US ECONOMICS

FISCAL POLICY

DOGE VERSUS THE NON-AUDITABLE NGO FRAUD

OBSERVATIONS: GOVERNMENT ACCOUNTABILITY & TRANSPARENCY

Quarterly my colleague Charles Hugh Smith and I sit down to discuss a central theme that our independent research writings are surfacing.The video “The Roaring 20’s or the Great Depression 2.0?” is the product of that discussion for Q1.

Over the past 15 years Charles and I often arrive at the same theme however often from different perspectives. Myself from an Economic & Financial view versus Charles more from a Social & Cultural context. We have both benefited in gaining clearer insights on the same focus from these different vantage points. This quarter was no different.

What we see and discuss in the video is that President Donald J Trump is now facing Governance, Economic, Social and Cultural forces at play. Presently the most obvious is Government Accountability and Transparency.

GOVERNMENT ACCOUNTABILITY & TRANSPARENCY

-

- GOVERNANCE – INTERNAL

- ACCURATE & AUDITABLE ACCOUNTING

- STOP SPENDING WASTE

- NON GOVERNMENT – EXTERNAL

- FRAUD & MIS-DIRECTED TAX PAYER $

- NGOs, ACTIVIST & CHARITABLE ORGANIZATIONS

- GOVERNANCE – INTERNAL

GOVERNMENT WAS NOT PROPERLY FOCUSED

This is due to the Obama and Biden administrations not focusing on and addressing the following:

-

- HALTING ASSET BUBBLE CYCLES

- THE US INCREASINGLY NOT PRODUCING MORE THAN WE CONSUME

- NOT INVESTING IN PRODUCTIVITY BUT SPENDING ON CONSUMPTION

- NOT RE-BALANCING & RE-INDUSTRIALIZING AMERICA

THE OBAMA / BIDEN ADMINISTRATIONS DID NOT TACKLE MASSIVE WEALTH INEQUALITY

-

- STRUCTURAL & SYSTEMIC IN SCOPE

- A GILDED AGE STATUS QUO

This has lead to a failure to recognize the emergence of the “Great Divide” now imperiling any party in successfully navigating the turbulent waters of the Fourth Turning.Both administrations failed to:

FAILURE TO RECOGNIZE “THE GREAT DIVIDE”

-

- ECONOMIC – URBAN v RURAL

- FINANCIAL- HAVES v HAVE NOTS

- CULTURAL – CREDENTIAL v WORKING CLASS

- GENERATIONAL – BOOMERS v MILLENNIAL / Z

THE “UGLY” THAT LIES AHEAD

The simple reality is that what lies ahead before we even begin to solve these problems is a Biden Hangover. This is the result from historic government spending levels that must be brought down and replaced with private investment spending.

This will inevitably lead to a “Detox Period” that goes with it!

There is no way of avoiding it!

Government spending supplies a “sugar high” that leaves behind it little more than debt. Most forget that in 2028 it took $3.9 dollars of new government debt to generate $1 of economic growth. With debt now far outstripping economic growth the US is entering a financial death spiral!

The process can be accelerated by taking the economy into a disinflationary recession or printing more money than Binde did.

What would you choose?

GOVERNMENT IS THE PROBLEM, NOT THE SOLUTION

PRESIDENT RONALD REAGAN

WHAT YOU NEED TO KNOW!

Q1 2025 GDPNow REDUCED TO -2.8%

Shockingly the GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is -2.4 percent on March 6, up from -2.8 percent on March 3.

Shockingly the GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is -2.4 percent on March 6, up from -2.8 percent on March 3.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is -2.4 percent on March 6, up from -2.8 percent on March 3. After recent releases from the Institute for Supply Management, the US Bureau of Economic Analysis, and the US Census Bureau, the nowcasts of first-quarter real personal consumption expenditures growth and real gross private domestic investment growth increased from 0.0 percent and 2.5 percent, respectively, to 0.4 percent and 4.8 percent, while the nowcast of the contribution of net exports to first-quarter real GDP growth fell from -3.57 percentage points to -3.84 percentage points.

GDPNow is not an official forecast of the Atlanta Fed. Rather, it is best viewed as a running estimate of real GDP growth based on available economic data for the current measured quarter. There are no subjective adjustments made to GDPNow—the estimate is based solely on the mathematical results of the model.

RESEARCH – MARKET DRIVERS

1- DOGE SAVINGS & WASTE v THE NON-AUDITABLE NGO / NON-PROFIT FRAUD

1- DOGE SAVINGS & WASTE v THE NON-AUDITABLE NGO / NON-PROFIT FRAUD

-

- We had insufficient time in this quarters Macro Analytics video to expand on DOGE not being able to audit the organizations that actually received money from the government! That is where DOGE must stop but that is where massive fraud and misuse of tax payer money is taking place.

- How? If I am for example the Red Cross, and everybody knows that historically the Red Cross is everything “good” then how can $300M given to them by the DHS to the Red Cross along with a Catholic Charity be bad?

- FACT: The new DHS Secretary Christie Noem was shocked to immediately identify that this $300M had been specifically used to fund and support the flow of illegal immigration from the Darien Gap in South / Central America to the US/Mexico border.

- THE WAY WASHINGTON WORKS: This example is only scratching the surface (ie USAID, $26K Politico Subscriptions, Millions of 130-210 year old seniors receiving Social Security, Untraceable US Treasury Disbursements et al) in what has come to light recently but it was a complete endorsement of what the former Chairman of the Congressional Committee on Oversight and Government reform had been yelling and writing about for nearly a decade now.

- CONGRESSIONAL COMMITTEE ON OVERSIGHT & GOVERNMENT: Up and comer, former Congressman Jason Chaffetz laid out in detail how the game of fraud is played in Washington. He has written four books on the subject and yet zero has been done. Unable to effect any change or even serious investigation he left Congress under heavy attack. His predecessor Trey Gowdy likewise followed the same quickpath out of Congress. Were they “pushed” or is this only a coincidence??

2- CHARLES HUGH SMITH MACRO ANALYTIC VIDEO RECAP

-

- My Colleague in the production of this month’s Macro Analytics video published a widely circulated recap of our video which you will find useful as a further expansion of the messages contained in the video.

DEVELOPMENTS TO WATCH – POLICY DRIVERS

1- A PERIOD OF TRANSITION INTO A GREAT DEPRESSION?

1- A PERIOD OF TRANSITION INTO A GREAT DEPRESSION?

-

- Coincidently my colleague Richard Duncan also produced a video this week on the same subject as this month’s Macro Analytics video entitled: ““A Period Of Transition” Into A Great Depression?”

2- THE APPROVED CONGRESSIONAL CR IS NOT WHAT YOU THINK IT IS!

-

- The approved Fiscal Year (FY) 2025 budget resolution (CR) calls for up to $2 trillion in spending cuts as partial offsets for $4.8 trillion of tax cuts and spending increases.

- Even with those offsets, the ensuing reconciliation bill would add $2.8 trillion to deficits through 2034 before interest.

GLOBAL ECONOMIC REPORTING – ECONOMIC DRIVERS

US DEFICIT HITS RECORD $1.1T IN FIRST 5 MO. OF 2025

US DEFICIT HITS RECORD $1.1T IN FIRST 5 MO. OF 2025

-

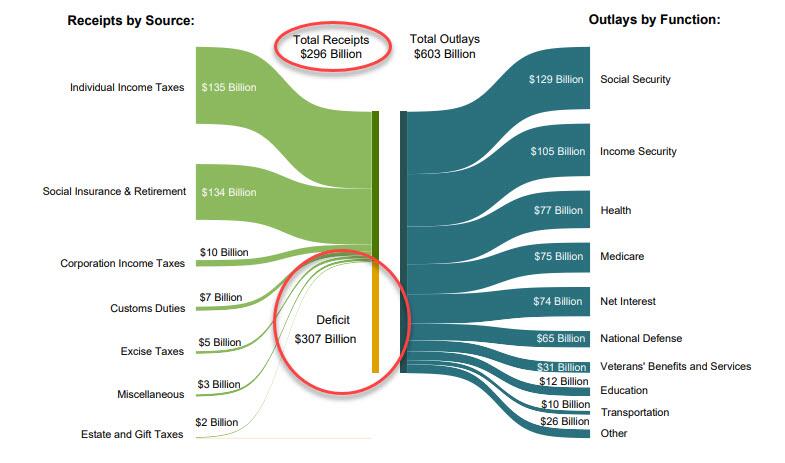

- February Taxes Failed To Cover Even Half Of Spending!!

- At the rate it is going, DOGE will need a few hundred years to make a tangible impact, because in February the US government spent a staggering $603 billion, a 6% increase from the $567 billion a year ago while it collected just $296 billion in tax revenues.

- Said otherwise, the US spent more than twice what it collected in February

FEBRUARY CPI / PPI

-

- CPI: Headline and core CPI both printed below expectations (+0.2% MoM) which dragged the headline CPI down to +2.8% YoY.

- PPI: Producer Prices following a similar path with Core PPI dropping by the most MoM since April 2020 (-0.1% MoM vs +0.3% exp), slowing the annual pace of change for producer prices to +3.4%…

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.