MACRO

JAPAN

A LOOMING JAPANESE FIRESALE OF US TREASURIES?

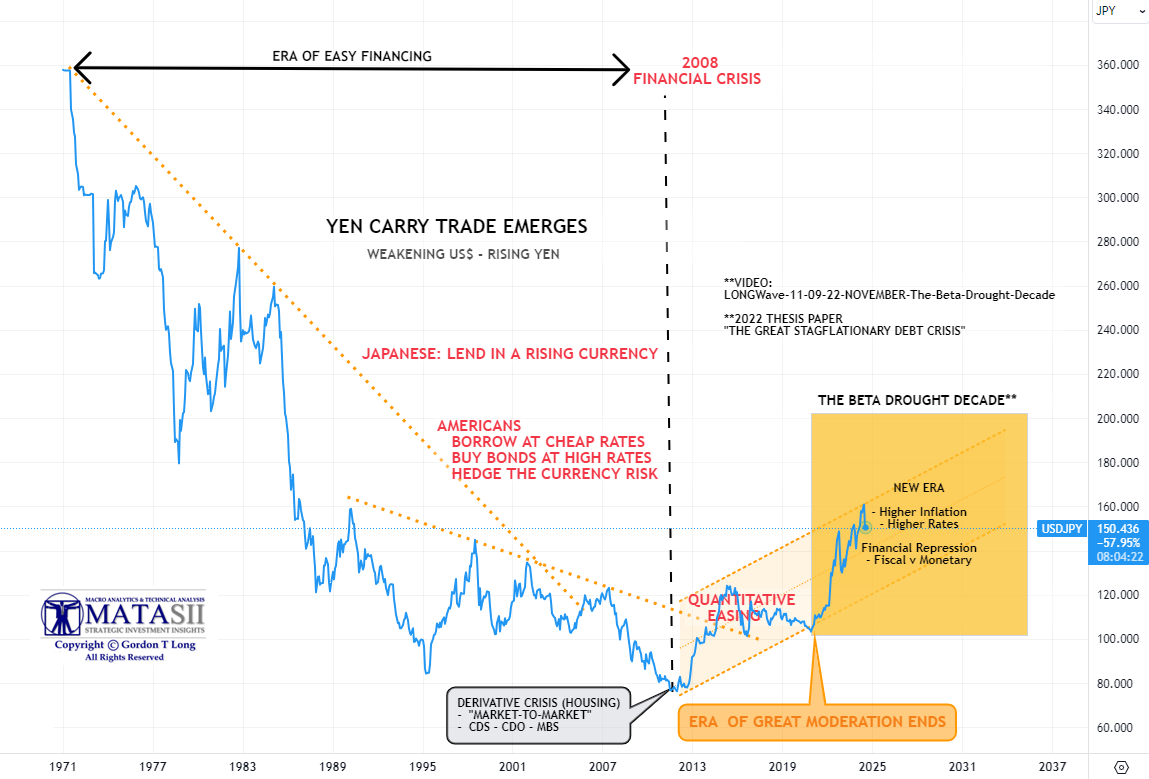

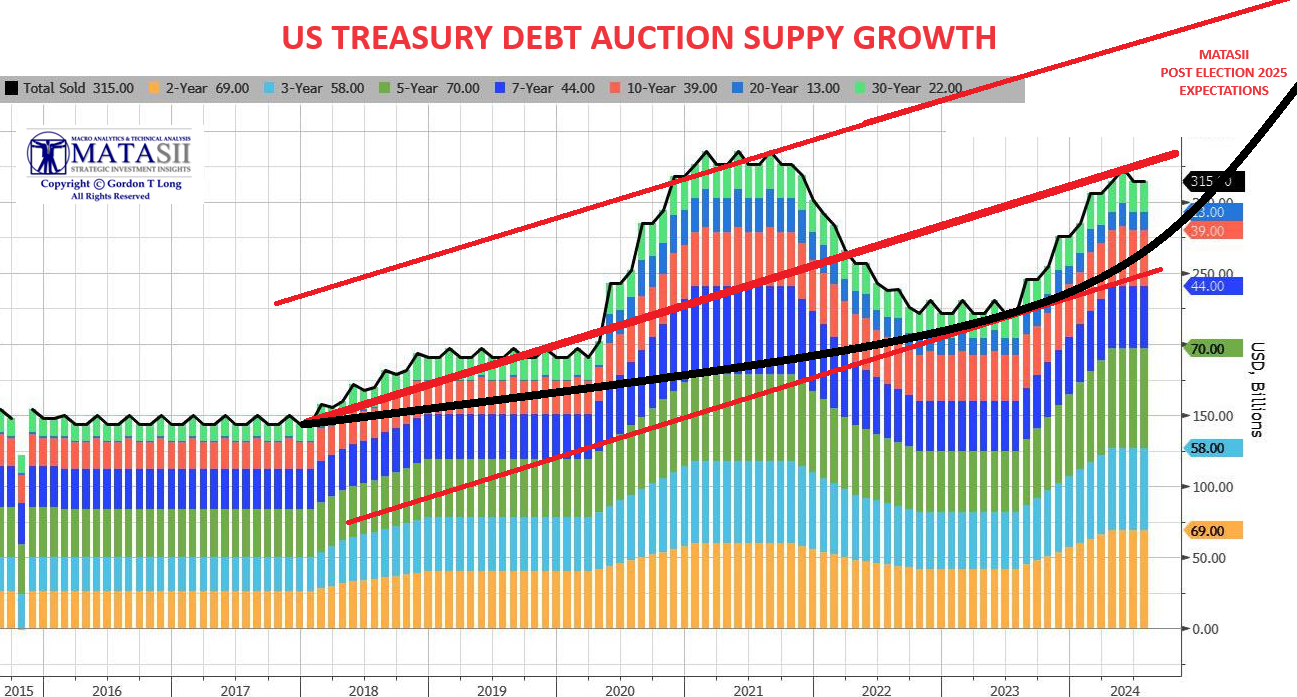

Profligate government spending has institutionalized multitrillion-dollar annual deficits, which have driven up interest rates and left Treasury markets teetering on the edge. Now Japan is on the verge of a $400 billion fire sale of U.S. debt. This could break the back of the Treasury market and devastate Americans’ finances.

The source of Japan’s sudden need for liquidity is the state-owned Government Pension Investment Fund, which holds the social security reserves of nearly every Japanese worker.

Because the government wants to prop up the plunging yen, it intends to sell the American assets and buy Japanese ones.

The amounts here aren’t trivial: the fund is more than $1.5 trillion, of which $400 billion is U.S. Treasuries. This conversion from dollar-denominated assets to yen-denominated ones means dumping a quantity of Treasuries on the market equal to about 20% of the federal government’s net annual borrowing.

A 20% increase in the supply of Treasuries is huge when yields are already around 5% and poised to go higher. Higher yields increase how much interest must be paid to service our $35 trillion federal debt.

Last month, the Treasury Department spent a record $140 billion just on interest to keep its debt scheme going. For perspective, that amounts to more than three-quarters of personal income tax revenue collected in June – for interest alone.

If Japan starts unloading its U.S. Treasuries, that exacerbates the problem: increasing the supply of Treasuries makes it harder for the U.S. government to sell new ones and finance the massive budget deficit. The only way to entice more people to buy Treasuries will be to offer higher interest rates, which will cause the interest on the debt to climb even faster, heading to $2 trillion annually and beyond.

Many countries, such as Russia, have already sold off all their Treasuries. China, the second-largest foreign holder of U.S. debt, is selling them hand-over-fist, having sold one-third in the past five years. If the largest holder, Japan, has a fire sale in this environment, it would be the equivalent of a margin call on the U.S. Treasury Department—the moment the bank tells you to cough up more cash or they cut you off.

People the world over are losing confidence in the federal government’s ability to repay its debts and no longer see the dollar as a secure asset. In just 3½ years, the dollar has lost one-fifth of its value, wiping out trillions of dollars of bondholders’ wealth around the world.

This kind of backdoor default is why some Japanese banks have already begun liquidating their Treasury holdings, including the country’s fifth-largest bank, Norinchukin, selling $63 billion in Treasuries.

The even larger Japan Post Bank has more than $550 billion, mostly U.S. bonds, which could also soon head to the auction block.

The fire sale doesn’t end there. Because Japan’s Government Pension Investment Fund influences all other pensions in Japan, another $800 billion in U.S. assets also might be looking for a new financial home.

Even as almost every Treasury buyer is selling, including the Federal Reserve, the federal government is ramping up borrowing to cover ballooning deficits. Financial markets are staring down the barrel of soaring interest rates and a massive liquidity drain.

If the Treasury gets backed into this corner and is forced to pony up higher yields, then things will unravel fast. We’ll look back fondly at 8% mortgage rates and the limited bank failures of spring 2023, because things will be much worse than that.

Of course, the government could short-circuit this entire collapse by simply cutting spending and getting on a path to fiscal sustainability. After all, margin calls don’t happen if investors believe the investments are still good.

Unfortunately, there’s no sign of such fiscal responsibility in our government.

h/t AJ ANTONI / PS ONGE

WHAT YOU NEED TO KNOW!

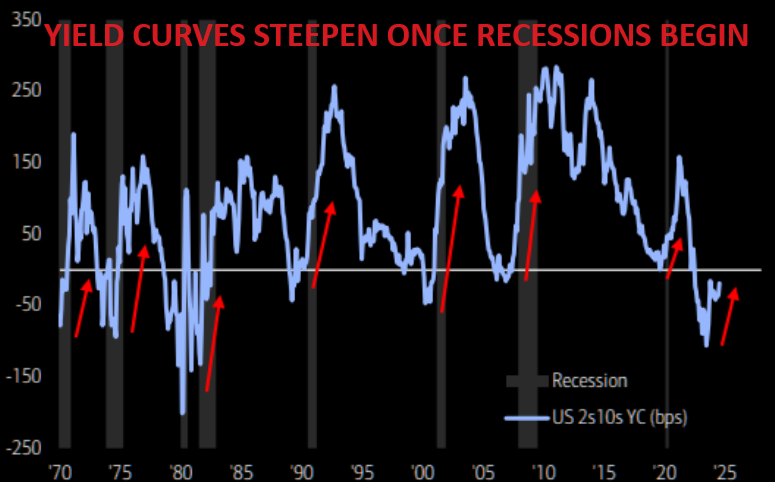

STEEPENING YIELD CURVES DON’T LIE!

STEEPENING YIELD CURVES DON’T LIE!

Yield Curves don’t lie nor are false indicators of pending recessions when they steepen – especially from current low levels and having been inverted this long!! (Red arrows shown on the chart to the right.)

Stock market selling however historically begins when the inversion actually goes positive and the Fed has initiated their first rate cut. Markets historically have risen in anticipation of rate cuts but sell on the fact, because the Fed only cuts on clearly evident deteriorating economic forces it to react. Falling PE begin to be priced in with earnings soon falling.

RESEARCH

1- 2024 Q2 EARNINGS

-

- When expectations are too high, then investors tend to over-react to any concerns. This is what we continue to see in this earning season. It has become a “Sell” the news.

- Major players announced operating concerns of various degrees. Investors however are immediately reacting by reducing their exposure.

- We examine a few of the major players who have announced their Q2 earnings: McDonalds (Fast Foods), Microsoft (PS Software), Meta (Social Media), Amazon (Online Retail) and Apple (Consumer Electronics).

2- BOJ RAISES RATES & REDUCES JGB BUYING

2- BOJ RAISES RATES & REDUCES JGB BUYING

-

- BoJ raised its short-term interest rate to 0.25% (prev. 0.00-0.10%).

- BoJ is to reduce scheduled monthly bond buying by around JPY 400bln each quarter and with bond purchases to be JPY 3tln a month as of Q1 2026.

- US rate cuts will shrink rate spread which, along with a strengthening Yen, will place pressures on the viability of the $3.5T Japanese Carry Trade to continue to finance US & EU debt and fiscal deficits.

DEVELOPMENTS TO WATCH

US TREASURY: QUARTERLY REFUNDING ANNOUNCEMENT

US TREASURY: QUARTERLY REFUNDING ANNOUNCEMENT

-

- Q3 funding needs were revised lower to $740 billion from $847 billion projected last quarter. According to the Treasury, the borrowing estimate was $106 billion lower than announced in April 2024, largely due to lower Federal Reserve System Open Market Account (SOMA) redemptions and a higher beginning-of-quarter cash balance.

- Q4 funding needs are estimated at $565 billion, $115 billion above estimates of $450 billion, which is quite a bit higher than expected, but is also due in part to the higher TGA estimate of $700 billion.

- The Treasury expects to borrow just over $1.3 trillion by year-end.

FOMC – JULY MEETING

-

- Federal Open Market Committee votes unanimously to leave benchmark rate unchanged in target range of 5.25%-5.5%, a more than two-decade high, for the eighth straight meeting

- Fed also tweaks language to say price pressures remain “somewhat” elevated, and acknowledge “some further progress” toward inflation goal, from “modest further progress” in previous statement

- Officials also adjust their assessment of the labor market, saying job gains “have moderated” and the jobless rate “has moved up but remains low”

GLOBAL ECONOMIC REPORTING

JUNE LABOR REPORT – NFP

JUNE LABOR REPORT – NFP

-

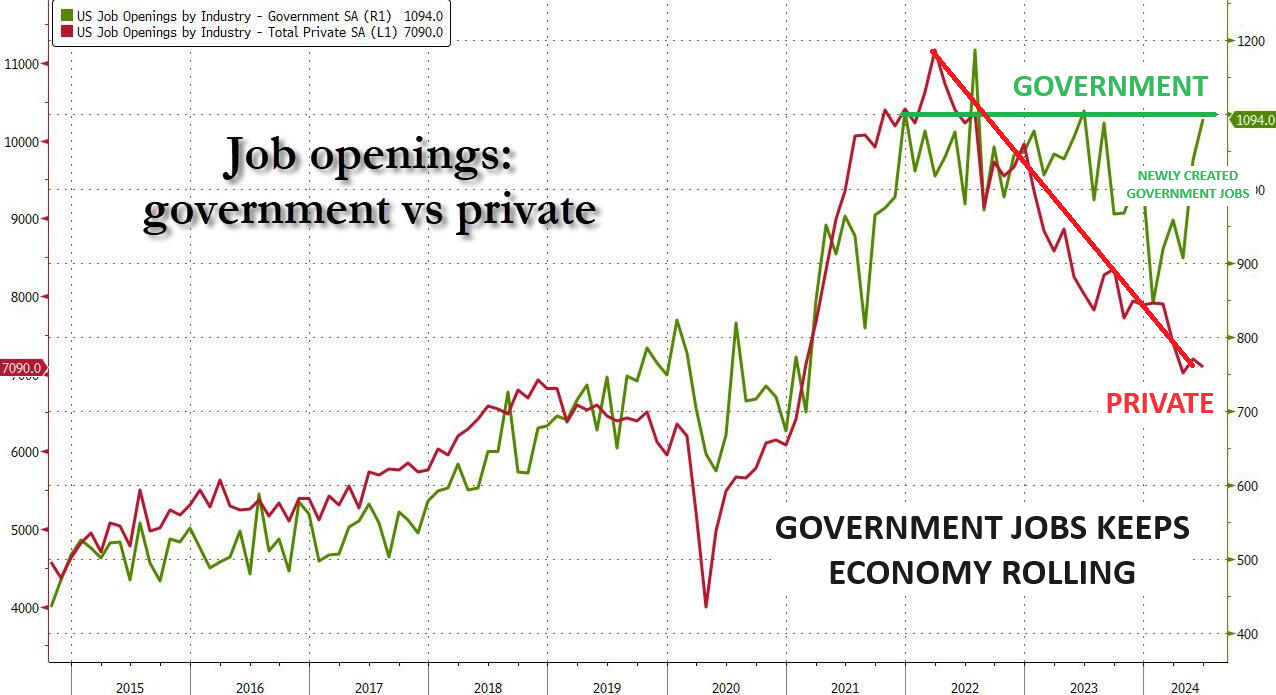

- The US added just 114K payrolls, a huge miss to expectations of 175K and also a huge drop from the downward revised June print of 206K, now (as always ) revised to just 179K.

- This was the lowest print since December 2020, (at least prior to even more revisions), and a 3 sigma miss to the median estimate of 175K.

- SAHM RULE TRIGGERED = RECESSION

JOLTS, QUITS & HIRES

-

- While private jobs saw another broad drop in openings across private sectors, this was almost fully offset by the relentless surge in government job openings.

- Private sector job openings plunged to a level seen back in late 2018. Government job openings are just shy of a record high!

CONSUMER CONFIDENCE – Expectations

-

- The overall trend in the labor market indicator remains weaker.

- Purchase plans for homes, cars, and appliances have all plunged.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.