TIPPING POINTS

PUBLIC SENTIMENT & CONFIDENCE

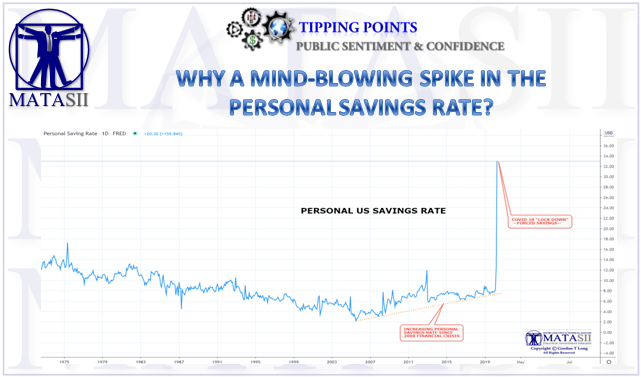

WHY A MIND-BLOWING SPIKE IN THE PERSONAL SAVINGS RATE?

We have moved from expectations of a stock market wipe-out and bond Armageddon into a full-blown expectations led rally. This is still a bear-trap rally though we still see further movement higher in the main indices as governments are pushed (rightly or wrongly) into re-opening the global economy.

There is nothing normal about what’s happening. We are stuck in the middle of an economic crisis completely unlike anything that’s ever happened before. It’s a global demand/supply shock and more – something wholly outside any previous experience. Its a major secular shift in sentiment which we outline in this month’s UnderTheLens video.

Investors are fully aware of the scale of the Coronovirus economic damage but are still grappling with understanding the full consequences it has triggered. They are now developing investment ideas on where this crisis and prices go next as economies rush to reopen. They are also factoring in how government bailouts and QE infinity have effectively shifted sentiment away from the precipice’s edge towards temporarily a more marginally positive bias with the hope of how new virus treatments and vaccines could ameliorate the crisis.

Markets are discounting prices for recovery. The result is a rally in value stocks:

-

- Those with clear economic upside from the end of lock-down, and

- Those where prices over-reacted and tumbled too far as we reacted to the worst-case Coronavirus scenarios.

-

- Though we never mentioned Neil Howe in this month’s UnderTheLens video he has extensively explored generational cycles (“turnings”) in America which reveal predictable social and sentiment trends that recur throughout history and invariably result in transformational crisis (a “fourth turning”). He is a well recognized demographer and co-author of the book The Fourth Turning.

- Fourth turnings are characterized by a growing demand for social order, yet supply of it remains weak. The emergence of the surveillance state, a perpetual war machine, increased intervention in failing markets by the central planners, greater government control of critical systems like health care and the Internet – all of these are classic fourth turning signs of the desperation authorities exert as they lose control.

- History shows time and time again that such overreach ends in rejection of the current order, usually via violent revolution. Now that we’re roughly halfway through the current Fourth Turning and things have really started to unravel here in 2020.

- During times of peace and prosperity, inequality over time always increases. It always increases. There are only four things which reduced inequality through history: total war, total revolution, famines, and plagues.

- The fourth turning is to some extent an act of creative destruction. It destroys as much as it creates. We saw that in the 1930’s. We saw that in the 1940’s which, by the way, was a period of huge shift from inequality to equality in America. But there’s a broader point about inequality and this is about creative destruction. There has to be some destruction in there. You have to destroy the privileges. You have to destroy the sinecures – and that’s never pleasant. But it’s part of the process.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.