MACRO

US FISCAL POLICY

2023 MARKET MAYHEM

2500 years ago, Aristotle wrote that “virtue” is the balance between Courage and Prudence. That is the challenge of our questionably virtuous elected legislative politicians in addressing the 2023 Debt Ceiling fight.

The Debt Ceiling has become a visible political public game somewhere between irrelevancy and congressional incompetence. However, this year the expected protracted first half Debt Ceiling negotiations will effectively act in a stealth fashion to loosen Financial Conditions. This is yet another example of Treasury Secretary Janet Yellen’s game of “clever theater”. Virtuous is a quality that has never been used to describe Janet Yellen!

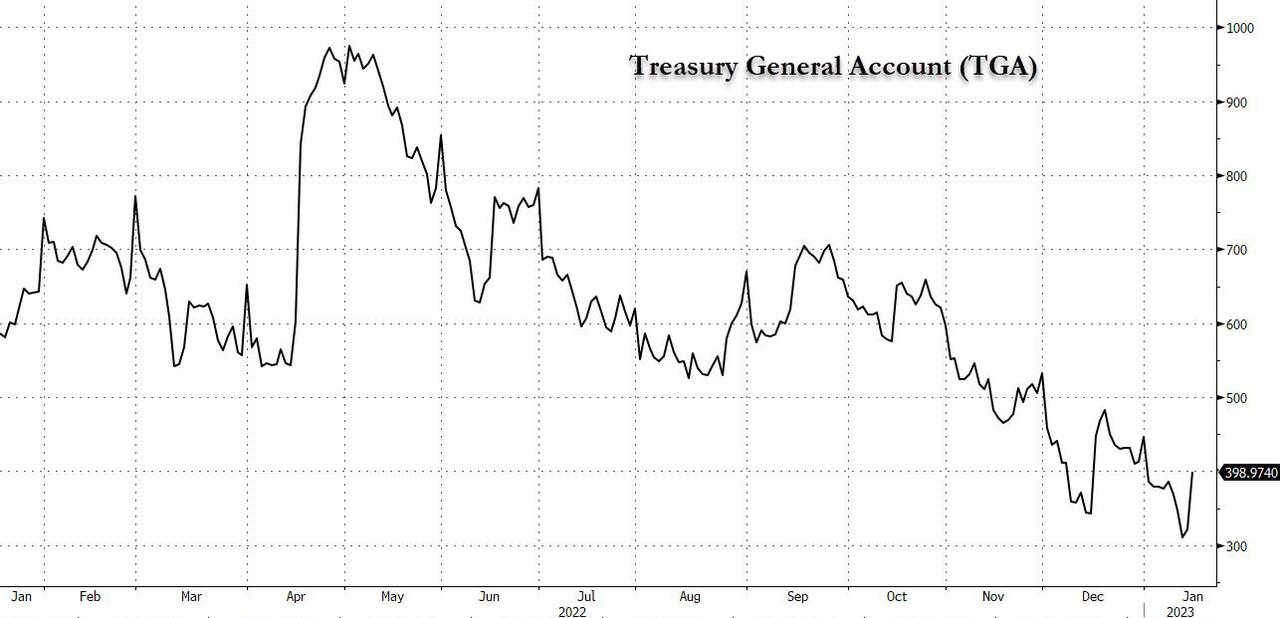

Yellen will use the spending down of the Treasury General Account to keep US fiscal spending liquidity flowing, while at the same time stop issuance of Treasury Debt, thereby adding downward pressures to interest rates.

There are no coincidences in Washington, only strategy! Read the details below, or if time is limited, jump to the conclusions for what it likely means for the markets.

THE LONG TERM OUTLOOK:

THE LONG TERM OUTLOOK:

Down > Quit > Up > Top.

There can be little double that coordinated Central Bank actions between the Fed, ECB and BOJ are in place and planned to maintain global financial stability during a tumultuous 2023.

=========

WHAT YOU NEED TO KNOW

- THE DEBT CEILING CHARADE BECOMES A CARNIVAL (AGAIN)

-

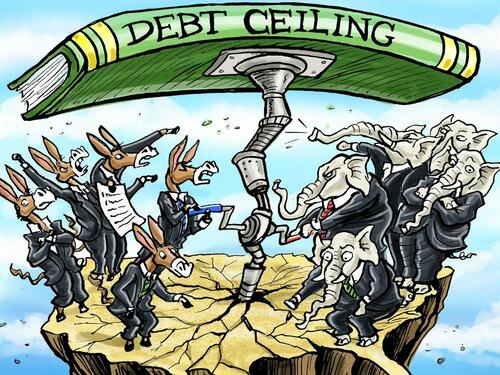

- The current debt ceiling is $31.381 Trillion. It again must be lifted to fully accommodate the following:

-

- The $1.7T Omnibus Bill,

- The $740B Inflation Reduction Act,

- The $280B CHIPS Act,

- The $1.2T Infrastructure Bill,

- The $1.9-3.5T American Rescue Plan

- The $100B Ukraine War Funding

-

- ~ $5.9 – 7.5 TRILLION

-

- Expect increased market volatility and a sell-off in Treasury securities maturing around the debt limit deadline.

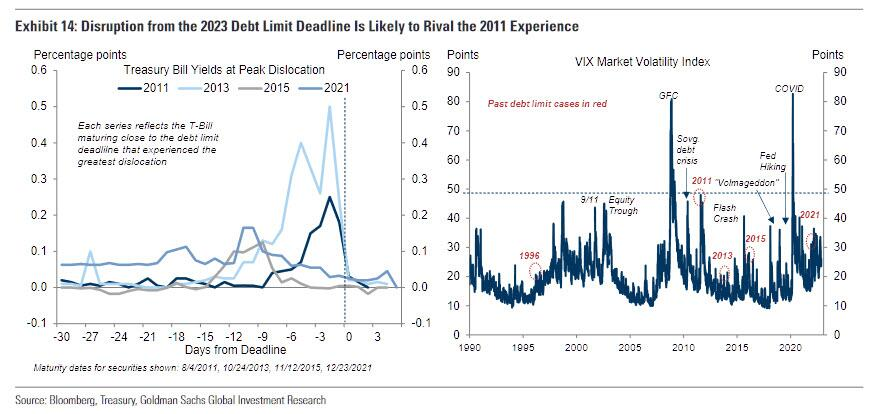

- We expect yields on bills maturing around the deadline to rise by at least as much as they did in 2011 and 2013, and for volatility in financial markets to rise similar to those periods.

- It should be expected that it will be difficult for Speaker Kevin McCarty to introduce a clean debt limit increase for a vote until forced by financial markets.

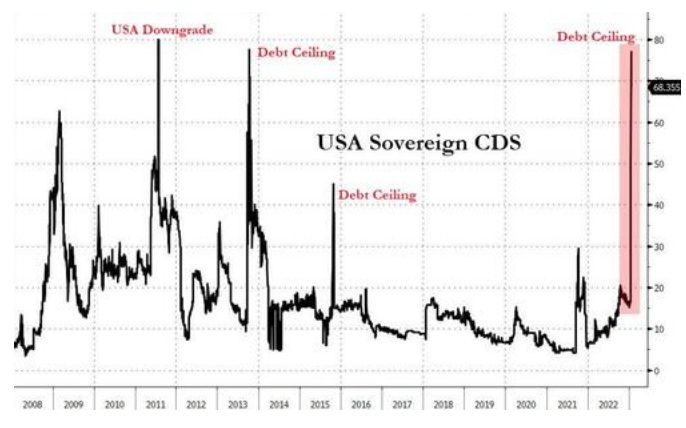

- US Sovereign Credit Default Swaps have responded and are now as high as the 2011 US credit downgrade and the 2013 Debt Ceiling fight.

- YELLEN’S TGA RELIEF VALVE

-

- Treasury Secretary Janet Yellen has now notified Congress about the debt ceiling “emergency actions” she is undertaking. It is our assessment that they will result in an approximate offset between treasury issuances and Quantitative Tightening (QT):

- A reduction in new treasury issuances will drive treasury prices up & interest rates down,

- A shrinking TGA will effectively increase available market liquidity,

- The TGA liquidity increase won’t necessarily go into USTs, therefore it will be a net downward pressure on UST intermediate to longer term rates.

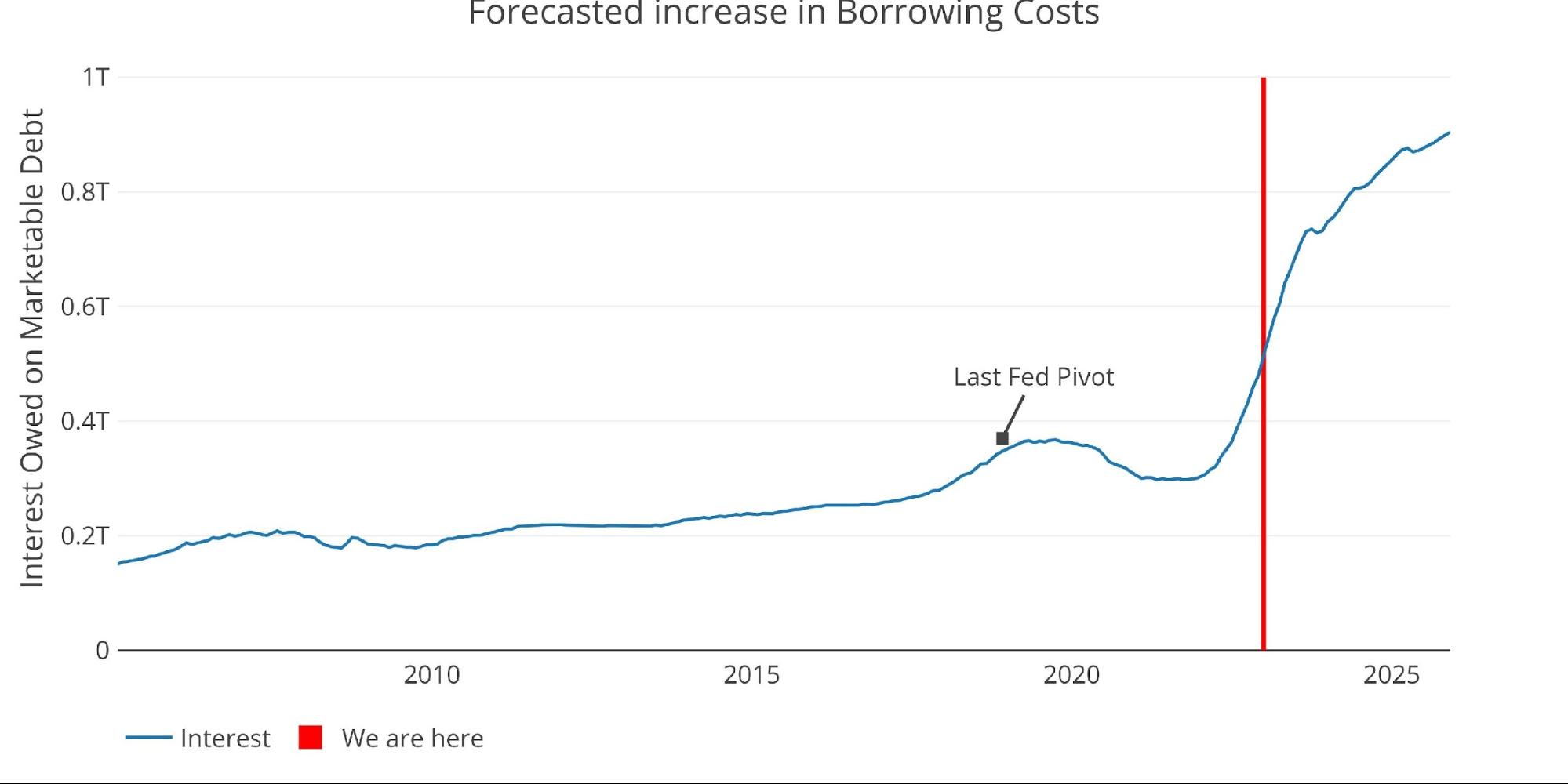

- Yellen appears to have been successful in her strategic efforts to offset pressures to force the Fed to take down the Fed Funds Rate to bolster the economy while maintaining its inflation fighting for a longer period of time. The rub is high UST rates are being quickly felt in debt interest rates, which will add fire to the debate on increasing the debt ceiling.

- Fiscal spending is likely to be resolved at the last minute with 3-5%, (maybe as high as 10%) “give back” in the current 2023 fiscal year expenditures approved by the recent Omnibus Bill.

- The Fed will become increasingly more concerned about the current level of the mounting layoffs than fighting inflation further as the inflation rate continues falling (though above 4-5%).

- EASING FINANCIAL CONDITIONS INDEX

-

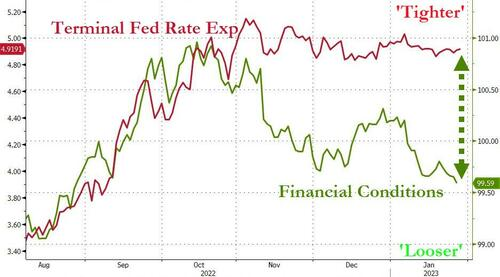

- Financial conditions for Investors are easing as the markets have begun piecing the likely outcome together.

- The markets are reacting and are currently taking on risk accordingly.

CONCLUSION

CONCLUSION

- We are presently expecting a continuation of the near term rally on global liquidity to meet falling earnings,

- Forward S&P EPS we feel should be expected to fall to meet a rising equity market in Q1,

- We are recently witnessing spectacular Treasury auctions. This suggests a confirmation of our thesis that buyers are afraid that the coming debt ceiling crisis could mean no new supply for months to come, and/or that the bond market simply is convinced that the Fed will be slashing rates in the very near future.

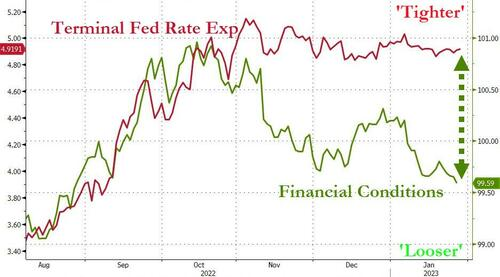

- The improving Financial conditions index is aligning with falling expectations for the Fed’s Terminal Rate which has been gradually falling from its high of ~5.15% to a current reading of 4.919%.

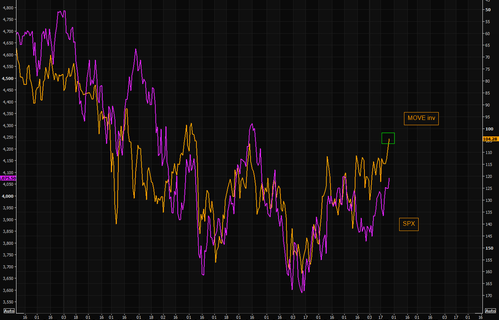

- The Bond volatility index or “MOVE” is presently sending a clear message further supporting our supposition.

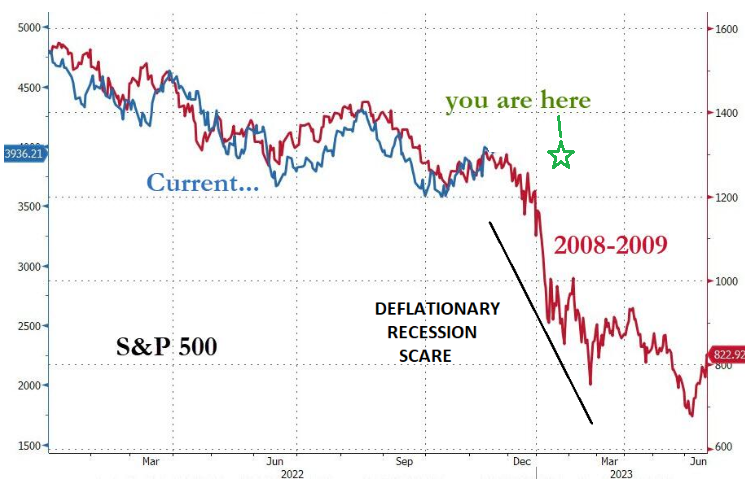

The Long Expected and Overdue Recessionary Deflationary Scare is Soon to Arrive.

=========

THE DEBT CEILING CHARADE BECOMES A CARNIVAL (AGAIN)

The fiscal spending process in the US Congress is blatantly broken and openly obvious to anyone who actually pays attention to how it is carried out, rather than drawing conclusions from a misleading nightly news snippet!

The fiscal spending process in the US Congress is blatantly broken and openly obvious to anyone who actually pays attention to how it is carried out, rather than drawing conclusions from a misleading nightly news snippet!

The most recent example was the passing of the $1.7 Trillion Omnibus Bill by the outgoing Democrats in the final hours of their legal term. A Bill of over 4000 pages that wasn’t delivered to Congress until hours before the vote. If passing that Bill makes sense to you (and doesn’t seem unusual), then do not continue reading this newsletter and please immediately cancel your subscription. We are both wasting our time.

As an elected representative of the people, how could you even go along with such a request or allow yourself to be placed in such a position? The only question you need to answer is whether to vote for the Bill or quit Congress, because if you don’t vote for your party’s Bill (or dare raise questions), you will be “primaried” out in disgrace at the next election (or sooner) by the party apparatus and operatives. All committee positions are removed and you are “shamed” by party leaders until your removal.

Congress has been captured and operates on a subtle game of extortion. Who is being extorted is you and I, the tax payer! Do you know what was in the $1.7 TRILLION Omnibus bill? Did you read it? You will likely respond by saying you rely on your elected official to have read it – well you are making an incorrect assumption. You likely also assume the bill was written by elected officials in some congressional committee. Wrong again! It is “delivered” to the committee and in fact written by Washington law firms (quietly referred to as the “Washington Illuminati”). The real question you should ask is who guides and tells the lawyers what to actually write, remembering it is all about the details??

I could go on further on how things actually work, but that is not the purpose of this newsletter. What we need to talk about is what yet another increase in the debt ceiling means and whether this one comes with investment opportunities. We can’t fix the country, but just maybe we can fix our personal fight against the inflation that is destroying our disposal income!

The current debt ceiling is $31.381 Trillion. It again must be lifted because of the following (NOTE: Please be aware the names of these Bills only partially represent what is actually in them or they are mislabeled – i.e. The Inflation Reduction Act increases Inflation and does not actually Reduce it!):

-

- A $1.7T Omnibus Bill,

- A $740B Inflation Reduction Act,

- A $280B CHIPS Act,

- A $1.2T Infrastructure Bill,

- A $1.9-3.5T American Rescue Plan

- A $100B Ukraine War Funding

=================================

-

- ~ $5.9 – 7.5 TRILLION

What we are also seeing here is spending authorizations without authority. The authority comes from meeting the Public Debt Acts passed in 1939 and 1941, which requires Congress to work within the existing legal debt limit when proposing or debating spending bills. If Congress believes the spending requirement will need to be higher, it by law must debate that and pass a law changing the ceiling before considering bills that might possibly result in breaching the legal existing debt ceiling. It is not a matter of the chicken or egg question, but actually the law! It was enacted this way to assure creditors and government services are not unduly disrupted while ensuring the long term ramifications of changing the debt ceiling are first considered before assessing the merits of increased spending.

The process has been quietly and simply altered to more easily “game it”.

DOES THE FOLLOWING RESEMBLE RESPONSIBLE MANAGEMENT OF MONEY?

IF YOUR SPENDING AND CREDIT CARD BALANCES MIRRORED THIS, WHAT WOULD YOU CONCLUDE?

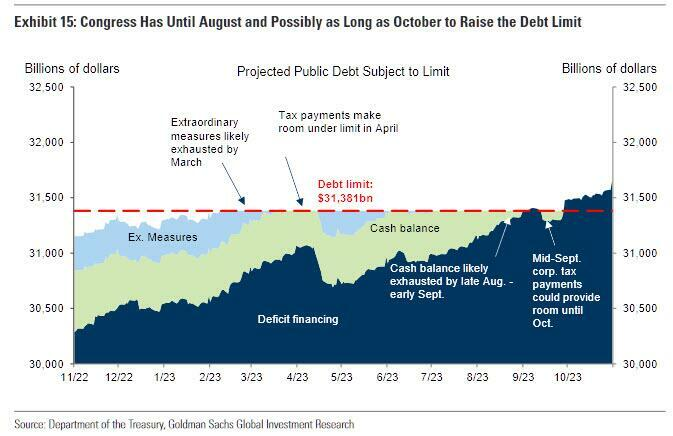

Let’s consider the realities of the current debt ceiling debacle. The Goldman Sachs Economic team did as good a job as I have read in outlining the key elements.

Will the debt limit have as negative an impact on financial markets in 2023 as in 2011?

Yes. The political and fiscal conditions next year will be similar to the last two extremely disruptive debt limit increases, in 1995 and 2011. Like next year, in those periods a Democratic President in his third year faced a Republican House after losing the majority in the midterm election. Those episodes also followed a run-up in public debt as a share of GDP and/or a rise in federal interest expense, similar to the experience over the last few years. However, midterm gains of 54 seats in 1994 and 63 in 2010 gave Republicans a clearer political mandate and the votes to carry it out, at least in the House. By contrast, Republicans netted only 9 seats in the 2022 midterms and entered 2023 with a very thin House majority. Public focus on the public debt is also much lower compared to those prior periods, and Republicans have not emphasized fiscal restraint nearly as much recently as they had in the mid-1990s or early part of the Obama Administration.

Prior disruptive debt limit standoffs led to increased market volatility and a sell-off in Treasury securities maturing around the debt limit deadline, and we would expect this to occur next year. In 2023, we would expect yields on bills maturing around the deadline to rise by at least as much as they did in 2011 and 2013, and for volatility in financial markets to rise similar to those periods (Exhibit 14 below).

There is also a real chance that Congress fails to raise the debt limit in time next year, forcing Treasury to reduce daily payments to the level of receipts (i.e. immediately eliminating the budget deficit), resulting in a spending cut of around 10% of GDP at an annualized rate. While we think it is more likely that Congress manages to avoid this and raises the debt limit before it constrains Treasury’s ability to pay its obligations, the risk appears higher than at any point since 2011.

The deadline for Congress to raise the debt limit before Treasury must cut back net borrowing will likely be sometime in August but could be as late as October, depending on Treasury cash flows. An early signal of the risk the debt limit poses will come at the start of 2023, when the new House of Representatives is seated. If Republicans reinstate the “motion to vacate” that allows any member of the House to call for a vote for a new speaker of the House—several Republican House members have recently called for this in return for their vote for speaker. It could be difficult for Speaker Kevin McCarthy to introduce a clean debt limit increase to a vote until forced by financial markets.

This is scaring the investment community to a much larger degree than in prior situations as can be seen below.

YELLEN’S TGA RELIEF VALVE

I have written in recent newsletters why you need to be watching Treasury Secretary Yellen quite closely. She is closely working in concert with Fed Chairman Jerome Powell to keep the system from rupturing while the Fed fights inflation in the “headlights” of a looming recession.

I have written in recent newsletters why you need to be watching Treasury Secretary Yellen quite closely. She is closely working in concert with Fed Chairman Jerome Powell to keep the system from rupturing while the Fed fights inflation in the “headlights” of a looming recession.

FOCUS ON YELLEN’S TREASURY GENERAL ACCOUNT (TGA) in H1 2023

Yellen has now notified Congress about the debt ceiling “emergency actions” she is taking. It is our assessment that they will result in an approximate offset between treasury issuances and Quantitative Tightening (QT):

-

- A reduction in new treasury issuances will drive treasury prices up & interest rates down.

- A shrinking TGA will effectively increase available market liquidity.

- The TGA liquidity increase won’t necessarily go into USTs, therefore it will be a net downward pressure on UST intermediate to longer term rates.

This effectively continues Yellen’s efforts to offset pressures on the Fed to take down the Fed Funds Rate to bolster the economy while maintaining its inflation fighting for a longer period of time. The rub is high UST rates are being quickly felt in debt interest rates, which will add fire to the debate on increasing the debt ceiling.

-

- Fiscal spending is likely to be resolved at the last minute with 3-5%, (maybe as high as 10%) “give back” in the current 2023 fiscal year expenditures approved by the recent Omnibus Bill.

- The Fed will become increasingly more concerned about the current level of the mounting layoffs than fighting inflation further as the inflation rate continues falling (though above 4-5%).

A PAYMMENT PRIORITIZTION PLAN

It is important to understand that a private deal was struck between House Conservatives and Rep. Kevin McCarthy (R-CA) in order for McCarthy to win speakership, according to Rep. Chip Roy (R-TX), who helped broker the deal. Roy told the Washington Post that McCarthy agreed to adopt a Payment Prioritization Plan by the end of the first quarter of the year.

It is important to understand that a private deal was struck between House Conservatives and Rep. Kevin McCarthy (R-CA) in order for McCarthy to win speakership, according to Rep. Chip Roy (R-TX), who helped broker the deal. Roy told the Washington Post that McCarthy agreed to adopt a Payment Prioritization Plan by the end of the first quarter of the year.

House Republicans’ payment prioritization plan stipulates that the Treasury Department should continue making payments on Social Security, Medicare and veterans benefits, as well as funding the military, two of the people said. –WaPo

This Republican plan includes major spending cuts from the Biden administration, in exchange for which Republicans will sign off on raising the current limit of $31.4 trillion before the Treasury Department will legally be allowed to borrow.

That said, Democrats are preparing to push back on the plan, and will likely note that any hypothetical proposal to triage Social Security, Medicare and benefits for veterans and the military would still leave out ‘huge swaths of critical federal expenditures on things such as Medicaid, food safety inspections, border control and air traffic control,’ etc. Democrats will also likely accuse Republicans of pandering to bondholders, which include Chinese banks, vs. Americans.

“Any plan to pay bondholders but not fund school lunches or the FAA or food safety or XYZ is just target practice for us,” said one senior Democratic aide.

IT IS GOING TO GET MESSY AND DRAWN OUT WITH THE MEDIA DOING ITS NORMAL JOB OF SELLING PUBLIC FEAR TO IMPROVE VIEWERSHIP AND ADVERTISING REVENUES

Here is what all this means for investors.

EASING FINANCIAL CONDITIONS INDEX

Financial conditions for Investors are easing as the markets have begun piecing the likely outcome together. This is shown to the right. NOTE: ‘Y” AXIS INVERTED FROM GOVERNMNET DATA BELOW

Financial conditions for Investors are easing as the markets have begun piecing the likely outcome together. This is shown to the right. NOTE: ‘Y” AXIS INVERTED FROM GOVERNMNET DATA BELOW

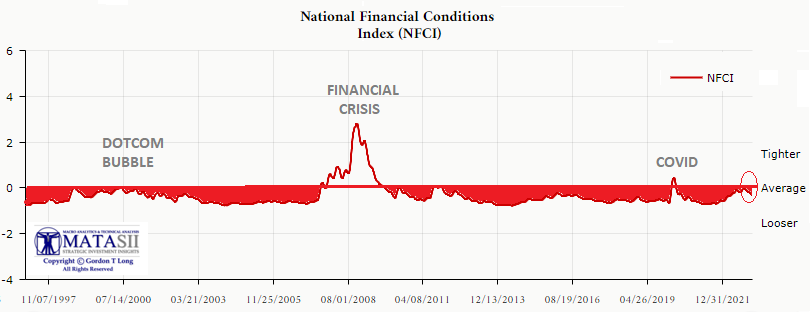

Shown below is a long term view of the Financial Conditions Index that illustrates the importance of the degree and rate of change of the Financial Conditions Index.

The markets are reacting and are currently taking on risk accordingly.

CONCLUSION

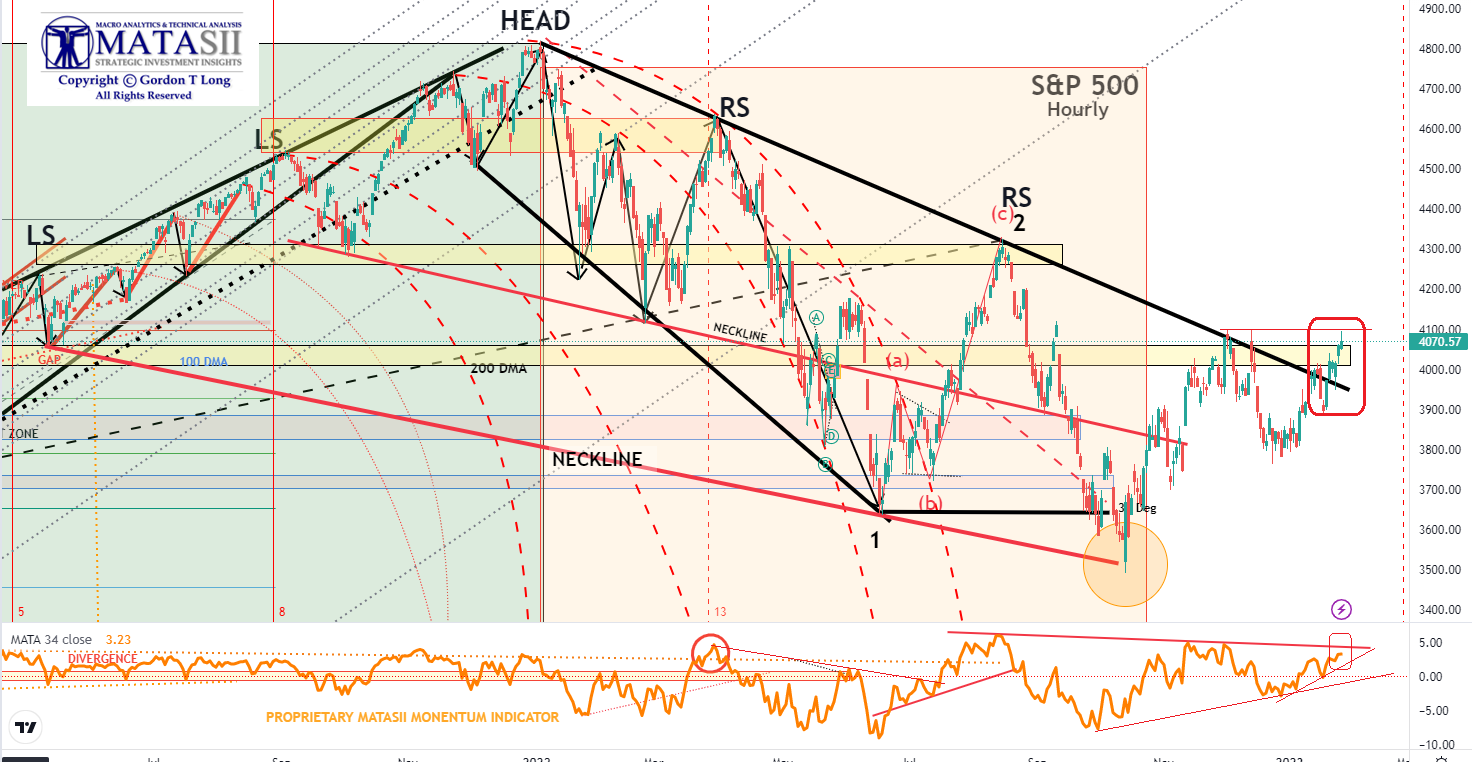

We are presently expecting a continuation of the near term rally on global liquidity to meet falling earnings, which the chart to the right suggests. The red Forward S&P EPS in the chart, we think, should be expected to fall to meet a rising equity market.

We are presently expecting a continuation of the near term rally on global liquidity to meet falling earnings, which the chart to the right suggests. The red Forward S&P EPS in the chart, we think, should be expected to fall to meet a rising equity market.

FURTHER CONFIRMATION OF OUR ANALYSIS

We witnessed a stellar 3Y auction on Tuesday (01/24), a record-breaking 5Y auction Thursday (01/26) and a blowout 7Y auction on Friday (01/27). This completes a sequence of three monster auctions which have seen an absolute flood of demand into US Treasuries – mostly by foreign buyers.

The high yield in Friday’s 7Y auction stopped at a high yield of 3.517%, which was 40bps below last month’s 3.921% and the lowest since August. It also stopped through the “When Issued” 3.538% by 2.1bps, the highest bid-to-cover also since August.

-

- The Bid to Cover surged from 2.454 to 2.691, much higher than the six-auction average and the highest since the TSY market panic bid during the March 2020 Covid crisis.

- The internals were even more notable, with Indirects confirming the pattern observed in the past two auctions, seemingly unable to get enough, and getting awarded a whopping 77.1% of the auction, sharply higher than the 68.1% last month and the 4th highest on record.

- With Directs awarded 16.8%, or just below recent averages, Dealers were left holding just 6.1%, a record low.

Overall, this was another spectacular auction and a far, far cry from that catastrophic 7Y “belly buster” auction two years ago. It also suggests a confirmation of our thesis that buyers are afraid that the coming debt ceiling crisis could mean no new supply for months to come, or that the bond market simply is convinced that the Fed will be slashing rates in the very near future.

Further supporting evidence of our outlook can be seen below, where we compare the improving Financial conditions index with the expectations for the Fed’s Terminal Rate. It has been gradually falling from its high of ~5.15% to a current reading of 4.919%.

WHEN BONDS “MOVE”, EQUITIES FOLLOW

The Bond volatility index or “MOVE” is presently sending a clear message. The “MOVE” has normally led.

THE CURRENT MARKET RISE IS LIKE CHILDREN PLAYING  WITH MATCHES!

WITH MATCHES!

REMEMBER: THE WORST IS STILL IN FRONT OF US

EXPECT MARKETS SHORT TERM TO RISE ON CONTINUED LOOSENING FINANCIAL CONDTIONS

DOWNSIDE WILL LIKELY RE-EMERGE IN Q2-Q3 2023.

FADE THE COUNTER RALLY – SELL THE RIPS.

HOLD LONG DATED TREASURIES.

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart: SUBSCRIBER LINK

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.