US ECONOMICS

FISCAL POLICY

THE US GLOBAL TRADE IMBALANCE PROBLEM

OBSERVATIONS: TARIFFS v EXCHANGE RATES v FREE TRADE

The market analysts and so-called economists panicking over President Donald Trump’s tariffs must be at least somewhat relieved that he’s agreed to pause the ones he wants to impose on Mexico and Canada. But they shouldn’t have been worried in the first place, because their fears are misplaced.

Trump understands the harsh reality of the situation: other nations have exploited the U.S. for decades, and it’s long past time America fought back. In fact, Trump’s actions are likely to benefit Americans greatly.

TARIFFS DON’T MEAN INFLATION – RATHER AN EXCHANGE RATE CHANGE

In the first place, the idea that tariffs are always and everywhere passed on to consumers is a fallacy, by both economic theory and the record of history. Factors such as changes in exchange rates mean that foreign producers typically end up paying some (or most) of a tariff.

We forget that during America’s Golden Age, the government essentially funded itself entirely with tariffs; the income tax didn’t even exist. Instead of tariffs wrecking untold economic calamity, they coincided with our fastest sustained levels of growth — a time that built America’s middle class not the global elite & their corporations.

But today, both our friends and foes alike abuse America in international trade and undermine her potential to thrive. For example, Mexico has been working with China to circumvent tariffs and non-tariff barriers (NTBs) on China and abuse provisions of the trade deal between Mexico and Canada (USMC). That makes it impossible for American companies and American workers to compete.

Slapping a tariff on both Mexico and China penalizes this kind of underhanded dealing and puts American exporters back on a more level playing field. When asked about tariffs on the European Union, Trump said he’ll use the same playbook, and rightfully so.

VALUE ADDED TAX (VAT) v TARIFFS

Many European nations use schemes like value added taxes (VATs) to impose implicit tariffs on American exports. Furthermore, countries like Germany and Japan still have tariffs that were put in place after World War II to protect industries being rebuilt following the conflict. The status quo has completely changed, and there’s no reason for these nations to continue penalizing American farmers and factory workers. We finally have a president who recognizes these realities and who is implementing a carrot-and-stick approach to reshuffle the international paradigm in America’s favor.

Trump is simultaneously making it more expensive to produce abroad and hire foreigners, while making it less expensive to produce domestically and hire Americans through his plans for:

-

- Deregulation & Government Downsizing

- Lower Marginal Tax Rates, and

- Abundant Energy

… which will all contribute to lower costs of production in the U.S. while tariffs will increase costs on overseas production. How does this play out?

THE TRUMP CARD

Consider Canada, whose leaders are ranting about Trump standing up for Americans. If Canada agrees to eliminate its own tariffs and NTBs, then American exporters, like dairy farmers, will be more competitive and will sell more product in Canada. That means doing more business and employing more Americans.

If Canada remains obstinate and insists on a trade war, then Canadian products will be less competitive, opening the door for American producers, like foresters, to expand production and sell more domestically while employing more Americans. Trump is positioning the American worker to come out on top either way.

As economist Art Laffer has noted, there are no winners in trade wars, but the losers can face drastically different losses. Nearly all Canadian exports go to the U.S., but only a small fraction of American exports go to Canada. If international trade between the two slows dramatically, it’ll lead to a steep recession in Canada but will be more like a speed bump for the U.S. In short, Trump holds all the cards. And he knows it.

TRADE DEFICITS

But it’s not just a matter of getting other nations to fully open their markets to American exporters; it’s about the trade deficit, which can’t go on forever. Economic textbooks sometimes explain away the deficit by pointing out that individuals often have steep trade deficits with retail stores, like Walmart or Amazon, and that doesn’t cause the individual to go bankrupt.

While that’s true, this singular trade deficit is only possible in the long run, because the individual has a massive trade surplus somewhere else, like their place of employment.

America’s long-standing deficit has been funded by the Federal Reserve, which has effectively been printing money and sending it around the world to finance our elephantine trade deficits for decades. This process has devalued the dollar over the years, so that Americans’ money doesn’t go as far as it used to — a phenomenon we call inflation.

But the inflationary impact of our trade deficits has been blunted by the dollar’s status as the world’s reserve currency. If we suddenly lose that, however, America may face hyperinflation. That’s why Trump has threatened tariffs on countries that seek to dethrone King Dollar from its place in the world monetary order — a quick end to the dollar’s reserve currency status would be disastrous.

FREE TRADE

Lastly, Trump understands the misnomer of “free trade.” If we really want free trade, then why only advocate for it in international markets? Why not domestic transactions too? In other words, if taxes on international trade are so bad, then why do we allow taxes on domestic trade — like the income tax, which is a tax on labor?

Free trade should apply first and foremost to domestic trade, because we should be focused on benefiting our own citizens before we worry about those overseas. We don’t hate foreigners — we just love Americans more.

E.J. Antoni – Research Fellow, Heritage Foundation

WHAT YOU NEED TO KNOW!

US IS RAPIDLY FALLING FURTHER BEHIND

US IS RAPIDLY FALLING FURTHER BEHIND

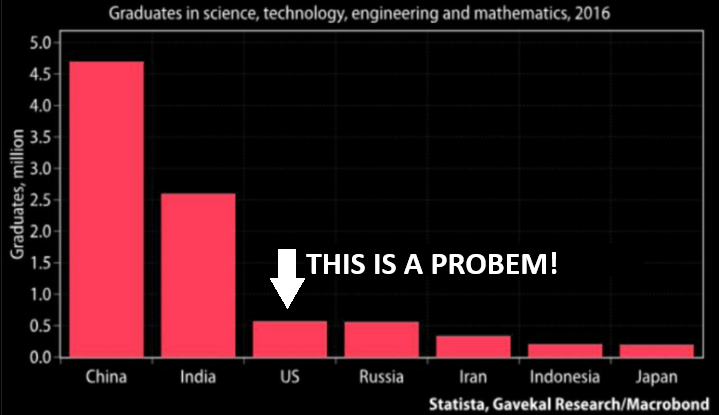

China produces as many graduates in STEM (Science, Technology, Engineering & Mathematics) as the next 4 countries combined. Meanwhile Europe’s graduates are more and more in less and less useful subjects.

NOTE: Patent and Research Papers being filed also mirrors this chart!

RESEARCH

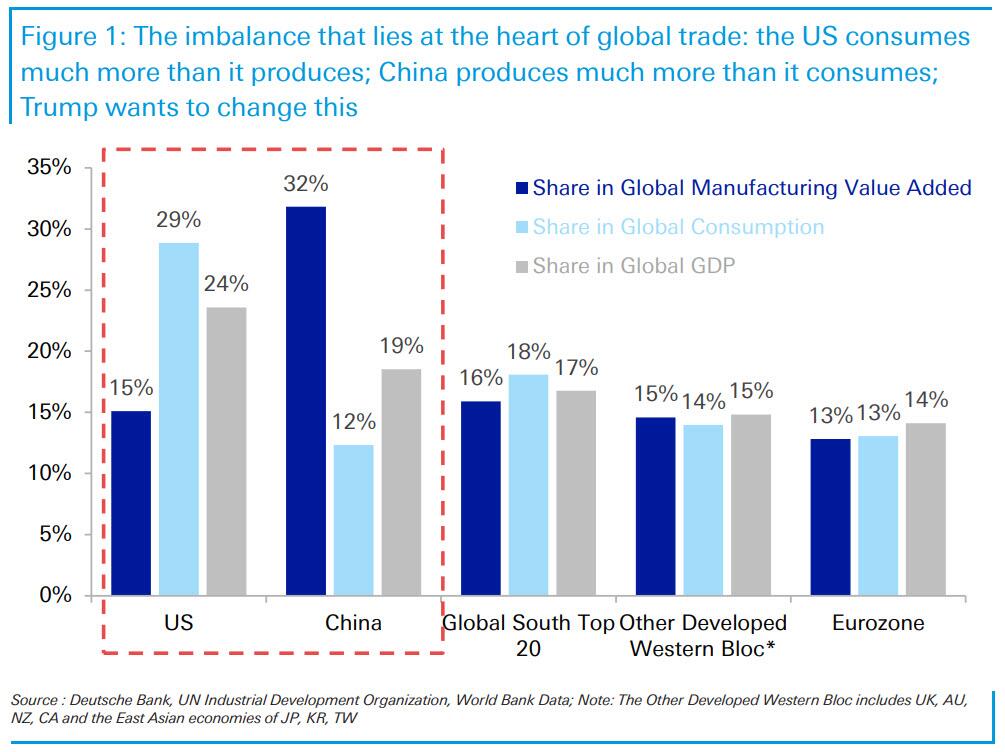

1- THE US GLOBAL TRADE IMBALANCE PROBLEM

1- THE US GLOBAL TRADE IMBALANCE PROBLEM

-

- The US Has Two Central Structural Problems:

-

-

- The US Consumes More Than It Produces versus China Producing More Than It Consumes.

- Fiscal Stimulus (Deficit Spending) Is No Longer Viable for achieving US Economic Growth!!

-

-

- Unless the Trump Administration strategically addresses these problems, it will fail!

- The $7tn US government is now 3rd largest economy in world, and Trump/Musk need US government recession to arrest US debt spiral (interest payments rise $100B-300B next 12 months).

- Speaker Johnson must persuade GOP deficit-hawkish Freedom Caucus to back Trump tax cuts (via budget reconciliation).

- DOGE (Department of Government Efficiency) needs to target $1T of public sector savings.

2- PREPARING FOR THE TRADE WAR WITH EUROPE

-

- The EU is a big trading partner for the US with around 15% of US imports from the EU.

- European indices, along with China and other EMs, tend to be highly sensitive to tariff announcements.

- Autos and Cyclicals generally are most vulnerable to rising trade uncertainty. Also of note, Goldman’s GRANOLAS basket (GSK, Roche, ASML, Nestlé, Novartis, Novo Nordisk, L’Oréal, LVMH, AstraZeneca, SAP, and Sanofi) which have under-performed recently, tend to be outperformers when trade policy uncertainty rises.

- 30% of STOXX 600 assets are now in the US vs. 18% in 2012. The trend to re-shore in the US is expected to continue regardless of tariff imposition on Europe.

- Goldman’s FX strategists are looking for EUR/USD at 0.97 and GBP/USD at 1.20 over 12-months partly on growth/rate differentials and partly on trade uncertainty – and of course the two things are interconnected.

- A lot of investors in the European equity market are dollar-based. This means that, unless they currency-hedge, they will lose in an FX fall, which discourages investment.

- Economists estimate that a 10% tariff rate on all US imports could knock 1% off Euro area growth (assuming full retaliation). Given the bank already forecasts low European EPS growth this would easily eliminate profit growth in 2025.

- US equities could prove more vulnerable if investors see these tariffs as a reason to reassess their assumptions about the risks that the Administration is willing to take with the growth and inflation outlook.

DEVELOPMENTS TO WATCH

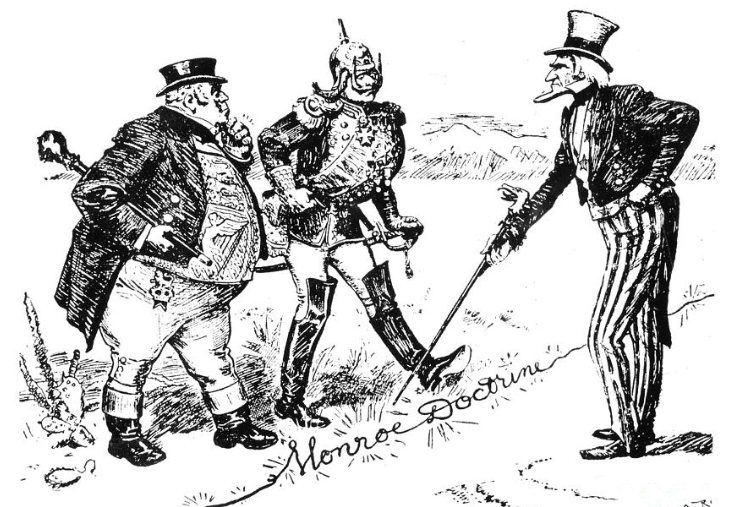

1- MONROE DOCTRINE 2.0 — AN EXPANDING USMC

1- MONROE DOCTRINE 2.0 — AN EXPANDING USMC

-

- It increasingly looks like a looming Monroe Doctrine Pan -North American trade stance is being framed.

- With 25% tariff threats Trump quickly achieved forced action by Mexico and Canada which is but the opening salvo in aligning these southern and northern territories with US trade goals.

- Next is likely a more globally encompassing, impenetrable and beneficial trade agreement for all three USMC parties.

- Using Immigration and Opioids as the initial “binding agent” Trump is likely to next use the Auto industry as the key strategic “bonding agent”.

2- HEDGE FUNDS HAVE BEGUN INCREASING THEIR SHORT POSITIONS

-

- The number of hedge fund strategies likely short the stock market is rising rapidly.

- The rise in the short count began before President Trump was elected and has gathered pace since then.

- Commodity Trading Advisors (CTAs) are also becoming more negative on the outlook.

- Hedge funds have also adopted an increasing dim outlook.

GLOBAL ECONOMIC REPORTING

EMPLOYMENT (NFP)

EMPLOYMENT (NFP)

-

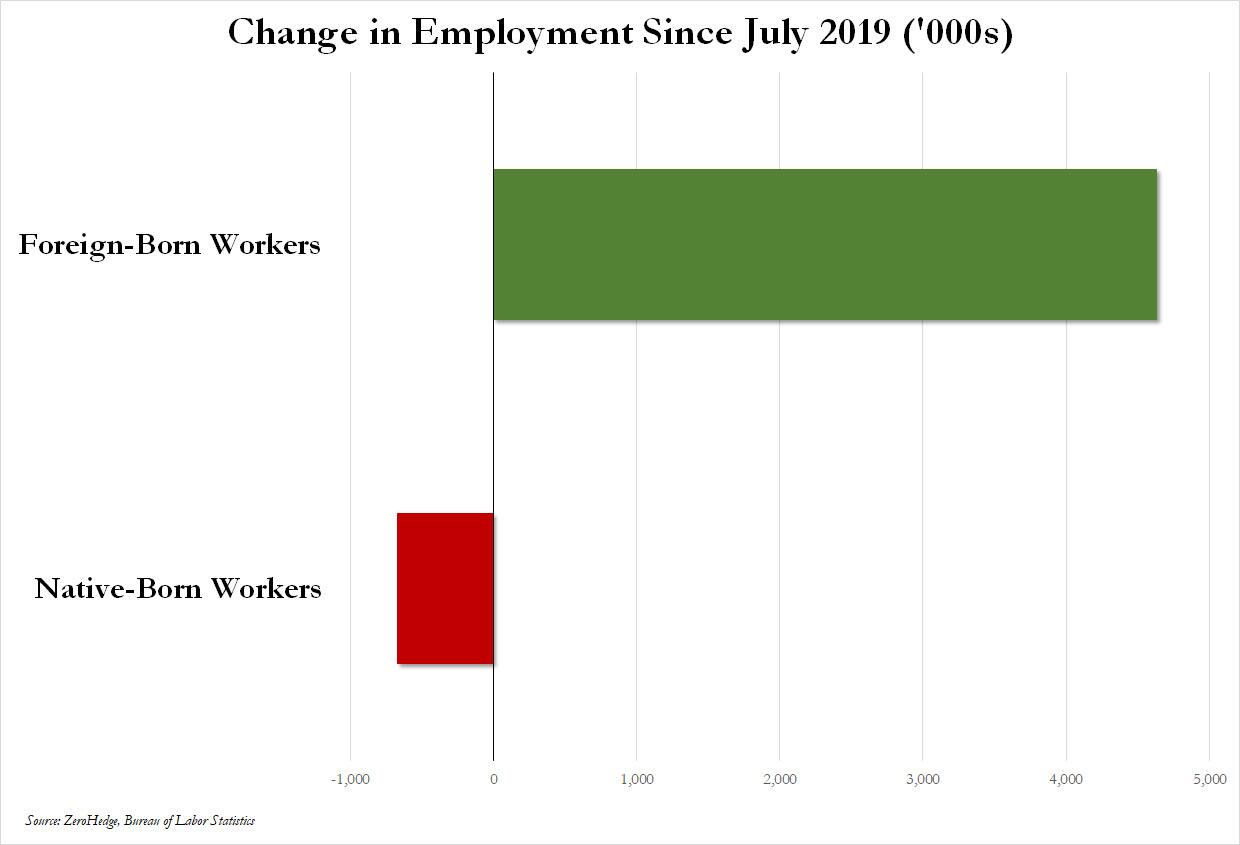

- While we just hit another month of record foreign-born, (largely illegal alien), workers at 31.774 million, the number of native-born workers remains unchanged over the past six years, still below levels last hit in 2019, just before the covid crisis.

- Since July 2018, the US labor force has added 4.6 million foreign-born workers, while the number of native-born workers has declined by nearly 700K.

- The only job growth the past 6 years in the US has been for foreigners.

TREASURY QUARTERLY REFUNDING ANNOUNCEMENT (QRA)

-

- Bessent left intact former Secretary Janet Yellen’s agenda. As widely expect, the Treasury will next week sell $125 billion of debt in its quarterly refunding auctions, which span 3-, 10- and 30-year maturities, the same amount as in the past several quarters. The gross issuance will refund $106.2 billion of privately-held Treasury notes and bonds maturing on February 15, 2025, and will raise new cash from private investors of approximately $18.8 billion. The securities are:

- A 3-year note in the amount of $58 billion, maturing February 15, 2028,

- A 10-year note in the amount of $42 billion, maturing February 15, 2035,

- A 30-year bond in the amount of $25 billion, maturing February 15, 2055.

- Bessent left intact former Secretary Janet Yellen’s agenda. As widely expect, the Treasury will next week sell $125 billion of debt in its quarterly refunding auctions, which span 3-, 10- and 30-year maturities, the same amount as in the past several quarters. The gross issuance will refund $106.2 billion of privately-held Treasury notes and bonds maturing on February 15, 2025, and will raise new cash from private investors of approximately $18.8 billion. The securities are:

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.