US ECONOMICS

FISCAL POLICY

WHERE THE MARKET PLUMBING IS NOW BROKEN!

OBSERVATIONS: A MISSION STATEMENT & TARIFF BASICS

Whether you want to call it a mission statement or what the current administration was elected to do, the following summarizes what the Trump administration campaigned on and is now executing:

REBUILD THE AMERICAN MIDDLE CLASS

-

- Create a larger, more successful middle class than we have seen in a very long time.

- Bring Jobs back to America.

- What is Good For National Security must be produced domestically.

- Reduce the Deficit – Reduced spending, increased revenue from foreign sources, lower interest rates, etc., all play into reducing the deficit. Which in turn will lower the tax burden on individuals.

I think that accurately reflects the main mission of this administration and two major elements of what they will work towards to achieve it.

WHAT IF IT BECOMES A GLOBAL ZERO-SUM GAME?

In game theory, it is usually safe to assume that a “zero-sum game” should be “win-win” (not impossible to achieve) and “lose-lose” should largely be avoided. So, in a zero-sum game, if the American Middle Class is to grow and get richer, it benefits the existing middle class and should reach down and help lower income families the most.

Well, where will the income/wealth distribution come from?

1- FOREIGNERS. Clearly the strategy of this administration revolves around the concept that much of the world has been taking advantage of the U.S. for decades. The policies are meant to shift resources/money/jobs from those countries to the U.S. So, one source of transfer will be from outside the U.S. Foreign companies, when importing something to the U.S. to sell will have to pay the tariffs, yet another way to transfer money from overseas to the U.S., in a way that should hurt the stock prices of those companies. Presumably, other countries will do what they can to mitigate such wealth transfer.

2- REDISTRIBUTION WITHIN THE U.S. The other potential is to transfer wealth within the country. That leaves the wealthy and corporations as pockets of wealth to be redistributed.

The Wealthy –

The wealthy can expect higher personal tax rates but lower corporate tax rates, which is what really matters to them. There is chatter about taxes for those making above $1 million emerging. ==>

Corporations –

That leaves corporations as the main domestic source. It is unlikely to be through “income taxes,” but it is likely to come down to lower profit margins initially.

-

- Whether paying more for workers, more for goods, or paying tariffs, one wealth source will be the transfer of wealth from corporations to the burgeoning middle class.

- That will likely hit stock prices (it already has, and there are a lot of reasons to think that it will continue), which indirectly transfers wealth from the wealthy.

EXPECT A TOUGH ERA FOR MARGINS & EARNINGS

As Chamath Palihapitiya (@chamath on X) points out in a tweet this weekend – the top 10% of households own 88% of the total equities owned by U.S. households. The bottom 50% have virtually no interest in U.S. stocks. Given his success on the investing side, with his All-In podcast and involvement with this administration, I would take the tweet quite seriously. It would argue, quite strongly, that there is no Trump Put. Which makes perfect sense as the administration is fully on board with the policies.

Clearly there is the belief that the brunt of the wealth transfer will come from foreigners, but as investors, we should be aware that some can come from corporations.

If the government plans work, that will change over time, as presumably the improving middle class in the U.S. is great for U.S. stock valuations.

Also, U.S. domiciled corporations, doing a lot of business in the U.S., have less ability to avoid government actions than (potentially) foreigners have.

I think it is perfectly rational to believe in the mission, and to believe that the policies will be successful, and at the same time still be nervous about corporate earnings and valuations.

WHAT YOU NEED TO KNOW!

A STAGFLATION RECESSION

A STAGFLATION RECESSION

From recent Market Gyrations we learned what a recession with high inflation (or stagflation) is likely to mean.

-

- Stagflation recessions now yield 3.85% to 4.00% (10-year).

- When the recession is removed, stagflation becomes just inflation, and a 4% 10-year yield is too low, (likely ~ 4.45%).

Want to see yields lower than 3.85%? ,This requires the economy to sink so far that it kills inflation, turning stagflation into just a recession.

-

- At its worst this past week, no one thought the coming recession would be this bad.

So, the market is priced in a Stagflation Recession, and that is 3.85% to 4.00%.

-

- For some context, yields are basically unchanged now since Trump unveiled the tariffs, (from being down notably as stocks fell), while stocks remain down hard… and the divergence started when China retaliated…

RESEARCH – MARKET DRIVERS

1- WHERE THE MARKET PLUMBING IS NOW BROKEN

1- WHERE THE MARKET PLUMBING IS NOW BROKEN

-

- The most popular trade among the hedge fund community is the Basis Pair Trade.

Long Treasuries + Short Swaps

-

- This trade is in the process of unwinding. As a result of the scramble to unwind, Swaps are now massively outperforming Treasuries, which are getting dumped, and pushing swap rates far below Treasury yields, resulting in record negative swap spread rates.

- The bottom line is that funds and banks are panic selling Treasuries to raise cash, while adding swaps to maintain exposure to interest rates, leading to the record low spread between swap rates and Treasury yields across the curve.

- TRANSLATION: The Basis Trade implosion is translating into a Swap Spread stop-out devastation!

2- TRUMP TARIFFS: EXPECTATIONS v RISK

-

- Since it will take time to build up manufacturing capacity in the U.S., (there is some excess capacity, but nothing on the scale that is envisioned by the administration), presumably the initial benefit will be the income from tariffs, and over time that income will dissipate as manufacturing shifts here. (The two goals are somewhat mutually exclusive – either import and get the tariff revenue but not the jobs, or build here and get the jobs, but not the tariff revenue).

- But in an ideal world, the tariffs pay for a lot up front as the U.S. builds the manufacturing base, creating jobs during the buildout and even more jobs down the road, which will replenish any revenue gap from no longer receiving the tariffs.

- Some of the Tariff Risks

- Currency moves can offset some of the costs

- The exporters can reduce price.

- Comparative Advantage

- GDP Matters

- Everyone is free to see how these scenarios play out, but for now I’m stuck in the camp:

- No major deals that make it clear that the administration is making big strides on jobs, so tariffs likely stay to provide the tariff revenue to the government.

- Profit margin erosion across the globe, but the U.S. is harder hit than China.

- No big boost in jobs on sales of U.S. brands in the near-term, (let’s call near-term a year).

- Inflation and some shortages in the U.S. causing some angst in the next year.

- New trade alliances formed, partly due to tariffs, but also due to concerns surrounding geopolitical posturing in and around the globe.

DEVELOPMENTS TO WATCH – POLICY DRIVERS

1- THE SPEED OF MARKET MOVEMENT IS THE “TELL”

1- THE SPEED OF MARKET MOVEMENT IS THE “TELL”

-

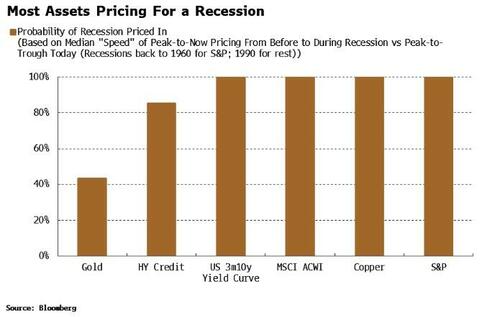

- Simon White of Bloomberg nets out the Recession Risks quite succinctly.

- The depth and speed of several assets’ recent decline is historically consistent with a recession. That doesn’t make it a ‘fait accompli’, and if one is ultimately avoided, then markets are priced too negatively.

- A simple way to gauge recession risk from asset pricing is to look at peak-to-trough declines before previous downturns and compare to today’s downturn. However, this doesn’t take account of the speed of the decline.

2- THE TURMOIL IS ABOUT MORE THAN TARIFFS

-

- I inserted a recent article by legendary Hedge Fund Manager Ray Dalio, because it captures from a different perspective what I have been writing about regarding the 4th Turning.

- Ray makes a number of points I have not been able to expand on that are important in understanding the Fourth Turning.

GLOBAL ECONOMIC REPORTING – ECONOMIC DRIVERS

CPI / PPI

CPI / PPI

-

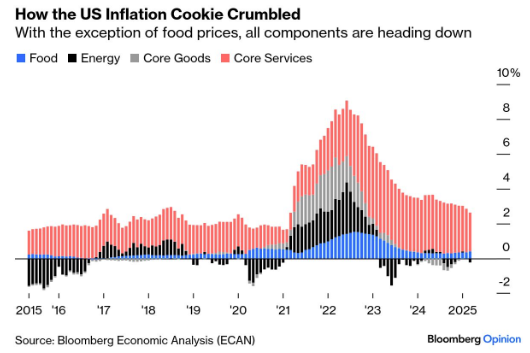

- March’s CPI report may give the illusion of inflation under control, but it was calculated before the ‘Liberation Day tariffs’ kicked in — enter the ‘Trump Reflation’ era.

- As the U.S.- China trade war rages on and new inflationary policies take hold, either consumers or producers will foot the tariff bill, while tighter immigration policies stir up a service-sector reflation.

- We highlight: The Umbrella Inflation Index is up 3.26% YoY, with no sign of hitting the elusive 2% target.

- We highlight: The US Trade Balance and the S&P 500-to-Gold ratio, which serves as a leading indicator of monetary illusion makes it clear that a break of the US Trade Balance of Goods & Services below its 7-year moving average has historically catalysed the spread of monetary illusion, signalling the shift from boom to bust in the economy.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.