GLOBAL MACRO

CHINA

CHINA IS A SEPTIC PROBLEM FOR THE BIDEN ADMINSTRATION

OBSERVATIONS: GET READY IN 2025 FOR TARIFFS AND TRADE WARS

PURELY OPTICS – Doomed-to-Failure

The rushed trip by Janet Yellen to meet with her Chinese counter-parts was billed to improve Sino-America relations. Festering, unresolved issues has been steadily deteriorating on multiple fronts, but her trip was billed to be focused on Trade Relations.

The Chinese have been pointedly clear that the US is the problem and there is little reason for wasted talks. A meeting seeking China to change its trade policies was simply not going to happen. (see below: RESEARCH – China Is Killing the Golden Goose).

The political optics therefore was to demonstrate to the US electorate that the Biden Administration was doing everything it could to achieve a working Trade relationship with China, before the inevitable collision resulting in much broadening Tariffs on Chinese consumer goods, not just the current tiffs on industrial and technology product and components.

PUBLIC PREPARATION FOR TARIFFS & RISING GOODS INFLATION

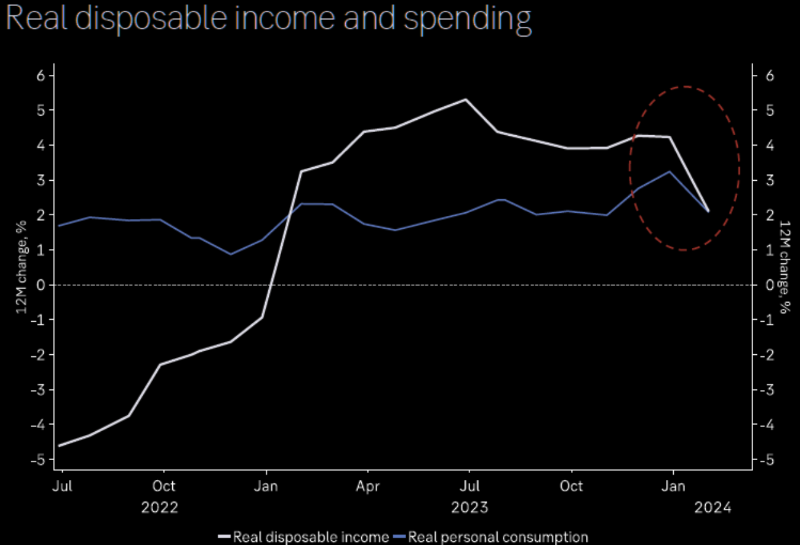

Tariffs and and heightened possibilities of escalating Chinese “Trade Wars” are now a real possibility. The result will be rising Consumer Goods prices in the US since China is a dominant supplier of almost everything in the average American home or apartment.

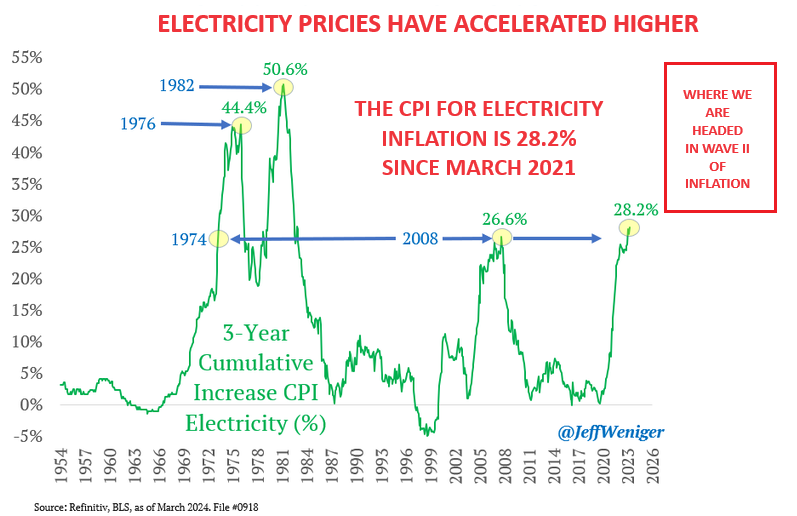

This will all be part of Wave 2 of US Inflation. – something that the US Consumer must be prepared for, or at least for the government to have demonstrated it did everything possible before bringing the “hammer down” on Tariffs after the election is over.

EVENTUALLY A FAILED US INDUSTRIAL POLICY WILL HIDE BEHIND CURRENCY MANIPULATION

Continued Inflation in the US, especially as it impacts the consumer, is a major problem in a 70% based economy. There is a strong likelihood that the US dollar will deteriorate as trade deficits increase, compounding the problem. Expect China to be accused of currency manipulation when the battle heats up.

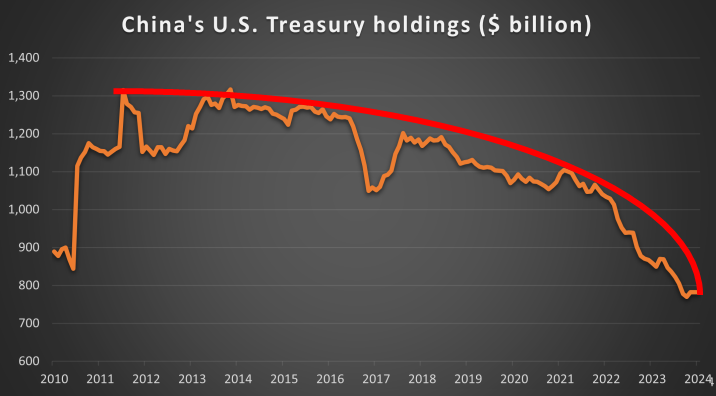

The hidden reason for the trip is to attempt to re-establish China as a Buyer of US Treasury Bonds or minimally to stop the unwinding of its Treasury holdings and reduce De-Dollarization efforts by the ever expanding BRICS-11 trading bloc. (see below: DEVELOPMENTS TO WATCH – Yellen’s Rush Trip to China)

That was going to be a tough sell even for a political operative and manipulator of the proven stature of a Janet Yellen!

WHAT YOU NEED TO KNOW!

28.2% ELECTRICITY INFLATION

We all know that Food Inflation has totaled 20.1% during the Biden Presidency. What few (other than Home Owners) fully appreciate is that Bidenomics and its war of Energy has resulted in Electricity increasing by a cumulative total of 28.2%. Everything we do requires electricity, which means this increase, like a cancer, has metastasized throughout consumer pricing on almost everything!

We all know that Food Inflation has totaled 20.1% during the Biden Presidency. What few (other than Home Owners) fully appreciate is that Bidenomics and its war of Energy has resulted in Electricity increasing by a cumulative total of 28.2%. Everything we do requires electricity, which means this increase, like a cancer, has metastasized throughout consumer pricing on almost everything!

Looking at Biden’s record on hourly wages, cumulative hourly wage increases trail his Presidential Inflation Rate (PIR) by 2.8 percent. For Trump, hourly wages exceeded his PIR by 3.3 percent. The ability to pay your bills is the real pain threshold or what should be called the Misery Index!!

RESEARCH

CHINA IS KILLING THE GOLDEN GOOSE

-

- According to Janet Yellen: “China is now simply too large for the rest of the world to absorb this enormous capacity.” — “Actions taken by the PRC today can shift world prices. And when the global market is flooded by artificially cheap Chinese products, the viability of American and other foreign firms is put into question.”

- The fact is when the Chinese Manufacturing Juggernaut reaches a point where it begins slowing the rate of economic growth of those countries buying its products, something happens. Job growth and wage growth slows in the consuming countries and with it Consumer demand growth slows as jobs are lost and competition disappears. This is effectively the slow starvation of the Chinese Golden Goose.

- The Chinese Strategy is currently to increase Production and go “up-scale” or to increase the production of higher value-add products. Until recently this has been the protected domain of the developed countries that allowed high paying jobs and consumption. Xi Jinping is very clear that is where they are going and will not be deterred.

- The US Strategy has increasingly become solely one of Tariffs and protective regulations.

- The strategy of both will only result in the mutual killing of the Golden Goose of global economic prosperity.

- We are on a collision course and is doomed to only result in heightened Global Conflict.

… BUT … THE FED CAN’T CONTROL “SUPER CORE” INFLATION!

-

- WHAT IS IT EXACTLY? – includes some of the most stubborn components of Services Inflation which are household necessities that are not taken out with the removal of housing, like: Car Insurance, Housing Insurance and Property Taxes.

- HOW BAD IS IT: The Super Core Inflation has been roaring higher since January: Up 4.8% year-over-year in March; Up more than 8% on a 3-month annualized pace; Up 0.7% in March to push the yearly increase up to 4.8% from 4.4%; Highest level in 11 months.

- WHY IS IT IMPORTANT: It Is seen as a proxy for labor costs. You’re not going to get to a sustained 2% Fed goal if you don’t get a key cooling in services prices. At this point it is simply not happening.

- WHY CAN’T THE FED FIX IT?: It is like Taxation rising. The Fed simply has no direct control or short term influence over it.

DEVELOPMENTS TO WATCH

YELLEN: A RUSH TRIP TO CHINA?

YELLEN: A RUSH TRIP TO CHINA?

-

- Treasury Secretary Janet Yellen needs buyers of this debt and the vast amount of the existing $34T coming due and being rolled over. Though she has implemented Stage I and Stage II of her stealth Liquidity Gambit (chart below), the Reverse Repo balances are depleted and the BTLF arb is not going to keep flowing unless those Hedge Funds and Banks know that rates can be brought down or they will be potentially left holding massive unrealized capital losses.

- Ideally, Yellen needs China to buy US debt with its currency reserves, BUT minimally she needs to convince China to stop selling US Treasury holdings.

THE TELL: BANK’S SLR TO ELIMINATE US TREASURIES

-

- The new SLR rule change could allow banks to be an endless buyer of treasury debt.

- How convenient for the banks — to be able to buy treasuries, take no haircut, and not have to worry about mark-to-market losses. All just in time, as issuances are taking on a life of their own!

- The Great Taking which we outlined in our Annual Thesis Paper: “The Regulatory Sate”, revealed that the bond market is also fractionalized (not enough to go around with some bonds held on the books by more than one owner).

GLOBAL ECONOMIC REPORTING

MARCH CPI

MARCH CPI

-

- Core CPI Services Ex-Shelter index – soared 0.7% MoM up to 5.0% YoY – the hottest since April 2023.

- The “SuperCore services CPI — “Core Services” without housing — jumped by 7.5% annualized in March from February, same red-hot increase as in the prior month, on top of the 11.6% spike in January. So it’s not just housing that drives services inflation.

- The six-month reading – six months to iron out the very volatile month-to-month readings – jumped by 6.4%, the highest since October 2022. This is really ugly.

- Core services price level – since March 2020, the core services CPI has increased by 19.4%.

-

- MARCH PPI

-

- The PPI, not absurdly seasonally adjusted, jumped by 6.2% annualized in March from February, though smaller spike than the 9.2% in February it was still a major disappointment

- The three-month rate, which irons out the month-to-month squiggles, jumped 7.8% annualized, the highest since June 2022.

-

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.