TIPPING POINTS

SLOWING US CONSUMER

A CRACKING CONSUMER IN A 70% CONSUMPTION ECONOMY

Recent releases of Quarterly Financial Stability Reports by the US Federal Reserve and the International Monetary Fund (IMF) are both preoccupied with the current fragility of the financial system. They warn that any economic or financial shock could now plunge the US and global economy into a serious downturn. Though they highlight many of the worrying geo-political risk exposure, they fail to highlight the most obvious.

We are all witnessing first hand the impact of slowing US consumer consumption as shrinking real disposable incomes cripple US families. As a 70% consumption economy the US has become precariously dependent on a healthy US consumer.

What many take for granted and forget is that the world economy has also built itself on and come to expect extraordinary levels of US consumption! What happens if this rate abruptly alters? The crippling shock wave that is occurring is the inflation shock to the American Family! It is only now beginning to ripple through the global supply chains.

A reverse wealth effect is something we warned about during the initial onslaught of Covid-19.

=========

WHAT YOU NEED TO KNOW

- A CRACKING CONSUMER IN A 70% CONSUMPTION ECONOMY

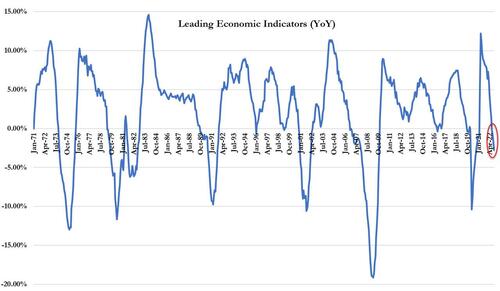

- The US Leading Economic Indicator (LEI) has recently gone negative. This level has only occurred during prior major US market corrections. The changing rate of US retail consumption is a key concern.

- The ratio of US Consumer Discretionary Spending to the S&P 500 is dropping like a stone. It is actually lower today than it was at the lows of the March 2020 Crash! This suggests the US consumer is “tapping out”.

- Major layoffs in areas that support retail consumption prior to the Christmas season such as Amazon, FedEx and Freightways is a clear warning that retail deterioration is severe!

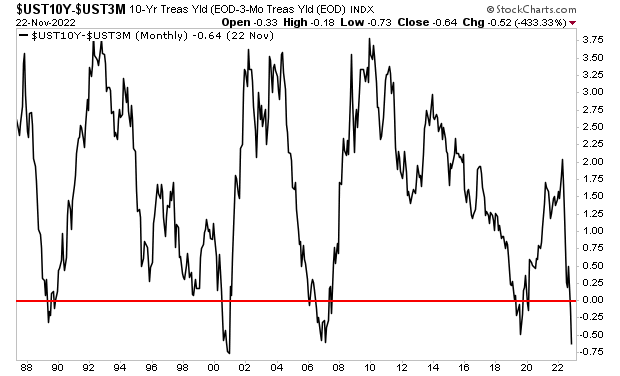

- A SERIOUS WARNING FROM THE YIELD CURVE

- The Yield Curve’s 2s10s is more negative today than it was before the COVID-19 crash, as well as the Great Financial Crisis. It is now barely above the Dotcom implosion. These are unprecedented levels that need to be heeded!

- IF THE US CATCHES A COLD, THE WORLD WILL GET PNEUMONIA

- The US has the world’s single largest economy, accounting for almost a quarter of global GDP (at market exchange rates), one-fifth of global FDI and more than a third of stock market capitalization. It is the most important export destination for one-fifth of countries around the world. If the US consumer slows down its rate of consumption, it will have an immediate and devastating impact on the global economy, which can not be understated!

- FINANCIAL FRAGILITY RISK

- The fragility of the financial system complicates the job of Central Banks. Instead of facing their normal dilemma—how to reduce inflation without harming economic growth and employment—the Fed now faces a trilemma: how to reduce inflation, protect growth and jobs, and ensure financial stability.

- The Fed Warns in their Latest US Financial Stability Report:

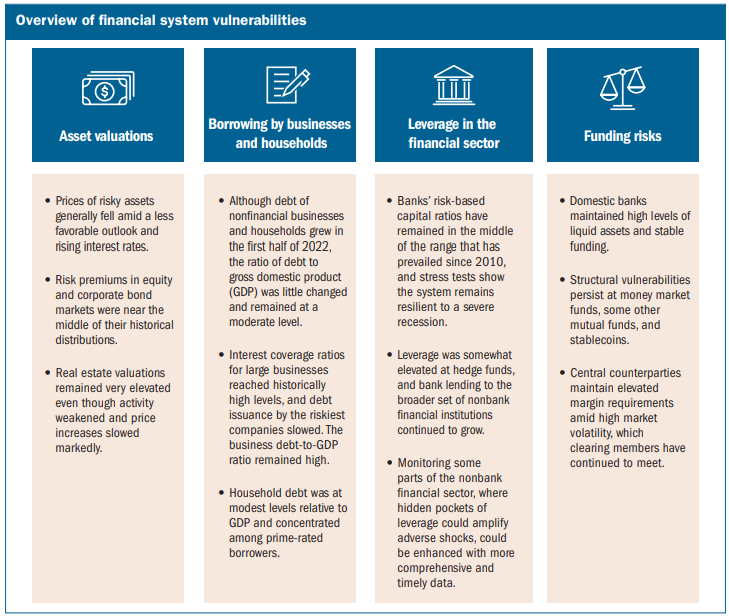

- “Future shocks have the potential to be amplified by vulnerabilities associated with asset valuations, borrowing by households and businesses, financial-sector leverage, and funding risks”.

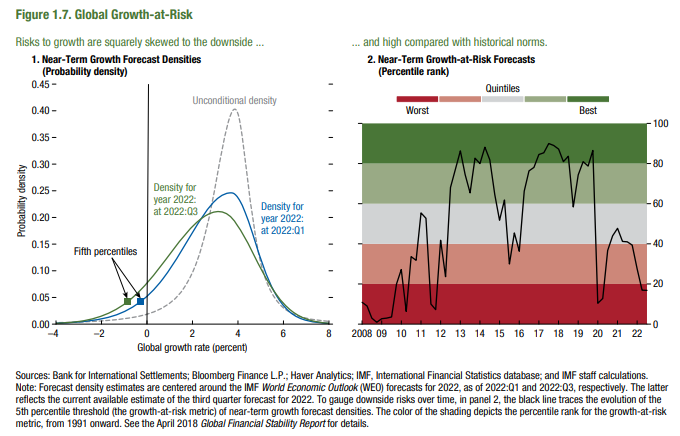

- The IMF Warns in their Latest Global Financial Stability Report:

- “Amid poor market liquidity, there is a risk that a sudden, disorderly tightening in financial conditions may interact with preexisting vulnerabilities. In emerging markets, rising rates, weak fundamentals, and large outflows have pushed up borrowing costs, particularly for frontier economies, with a heightened risk of additional defaults”.

- We currently have multiple global factors at play which are all interconnected. This creates a potential domino-like effect, contributing to the heightened possible of unexpected and unintended consequence.

- CONCLUSION

- The analogy to the market behavior to deteriorating economic and financial conditions increasingly becomes a real outcome possibility.

- A lesson I have learned over decades of investing is to never under estimate the US Consumer and its’ addiction to consumption. Like a drug addict without money they will always find a way to fulfil their addiction!!

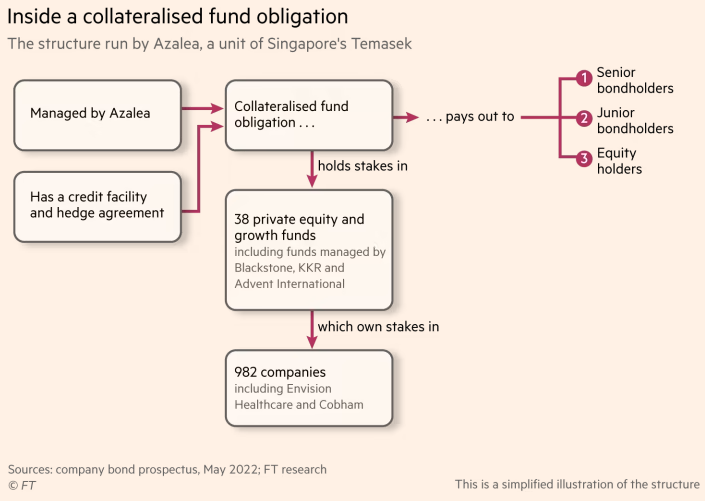

- SPECIAL NOTE: DERIVATIVES — Collateralized Fund Obligations (CFO)

- YET ANOTHER MAJOR NEW DERIVATIVE GAME UNCOVERED!

- How private equity are securitizing themselves.

The Long Expected and Overdue Recessionary Deflationary Scare is Soon to Arrive.

However, first a Seasonal Santa Claus Rally … then the Pain!

=========

A CRACKING CONSUMER IN A 70% CONSUMPTION ECONOMY

US LEADING ECONOMIC INDICATOR (LEI)

For those don’t believe we are yet technically in a recession, they will all agree the US is very close. The US Leading Economic Indicator is now negative. As the LEI shows (chart right), we have seen this level occur in parallel with major market crashes.

For those don’t believe we are yet technically in a recession, they will all agree the US is very close. The US Leading Economic Indicator is now negative. As the LEI shows (chart right), we have seen this level occur in parallel with major market crashes.

RAPIDLY SHRINKING REAL DISPOSABLE INCOME

The consumer is tapping “out.” Ever since inflation entered the financial system in early 2021, there has been a debate as to when the higher cost of living would hit consumer spending to the point of inducing a recession. Consumers can rely on savings or credit to make ends meet in the near-term. However, if inflation remains elevated for a prolonged period, eventually it becomes too much to bear, and the consumer is forced to “tap out” and cut discretionary expenses. That’s when a recession hits. The stock market is telling us that the recession has arrived.

US RETAIL SECTOR

One of the best means of analyzing intra-market developments is ratio work. This consists of comparing the performance of one asset or stock relative to the performance of another. For example, let’s look at the ratio between the Consumer Discretionary ETF (XLY) and the S&P 500 (SPX). During periods of consumer spending strength, this line rises. And during periods of consumer spending weakness this line falls. The ratio of US Consumer Discretionary Spending to the S&P 500 is dropping like a stone. It is actually lower today than it was at the lows of the March 2020 Crash! This suggests the consumer is “tapping out” right here and now. The question now is if this is just a slight downturn or the start of a major recession.

From an economics perspective, this is very disturbing. It suggests the U.S. is entering its first major recession since the Great Financial Crisis of 2007-2009. I think we all remember what happened to stocks during that time: an extraordinary crash in which stocks lost over 50% of their value.

A SERIOUS WARNING FROM THE YIELD CURVE

A HISTORICALLY INVERTED YIELD CURVE

The Yield Curve (2s10s to the right) is MORE negative today than it was before the COVID-19 crash, as well as the Great Financial Crisis and barely above the Dotcom implosion. It doesn’t get much clearer than this!

The Yield Curve (2s10s to the right) is MORE negative today than it was before the COVID-19 crash, as well as the Great Financial Crisis and barely above the Dotcom implosion. It doesn’t get much clearer than this!

The yield curve of the Treasury market is predicting a severe recession in the near future, likely the early part of 2023. Historically this forces stocks to major new lows.

THE FFR:10s RATIO (MATASII PROPRIETARY INDICATOR)

IS WARNING OF A SUDDEN POTENTIAL DROP IN FINANCIAL ASSETS

IF THE US CATCHES A COLD, THE WORLD WILL GET PNEUMONIA

The US has the world’s single largest economy, accounting for almost a quarter of global GDP (at market exchange rates), one-fifth of global FDI, and more than a third of stock market capitalization. It is the most important export destination for one-fifth of countries around the world. In 2021, the United States accounted for 15.74 percent of global gross domestic product (GDP) after adjusting for purchasing power parity (PPP).

Constituting less than 5 percent of the world’s population, Americans generate and earn more than 20 percent of the world’s total income. America is the world’s largest national economy and leading global trader. The United States accounted for over 20 percent of the expansion in world real GDP during the past two decades, and for nearly a quarter of the expansion during 1992-2000. World and U.S. growth have moved closely together in recent decades, with a correlation coefficient of over 80 percent.

What does this tell us?

If the US consumer slows down its rate of consumption it will have an immediate and devastating impact on the global economy which can not be understated!

THE GLOBAL ECONOMY IS HEAVILY DEPENDENT ON THE

US CONSUMER’S RATE OF CONSUMPTION.

What many forget is that American consumers flush from Covid stimulus statistically shifted their spending away from services and toward goods. In the first four months of 2021, imports of consumer goods were 29 percent higher than in 2020, a $57 billion jump. “The only thing people could consume was goods,” said Constance Hunter, chief economist at KPMG. “You couldn’t have a wedding, you couldn’t go to a baseball game. So what did people buy? They bought goods, and that’s much more of a global market. That has reversed back“. However with the snap back, the US consumer has become tapped out without more stimulus checks and extending forbearances on sheller. Additionally, and most importantly, the impact of the unexpected inflation shock has had a major impact on real disposable income!

FINANCIAL FRAGILITY RISK

FINANCIAL FRAGILITY REPORT – IMF (Report Link)

FINANCIAL FRAGILITY REPORT – IMF (Report Link)

A SLOWING US CONSUMER COULD EXASPERATE “DISORDERLY TIGHTENING”

Financial stability risks have increased amid the highest inflation in decades and the ongoing spillovers from Russia’s war in Ukraine to European and global energy markets. Amid poor market liquidity, there is a risk that a sudden, disorderly tightening in financial conditions may interact with preexisting vulnerabilities. In emerging markets, rising rates, weak fundamentals, and large outflows have pushed up borrowing costs, particularly for frontier economies, with a heightened risk of additional defaults. In China, the property downturn has deepened as sharp declines in home sales have exacerbated pressures on developers, with heightened risks of spillovers to the financial sector.

Open-end investment funds play a key role in financial markets, but those offering daily redemptions while holding illiquid assets can amplify the effects of adverse shocks by raising the likelihood of investor runs and asset fire sales. This contributes to volatility in asset markets and potentially threatens financial stability. The impact of these vulnerabilities could also spillover to emerging markets and lead to a tightening of financial conditions. To correct course, policymakers should ensure that liquidity management tools are available, calibrated appropriately, and utilized by funds.

FINANCIAL FRAGILITY REEPORT – FEDERAL RESERVE (Report Link)

FINANCIAL FRAGILITY REEPORT – FEDERAL RESERVE (Report Link)

Since the May 2022 Financial Stability Report was released, the economic outlook has weakened, and uncertainty about the outlook has remained elevated. Inflation remains unacceptably high in the United States and is also elevated in many other countries. Central banks around the world, including the Federal Reserve, have tightened monetary policy in response. A weaker outlook, higher interest rates, and elevated uncertainty have contributed to a substantial tightening in financial conditions. Economic, financial, and geopolitical risks also have risen across advanced and emerging market economies (EMEs), further contributing to asset price declines and periods of significant market volatility.

These developments, and future shocks, have the potential to be amplified by vulnerabilities associated with asset valuations, borrowing by households and businesses, financial-sector leverage, and funding risks. Against this backdrop, our view of the current level of vulnerabilities is as follows:

-

- Asset valuations. Higher interest rates and a weaker outlook for the economy led prices of financial assets to fall amid heightened volatility, but real estate prices remained elevated. Measures of equity prices relative to expected earnings declined. Risk premiums in equity and corporate bond markets were near the middle of their historical distributions. In contrast, property markets still show elevated valuations. Although housing activity weakened and national average price increases slowed sharply year over year, home prices remained historically high relative to rents. Valuations of commercial real estate (CRE) were also elevated (see Section 1, Asset Valuations).

- Borrowing by businesses and households. On balance, vulnerabilities arising from borrowing by nonfinancial businesses and households were little changed over the first half of 2022 and remained at moderate levels. Borrowing by businesses remained at high levels relative to gross domestic product (GDP) in the first half of 2022, but some measures of their ability to service that debt improved as the effects of rising interest rates were offset by higher business earnings. Household debt remained at modest levels relative to GDP, and most of that debt is owed by households with strong credit histories or considerable home equity. Nonetheless, borrowing costs continue to rise and inflation is reducing real incomes, a combination that may pose risks to the ability of some businesses and households to service their debts, especially in the event of further adverse shocks to income or inflation (see Section 2, Borrowing by Businesses and Households).

- Leverage in the financial sector. Banks maintained risk-based capital ratios near their post2010 averages, and broker-dealer leverage remained historically low. Leverage at life insurance companies declined to about the middle of its historical range. In contrast, hedge fund leverage likely remained somewhat above its historical average, though comprehensive data are available only with a lag. Bank lending to nonbank financial institutions (NBFIs), an indicator of NBFI leverage, reached new highs. More generally, monitoring some parts of the nonbank financial sector, where hidden pockets of leverage could amplify adverse shocks, could be enhanced with more comprehensive and timely data (see Section 3, Leverage in the Financial Sector).

- Funding risks. Short-term funding markets continue to have structural vulnerabilities, as some markets and institutions remain vulnerable to large and unexpected withdrawals, especially considering the highly uncertain outlook. Funding risks at domestic banks are low, given their large holdings of liquid assets and limited reliance on short-term wholesale funding. Prime Overview 3 and tax-exempt money market funds (MMFs), as well as other cash-investment vehicles, remain vulnerable to runs. Many bond and bank-loan mutual funds continue to be susceptible to large redemptions, because they hold assets that can become illiquid amid stress. The market capitalization of stablecoins—which have a set of structural vulnerabilities, including weaknesses in regulatory oversight, opacity, and consumer protection issues—continued to decline after falling sharply earlier in the year. Central counterparties (CCPs) have maintained a high level of financial resources to cover potential credit exposures in case of default by one or more clearing members, and participants have continued to meet their margin calls to date (see Section 4, Funding Risks).

In addition, market liquidity—the ability to trade assets without a large effect on market prices— remained low in several key asset markets since the May report, as discussed in the box “Liquidity Conditions in Treasury and Other Core Financial Markets.” Low liquidity amplifies the volatility of asset prices and may ultimately impair market functioning. It could also increase funding risks to financial intermediaries that rely on marketable securities as collateral. These potential amplification channels may interact with leverage in the financial system.

CONCLUSION

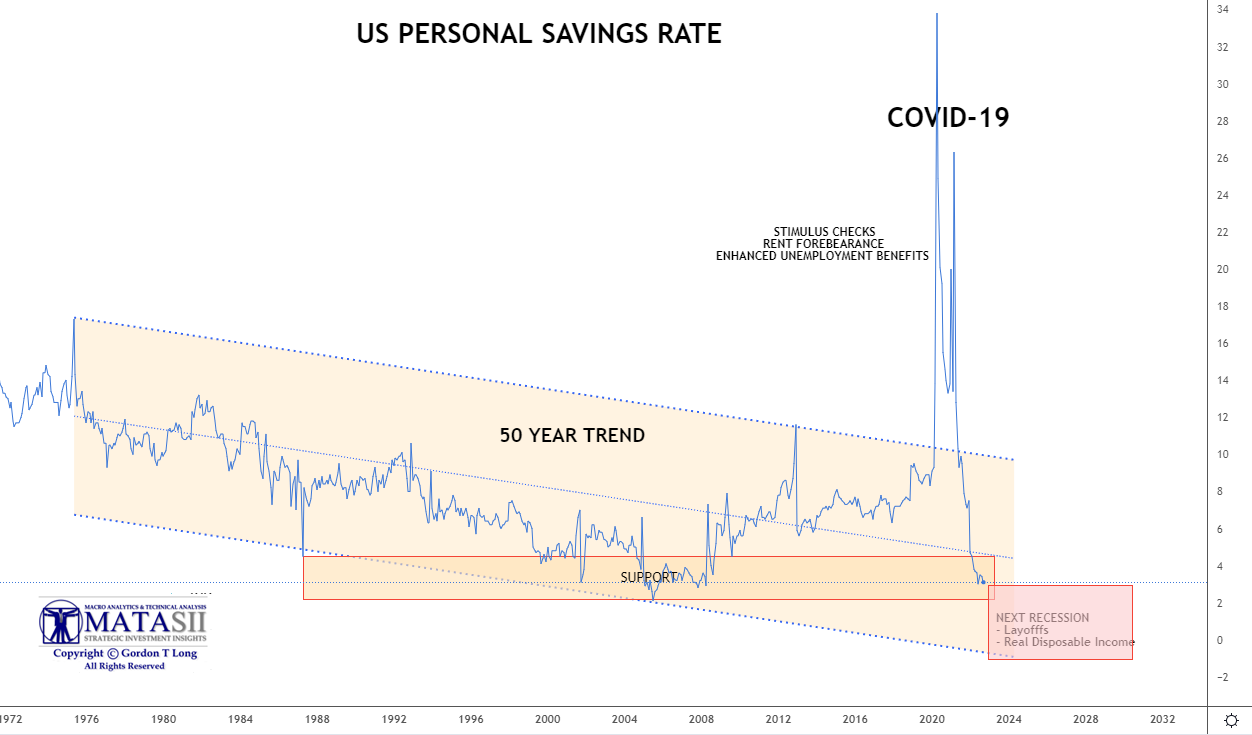

The US Personal Savings Rate is rapidly approaching a 35 year low (see Current Market Perspective below), which leaves the US consumer vulnerable to a slowing economy and layoffs. Layoffs, which in our last newsletter, are accelerating at a rate not seen since the Dotcom Bubble. There is a US consumer led shock beginning to occur which will quickly accelerate a reverse wealth effect that appeared at the beginning of the year.

The US Personal Savings Rate is rapidly approaching a 35 year low (see Current Market Perspective below), which leaves the US consumer vulnerable to a slowing economy and layoffs. Layoffs, which in our last newsletter, are accelerating at a rate not seen since the Dotcom Bubble. There is a US consumer led shock beginning to occur which will quickly accelerate a reverse wealth effect that appeared at the beginning of the year.

- NOTE – A CAUTIONARY WARNING: A lesson I have learned over decades of investing is to never under estimate the US Consumer and its’ addiction to consumption. Like a drug addict without money they will always find a way to fulfil their addiction!!

We currently have multiple global factors at play which are all interconnected. This creates a potential domino-like effect, contributing to the heightened possibility of unexpected and unintended consequence.

The fragility of the financial system complicates the job of Central Banks. Instead of facing their normal dilemma—how to reduce inflation without harming economic growth and employment—the Fed now faces a trilemma: how to reduce inflation, protect growth and jobs, and ensure financial stability.

SPECIAL NOTE

YET ANOTHER MAJOR NEW DERIVATIVE GAME UNCOVERED!

Collateralized Fund Obligations (CFO): How private equity securitized itself.

Collateralized Fund Obligations (CFO): How private equity securitized itself.

A widely used product known as a “Collateralized Fund Obligation” is now coming into public view. Its stated aim is to diversify risk by parceling up companies providing returns.

CFOs are, in some ways, a private equity variant of “collateralized debt obligations”, the bundles of mortgage-backed securities that only reached the public consciousness when they wreaked havoc during the 2008 financial crisis.

So far, CFOs have flown largely under the radar. Although some of private equity’s largest names such as Blackstone, KKR, Ares and the specialist firm Coller Capital have set up versions, this is often done privately with little or no public disclosure of the vehicle’s contents — or even, in some cases, of its existence, making it all but impossible to build a full picture of who is exposed and on what scale.

CFOs introduce a new layer of leverage into a private capital industry already built on debt. Their rise is one illustration of how post-crisis regulation, rather than ending the use of esoteric structures and risky leverage, has shifted it into a quieter, more lightly regulated corner of the financial world.

GOOGLE “Collateralized Find Obligations” for more detail

ADD CFO’S TO OUR PREVIOUSLY DISCUSSED LIST OF WHAT IS GOING ON THE MARKETS THROUGH UNREGULATED OTC MARKETS BELOW THE RADAR.

2023 OUTLOOK

It is highly likely that the 2023 bottom up consensus earnings are materially too high. It is more inline with another 8% lower to $195 in the base case, a reflection of worsening output from our leading earnings models. This leaves16% below consensus on ’23 EPS and down 11% from a year-over-year growth standpoint. After what’s left of this current tactical rally, we see the S&P 500 discounting the ’23 earnings risk sometime in first half via a ~3,000-3,300 price trough. Our long held 3270 low on the S&P 500 is still valid.

We think this occurs in advance of the eventual trough in EPS, which is typical for earnings’ recessions. While we see 2023 as a very challenging year for earnings growth, 2024 should be a strong rebound where positive operating leverage returns—i.e., the next boom. Equities should begin to process that growth reacceleration well in advance and rebound sharply to finish the year at ~3,900.

Price leads earnings and it’s not typical to put a trough multiple on trough earnings. What this suggests is the Q1 price low is marked by a 13.5-15X multiple on a forward EPS number of ~$220.

13.5 X 220 = 2970

15.0 X 220 = 3300

THE WORST IS STILL IN FRONT OF US THROUGH TO THE BEGINNING OF Q1 2023.

FADE THE COUNTER RALLY – SELL THE RIPS.

HOLD LONG DATED TREASURIES

IN Q2-Q3 2023, EXPECT TO BUY EQUITIES & SELL TREASURIES.

US PERSONAL SAVINGS RATE APPROACHES 35 YEAR LOW

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart: SUBSCRIBER LINK

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.