leading Role In De-Dollarization

- Macron Says Europe Should Reduce Dependence On US Dollar, Seek ‘Strategic Autonomy’

- IMF Unveils New Global Currency Known As The “Universal Monetary Unit” To “Transform” World Economy

THESIS 2020: Global Confict

Emerging Era of Geo-Political, Military & Social Conflict

DOWNLOAD: 104 Page Paper

DOWNLOAD: 104 Page Paper

Some of the extensive lsit of articles in last 60 days:

THESIS 2021: Social Suppression

Controlling Elitism, Fascism & Totalitarianism!

DOWNLOAD: 66 Page Paper

DOWNLOAD: 66 Page Paper

US Congress Launches a Full Investigation of Media Censorship & the “Weaponization of Government”.

- The Cover Up: Big Tech, the Swamp, and Mainstream Media Coordinated to Censor Americans’ Free Speech House Committee on Oversight and Accountability

- The Twitter Files

US PERSPECTIVE: Not Addressing Domestic Problems!

Within the US there is a continually broadening belief by the public that government is no longer serving the people’s needs and addressing real “Kitchen Table” concerns!

Three issues are often cited as to why this is:

1- CONFIDENCE IN LEADERSHIP & DIRECTION

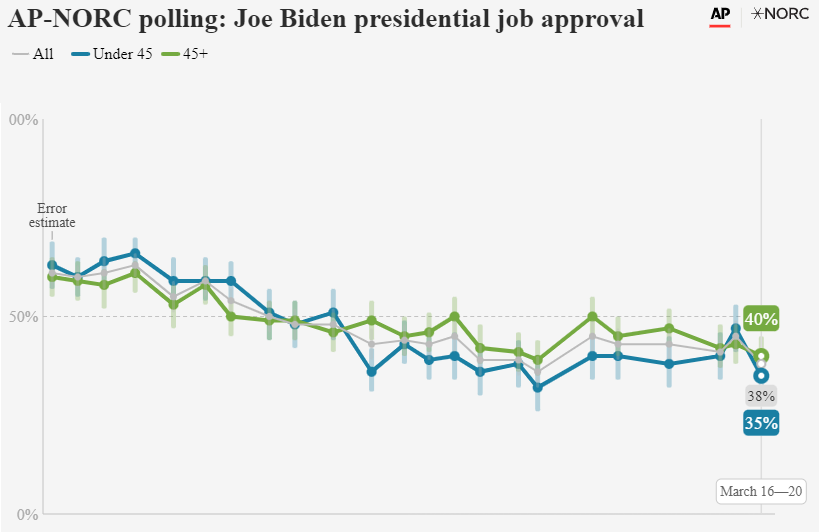

A new poll by the Associated Press-NORC Center for Public Affairs Research shows approval of President Joe Biden has dipped further, nearing the lowest point of his presidency as his administration tries to project a sense of stability while confronting a pair of bank failures and inflation that remains stubbornly high.

A new poll by the Associated Press-NORC Center for Public Affairs Research shows approval of President Joe Biden has dipped further, nearing the lowest point of his presidency as his administration tries to project a sense of stability while confronting a pair of bank failures and inflation that remains stubbornly high.

-

- The president notched an approval rating of 38% in the new poll, after 45% said they approved in February and 41% in January.

- His ratings hit their lowest point of his presidency last July, at 36%, as the full weight of rising gasoline, food and other costs began to hit U.S. households.

- In recent months, approval of Biden had been hovering above 40%.

Interviews with poll respondents suggest the public has mixed feelings about Biden.

Lowest In 27 Months

2- POLITICAL POLARIZATION & GRIDLOCK

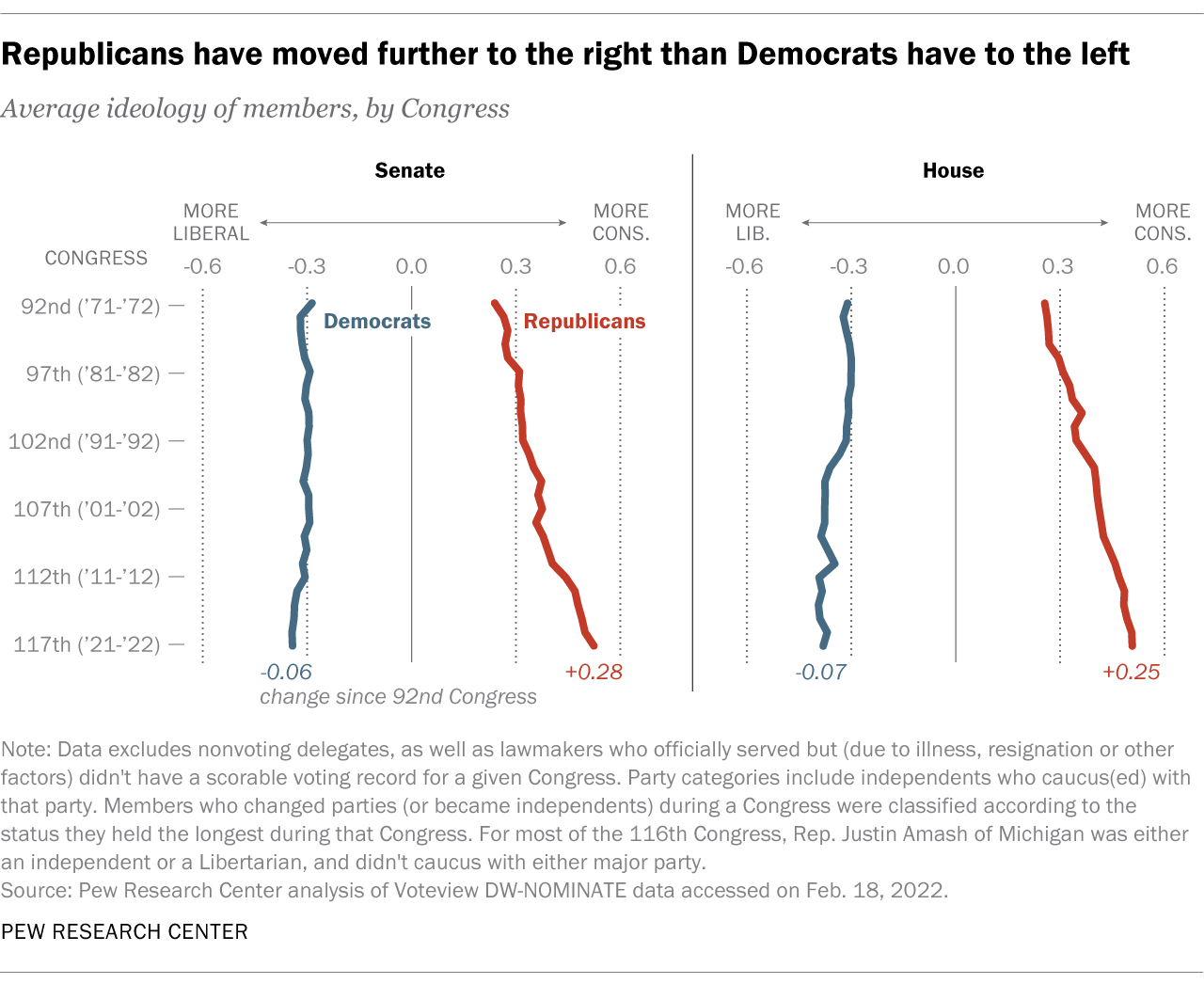

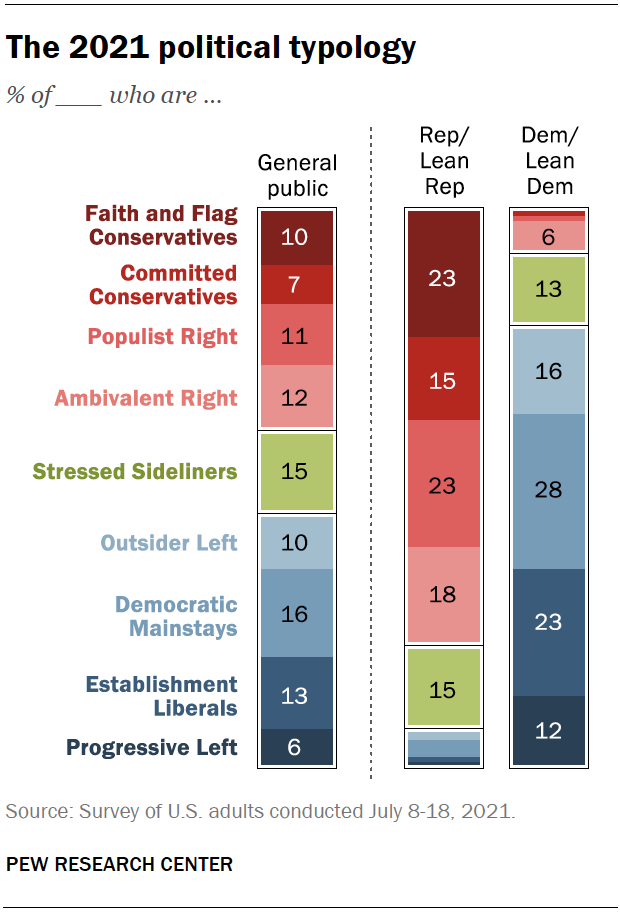

According to PEW Research, on average, Democrats and Republicans are farther apart ideologically today than at any time in the past 50 years.

Both parties have grown more ideologically cohesive. There are now only about two dozen moderate Democrats and Republicans left on Capitol Hill, versus more than 160 in 1971-72.

Across 10 measures that Pew Research Center has tracked on the same surveys since 1994, the average partisan gap has increased from 15 percentage points to 36 points.

3- MIDST OF DISTRACTING CULTURAL WARS

New beliefs, as represented by the movements pushing ideas such as Woke, Transgender, CRT, DEI, ESG, Open Borders, merge with increases in crime, criminal justice leniency, mass killings, domestic terrorism, and cancel culture.

The Economist (Lean Left media bias), shows the distribution of ideology of House candidates who won their primaries in 2018.

Democracy is built on compromise, and historically, a set of shared values tied Americans together and helped those on the Left and Right to come to mutual agreement — even with their differences. But as the overlap between the parties — and the core values they embody — draws ever farther apart, it becomes increasingly hard to imagine how Americans will be able to solve problems through mutual agreement.

EXAMPLES:

-

- Government aid. More Democrats and Democratic-leaning independents say the government should do more to help the needy, even if it means going deeper into debt. 54% believed this 6 years ago; now 71% do. Between 2007 and 2011, the share of Republicans expressing this view fell from 45% to 25%.

-

- Race. When Pew asked Americans if they believe racial discrimination is the main reason many blacks cannot get ahead, they found a difference of 50 points between Republican and Democratic views. That gap was 13 points in 1994, and 19 points in 2009.

-

- Immigration. In 1994, 32% of Democrats said immigrants strengthen the nation; now a whopping 84% do. Republicans are divided: 42% have a positive view of immigrants, and 44% say they’re a burden becasue they take jobs, healthcare, and housing. Yet Republicans have inched closer to Democrats in their views: in 1994, 30% of Republicans had a positive view of immigrants, while 64% said they were a burden.

GLOBAL PERSPECTIVE: The Void In Global Leadership Will Be Seized!

Few have the insights that Victor Davis Hanson has consistently exhibited. He summarized the problem as few can.

Our enemies do not fear us, our allies judge us unreliable, and neutrals assume America is in descent and too dangerous to join…

-

- Why is French President Emmanuel Macron cozying up to China while trashing his oldest ally, the United States?

- Why is there suddenly talk of discarding the dollar as the global currency?

- Why are Japan and India shrugging that they cannot follow the United States’ lead in boycotting Russian oil?

- Why is the president of Brazil traveling to China to pursue what he calls a “beautiful relationship”?

- Why is Israel suddenly facing attacks from its enemies in all directions?

- What happened to Turkey? Why is it threatening fellow NATO member Greece? Is it still a NATO ally, a mere neutral, or a de facto enemy?

- Why are there suddenly nonstop Chinese threats toward Taiwan?

- Why did Saudi Arabia conclude a new pact with Iran, its former archenemy?

- Why is Egypt sending rockets to Russia to be used in Ukraine?

- Since when did the Russians talk nonstop about the potential use of a tactical nuclear weapon?

- Why is Mexican President Andrés Manuel López Obrador bragging that millions of Mexicans have entered the United States, most of them illegally? And why is he interfering in U.S. elections by urging his expatriates to vote for Democrats?

- Why and how, in just two years, has a confused and often incoherent Joe Biden and team created such global chaos?

Let us answer by listing 10 ways by which America lost all deterrence:

1) Joe Biden abruptly pulled all U.S. troops from Afghanistan. He left behind to the Taliban hundreds of Americans and thousands of pro-American Afghans. Biden abandoned billions of dollars in U.S. equipment, the largest air base in central Asia—recently retrofitted at a cost of $300 million—and a $1 billion embassy. Our government called such a debacle a success. The world disagreed and saw only humiliation.

2) The Biden Administration allowed a Chinese high-altitude spy balloon to traverse the continental United States, spying on key American military installations. The Chinese were defiant when caught and offered no apologies. In response, the Pentagon and the administration simply lied about the extent that China had surveilled top-secret sites.

3) In March 2021, at an Anchorage, Alaska mini-summit, Chinese diplomats unleashed a relentless barrage at their stunned and mostly silent American counterparts. They lectured the timid Biden Administration diplomats about American toxicity and hypocrisy. And they have defiantly refused to explain why and how their virology lab birthed the COVID virus which has killed tens of millions worldwide.

4) In June 2021, in response to Russian cyber-attacks against the United States, Biden meekly asked Putin to at least make off-limits certain critical American infrastructure.

5) When asked what he would do if Russia invaded Ukraine, Biden replied that the reaction would depend on whether the Russians conducted a “minor incursion.”

6) Between 2021 and 2022, Joe Biden serially insulted and bragged that he would not meet Muhammad bin Salman, the de facto ruler of Saudi Arabia, and one of our oldest and most valuable allies in the Middle East.

7) For much of 2021, the Biden Administration made it known that it was eager and ready to offer concessions to re-enter the dangerous Iran nuclear deal—at a time when Iran has joined China and Russia in a new geostrategic partnership.

8) Almost immediately upon inauguration, the administration moved the United States away from Israel, restored financial aid to radical Palestinians, and both publicly and privately alienated the current Netanyahu government.

9) In serial fashion, Biden stopped all construction on the border wall and opened the border. He made it known that illegal aliens were welcome to enter the United States unlawfully. Some 6-7 million did. He reinstated “catch and release.” And he did nothing about the Mexican cartel importation of fentanyl that has recently killed over 100,000 Americans per year.

10) In the last two years, the Pentagon has embarked on a woke agenda. The army is short by 15,000 in its annual recruitment quota. The defense budget has not kept up with inflation. One of the greatest intelligence leaks in U.S. history just occurred from the Pentagon. The Pentagon refused to admit culpability and misled the country about Afghanistan and the Chinese spy balloon flight. The current chairman of the Joint Chiefs of Staff called his Chinese communist counterpart and head of the People’s Liberation Army to advise him that the U.S. military would warn the Chinese if it determined an order from its commander-in-chief was inappropriate.

This list of these self-inflicted disasters could be easily expanded. But the examples explain well enough why our emboldened enemies do not fear us, our triangulating allies judge us unreliable, and calculating neutrals assume America is in descent and too dangerous to join.

COMMERCIAL OFFICE REAL ESTATE – More Thought Leaders Agreeing With MATASII

John Rubino was co-host of Macro Analytics with me for many years. When John feels as strongly about something as he does here, investors should heed his sage advise! As the author of “Dollar Collapse”, he is a well recognized authority.

“Basically, interest rates have been artificially low for a decade…

… In that time, crazy numbers of office buildings went up and were financed at really low rates… Now, office vacancy rates are spiking, which means office building are not profitable anymore.

The debts they have at 2% to 3% now have to be rolled over at 5%, 6% or 7%. This means an already unprofitable office building is going to be even more unprofitable because of rising interest rates. Now, they want to sell this office space, and the price cuts that have to be done to get a deal done is 30% to 50%… Some are down by 80%…

Local and regional banks already had their troubles last month, but are going to have bigger troubles when all these buildings turn out to be not worth nearly as much as we thought they were. This paper is in pension funds… they are going to go into crisis.

So, real estate is liable to be the catalyst in crisis in several other sectors… The government is going to have to let it burn and have a 1930’s style depression, or bail out everybody in sight… at the cost of rising inflation and the dollar tanking.”

Rubino says, “There is no fix…”

“There is no way to refill these buildings. There is no way to refinance them without going bankrupt…

Sometime this year we are going to drop back into negative growth, and it’s going to be a bloodbath. There is no solution, and these guys see it coming and they have no idea what to do about it…

This is the sector we want to watch and will be the catalyst for the next big crisis…

The next bailout crates a lot of new dollars, and that pushes down the dollar, and then, we are in the death spiral where there is no fix.

That is out there waiting to happen, a bailout so huge that it terrifies holders of the currency and Treasury bonds.

Then it’s game over… This is just a question of when people figure this out. That really is our situation right now.”

“This is a much bigger story than what happens to the dollar as the reserve currency. This is the end of a global monetary experiment that is going to go out with a very fiery end. This is not going to be fun to watch.”

CONCLUSION

CURRENCIES: Currencies Mirror Political & Economic Strength

CURRENCIES: Currencies Mirror Political & Economic Strength

-

- Over time currency will mirror the political strength of a country as shown by policies that deliver a strong economy, the strength of its military and social stability

In this week’s expanded “Current Market Perspectives” we focus on the US Dollar as a follow on from our discussions in the body narrative, as an adjunct to what is happening as a result of, and in concert with, the “Fourth Turning”.

It is quite alarming when the US$ follows the movements in the US Credit Default Swap Rate!

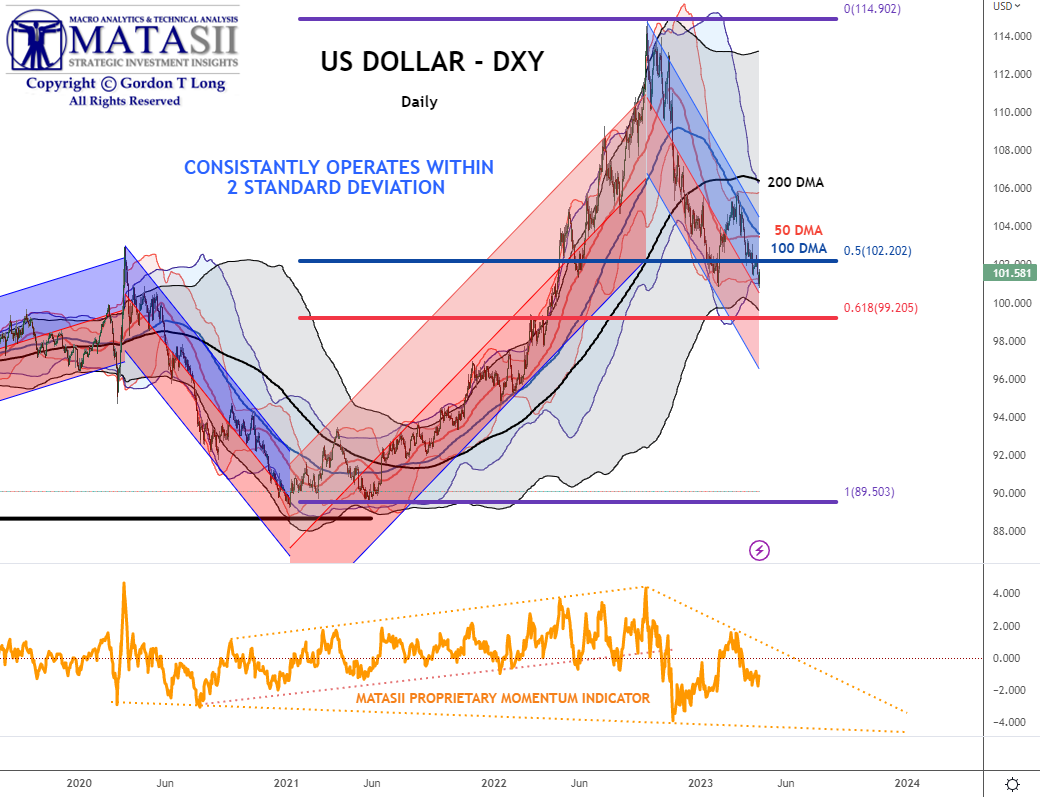

MORE DOWNSIDE FOR US$ SHORT TERM!

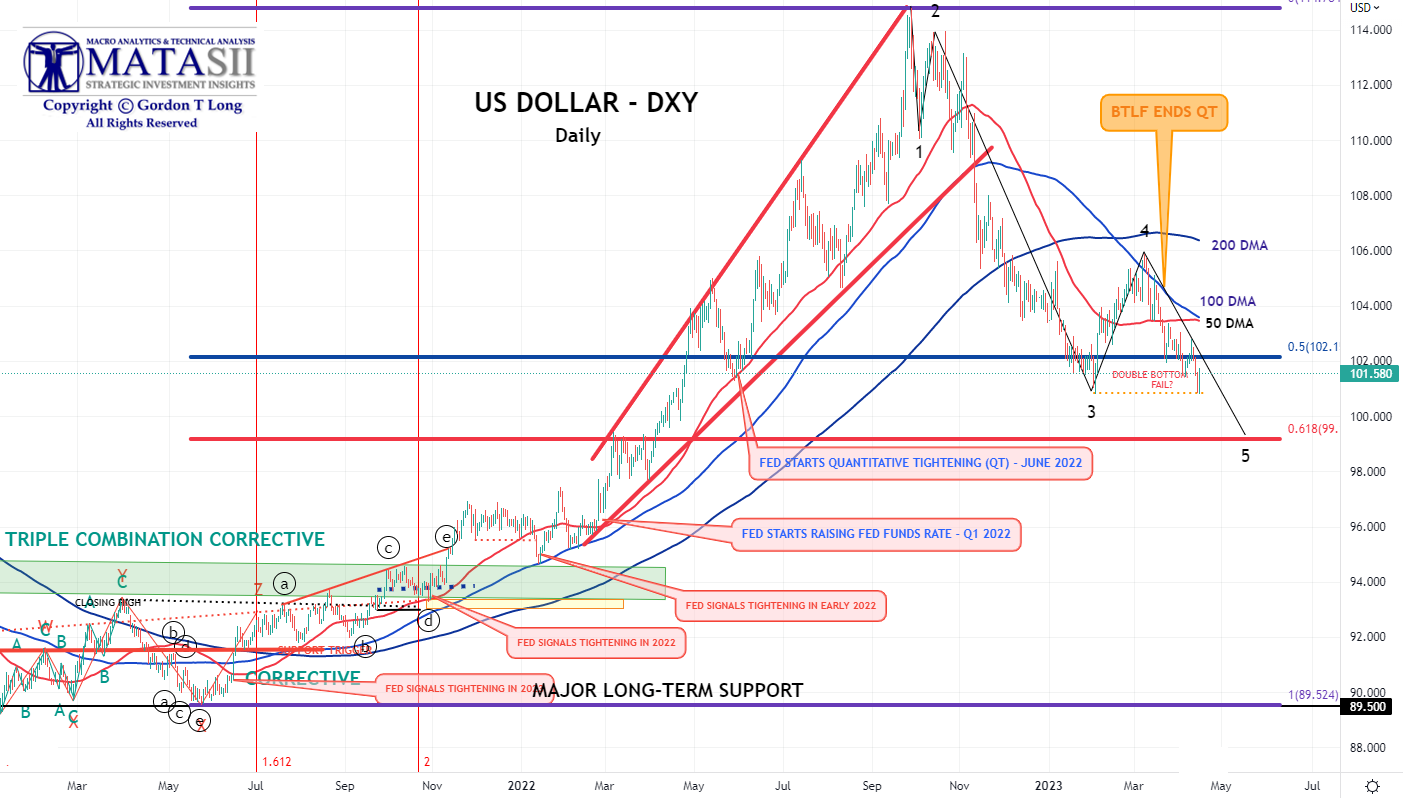

The US Dollar has entered a long term bear market and we are completing the initial Wave 2 counter rally! Expect further short term US$ weakness before looking for a US$ trading bounce, after the Fed ends its hiking cycle May 3rd. Only then consider going short the greenback with a full understanding that any advancing financial crisis could trigger a temporary Flight-to-Safety of the US Dollar!

THE DOLLAR, YEN, EURO & YUAN

We believe during the October 2022 UK Budget debacle, resulting in the British PM resigning and forcing major BOE intervention to stabiize the situation, that a coordinated global central bank plan was implemented.

Additionally, a steadily rising US Dollar was in parallel wrecking havoc world wide and needed to be weakened to stabilize the global economy from the possible destabilizing impacts of the UK problems.

The major global currencies, as a consequence, all reflect abrupt reversals from their October lows with the US reversing downward from its peak. The counter rallies are now nearing overhead resistance, while the US Dollar is reaching key support levels.

Though there is a little more to go, we should expect the prior trends in global currencies to soon resume their prior trends in the short to intermediate term.

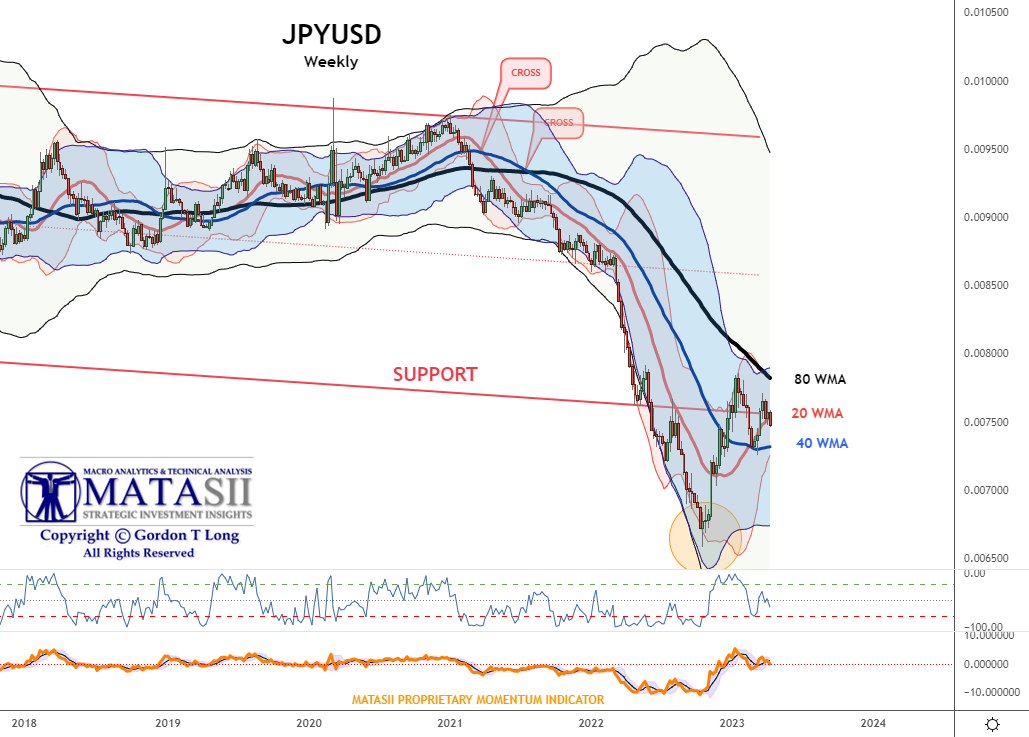

JPYUSD

Likely to find overhead resistance at its 80 WMA (Black MA).

Macro Analytics Chart Above: SUBSCRIBER LINK

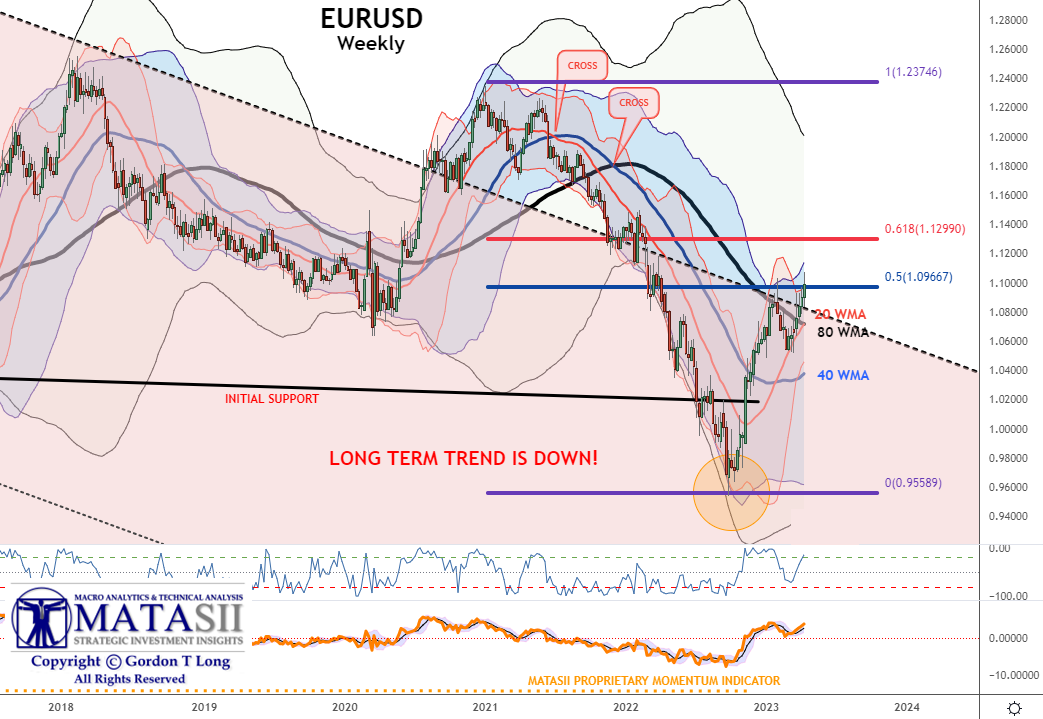

EURUSD

Likely to find overhead resistance at a 61.8% retracement (red line) of its prior downleg.

Macro Analytics Chart Above: SUBSCRIBER LINK

CNYUSD

Likely to find overhead resistance at its 80 WMA (Black line) and underside of prior rising trend channel.

Macro Analytics Chart Above: SUBSCRIBER LINK

DOUBLE CHARTS BELOW

The preponderance of economic analytic work that we have examined suggests further US Weakness going forward. However, if the unfolding global slowdown causes major financial disruptions, a dollar flight to safety can be expected, despite the current media onslaught of negative US dollar news!

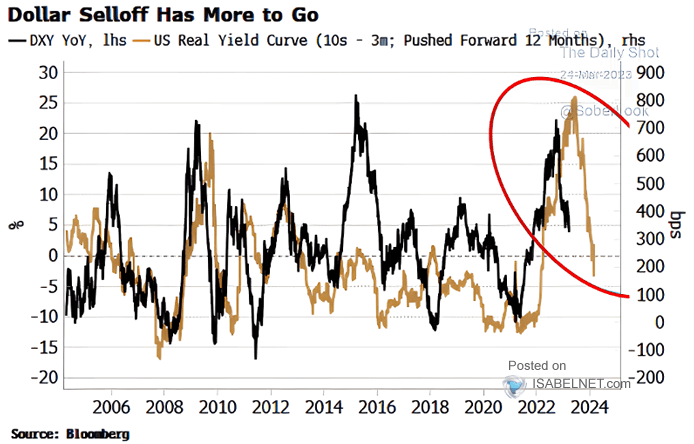

DXY v US REAL YIELD CURVE (10Y-3M):

The US Real Yield Curve as represented by the 10Y-3Mo is suggesting further dollar weakness still ahead!

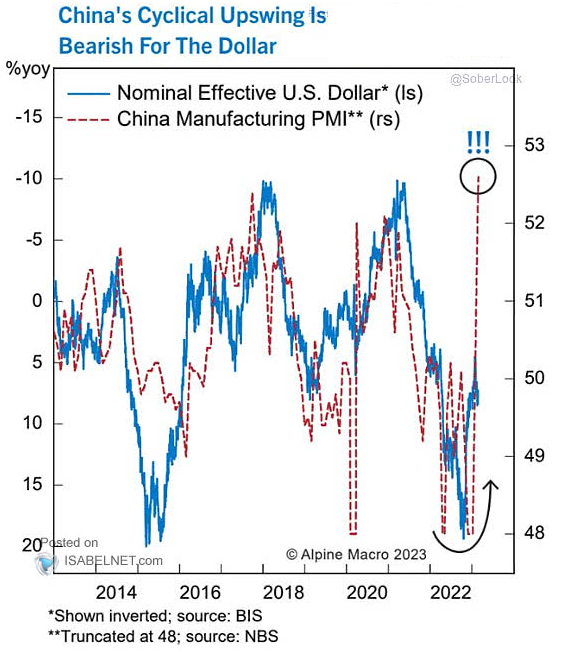

Nominal Effective US Dollar v China’s Manufacturing PMI: A Bearish Signal

DXY – SHORT TO INTERMEDIATE TERM

We currently seeing the US Dollar (DXY) further weakening to find suport at the 61.8% Fibinacci Retracement level (red line below). This should complete wave 5 of a larger degree Wave 4 within the Bear Market Wave 2 (see Long Term Count, bottom chart).

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

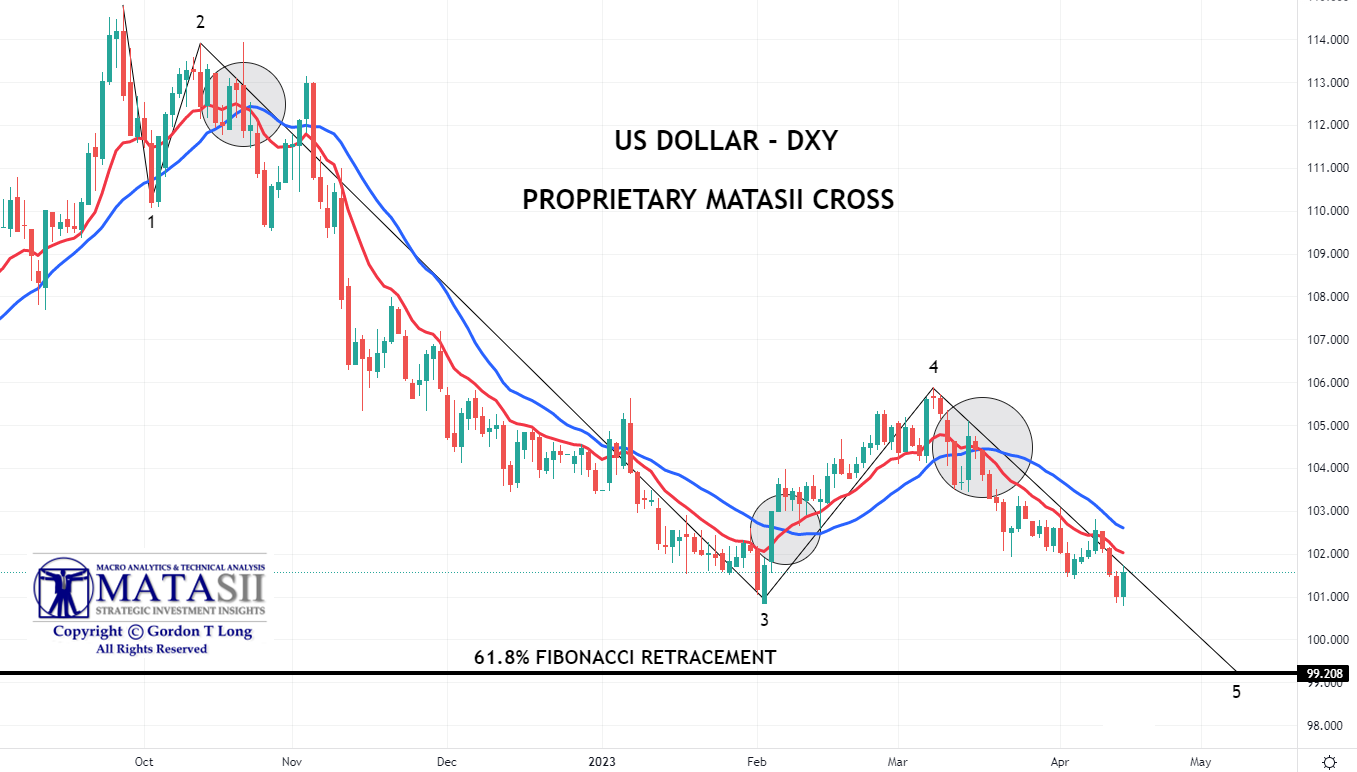

PROPRIETARY MATASII CROSS

The proprietary MATASII Cross on a shorter term Daily chart is currently on a SELL Signal indicating a move towards the 61.8% Fibonacci Retracement Support level at ~99.208 on the DXY.

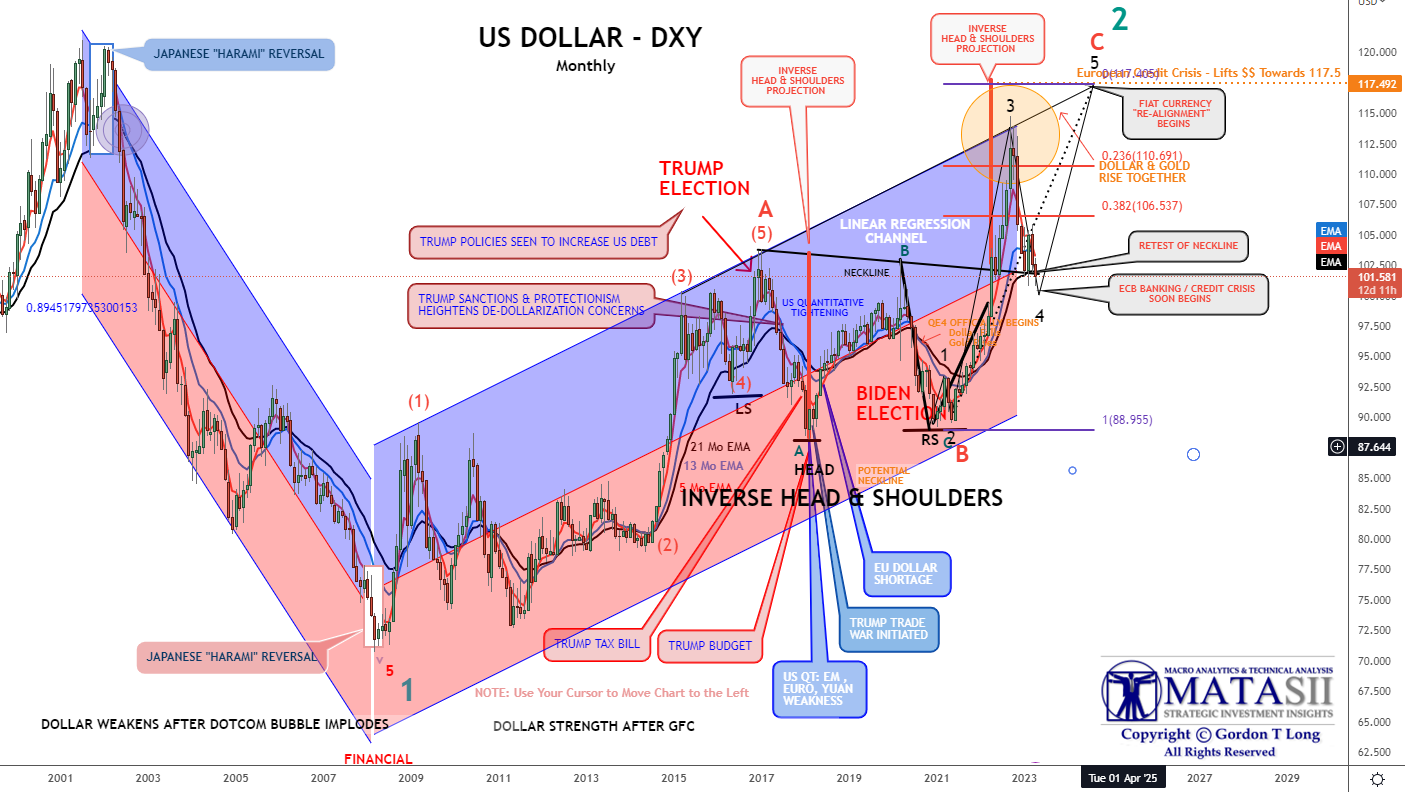

DXY – LONGER TERM

Longer Term we still see the US Dollar completing its longer term lift to finish counter rally Wave 2. Our current sense is that this final wave will most likely be about serious global financial dislocations primarily resulting from an EU Banking crisis.

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.

John Rubino

John Rubino