US ECONOMICS

INVESTMENT CYCLE

TIME TO INVEST IN THE US & EU DEFENSE SECTORS?

OBSERVATIONS: THE EU HAS ENTERED A DEATH SPIRAL OF ITS POLITICAL MAKING!

The economy of the European Union operates on an inverted economic model. It puts entitlement spending as its pillar, instead of seeing that the welfare state is, at best, a consequence of wealth creation, not a cause. Without a thriving private sector, there is no welfare. Politicians forget that you cannot provide citizens with social programs if the productive economy is weakened by political overreach.

In the latest Eurostat estimates, the ratio of social insurance pension entitlements to GDP was between 200% and 400% in European economies. Unfunded financial commitments are so large they will only be paid in a massively weakened currency if the current economic policies continue.

France is the prime example of this “upside down” approach to the economy. Putting entitlement spending at the forefront of economic policies has led to decades of stagnation, high debt and deficit, and social discontent. Taxpayers are tired, and recipients of entitlements are relegated to a “dependent subclass”.

AN INGRAINED REACTIVE FUNCTION

-

- Government spending soars and everything spent is justified under the banner of “social spending.”

- Deficit and debt rise, so the government increases taxes to balance the budget.

- If the economy grows, spending grows faster, and if the economy enters recession, the government spends even more to “protect” citizens. Thus, taxes rise even faster.

- The constant process of expropriation of productive wealth becomes a burden on growth, investment and productivity. Furthermore –

- More taxes generate lower incremental revenues and a demotivated business and workforce community that finds it impossible to thrive alongside the burden of bureaucracy and taxation.

Macron says that Europe is “underleveraged.” The statement is foolishly incorrect, of course, but it is even less believable when we look at all the unfunded commitments.

Europe needs to abandon the current high taxes and bureaucracy and cut unnecessary spending so the pension and healthcare systems remain viable. This means slashing budgets and eliminating political spending. However, no political party wants to do it because thousands of their members depend on government jobs. The situation is so desperate that European nations cannot even increase the much-needed defense budget despite acknowledging the urgency of improving investment in security.

Europe’s welfare state became the welfare of the state at the expense of its businesses and taxpayers. The European Union has human capital, great business people and entrepreneurs. However, it is being destroyed from the inside by an entrenched political class that would rather see high inflation and a weaker currency than reduce its grip on the economy.

WHAT YOU NEED TO KNOW!

WHEN THE LONGER-TERM S&P 500 RALLY STALLS

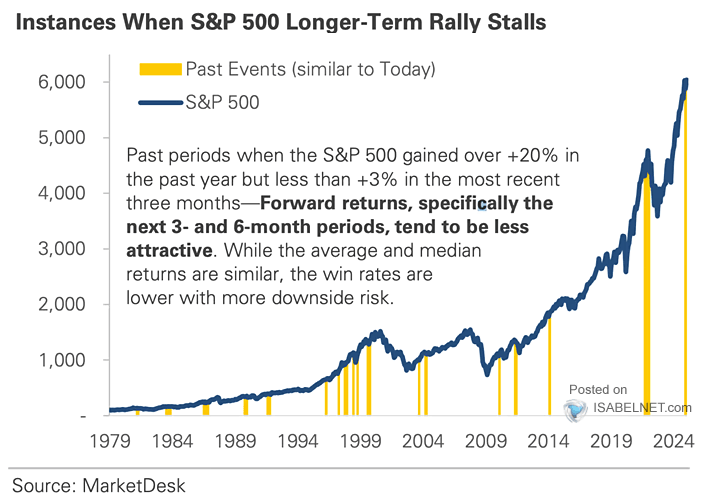

It has been my studied opinion that periods of strong annual stock gains of over 20%, then followed by short-term flat performance, have historically led to weaker returns in the following 3 to 6 months.

It has been my studied opinion that periods of strong annual stock gains of over 20%, then followed by short-term flat performance, have historically led to weaker returns in the following 3 to 6 months.

The US equity markets are increasingly exhibiting range bound behaviour. If breakouts to higher levels do not develop from these levels then markets can historically be counted on to find support at lower levels, from which to attempt to launch an upward trend. Markets want to grow if earnings grow.

However, when Overbought, or Overvalued or have Mispriced Risk, then the “Stall” can be counted on to develop into a “Spin”!

RESEARCH – MARKET DRIVERS

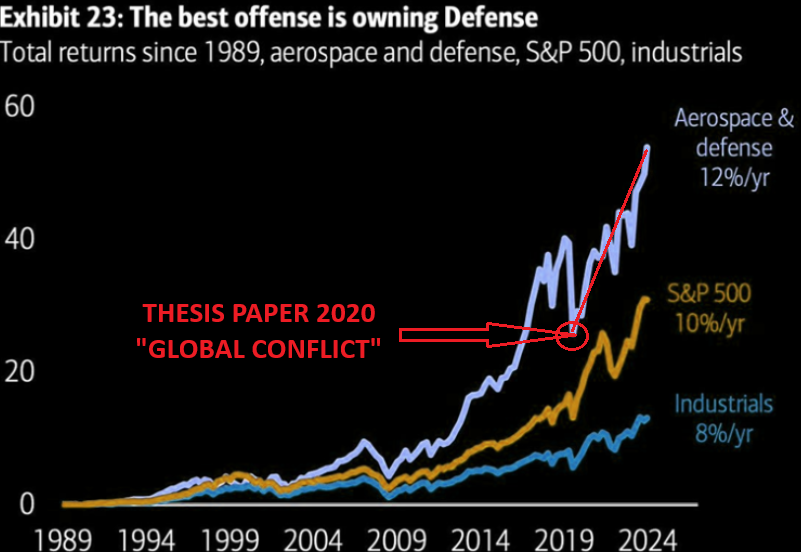

1- TIME TO INVEST IN THE US & EU DEFENSE SECTORS?

1- TIME TO INVEST IN THE US & EU DEFENSE SECTORS?

-

- EU is planning massive defense budget increases of $3.1T over 10 years.

- Goldman’s index of European defense shares topped a record high: Saab +11%,Hensoldt +13%, RENK +13%, Leonardo +5.7%, BAE Systems +7%.

- Taiwan is considering multi-billion Dollar weapons purchase from US, according to Reuters sources. “Arms purchase could be between USD $7-10B” as RTX and LMT spike.

- US Defense Department under Secretary Hegseth has announced redirecting budget towards goal of “War Fighting”.

2- INVESTING IN CHINA TECH & AI

-

- Goldman Sachs is out with a major China – AI Report.

- The report suggests that widespread AI adoption could boost Chinese EPS by 2.5%/year over the next decade and raises their target price for the overall equity market.

- “Improving growth prospects and perhaps a confidence boost could also raise the fair value of China equity by 15-20%, and potentially usher in over US$200bn of portfolio inflows. These prompt us to raise our MSCI China/ CSI300 target to 16%/19% implied 12m upside.”

- We highlight some of the highlights & chart porn.

DEVELOPMENTS TO WATCH – POLICY DRIVERS

1- TRUMP’S SIX QUESTIONS FOR EUROPE

1- TRUMP’S SIX QUESTIONS FOR EUROPE

-

- President Trump is clearly taking aim at Europe! It has become increasingly clear that President Donald Trump is coming after the EU as part of a crafted strategy to setup a “Deal”!

- This week we witnessed:

- JD Vance’s EU Speech sets EU leadership on its heals.

- Russia / US talks held in Saudi Arabia w/o Ukraine and EU??

- Trump Tariffs on the docket for the EU and their Auto Industry.

- Now Trump sends the EU Six Questions he wants their leadership to answer.

- The Gauntlet is being thrown down – HARD!!!

2- A US SOVEREIGN WEALTH FUND

-

- President Donald Trump has signed an executive order establishing a U.S. Sovereign Wealth Fund (SWF), a groundbreaking move that could reshape the nation’s economic future.

- The fund, designed to invest in infrastructure, advanced technology, manufacturing and other strategic industries, marks a significant departure from past U.S. policy. If managed wisely, it is certain to drive long-term:

-

-

- Economic growth

- Enhance national security and

- Strengthen America’s global leadership.

-

-

- With the executive order now in place, the Treasury and Commerce Departments have 90 days to present a detailed plan for how the fund will be structured, financed, and managed. Several potential funding sources have been discussed, including: Monetizing Federal Assets, Spectrum Auctions,Tariffs and Direct investment Partnerships with the private sector.

GLOBAL ECONOMIC REPORTING – ECONOMIC DRIVERS

INFLATION MONITOR

INFLATION MONITOR

- REGIONAL BANK REPORTS – Uptick in Prices Paid

- GOLDMAN INFLATION MONITOR REPORT – The core CPI increased 0.23% month-on-month. The year-on-year rate is now at 3.25%.

- SERVICE SECTOR INPUT COSTS – Cost pressures intensified to the highest since last September.

- Service sector input cost inflation edged up to a four-month high.

- Manufacturing saw the steepest increase in costs, with raw material prices showing the largest monthly gain since October 2022.

- INFLATION EXPECTATIONS – After exploding higher (to 4.3%) in the preliminary February data, UMich’s final print for the medium-term (5-10Y) expectation shot up to 3.5% – its highest since April 1995.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.