TIPPING POINT

FUNDAMENTALS

THE TIME FOR THE INDIRECT EXCHANGE HAS ARRIVED

OBSERVATIONS: NEXT UP – PROPERTY TAX INFLATION

Small Businesses predominately fail because of Cash Flow problems. They don’t fail due to a bad business plan, bad strategy, bad product – they fail because unexpected cash issues associated with major unpaid receivables, litigation costs, unexpected regulation changes etc. They find the banks then abruptly refuse to lend anymore. Not being able to pay their bills, payrolls and contractual commitments, owners are legally forced to declare bankruptcy. The banks’ closely watched “cash clock” is always ticking!

Farmers in the Great Depression lost their farms because of the “Dirty Thirties” dust storms which ruined crops, allowing the banks to legally “pull the plug” on them and seize the collateral. The villain here was the banks. My grandfather never missed an opportunity to expound: “banks will lend you an umbrella on a sunny day but quickly ask for it back when it starts to rain!”

2007 MORTGAGE CRISIS

When values fell in 2007, the banks quickly demanded higher collateral be posted by homeowners. Families didn’t have the money and suddenly there was a mortgage and banking crisis.

The banks were bailed out as “too big to fail”, the shrill of the day. Fannie Mae and Freddie Mac were placed in “Conservatorship” (Nationalized) and the banks were relieved of their “Mark-to Market” derivatives burden (never was reinstated?).

2025 PROPERTY TAX CRISIS

Housing is now beyond affordable for buyers. Soon it will be unaffordable for owners!

Everyone who owns a house can be counted on, if given even the slightest opportunity, to expound on how much they have made on their house. What they don’t say is they are “house poor” trying to carry the mortgage and rising mortgage insurance while absorbing unprecedented inflation on everything.

As savings have plummeted to all time lows, while credit card debt explodes higher with predatory rates, the problem they are now ill prepared to handle is a cash flow problem. A shock that is soon to appear as property taxes rise to match their exploding higher property appraisal prices.

Homeowners are extremely wealthy on paper but today are historically cash flow poor. This is a recipe for banks to again seize assets on delinquent mortgage payments. There is a ready market for these houses from major Private Equity firms ready to cobble up the properties with better collateral financing.

I have retired friends who found their property taxes spike to become equal to their social security checks. It forced them to sell and leave the state they were living in (one in Illinois, the other in California).

It is coming – are you prepared??

WHAT YOU NEED TO KNOW!

PREPARE FOR A HARD LANDING!

PREPARE FOR A HARD LANDING!

The Yield Curve & Christine Lagarde Agree… Don’t Expect A “Soft Landing”! The curve has inched slightly back up but remains stubbornly inverted, and now even the Wizards of Global Finance themselves like European Central Bank President Christine Lagarde are warning against assuming a “soft landing” is anything but assured for the global economy.

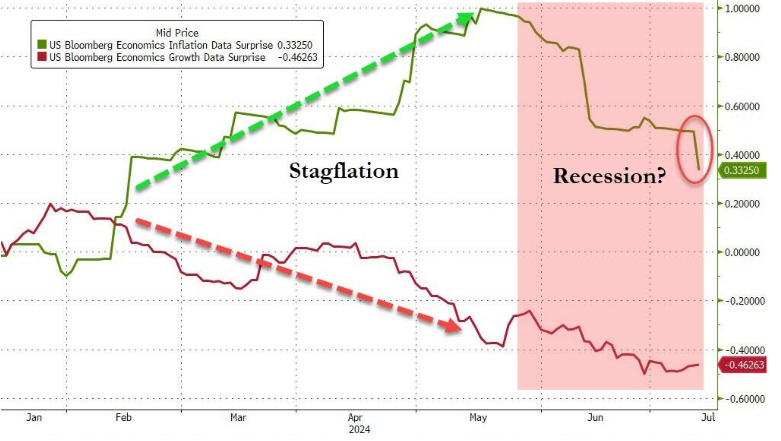

Inflation and growth factors are now tumbling in a ‘recessionary’ kind of way (CHART RIGHT).

All of which has prompted a surge in rate-cut hopes, with 2024 expectations at their highest since April (61bps) as 2025 is now pricing in four full rate-cuts.

RESEARCH

THE TIME FOR THE “INDIRECT EXCHANGE” HAS ARRIVED!

-

- There is NOTHING SAFE or RISK FREE in Storing wealth in Fiat currency or Sovereign Bombs (.. er BONDS)!

- Holding Fiat Currencies is not a way to STORE WEALTH and Value, or CREATE cash flow!

- Storing wealth in PAPER is a RECIPE for CONFISCATION of your WEALTH!

- Since going of the Gold Standard the US Dollar became a FIAT Currency because it can’t assure it will be a Store of Value. Specifically, it can be debased by simply creating more of it. That is the problem we have today. The dollar continues to lose its purchase power because of the expansion of the money supply at a greater rate than the creation of real wealth.

THE MASTER OF THE INDIRECT EXCHANGE – Berkshire Hathaway

-

- There is no better example than the King of the Indirect Exchange – Warren Buffett and Berkshire Hathaway. Buffett has an extensive portfolio of various types of Insurance companies which we will use as an example.

- Buffett takes continuously diminishing paper money and exchanges it for companies which create more (cash flow) than they consume for inelastic (basic industries) products and services for Consumers.

- He then rides the waves of Inflation and Deflation (Booms and Busts of fiat currencies and credit based financial system) to create opportunities just like bankers do!

- Buffett sells paper claims (Insurance) whose claims are constantly debasing; (Money creation reduces the purchasing power of paper claims) and invests in Real things (will re-price to reflect the lower purchasing power of the currency they are denominated in) that cash flow.

- His Insurance liabilities recede at the rate of debasement, while his Wealth multiplies with:

- Cashflow and

- Repricing of the asset in debasing IOU’s (known as Fiat Currency)

Q2 EARNINGS SEASON

-

- Investors are increasingly worried about the deviation of earnings expectations being so far above long term growth trends.

- NVIDIA, Amazon.com, Meta Platforms, and Alphabet are expected to report year-over-year earnings growth of 56.4% for the second quarter.

- Excluding these four companies, the blended (combines actual and estimated results) earnings growth rate for the remaining 496 companies in the S&P 500 would be 5.7% for Q2 2024.

- Overall, the blended earnings growth rate for the entire S&P 500 for Q2 2024 is 9.7%.

DEVELOPMENTS TO WATCH

1- DECEMBER 2023 – THE ELECTION YEAR PUMP

1- DECEMBER 2023 – THE ELECTION YEAR PUMP

-

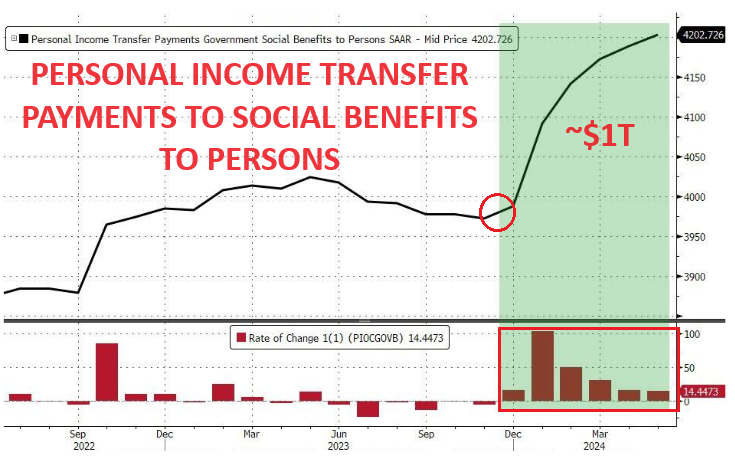

- Beginning in December 2023 Government Personal Income Transfer Payments to Social Benefits for Persons (Illegal Immigrants) began.

- Over 6 Months it totaled ~$1Trillion.

- This Direct Treasury Liquidity Injection triggered an unprecedented Election Year Market Surge.

2- NATO – EXPLODING DEFENSE SPENDING

-

- In 2023, the U.S. accounted for $860 billion spent by member countries in the organization, representing 68% of the total expenditure.

- This amount is over 10 times more than that of the second-placed country, Germany.

- Twenty-three of NATO’s 32 members are now meeting the minimum level of annual defense spending (2% of GDP), stipulated for countries in the alliance. This is up significantly from 10 member countries in 2023.

GLOBAL ECONOMIC REPORTING

ADVANCED RETAIL SALES

ADVANCED RETAIL SALES

-

- The Y-o-Y retail sales growth slowed to just 2.3% – the slowest since February.

- May 2024’s upward revision was the largest since May 2023.

- Core (Ex-Autos) retail sales soared 0.4% MoM (well above the 0.0% exp) and May was also revised higher.

INDUSTRIAL PRODUCTION

-

- The Y-o-Y retail sales growth slowed to just 2.3% – the slowest since February.

- May 2024’s upward revision was the largest since May 2023.

- Core (Ex-Autos) retail sales soared 0.4% MoM (well above the 0.0% exp) and May was also revised higher.

FED DISTRICT BANK SURVEYS

-

-

- 5 out of 12 Fed Districts Show Flat or Declining Economic Growth.

- Very recessionary because it is very recessionary. Within 2-3 months a majority will highly likely be in decline.

-

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.